How my first trade paper trading went Based on the hr chat. It did not have a breakout as yet but it had a buy signal.

It was in an uptrend according to the lower timeframes like 5m, 15m, etc.

I still entered the trade around 9:50am and made a profit around 11:50am.

Around 1pm the trade reversed and I’m not at a loss.

Maybe I should have gotten out earlier.

What I did also was went a few rows down from last and entered a call with the most open int

AMZN trade ideas

Amazon (AMZN): Long-Term Opportunity or Short-Term Risk?

-Key Insights: Amazon faces headwinds from bearish market sentiment, trade

issues, and cloud service competition. Near-term challenges stem from tariffs

impacting goods sold on its platform and slowing momentum in Amazon Web

Services. The upcoming earnings report may provide clarity on its resilience.

Valuation metrics suggest potential upside, but caution is advised.

-Price Targets: Next week price levels suggest possible long entry points near

support zones.

- Target 1 (T1): $180

- Target 2 (T2): $185

- Stop Level 1 (S1): $170

- Stop Level 2 (S2): $167

-Recent Performance: Amazon has recently underperformed, trading 1% lower amid

overall large-cap tech weakness. Broader market struggles, particularly in the

Nasdaq index, reflect bearish sentiment affecting growth-focused sectors. Trade

tensions and increased competition in cloud services are significant factors

weighing on its performance.

-Expert Analysis: Analysts highlight Amazon’s vulnerability to tariffs, which

could squeeze margins and affect merchants relying on imported goods from China.

AWS growth faces slowing dynamics as Google Cloud and Microsoft Azure gain

ground. While some experts argue Amazon’s valuation is becoming attractive with

a P/E ratio near 30, its risks warrant cautious optimism ahead of earnings.

-News Impact: The upcoming earnings report will be pivotal for assessing

Amazon’s adaptability to macroeconomic pressures. Tariff-related disruptions

could reveal more pain points in its retail segment. Simultaneously, competition

in cloud services and shifts in consumer demand may paint a clearer picture of

long-term growth potential. Competitive pressures from Google Cloud, which grew

30% year-over-year, indicate AWS’s dominance is under threat.

AMZN Bulls Crab After a period of seller dominance, indicated by the exhaustion of previous pricing strategies and the "crab" reaching its limit, the market dynamic has shifted.

The impetus now lies with the buyers, as their own strategic maneuvering and pricing pressure ("crab") begins to exert influence on the negotiation process and overall market direction.

This transition suggests a potential re-evaluation of asset value and a possible consolidation of buyer power.

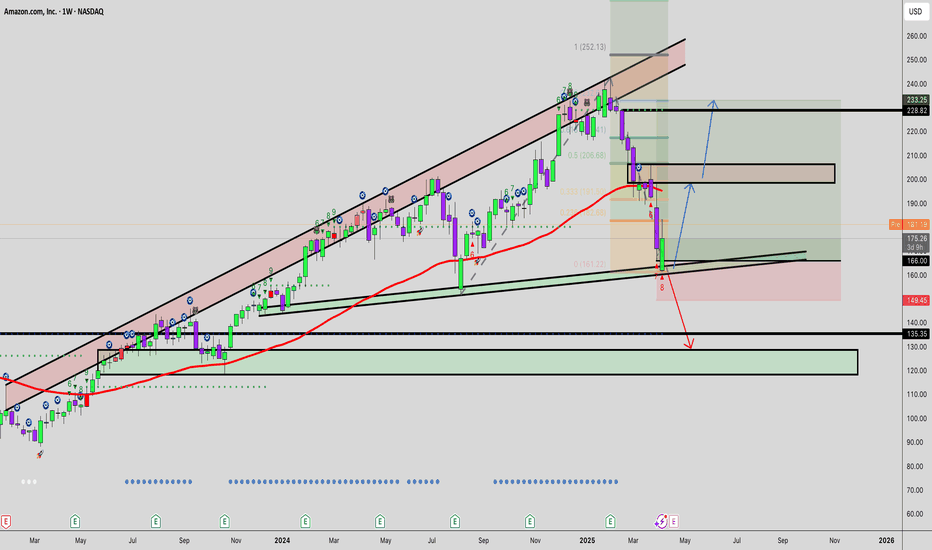

Amazon losing weekly trendline – watch these Fibo levels nextTechnical Analysis

Amazon (AMZN) has broken below its weekly ascending trendline and failed to reclaim the key 0.618 Fibonacci level (180.52). Strong bearish volume and a weakening RSI suggest downside continuation. Key support targets lie at 161.55, 151.21, and 142.58, with extended downside to 119.12.

Fundamentals

Macro pressure from high interest rates and a slowdown in consumer spending weighs on Amazon. Intense competition in AWS and e-commerce adds uncertainty. Upcoming earnings may serve as a catalyst for directional clarity.

Scenarios:

Base case – move down toward 151.21, 142.58, 119.12

Bullish case – break above 180.52 → rally toward 207.52, 241.92

AMZN Weekly Options Trade Plan 2025-04-16AMZN Weekly Analysis Summary (2025-04-16)

Below is a synthesis of all the reports and our resulting view:

──────────────────────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report – Viewed AMZN’s charts as showing a short‐term bearish bias even as some technicals (daily MACD) hint at a possible rebound. – Noted price near key supports and high put open interest. – Recommended a bearish single‐leg play: buying the $172.50 put at a premium of $0.85 (despite that premium being a bit high relative to our “ideal” range).

• Claude/Anthropic Report – Highlighted that on shorter timeframes (and with max pain at $185), some momentum and oversold conditions might create a bounce. – Emphasized bullish short‐term potential, recommending a trade on the $180 call at a premium of $0.71.

• Gemini/Google Report – Interpreted the technicals (EMAs, RSI, Bollinger Bands) as strongly bearish, with price testing a critical support level near $176. – With the options chain showing significant put volume at lower strikes, they recommended buying the $170 put (ask roughly $0.46) for its leverage and within or close to the target premium range.

• Llama/Meta Report – Also examined the multiple technical indicators and noted the mixed signals. – Although they observed bearish factors, their conclusion was cautious enough to state “NO TRADE RECOMMENDATION TODAY” if conditions aren’t optimal.

• DeepSeek Report – Concurred with the bearish outlook on both intraday and daily levels. – Recommended a trade on the $170 put (premium $0.46) with clear risk management (stop out if AMZN rallies above approximately $177.50).

────────────────────────────────────────────── 2. Areas of Agreement and Disagreement Between Models

• Agreements – Most models agree that AMZN is trading below key short‐term and longer-term EMAs, with technical momentum looking bearish. – There is a consistent theme in the options data of high put open interest and strong volume in strikes below the current price. – Several reports (Grok/xAI, Gemini/Google, DeepSeek) favor a bearish put trade based on support levels and risk/reward dynamics.

• Disagreements – The Anthropic analysis offered a moderately bullish case (with a call trade) based on oversold short‐term conditions and a max pain level high above current price. – Llama/Meta expressed enough caution so that if price action does not break expected levels, the trade might be skipped entirely. – The recommended strike/premium differs: Grok/xAI’s $172.50 put is slightly closer to the money with a higher premium, while Gemini/DeepSeek prefer the leaner $170 put (solid liquidity, premium ~ $0.46 in our target range).

────────────────────────────────────────────── 3. Clear Conclusion

Overall Market Direction Consensus: The majority of the reports lean toward a moderately bearish outlook given that AMZN’s current price is below key EMAs, near immediate support levels, and is trading in a high-volatility environment. Although there’s one bullish view (and some caution from Llama/Meta), the bearish technicals and put-side open interest weigh more heavily for a weekly option play.

Recommended Trade (if conditions are met at open): • Trade: Buy a single-leg, naked put option. • Strike: $170.00 • Expiration: April 17, 2025 • Premium: Approximately $0.46 per contract (which sits nicely near our ideal range of $0.30–$0.60) • Entry Timing: Begin at market open based on confirmed weakness below support levels • Profit Target: Approximately a 100% gain on the premium (aiming for roughly $0.90) • Stop Loss: About $0.35 (or exit if AMZN rallies decisively above roughly $177.50) • Trade Confidence: Around 65% given the technical bearish bias and clear liquidity, though mindful of the risk that a short-term bounce at support could reverse the trade.

Key Risks and Considerations: • A sudden short-term recovery (bouncing off support around $176) could trigger losses. • High volatility (indicated by the VIX) means that intraday whipsaws remain possible. • The mixed viewpoints (especially the bullish call suggestion) underscore that any entry must respect tight stop-loss discipline. • News and broader sector conditions could alter momentum unexpectedly.

────────────────────────────────────────────── 4. TRADE_DETAILS (JSON Format) { "instrument": "AMZN", "direction": "put", "strike": 170.0, "expiry": "2025-04-17", "confidence": 0.65, "profit_target": 0.90, "stop_loss": 0.35, "size": 1, "entry_price": 0.46, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

Amazon.com, Inc. (AMZN) – Short-Term Bullish OutlookTechnical Analysis

From the monthly chart, Amazon (AMZN) has demonstrated strong price structure within two clearly defined bullish channels:

Bullish Channel 1 (2018–2021): This marked a significant uptrend phase, culminating in an extended consolidation and pullback.

Bullish Channel 2 (2023–2025): After a period of correction that bottomed near a “Weak Support Region” (~$80–$100), AMZN entered another strong upward trajectory.

Most recently, AMZN broke below the current bullish channel, retesting the critical horizontal support zone around $186.93. This red zone represents a key breakout-retest area, suggesting a short-term accumulation phase.

Entry Zone: ~$172–$180

Target: $258.58 (Upside of ~38.34%)

Stop-Loss: $151.76 (Downside risk ~18.81%)

The risk-to-reward ratio of 2:1 supports a high-conviction bullish trade setup. Should price hold above the $172 area and regain momentum, we may see a continuation toward the upper price targets.

Fundamental Analysis

Amazon’s fundamentals remain robust, providing a solid foundation for the bullish technical thesis:

Strong Operating Margins: AMZN boasts a high EBITDA/Sales ratio, signaling efficient operations and solid cash flow generation.

Financial Strength: The company is financially sound, with low debt levels and strong investment capacity—critical for maintaining leadership in tech and logistics.

Positive Analyst Sentiment: The stock enjoys favorable analyst coverage, with an average consensus to buy or overweight. Recent upward revisions in EPS estimates reinforce expectations of earnings strength.

Valuation Gap: There’s a significant upside gap between the current market price and the average analyst target, reflecting potential for re-rating as growth accelerates.

Consistent Outperformance: Historically, Amazon tends to beat earnings expectations, showcasing its operational consistency and innovation-led edge.

ESG Rating: MSCI scores Amazon positively on ESG for its industry, which can attract long-term institutional interest.

Amazon is currently in a key technical zone where fundamental strength meets technical opportunity. Your chart shows a well-placed entry aligned with structural support, and the company's solid balance sheet, rising analyst expectations, and earnings history all add fuel to the bullish outlook.

If current support holds, the technical and fundamental setup favors a short- to medium-term rally, targeting levels beyond $250, while maintaining a controlled downside.

AMZN GEX Breakdown: Gamma Cliff Below! It's on Edge into Earning🔮 GEX (Gamma Exposure) – Options Flow Analysis

🚩 Heavy PUT Pressure at 179–175

* AMZN is trading just above its highest negative GEX zone at 179.30, which marks the top of a dense PUT support zone.

* A breakdown below 179 may trigger aggressive dealer hedging and push price swiftly to 175, then 172.5 where second PUT Wall is located.

* Further support sits around 170, with a deeper PUT wall at 166.94.

📈 Resistance Cluster at 185–190

* Above price, multiple CALL resistance levels stack tightly from 185 → 187.5 → 190.

* The 86.44% CALL Resistance at 190 marks the gamma ceiling — dealers are short CALLs and likely to hedge against rallies here, making upside stickiness high.

📊 GEX Sentiment Summary:

* IVR: 58.4 → Volatility is elevated, traders are hedging more aggressively.

* IVx: 49.2, down –9.59%, shows softening vol despite rising risk — hinting a potential vol crush if breakdowns continue.

* PUTs only 14.4%, but concentrated around current price levels — enough to trigger sharp gamma-driven moves on breakdowns.

🎯 GEX Implications:

* Bearish trigger if AMZN loses 179 — opens room to 175, 172.5, possibly 170–166.9.

* Bullish bounce only holds if 179 defends and price reclaims 183+, but faces strong CALL resistance near 190.

🕰️ Technical Analysis – 1 Hour Chart

Trend Analysis:

* AMZN broke below both VWAP and rising support line, confirming bearish short-term trend.

* Price is compressing inside a descending triangle, now threatening a full breakdown.

Indicators:

* MACD: Bearish crossover is holding, with no bullish momentum yet.

* RSI: Falling under 40, no divergence forming — confirms sellers still in control.

Key Zones to Watch:

* Support: 179 → 175 → 172.5 → 170 → 166.94

* Resistance: 183.5 → 185 → 188.42 → 190

🧠 Final Thoughts:

AMZN is perched right above a gamma cliff, with GEX showing dominant PUT support that could flip into downside acceleration on any weakness under 179. CALL resistance above is dense and unrelenting, especially ahead of earnings.

Bulls need a sharp reclaim of 183+ to neutralize risk — otherwise, this chart favors continuation lower into the mid-170s.

This analysis is for educational purposes only and does not constitute financial advice. Always trade with proper risk management and let price confirm your bias.

AMAZON is on its 3rd historic +1000% growth Bull Cycle.Amazon (AMZN) almost has been trading within a multi-year Channel Up pattern since the Housing Bubble bottom in November 2008 and this month almost touched its 1M MA50 (blue trend-line).

With the exception of the 2008 Housing Crisis and the 2022 Inflation Crisis, which bottomed on the 1M MA100 (green trend-line), the 1M MA50 has never been broken. In fact it has been the key Support of every Bull Cycle that surprisingly has so far peaked on a +1051% rise.

As you can actually see by the 1M RSI, such corrections, like the one in the past 3 months, are quite common within the Channel Up and offer excellent long-term buy entries.

So, technically the Inflation Crisis bottom (December 2022) on the 1M MA100 has initiated Amazon's 3rd historic Bull Cycle within this pattern and based on the previous two, it may also peak after a +1051% rally inside 2028. Our projected Target on this is $900.

Would you miss out on such an opportunity in the past?

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Amazon (AMZN): Eyeing a Long Opportunity Amid AI Growth Potentia-Key Insights: Amazon demonstrates a dual opportunity for investors. Short-term

technical analysis shows a bounce toward resistance levels at $188-$200, driven

by accumulation trends in broader tech stocks. Long-term catalysts include

undervaluation, a robust cloud computing business, and aggressive AI

infrastructure expansion, solidifying Amazon as a leading contender among major

tech firms. Investors should consider long positions, leveraging the current

market narrative of stabilization and upside.

-Price Targets:

- Next Week Targets: T1=$195, T2=$200

- Stop Levels: S1=$181, S2=$175

-Recent Performance: Amazon has experienced bearish pressure with its year-to-

date performance down by 16%-33%, aligning with broader trends in major tech

stocks. Despite these declines, accumulation patterns suggest a pivot toward

bullish momentum. The stock showed resilience, touching resistance levels in the

$190-$200 range amid temporary rebounds prompted by sector-wide stabilization.

-Expert Analysis: Analysts highlight Amazon’s undervaluation and long-term

growth opportunities, reinforced by a PE ratio of 33 and a DCF model suggesting

72% upside potential. Robust AI investments, including cost-effective in-house

solutions, signal leadership in technology infrastructure while challenging

competitors like Nvidia. Diversified revenue streams from advertising, cloud

computing, and robotics further strengthen its investment appeal.

-News Impact: Tariff concerns on semiconductors could contribute to short-term

volatility but are unlikely to undermine Amazon’s strong fundamentals.

Anticipated earnings announcements may become a critical catalyst for price

movements, with broad tech recovery trends providing support. Allegations of

insider trading involving U.S. Representative Marjorie Taylor Greene shed light

on the market importance of Amazon stock, underscoring its pivotal role in

investor portfolios.

AMZN Breaks Channel: Bearish Setup Targets $184AMZN Daily Chart Analysis

Price Action: AMZN has been in a strong uptrend, trading within an ascending channel (yellow and blue lines). Recently, it broke below the channel support around $204.17, signaling a potential trend reversal or pullback.

Indicator: The Enhanced Trend & Volume Confirmation Indicator shows a bearish shift, with the price dropping to $195.55 after failing to hold above the upper channel resistance.

Key Levels:

Support: $184 (recent low and psychological level).

Resistance: $204.17 (channel support turned resistance).

Volume: The sharp decline suggests strong selling pressure, confirmed by the indicator's bearish signal.

Outlook: Bearish in the short term. Watch for a retest of $184 support. A break below could target $175 (next major support). If price reclaims $204.17, the uptrend may resume.

Trade Idea: Consider shorting on a bounce to $204 with a stop above $208, targeting $184. Alternatively, wait for confirmation of support at $184 for a long entry.

#AMZN #Bearish #TrendAnalysis

AmazonAs with the rest of the market, it seems that Amazon found its local bottom. If this pattern is to remain standard, it should ideally move slightly higher to finish of the a wave. Afterwards it should spend some time consolidating lower for b before raising up to the target box for c of B. This pattern is pretty straight forward so just let me know if you have any questions regarding the price action of Amazon. Remember, we should move up to the target box in a 3-wave fashion. Also, this is a B wave and thus can become very complex. Have patience as it may end up being needed with all of the whip saw of the markets lately.

Amazon I Technical & Tariff Analysis Welcome back! Let me know your thoughts in the comments!

** Amazon Analysis - Listen to video!

We recommend that you keep this pair on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!Welcome back! Let me know your thoughts in the comments!

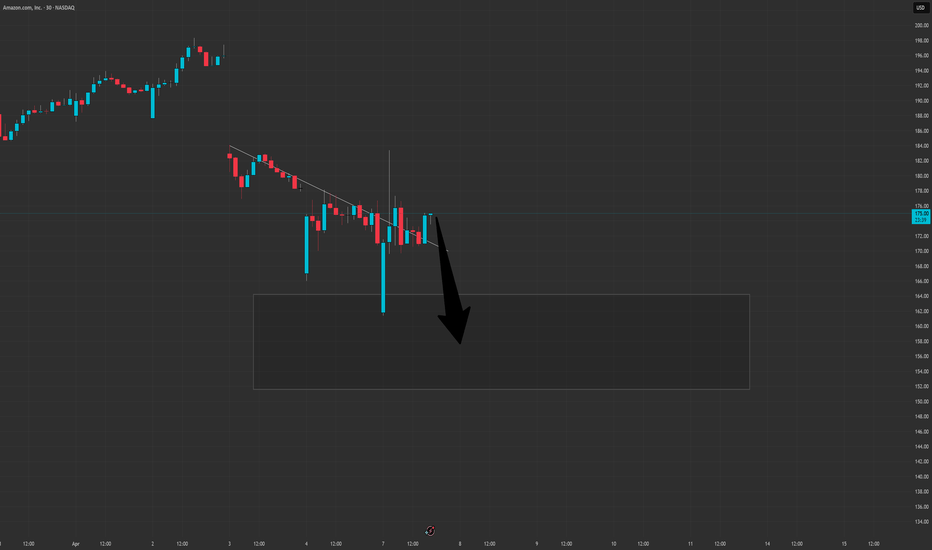

OptionsMastery: This is the "h" DayTrading Pattern.This is the "h" pattern. A highly successful daytrading pattern!

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Apparatchik Trump Says 'No.. More Pain' Ahead of Amazon EarningsPresident Trump's new tariffs have had a significant negative impact on Amazon's stock performance, revenue, and earnings, primarily due to increased costs and supply chain disruptions.

Here below is a detailed analysis of these effects.

Impact on Amazon's Stock Performance

Amazon's stock has seen substantial declines following the announcement of Trump's tariff plan. The company's shares dropped nearly 7% within two days of the announcement and are down nearly 21% year-to-date. These tariffs have exacerbated existing challenges for Amazon, which was already struggling in early 2025 with a 13% decline in stock value during the first quarter. The broader market also suffered, with technology stocks experiencing sharp declines as investors reacted to fears of higher costs and inflation.

Revenue Challenges

Amazon's reliance on Chinese suppliers for merchandise has made it particularly vulnerable to the newly imposed tariffs. Over 50% of Amazon's top third-party sellers are based in China, and many of their products are subject to hefty import taxes, including a 34% tariff on Chinese goods. These tariffs increase landed costs for a significant portion of Amazon's inventory, forcing sellers to either absorb the additional expenses or pass them on to consumers through higher prices. This could lead to reduced consumer demand, as higher prices may deter shoppers from purchasing goods on Amazon's platform.

Additionally, the elimination of duty exemptions on minor imports—previously advantageous for discount platforms such as Temu and Shein—has disrupted Amazon's competitive pricing strategy. While this change may level the playing field among e-commerce platforms, it also raises operational costs for Amazon's marketplace vendors who had relied on these exemptions.

Earnings Pressure

The tariffs are projected to slash Amazon's annual operating profits by $5 billion to $10 billion due to increased merchandise costs. Goldman Sachs estimates that these costs could rise by 15% to 20%, further straining profitability. While Amazon has historically maintained lower prices compared to competitors, absorbing these increased expenses without raising prices significantly may be unsustainable in the long term.

Moreover, fears of inflation resurgence due to Trump's trade policies could further dampen consumer purchasing power. This would likely lead to lower sales volumes and additional pressure on profit margins across Amazon's retail operations.

Potential Mitigation Strategies

To counteract these challenges, Amazon may implement several measures:

Vendor Negotiations. The company could negotiate with suppliers to share the burden of increased input costs rather than bearing them entirely.

Price Adjustments. Selective price increases on certain products may help offset rising costs without alienating customers entirely.

Supply Chain Diversification. Shifting sourcing away from heavily tariffed regions like China or focusing more on domestic suppliers could reduce exposure to trade disruptions.

Focus on Services. Amazon’s cloud division, AWS, contributes significantly to its operating income (58% in Q4 2024) and remains largely unaffected by tariffs. Increased emphasis on AWS could help mitigate losses from retail operations.

Technical challenge

The main technical graph indicates on Bearish market in development, with nearly 30% potential to further decline, down to major 10-year average support.

Conclusion

Trump’s tariffs have created substantial headwinds for Amazon by driving up costs and disrupting its supply chain. These challenges have led to stock declines, reduced revenue potential, and significant earnings pressure. While Amazon is exploring mitigation strategies such as vendor negotiations and diversification, the long-term impact will depend on how effectively the company adapts its operations amidst ongoing trade tensions.

--

Best 'Apparatchik' wishes,

PandorraResearch Team 😎

AMZN at a Decision Point! Bulls or Bears—Who Will Win This Week?Technical Analysis (TA) for AMZN – April 7, 2025

After last week's broad-market flush triggered by tariff headlines, AMZN now sits at a key support level near $170, showing signs of weakness but holding a structure that traders should monitor closely.

Market Structure & Price Action:

* Price remains within a descending channel, making consistent lower highs.

* The recent Break of Structure (BOS) confirms bearish control after failing to hold the demand zone near $175.

* Price has now formed a small consolidation box below the BOS, typically a sign of continuation if no bullish momentum appears.

* Support remains weak near $170; a breakdown here opens the door toward the next major level at $165 and potentially down to $160.

* Overhead resistance sits at $184.50, aligned with the upper trendline and a previous liquidity sweep.

Indicators:

* MACD is slowly curling up from deeply negative territory, but still lacks a clear bullish crossover.

* Stoch RSI is oversold but hasn’t crossed up yet, indicating buyers are not yet stepping in aggressively.

GEX and Options Sentiment Analysis (1H Timeframe):

* Put Support (NETGEX) is strongest at $170, exactly where price is sitting now, giving short-term protection to the downside.

* Beneath that, $165 and $160 show substantial GEX negatives, meaning if $170 breaks, downside acceleration is highly likely.

* Gamma Resistance and Call Wall are stacked between $190–$203, with $190 showing the highest positive NETGEX – making it a strong resistance cap.

* IVR 142 and IVx avg 83.4%: Elevated volatility indicates strong market uncertainty.

* PUTs: 16.4% dominance, with 3 red GEX dots = bearish pressure with low call support.

Trade Setups to Watch This Week:

Bearish Continuation Setup (If $170 breaks):

* Entry: Below $169.80

* Target 1: $165

* Target 2: $160

* Stop: Above $173.50

Bullish Reversal (Only if strong reclaim of BOS):

* Entry: Above $176.50

* Target 1: $182.50

* Target 2: $190

* Stop: Below $170

Summary & Suggestions:

* Short-term traders can look to play the breakdown below $170, but must react quickly and respect momentum.

* Investors should stay cautious here. Only consider adding if AMZN reclaims the BOS zone and the market stabilizes.

* With tariff-related volatility still in the headlines, trade with reduced size and tighter stops.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

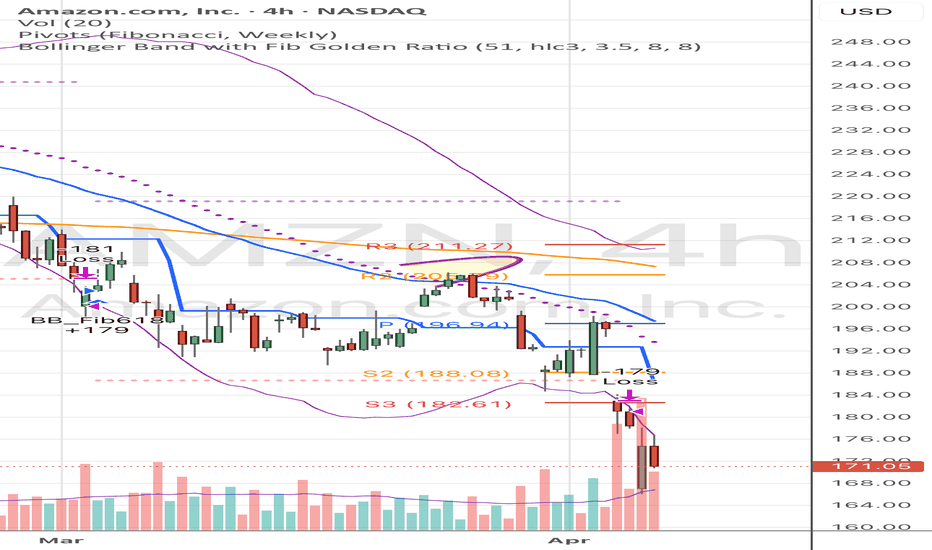

A falling knife - don’t catch it

Analysis on 4H Chart (April 2025)

Amazon (AMZN) experienced a sharp sell-off, currently trading at $171.05, down -7.41% on the session. This 4H chart shows a significant bearish movement, and there are clear signs of trend continuation if key support zones don’t hold.

• Current Price: $171.05

• Weekly Pivot S3: $182.61 (Broken convincingly)

• Next Major Support: Psychological level around $165, and volume profile shows thinning in that region — potential for rapid drop if $170 fails.

• Resistance Levels:

• R1: $196.94 (Pivot)

• R2: $205.79

• R3: $211.27 (Aligns with previous highs)

Volume Profile:

• Sharp increase in bearish volume on the breakdown – confirms strong selling pressure.

• Price has breached the lower Bollinger Band decisively — could mean oversold in the short term.

Trade Ideas

Short-Term Bearish Continuation

• Entry: Below $170 on a retest and rejection.

• Target: $165 (1st target), $160 (2nd target).

• Stop: Above $175

Happy trading

More Downside For AMZN Before CrossroadsMy overall thesis is we are in the very early stages of a multi-year decline ultimately with the S&P 500 below 3500. I am estimating this symbol to be in wave position SuperCycle 2, Cycle A, Primary 1, Intermediate 3 (pink), Minor 3 (yellow), Minute 5(green). I originally had this symbol nearly complete with Primary wave 1, but the continued declines received significant wave 3 of 3 of 3 signals (pink lines in bottom chart band). It is still unclear if we are in my theoretical larger decline or if we are in a simple corrective wave. It will take at least another two months to likely achieve the answer.

Theory 1 is my hypothesis where we are about to finish Minor wave 3 in Intermediate wave 3 in Primary wave 1 in a multi-year market correction. This would see AMZN bottom around 148-156 within two weeks and briefly head up toward 180 before continuing significant downward movement. Currently Intermediate wave 1 lasted 201 trading hours. Based on the breakneck pace of Intermediate wave 3, it may finish well before the 201st hour on 5 May. Extensions based on Minor wave 1's movement could put Minor wave 3's bottom around 162.59.

Theory 2 is that Intermediate waves 1, 2 and 3 (pink) are actually waves A, B, and C (white) in a short-term corrective wave. This would mean this symbol returns to all-time highs around the fall of 2025.

Theory 3 places the stock in the third wave about to finish a wave A down. Wave B up would last a few months before wave C takes the market to a bottom sometime around the end of 2025.

All three theories will observe the same movement over the next few weeks with a low soon and then a bounce up. Theory 2 becomes the likely winner if AMZN breaks above 206.21 within the next 2 months. Theories 1 and 3 will trade the same for quite some time.

I will reevaluate this stock once Minor wave 3 finishes. It should aid in providing a better bottom for Intermediate wave 3 in the next week or two.