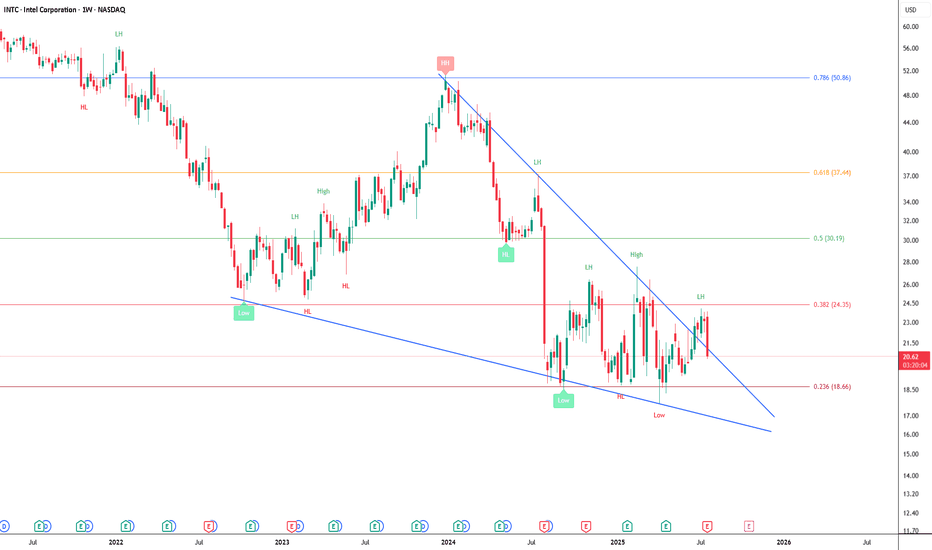

Intel - The bottom is in!🔮Intel ( NASDAQ:INTC ) forms a clear bottom:

🔎Analysis summary:

After a consolidation of about three decades, Intel is now creating a strong bottom formation. With the retest of a major horizontal support area, Intel is respecting clear market structure. Quite likely therefore that Intel will

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−17.19 PLN

−77.61 B PLN

219.73 B PLN

4.37 B

About Intel Corporation

Sector

Industry

CEO

Lip-Bu Tan

Website

Headquarters

Santa Clara

Founded

1968

FIGI

BBG01R39S130

Intel Corp. engages in the design, manufacture, and sale of computer products and technologies. It delivers computer, networking, data storage, and communications platforms. The firm operates through the following segments: Client Computing Group (CCG), Data Center and AI (DCAI), Network and Edge (NEX), Mobileye, Accelerated Computing Systems and Graphics (AXG), Intel Foundry Services (IFS), and All Other. The CCG segment consists of platforms designed for notebooks, 2-in-1 systems, desktops, tablets, phones, wireless and wired connectivity products, and mobile communication components. The DCAI segment delivers solutions to cloud service providers and enterprise customers, along with silicon devices for communications service providers and high-performance computing customers. The NEX segment offers computing system solutions from inflexible fixed-function hardware to general-purpose compute, acceleration, and networking devices running cloud native software on programmable hardware. The Mobileye segment develops driving assistance and self-driving solutions. The AXG segment provides products and technologies designed to help customers solve the toughest computational problems. Its products include CPUs for high-performance computing and GPUs targeted for a range of workloads and platforms, from gaming and content creation on client devices to delivering media and gaming in the cloud, and the most demanding high-performance computing and AI workloads on supercomputers. The IFS segment refers to full stack solutions created from the foundry industry ecosystem. The All Other segment represents results from other non-reportable segments and corporate-related charges. The company was founded by Robert Norton Noyce and Gordon Earle Moore on July 18, 1968 and is headquartered in Santa Clara, CA.

Related stocks

$INTC - Best in the sector against Trump tariffsIntel is a semiconductor technology giant, renowned for its x86 processors that dominate the CPU segment, top revenue in Q2 2025 came from PC chips (Client Computing Group, ~$7.9B) and server/AI chips (Data Center & AI, ~$3.9B) . Other revenue includes foundry services ($4.4B) and legacy businesses

CryptoWolfy - Why you should all buy $Intel right now🔍 Why Intel Is a Good Buy Right Now

1. Strategic Leadership & Restructuring

Intel’s new CEO, Lip-Bu Tan, has initiated a bold turnaround strategy focused on financial discipline and operational efficiency 1.

The company is cutting unnecessary capital expenditures and streamlining its foundry operat

$INTC looks good for at trade to the upside? Targeting $34+?If we look at the chart, we can see INTC failed the breakdown of an H&S, retested the trendline breakout and seems to be heading higher.

Failed breakdowns are usually the most bullish patterns.

I could see the possibility of a large move here to go back and retest the $34 region, or potentially ev

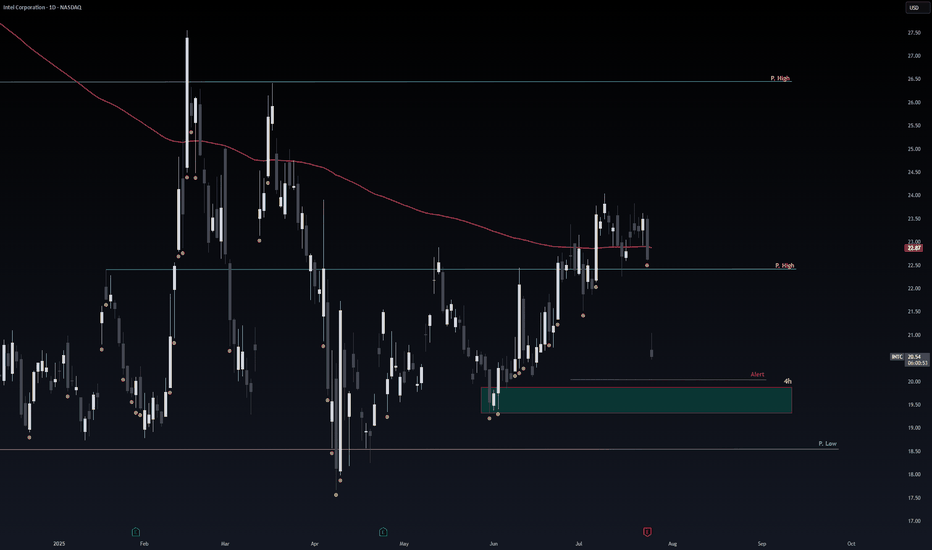

Safe Entry IntelThe 4h Green Zone is Safe & Strong Support for Intel.

If not respected the Pink Line is Second Strong support level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake

Intel: Still Not Cheap Enough?Intel has been falling for years, but some traders may think it’s still not cheap enough.

The first pattern on today’s chart is the series of higher lows since April, combined with lower highs since February. That converging range is a potential consolidation pattern.

Second, the chipmaker broke t

NVDA to save IntelThis may be one of the best entries you get to intel in your life time. NVDA just announced today that all of their new super computer systems are utilizing Intel chips alongside NVDA chips. This is going to push a huge surge in demand for Intel, and also help them get back on track with creating ch

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US458140BK5

INTEL 20/60Yield to maturity

8.25%

Maturity date

Feb 15, 2060

US458140BX7

INTEL 21/61Yield to maturity

8.15%

Maturity date

Aug 12, 2061

US458140BW9

INTEL 21/51Yield to maturity

8.00%

Maturity date

Aug 12, 2051

INTC4914060

Intel Corporation 3.25% 15-NOV-2049Yield to maturity

7.57%

Maturity date

Nov 15, 2049

US458140BV1

INTEL 21/41Yield to maturity

7.45%

Maturity date

Aug 12, 2041

INTC4633368

Intel Corporation 3.734% 08-DEC-2047Yield to maturity

7.34%

Maturity date

Dec 8, 2047

US458140AY6

INTEL CORP. 17/47Yield to maturity

7.19%

Maturity date

May 11, 2047

US458140AV2

INTEL CORP. 16/46Yield to maturity

7.16%

Maturity date

May 19, 2046

US458140BM1

INTEL 20/50Yield to maturity

7.03%

Maturity date

Mar 25, 2050

INTC5456467

Intel Corporation 5.05% 05-AUG-2062Yield to maturity

6.99%

Maturity date

Aug 5, 2062

INTC4969550

Intel Corporation 4.95% 25-MAR-2060Yield to maturity

6.94%

Maturity date

Mar 25, 2060

See all INTL bonds

Curated watchlists where INTL is featured.

Frequently Asked Questions

The current price of INTL is 77.81 PLN — it has increased by 2.89% in the past 24 hours. Watch INTEL stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on GPW exchange INTEL stocks are traded under the ticker INTL.

INTL stock has risen by 5.35% compared to the previous week, the month change is a −9.08% fall, over the last year INTEL has showed a −17.77% decrease.

We've gathered analysts' opinions on INTEL future price: according to them, INTL price has a max estimate of 101.41 PLN and a min estimate of 50.71 PLN. Watch INTL chart and read a more detailed INTEL stock forecast: see what analysts think of INTEL and suggest that you do with its stocks.

INTL reached its all-time high on Feb 19, 2025 with the price of 113.64 PLN, and its all-time low was 65.60 PLN and was reached on Apr 10, 2025. View more price dynamics on INTL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

INTL stock is 2.92% volatile and has beta coefficient of 1.42. Track INTEL stock price on the chart and check out the list of the most volatile stocks — is INTEL there?

Today INTEL has the market capitalization of 348.30 B, it has increased by 1.25% over the last week.

Yes, you can track INTEL financials in yearly and quarterly reports right on TradingView.

INTEL is going to release the next earnings report on Oct 23, 2025. Keep track of upcoming events with our Earnings Calendar.

INTL earnings for the last quarter are −0.36 PLN per share, whereas the estimation was 0.04 PLN resulting in a −929.12% surprise. The estimated earnings for the next quarter are 0.04 PLN per share. See more details about INTEL earnings.

INTEL revenue for the last quarter amounts to 46.40 B PLN, despite the estimated figure of 43.25 B PLN. In the next quarter, revenue is expected to reach 47.77 B PLN.

INTL net income for the last quarter is −10.53 B PLN, while the quarter before that showed −3.18 B PLN of net income which accounts for −231.01% change. Track more INTEL financial stats to get the full picture.

Yes, INTL dividends are paid quarterly. The last dividend per share was 0.50 PLN. As of today, Dividend Yield (TTM)% is 2.29%. Tracking INTEL dividends might help you take more informed decisions.

As of Aug 13, 2025, the company has 108.9 K employees. See our rating of the largest employees — is INTEL on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. INTEL EBITDA is 27.24 B PLN, and current EBITDA margin is 12.56%. See more stats in INTEL financial statements.

Like other stocks, INTL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade INTEL stock right from TradingView charts — choose your broker and connect to your account.