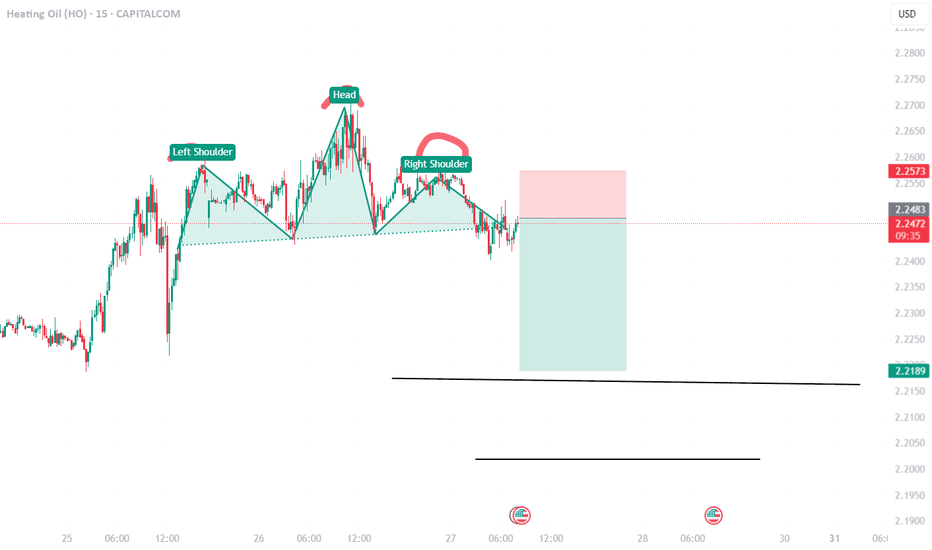

Head & Shoulders Breakdown, More Downside Ahead?### **Heating Oil (HO) – Head & Shoulders Breakdown, More Downside Ahead?**

Heating Oil (HO) has formed a **Head and Shoulders** pattern on the **15-minute chart**, signalling a potential **bearish reversal**. The breakdown of the **neckline** suggests that further downside is likely.

### **Key Observations:**

✅ **Head & Shoulders Breakdown** – The price has completed the right shoulder and is breaking lower.

✅ **Bearish Targets** – Possible move towards the **2.218** support area, with extended targets even lower.

✅ **Declining Demand Due to Warmer Weather** –

- Warmer temperatures reduce the need for heating oil as residential and commercial heating demand drops.

- Weather forecasts indicate above-average temperatures, limiting short-term demand.

- Lower demand from key regions contributes to downward pressure on prices.

### **Trading Plan:**

📉 **Bearish Bias** – Short opportunities on pullbacks, targeting the marked demand zones.

📊 **Risk Management** – Stop-loss above the right shoulder to protect against invalidation.

🚨 **Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also, share your ideas and charts in the comments section below! This is the best way to keep it relevant, support us, keep the content here free, and allow the idea to reach as many people as possible.**

🚀🔥

HEOUSD trade ideas

HEATING OILUS heating oil futures traded around $2.47 per gallon, hovering near a one-month low of $2.467 touched on July 16th as markets assessed the latest supply levels. The EIA showed that distillate stockpiles rose by 3.454 million barrels in the week ending July 12th, against estimates of a 0.5 million barrel draw. Meanwhile, heating oil inventories rose by 252 thousand barrels. Additional pressure for energy commodities came from China’s economic slowdown in the second quarter. Conversely, the report showed that distillate fuel supplied rose by 119 thousand barrels, indicating higher demand compared to the previous week, while crude oil inventories sank.

HEATING OIL to follow general trend of OIL prices DOWN!Similar to USOIL and UKOIL , HEATING oil follows similar steps!! HEATING oil has been rising for a very long time and hit all-time highs, and we see that oscillators are showing that HEATING oil is overbought. We also see signs of rejection from the resistance zone that formed due to all-time highs!! Candlestick patterns are also confirming rejection from resistance. We see that the general trend of oil is reversing globally!

We aim to open in the range of 2.61-2.7 and TP at 2.38 with an SL above 2.8.

If you like this idea please like and follow us for some awesome ideas!!!

DISCLAIMER: ‘CFDs’ are complex financial products that are traded with leverage. Trading CFDs carries a high risk and it is possible to lose all your capital. CFD's may not be suitable for everyone and you should ensure that you fully understand the risks involved before taking any trade. All information on this page is provided for information purposes only and is not intended to be a recommendation or advice. AIE trading doesn’t hold any responsibility for any trading losses for any ideas shared on its pages. No past performance or simulation of past performance guarantees future success.