GOOGL Weekly Options Trade Plan 2025-04-17GOOGL Weekly Analysis Summary (2025-04-17)

Below is our integrated analysis for GOOGL weekly options trading based on the current options data and the multiple model reports:

──────────────────────────────

Comprehensive Summary of Each Model’s Key Points

• Grok/xAI Report – Observes that although the 5‐minute chart shows a hint of short‐term bullishness, the daily chart is clearly bearish (price below the 10 EMA and RSI around 41) and news catalysts (antitrust concerns) add further downside bias. – Highlights a significant concentration of put open interest around the $150 strike and recommends buying the $150 put at a premium of about $0.24 with an entry at open. – Suggested profit target at roughly a 50% premium increase and a stop loss if the premium falls by about 25% (or if the price fails to break key resistance).

• Claude/Anthropic Report – Confirms a moderately bearish bias with price trading below all key daily EMAs and negative regulatory news intensifying the downside. – Points to the heavy open interest in the 150 puts and emphasizes that although max pain is at $155 (a theoretical pull toward higher prices), the aggressive negative catalyst trumps this signal. – Recommends a put trade with guidelines for profit-taking (roughly a 100% premium gain) and a 50% premium stop-loss; entry to be made at market open.

• Gemini/Google Report – Notes the strong bearish daily setup (price clearly below the 10/50/200 averages and near key supports around $150) combined with negative antitrust headlines. – While acknowledging some short-term consolidation on the 5-minute chart, the report favors a bearish play and selects the $150 put (even though its premium of $0.24 is a bit below the “ideal” $0.30–$0.60 range). – Recommends entering at open with specific targets (aiming for around a 100% return on premium or an exit if the underlying fails to break levels) and strict stop-loss discipline.

• Llama/Meta Report – Summarizes that the technicals (including MACD and RSI on both timeframes) and high volatility (VIX ~32.64) combine for a moderately bearish setup. – The heavy put open interest at $150 further reinforces this view. – Recommends buying the $150 put at market open with a modest profit target (around a 50% gain on premium) and a stop-loss if the underlying rallies above key resistance levels.

• DeepSeek Report – Emphasizes that despite the max pain at $155, the technical breakdown below key moving averages and significant negative news support a bearish trade. – Recommends buying weekly (0DTE) $150 puts at the current premium of $0.24, with exit parameters tied to breaching immediate support or achieving a 50% gain in premium. – Notes that risk management is crucial given the 0DTE nature and high volatility.

────────────────────────────── 2. Areas of Agreement and Disagreement Between Models

• Agreement: – All models share a moderately bearish outlook driven by a combination of: ○ Price performance below key moving averages and declining daily RSI. ○ Negative news catalysts (antitrust issues and breakup concerns). ○ Heavy put open interest at the $150 strike, aligning with technical support. – Each model favors a single-leg, naked put strategy on GOOGL weekly expirations, with an entry at market open.

• Disagreement: – There is some variation in the selection of profit target and stop loss levels: ○ Grok/xAI and DeepSeek lean toward a profit target near a 50% premium gain and a tighter stop loss, while Claude/Anthropic and Gemini reference a slightly larger profit target (up to 100% gain) paired with a 50% stop loss. – There is a mild conflict with the max pain theory (which is bullish at $155) versus the consensus technical and news story indicating further downside. However, all models agree that the negative catalysts outweigh the theoretical pull toward max pain.

────────────────────────────── 3. Conclusion and Trade Recommendation

• Overall Market Direction Consensus: – The integrated view is moderately bearish. Although intraday charts hint at short-term consolidation, the dominant daily technicals, high volatility, and strongly negative news set the stage for further downside pressure.

• Recommended Trade: – We recommend buying a single-leg, naked put option. – Selected Instrument: GOOGL weekly option with a $150 strike (0DTE expiring on 2025-04-17). – Premium: The current ask is $0.24 per contract. Although this is slightly below the ideal range, the risk/reward profile is favorable given the strong technical and sentiment bias. – Entry Timing: Enter at market open. – Profit Target: Aim for a premium increase to approximately $0.36 (a ~50% gain). – Stop-Loss: Set a stop-loss around $0.12 (roughly a 50% reduction in premium), or exit if the underlying rallies decisively above the intraday resistance levels (around $152). – Confidence Level in the Recommendation: Approximately 70%.

• Key Risks and Considerations: – The max pain level at $155 could introduce some intraday upward pressure. – High implied volatility (VIX at 32.64) means rapid moves could quickly hit stop-loss triggers. – The 0DTE nature of the option calls for strict monitoring; if GOOGL fails to break below key support levels early on, exit the position promptly. – Overall market reversals or unexpected news can rapidly change the trade dynamics.

────────────────────────────── 4. TRADE_DETAILS (JSON Format)

{ "instrument": "GOOGL", "direction": "put", "strike": 150.00, "expiry": "2025-04-17", "confidence": 0.70, "profit_target": 0.36, "stop_loss": 0.12, "size": 1, "entry_price": 0.24, "entry_timing": "open" }

Disclaimer: This newsletter is not trading or investment advice but for general informational purposes only. This newsletter represents my personal opinions based on proprietary research which I am sharing publicly as my personal blog. Futures, stocks, and options trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators, and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC, or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. By reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are courtesy of TradingView. I am just an end user with no affiliations with them. Information and quotes shared in this blog can be 100% wrong. Markets are risky and can go to 0 at any time. Furthermore, you will not share or copy any content in this blog as it is the authors' IP. By reading this blog, you accept these terms of conditions and acknowledge I am sharing this blog as my personal trading journal, nothing more.

GOGL trade ideas

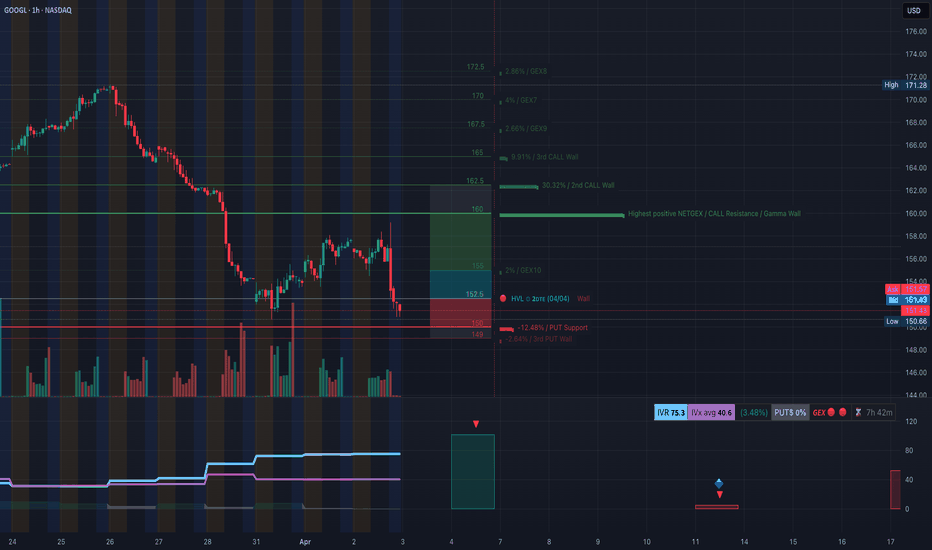

GOOGL GEX Alert: Sitting on a Gamma Cliff! 🔮 GEX (Gamma Exposure) – Options Sentiment Analysis

🚨 Key PUT Pressure Zone at 155–152.5

* GOOGL is currently hovering above its highest negative GEX level at 155.14, which aligns with a thick PUT support wall.

* A breakdown below 155 could trigger gamma-induced acceleration to 152.5, then quickly toward 150, where another major PUT wall sits.

🧱 Resistance Cluster Overhead at 157.5–162.5

* GEX shows a dense band of CALL resistance forming between 157.5 and 162.5, topped off by another CALL wall around 165.

* Dealers will likely hedge downward moves aggressively below 155, while upside attempts could struggle to break through the 160–162 band unless sentiment flips.

💡 Options Data Summary:

* IVR: 54.6 → Elevated implied volatility rank, indicating heightened option premiums.

* IVx: 46.6 with a –10.67% drop, suggesting traders are de-risking or volatility is being absorbed.

* PUTS make up 15.8%, which is moderate but growing — enough to trigger strong downside gamma flows if breakdown happens.

🎯 GEX Scenario Outlook:

* Bearish Trigger: A flush under 155 likely unlocks 152 → 150 → 145 range targets fast.

* Bullish Reversal: Needs to reclaim 157.5, then challenge the 160–162.5 zone, where CALL hedging could stall any rally.

🕰️ Technical Analysis – 1H Chart Summary

Trend Weakening:

* GOOGL is breaking down from a rising wedge and has lost VWAP and short EMAs.

* Selling volume is increasing while momentum fades — confirming short-term bearish bias.

MACD:

* Bearish crossover confirmed, histogram widening on the downside.

RSI:

* Sliding under 40, no sign of bullish divergence — momentum supports further downside.

Key Technical Zones:

* Support: 155.14 (GEX support), 152, 149.96, 141.78

* Resistance: 157.5, 160, 162.31

🧠 Final Thoughts:

GOOGL is resting on critical GEX PUT support at 155 — a break here could act like a trapdoor to 150 or even sub-145 levels. On the other hand, bulls must break through layered CALL walls up to 162.5 to regain any control.

With IV cooling, GEX dominant to the downside, and technicals aligning, caution is key. Wait for confirmation — this is a gamma-driven battleground.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk accordingly.

Google - Fantastic Bullish Break And Retest!Google ( NASDAQ:GOOGL ) just looks amazing:

Click chart above to see the detailed analysis👆🏻

For more than a decade, Google has been trading in a rising channel formation, perfectly respecting all market structure. Now, Google is about to retest the previous all time high once again and with a sharp correction of about -25%, this offers a significant bullish reversal setup.

Levels to watch: $150

Keep your long term vision,

Philip (BasicTrading)

GOOGLE's generational bottom made. This is how it reaches $350.Alphabet Inc. (GOOG) almost tested last week its 1W MA200 (orange trend-line). That level has been holding for more than 2 years (since March 13 2023) and it's been the main Support of the Bull Cycle that followed the November 2022 Inflation Crisis bottom.

The pattern is almost like the Ascending Triangle that led to the March 2020 COVID crash, which was the most recent time before the late 2022 bottom that the stock made contact with the 1W MA200. As you realize, all those times have been what we call 'generational bottoms', thus extremely good long-term buy opportunities. And as you see they've been on extremely tight time symmetry, all took place roughly every 2.5 years.

If the pattern continues to repeat itself, then we may witness a rally (green Channel Up) similar to the one that peaked on November 2021 and reached the 2.618 Fibonacci extension. As a result, setting a $350 Target would be more than realistic based on this pattern.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Pop and Flop in GOOGL?Google recently staged a sharp rebound, filling the gap perfectly after a major sell-off driven by tariff-related headlines. While I had personally expected a deeper move into the $137.36–$135.41 range, price found strong buying interest earlier than anticipated.

The area we bounced from is significant—it's essentially the origin of the move that led to Google’s all-time high in 2024. However, despite the bounce, GOOGL has lost support across all timeframes , which shifts my focus toward potential short opportunities.

I’m now watching for a reaction around the support-turned-resistance zone near $164 . There’s an untested monthly level at $161.72 , which could trigger a reaction, but the area I’m really eyeing is the weekly resistance zone from $164 to $165.87 . I believe this range could act as a strong reversal zone and spark a deeper pullback.

If that rejection plays out, here are the levels I’m watching for downside targets:

- Target 1: $157.04 (daily support zone)

- Target 2: $146.75 (leg end and major weekly swing low from September 2024)

- Target 3: $141.55 (previous leg low)

- Final Target: New lows below $140.00

This short setup was far more appealing before the recent bounce off the $140 zone, so I will remain cautious. However, if price starts reacting from this resistance zone and breaks back below the monthly at $161.72 —or even more convincingly, the local daily support at $160.67 —that would trigger confirmation for continuation to the downside.

Invalidation levels:

- A weekly close above $165.03

- A daily close above $170.60

Either of those would invalidate the short thesis.

Can Efficiency Topple AI's Titans?Google has strategically entered the next phase of the AI hardware competition with Ironwood, its seventh-generation Tensor Processing Unit (TPU). Moving beyond general-purpose AI acceleration, Google specifically engineered Ironwood for inference – the critical task of running trained AI models at scale. This deliberate focus signals a Major bet on the "age of inference," where the cost and efficiency of deploying AI, rather than just training it, become dominant factors for enterprise adoption and profitability, positioning Google directly against incumbents NVIDIA and Intel.

Ironwood delivers substantial advancements in both raw computing power and, critically, energy efficiency. Its most potent competitive feature may be its enhanced performance-per-watt, boasting impressive teraflops and significantly increased memory bandwidth compared to its predecessor. Google claims nearly double the efficiency of its previous generation, addressing the crucial operational challenges of power consumption and cost in large-scale AI deployments. This efficiency drive, coupled with Google's decade-long vertical integration in designing its TPUs, creates a tightly optimized hardware-software stack potentially offering significant advantages in total cost of ownership.

By concentrating on inference efficiency and leveraging its integrated ecosystem, encompassing networking, storage, and software like the Pathways runtime, Google aims to carve out a significant share of the AI accelerator market. Ironwood is presented not merely as a chip, but as the engine for Google's advanced models like Gemini and the foundation for a future of complex, multi-agent AI systems. This comprehensive strategy directly challenges the established dominance of NVIDIA and the growing AI aspirations of Intel, suggesting the battle for AI infrastructure leadership is intensifying around the economics of deployment.

GOOGL Technical Analysis (1H)Trend: Short-term bullish channel developing

Price: $157.09

Structure: Price is currently grinding upward inside a rising channel with support around $150 and resistance near $159.50.

Key Support & Resistance Levels:

* 🔽 Support: $150.04 → confluence with lower trendline and previous demand zone

* 🔼 Resistance: $159.51 → upper trendline, testing prior intraday rejection level

Volume: Rising steadily with every test of the lower channel support—buying pressure is evident.

RSI: Slight bullish momentum but approaching mid-range (not yet overbought)

🎯 Trade Idea:

* Bullish Scenario: If price breaks and closes above $159.50 with volume, the next leg toward $162–$165 is possible.

* ⚡️ Entry: $158 breakout

* 🎯 Target: $162.50 / $165

* 🛑 Stop: $155

* Bearish Scenario: A breakdown below $155 may trigger a move toward the $150 and $144 zones.

* ⛔️ Entry: Below $154.80

* 🎯 Target: $150 → $144

* 🛑 Stop: $158

🔥 Options GEX & Sentiment Insights

IVR/IVx:

* IVR: 70.6 (elevated, traders are pricing in movement)

* IVx Avg: 58 → implies option prices are above historical norm

Options Flow:

* Puts: 27.1% dominance (moderate hedging activity)

* GEX Bias: Strong Gamma Wall at $157, suggesting price may gravitate toward or stall here unless a breakout occurs.

* Call Walls:

* $160 – Mild resistance

* $162.5 – Potential profit-taking zone

* Put Walls:

* $150 – Strong support area due to GEX negative cluster

* $145–$140 zone – Loaded with high negative GEX: bounce likely if it dips there

⚠️ GEX Highlight:

* The Highest Positive NETGEX is near $157, suggesting market makers prefer pinning price near this zone unless there's a volatility jolt.

💡 Final Thoughts & Strategy

GOOGL is currently in a tight spot where price is climbing within a narrowing channel, and the GEX walls are aligning perfectly around it. It’s a gamma-neutral zone where market makers may suppress volatility short term unless external catalysts break the structure.

Scalp Idea: Use break/retest around $157 or $160 for quick directional trades.

Options

Strategy:

* Neutral-to-Bullish: Consider selling a put credit spread above $150 if expecting price to consolidate.

* Directional Call: Buy 0DTE or 2DTE calls if price breaks above $159.50 with volume.

GOOGL Tariff Relief dips to buy: $156.76 ideal, 150.00 possible GOOGL got sold in panic then bought in fomo.

We of the Fib Faith indulge in logical serenity.

We plan and execute calmly and deliberately.

$156.10-156.76 Bounce would indicate strong bull.

$150.55-150.84 is a Must-Hold or it was a bull trap.

$168.17-170.00 should be an achievable first target.

===============================================

Google may rotate up soon - Bearish exhaustion maybe?NASDAQ:GOOGL is looking at a possible short-term recovery after the stock has shown significant bearish exhaustion. 1.) Prices dip below the key support with spike in volume. Suspected manipulation or bear trap. 2.) the whole corrective move since Aug 2024 is in a bearish corrective flat structure. Meaning to say, that the stock may find its major support at 123.6% extension of the previous day range.

While stochastic is showing potential signs of oversold and DM- is peaking. so anytime from now, we are looking for strong opportunity to buy. Key clue, if the stock rally 6-8% within a day, we are looking at a possible recovery.

Trump tariffs 2018 vs 2025Based on the Google stock chart, I believe that large corporations reflect the overall economy more than their individual financial strength.

History:

January 2018: The U.S. imposed tariffs ranging from 30% to 50% on imported solar panels and washing machines.

March 2018: Tariffs of 25% on steel and 10% on aluminum imports were enacted, citing national security concerns.

June 2018: The steel and aluminum tariffs were extended to include imports from the European Union, Canada, and Mexico.

July 2018: The U.S. imposed a 25% tariff on $34 billion worth of Chinese goods, initiating a trade conflict with China.

August 2018: An additional 25% tariff was applied to another $16 billion of Chinese imports.

September 2018: The administration implemented a 10% tariff on $200 billion worth of Chinese goods, with plans to increase it to 25% by January 2019.

May 2019: The tariff on the $200 billion of Chinese goods was increased from 10% to 25% after trade negotiations stalled.

August 2019: President Trump announced plans for a 10% tariff on an additional $300 billion of Chinese goods, which were later adjusted, with some products facing a 15% tariff starting in September 2019 and others delayed to December 2019.

OptionsMastery: Looks like a good buy on GOOGLE!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Alphabet ($GOOGL) Nearing Completion of 5-Wave DeclineIn our latest Elliott Wave analysis of Alphabet ( NASDAQ:GOOGL ) on the 30 minute chart, we observe a clear 5-wave impulse structure unfolding to the downside, originating from the February 5, 2025 peak. This decline aligns with the broader corrective pattern, and we believe NASDAQ:GOOGL is now in the final stages of this bearish move before a larger recovery takes shape. Let’s break down the structure and what to expect next.

Wave Structure Breakdown

The chart below illustrates that NASDAQ:GOOGL reached a significant high on February 5, 2025, at 209.51.

From this peak, the stock initiated a 5-wave impulse decline:

- Wave ((1)): The first leg down concluded at 156.72, marking a sharp initial decline from the February 5 high.

- Wave ((2)): A corrective rally followed, retracing part of the decline and peaking at 171.28, completing wave ((2)) as the 30 minute chart below shows.

- Wave ((3)): The decline resumed with wave ((3)), which extended lower to 150.66.

- Wave ((4)): A counter-trend rally unfolded in a 3-wave structure, labeled (W)-(X)-(Y) on the chart, reaching a high of 159.23 on April 3, 2025, as indicated on the chart. This peak marked the completion of wave ((4)).

- Wave ((5)): The current leg lower began after the April 3 peak at 159.23. As of the latest data on April 3, 2025, NASDAQ:GOOGL has reached 152.76, as shown on the chart, and appears to be in the final stages of wave ((5)).

Current Position and Invalidation Level

The chart highlights an invalidation level at 171.34 (the “RIGHT SIDE+” line in red). As long as NASDAQ:GOOGL remains below this level, the bearish outlook for wave ((5)) remains valid. With the current price at 152.76, wave ((5)) is likely approaching its conclusion soon. It should not go below 138.7, otherwise wave ((3)) will be the shortest wave. Alphabet (GOOGL) 30 Minutes Elliott Wave Chart

What’s Next: A Larger 3-Wave Rally

Upon the completion of wave ((5)), we expect NASDAQ:GOOGL to initiate a larger 3-wave corrective rally. This should be end a higher-degree wave b. The rally should unfold in a 3-wave pattern (A-B-C) and could target a retracement toward the 170.6 area, where prior wave ((2)) levels may act as resistance.

GOOGL Testing Key Support: Breakdown or Bounce from $150?

🧠 Macro Context:

In the wake of the Trump tariff announcement, market-wide risk aversion hit big tech hard. GOOGL is now sitting on a crucial $150 gamma support zone, where both technical and options flow converge. The market is indecisive: is this a base or a trap?

📊 Technical Analysis (1H Chart)

Market Structure:

* GOOGL has been in a consistent downtrend, rejecting lower highs.

* Attempted recovery stalled at the HVL around $152.50, and now price is back down to support near $150.66.

* The short-term trendline from the late March breakdown has held, acting as dynamic resistance.

Key Levels:

* Support:

* 🔻 $150.66 = Recent session low

* 🔻 $149 = PUT wall / breakdown risk zone

* Resistance:

* 🔺 $152.50 = HVL rejection zone

* 🔺 $155 = First GEX resistance area

* 🔺 $160 = Massive Gamma Wall / Call Resistance

Indicators:

* Selling volume continues to be elevated.

* No real sign of divergence or bottoming pattern yet, but price is coiling near a gamma pivot.

🧨 GEX & Options Flow Analysis

GEX Map (Options GEX ):

* GEX: 🔴🔴🔴 — heavy short gamma positioning means dealers are sellers into strength, adding fuel to downside momentum if $150 breaks.

* Highest Net Positive GEX / Call Wall sits around:

* $160–162.5 = Gamma resistance cluster

* Put Support:

* $150–149 = Highest PUT density. A break below could trigger dealer hedging flows, accelerating losses.

Options Oscillator:

* IVR 75.3 → Elevated risk expectations.

* IVx 40.6 avg vs 3.48% daily → Volatility is rising but hasn't spiked.

* PUT$ 0% → Either the data is delayed or retail isn't hedging — could mean more downside is possible.

🧭 Trade Scenarios

🐻 Bearish Breakdown Setup:

* Trigger: Clean break below $150.60 with volume

* Target: $149 → $147.50

* Stop: Above $152.50 (tight control)

* Edge: GEX confirms no real support below $149

🐂 Gamma Bounce Setup:

* Trigger: $150 holds and price reclaims $152.50

* Target: $155 → $160 (scalp to swing)

* Stop: $149 breakdown

🔥 Summary:

GOOGL is coiled at the gamma pivot zone ($150). If it breaks, the lack of strong PUT interest and dealer short gamma could trigger a fast move down to $147 or lower. On the flip side, a strong bounce and reclaim of $152.50 can open up a path toward $155–$160.

⚔️ Suggested Plays:

🔻 Buy $150P 0DTE/2DTE on breakdown — ride momentum

🔺 Buy $155C 1-week expiry only if $152.50 is reclaimed with strength

Stay nimble — we’re in a gamma battlefield.

Disclaimer: This is not financial advice. Trade your own plan, manage your risk, and stay objective.

GOOGL - bears taking controlhi traders,

GOOGL ready for more downside.

The monthly time frame is pretty straightforward here.

Huge bearish engulfing is almost confirmed.

STOCH RSI with a bearish cross.

It's a time to retest the 50 simple moving average.

Bears will drag the price towards 135$ where we should see some bounce.

Lower prices are coming.

Check out our SPX analysis:

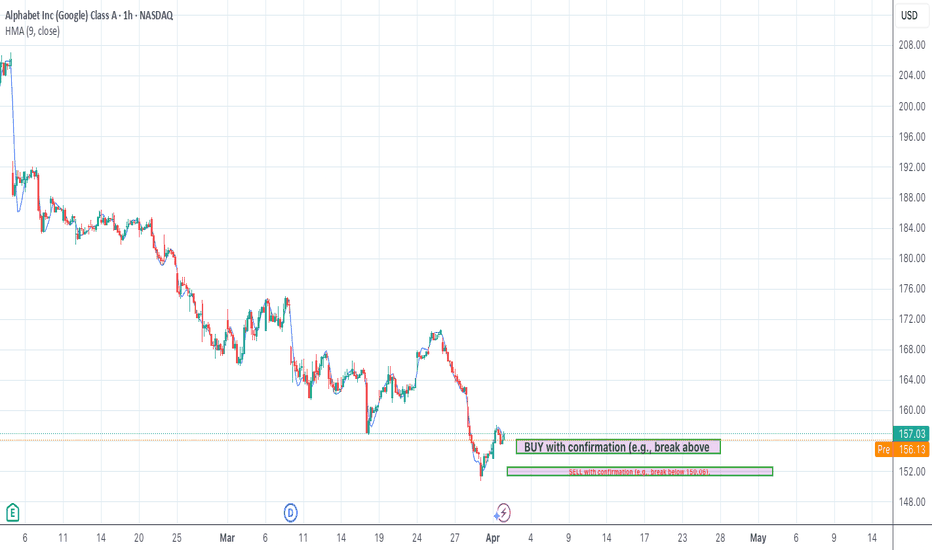

The analysis focuses on the short-term to medium-term timeframe.The analysis focuses on the short-term to medium-term timeframe.

Tug-of-War Between Bulls and Bears: At the current price of 157.04, the market is in a tug-of-war between buyers (bulls) and sellers (bears).

Bulls are defending key support levels near 152.48 (Fibonacci 100% retracement of Wave C) and 154.34 (Expanded Flat target). A hold above these levels could signal a potential reversal.

Bears are attacking resistance levels at 160.31 (Fibonacci 100% projection of Wave C) and 162.82 (Expanded Flat target). A break below 152.48 could accelerate downward momentum.

Recent Price History: The market has been in a downtrend recently, with the price dropping from 191.18 (July 10, 2024) to 157.04. Key Fibonacci levels (e.g., 161.8% retracement at 159.84) and Elliott Wave patterns (e.g., Diagonal Ending Downward Candidate) have guided this decline. Momentum indicators (e.g., RSI at 47.51) suggest the downtrend may be losing steam, but the MACD histogram turning positive hints at a potential short-term bounce.

Current Sentiment (Technical & News):

Technical Indicators: Mixed signals. RSI (47.51) is neutral, while MACD shows a bullish crossover (histogram turning positive). The price is below key moving averages (e.g., 200-day SMA at 167.35), indicating a bearish bias.

News Sentiment: Mixed to slightly negative. Ad revenue pressures and regulatory risks weigh on sentiment, but long-term growth catalysts (AI, cloud) provide optimism. Analysts maintain a "Buy" rating despite near-term challenges.

Synthesis: The technical picture aligns with the news—short-term bearishness (price below MAs, ad revenue concerns) but potential for a reversal if support holds (undervaluation, bullish MACD).

Key Levels & Momentum:

The price is currently below the 50-day SMA (161.89) and 200-day SMA (167.35), signaling bearish dominance.

Momentum is fading (RSI neutral, Stochastic not oversold), but the MACD histogram suggests a possible short-term bounce.

2. Elliott Wave Analysis (Contextualized to Current Price)

Relevant Elliott Wave Patterns:

Diagonal Ending Downward Candidate (Valid): Suggests the downtrend may be nearing completion, with Wave 5 potentially ending near 152.48-154.34 (Fibonacci 100% projection).

Expanded Flat Upward Candidate (Potentially Valid): If the price holds above 152.48, this pattern could signal a corrective rally toward 162.82.

Wave Count vs. Indicators/Sentiment:

The Diagonal Ending pattern contradicts the bearish news sentiment but aligns with oversold technicals (RSI, MACD). This divergence suggests a potential reversal if support holds.

The Expanded Flat pattern would confirm a bullish reversal if the price breaks above 160.31.

Near-Term Projections:

Downside: A break below 152.48 could extend losses to 148.36 (161.8% Fibonacci projection).

Upside: A hold above 152.48 and break above 160.31 could target 162.82 (Expanded Flat target) and 167.35 (200-day SMA).

3. Strategy Derivation (Realistic, Actionable NOW, News Considered)

Primary Strategy: WAIT (due to conflicting signals).

Why Wait? The technical setup is mixed (bullish MACD vs. bearish MAs), and news sentiment is neutral-to-negative. The upcoming Q1 earnings could add volatility.

If Price Holds Support (152.48-154.34):

BUY with confirmation (e.g., break above 160.31).

Entry Zone: 154.34-156.13 (Fibonacci 78.6% retracement).

Stop-Loss: 151.44 (below recent low).

Take Profit: TP1 at 160.31 (Fibonacci 100%), TP2 at 162.82 (Expanded Flat target).

Risk/Reward: ~1:2 for TP1.

If Price Breaks Below Support (152.48):

SELL with confirmation (e.g., break below 150.06).

Entry Zone: 152.48-151.44.

Stop-Loss: 154.34 (above support).

Take Profit: TP1 at 148.36 (161.8% Fibonacci), TP2 at 145.90 (Wave 5 projection).

News Context Check:

Earnings uncertainty and ad revenue pressures favor caution. Reduce position size if trading.

4. Trade Setup (Actionable, Realistic, News Aware)

Direction: WAIT (watch key levels).

Key Levels to Watch:

Upside: 160.31 (breakout confirmation).

Downside: 152.48 (breakdown confirmation).

News Reminder: Be mindful of Q1 earnings and ad revenue trends.

5. Summary Section

✅ Investor / Long-Term Holder Summary:

Key Support: 152.48 (accumulation zone if held).

Long-Term Outlook: Undervalued (DCF: $260 vs. $157). Focus on AI/cloud growth.

Action: Wait for pullback to 152.48 or break above 167.35 (200-day SMA).