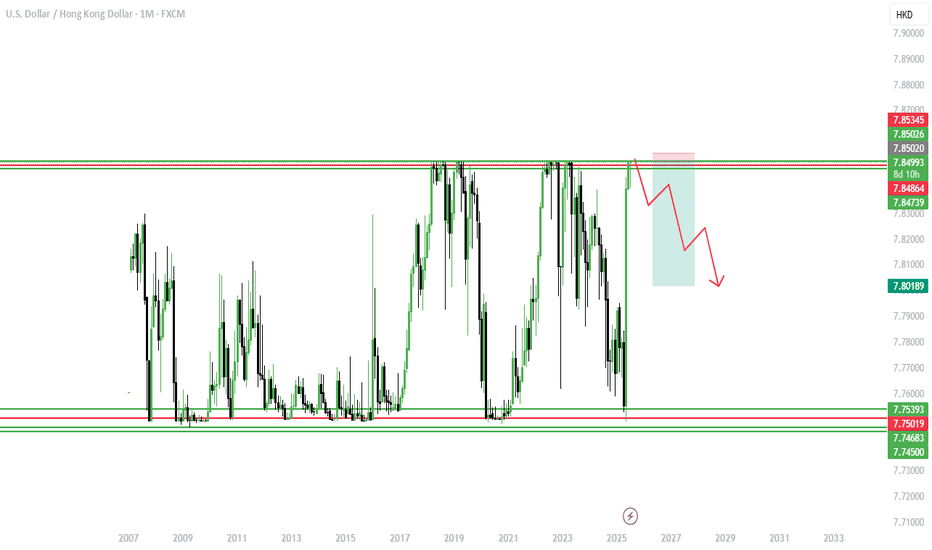

USD/HKD short?Factors That Could Push USD/HKD Lower (HKD Appreciation)

Capital Inflows Into Hong Kong

-Increased foreign investment (e.g., into Hong Kong equities, IPOs, real estate) can drive demand for HKD.

-This forces HKMA to intervene by selling HKD and buying USD to keep the peg in place.

Stronger Chinese Economic Outlook

-Since Hong Kong is tightly linked to China, a surge in investor confidence in China’s recovery or stimulus measures can boost demand for HKD assets.

US Dollar Weakness

-If the Fed cuts rates aggressively or if inflation in the US falls sharply, USD could weaken across the board, including versus HKD (within the peg limits).

-Lower US yields reduce the interest rate differential that typically favors USD holdings.

Shift in Carry Trade Dynamics

-Traders who borrowed in HKD to invest in higher-yielding USD assets may unwind positions if USD rates fall, pushing demand back into HKD.

Intervention by the HKMA at the Strong Side

-When USD/HKD nears 7.75, the HKMA sells HKD to prevent further appreciation, thus maintaining the lower bound of the peg.

Important Limits

-The Peg Is Actively Defended: The HKMA intervenes automatically to keep USD/HKD within the 7.75–7.85 range, using its foreign reserves.

Extreme Downward Movement Unlikely: Unless there’s a major structural change, such as abandoning the peg or switching to another anchor currency (e.g., RMB), a sustained move below 7.75 is not possible under current policy.

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

HKDUSD trade ideas

How can I use PEGs to trade Forex?Hello everyone,

On May 6, we brought you a technical update on the USD/HKD rate (US dollar VS Hong Kong dollar), as the exchange rate was testing the PEG level of 7.75, defended by the Hong Kong monetary authorities. The PEG therefore provided solid support, and the exchange rate rebounded strongly. It is now under resistance. We'd like to take this opportunity to offer you an educational update on the notion of the PEG in Forex. The link to our May 6 article is just below.

What is a PEG and why use it?

A PEG, or fixed-rate exchange rate regime, consists of a central bank maintaining its currency at a stable value against a foreign currency, often the US dollar or the euro. This system aims to reduce exchange rate volatility, and is advantageous for a country's trade and investment. It promotes economic stability, particularly in countries that are heavily dependent on a stable currency. PEGs survive thanks to the considerable reserves mobilized by monetary authorities to support the target exchange rate. PEGs can thus create technical supports or resistances that can be worth exploiting, but caution is sometimes called for, as history has shown that some central banks can abruptly stop defending a PEG.

1) Interesting PEGs currently in force

Many countries, particularly in the Middle East, Africa and the Caribbean, maintain a fixed rate against the dollar:

Bahrain (BHD), Kuwait (KWD), Oman (OMR), Qatar (QAR), Saudi Arabia (SAR), United Arab Emirates (AED), Panama (PAB). The CFA franc (XOF/XAF), used in 14 African countries, is pegged to the euro at 655.957 CFA per euro.

Some PEGs use a currency board or fluctuation band, such as the Hong Kong dollar (HKD) via a band of 7.75-7.85 HKD per USD. This is the support we shared with you on May 6, and the price rebounded strongly.

The case of the Singapore dollar (the USD/SGD rate) illustrates yet another sophisticated form of intermediate exchange rate regime. Unlike a fixed-rate policy or a free float, the Monetary Authority of Singapore (MAS) steers the value of the SGD through a regime based on a basket of weighted commercial currencies, the exact composition of which remains confidential. This system is based on an unannounced fluctuation band around a central rate, also unpublished.

2) Historical and discontinued PEGs (the landmark episode of the 1.20 PEG on the EUR/CHF rate)

The 1.20 PEG between the euro (EUR) and the Swiss franc (CHF) is one of the most significant episodes in the recent history of European exchange rate policies. Here is a detailed summary of this PEG and its spectacular abandonment in January 2015.

In September 2011, the Swiss National Bank (SNB) set a floor of CHF 1.20 to EUR 1, i.e. a unilateral PEG (not a classic fixed rate, but a floor rate). On January 15, 2015, the SNB abandoned the PEG without notice, citing the growing divergence between the monetary policies of the ECB (falling rates) and the United States. The immediate result: a historic crash on the Forex market.

The EUR/CHF rate dropped instantly from 1.20 to around 0.85-0.90, before stabilizing at around 1.00. The Swiss franc appreciates by almost 30% in a matter of minutes, causing forex intermediaries to go bankrupt, Swiss exporting companies to suffer huge losses and, above all, retail investors who had staked a lot on preserving the CHF 1.15 support level to suffer huge trading losses.

3) The case of the Yuan exchange rate against the US dollar

Another emblematic example is that of China, whose exchange rate regime against the US dollar is not a classic PEG, but a hybrid system often referred to as managed floating. Prior to 2005, the yuan (CNY) was firmly pegged to the dollar at a fixed rate of 8.28, maintained since 1994. In 2005, Beijing decided to make this mechanism more flexible, allowing the yuan to appreciate gradually. However, in the face of the global financial crisis, the People's Bank of China (PBoC) once again froze the rate at around 6.83 until 2010. Since then, the regime has evolved towards a more sophisticated system: every morning, the central bank publishes a USD/CNY reference rate, around which the currency is allowed to fluctuate within a narrow band of plus or minus 2%. This daily fixing is based both on recent market movements and on a basket of strategic currencies. Although this system is not a formal PEG.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Caution: USD/HKD rate tests decisive PEG of 7.75Introduction: Since the start of 2025, the US dollar has been the only major currency to post a significant decline on the forex market. In fact, it is the only so-called major currency to have fallen on Forex this year. Against this backdrop, Donald Trump's trade war has weakened the greenback's image as a safe haven in the face of the risk of global economic recession. Institutional investors have increased their short positions in the US dollar in recent weeks, reaching a net short exposure of US$17 billion according to the CFTC's COT report. It should be noted that the rebound in the US equity market has not led to a strong rebound in the US dollar (DXY), although the latter is stabilizing in the short term against the euro.

The US dollar (DXY) has lost over 8% against a basket of major currencies since the start of the year, and remains under heavy pressure against Asian currencies at the start of the week, notably the Hong Kong and Taiwan dollars.

1) Institutional bearish positioning reaches a zone of excess

Analysis of data from the CFTC's latest COT (Commitment Of Traders) report shows that institutional positioning on the US dollar is reaching excessive levels: on both the EUR/USD and JPY/USD rates, bearish USD positions are reaching high levels which could be close to their paroxysm. The DXY (index of the US dollar against a basket of major currencies) shows a technically bearish monthly close, but oversold signals are increasingly numerous on the weekly and daily horizons. Sellers are beginning to reach the technical thresholds seen in the years 2023 and 2024, and the DXY appears to be stabilizing in the short term as we await the FED's next monetary decision on Wednesday May 7. The case of the dollar against Asian currencies is also revealing: volatility is exploding, forcing monetary authorities such as those in Hong Kong and Taiwan to intervene. This confirms that the dollar's weakness is beginning to generate tensions on fixed exchange rate regimes, notably the USD/HKD PEG.

2) The USD/HKD exchange rate on the decisive PEG of 7.75;

Faced with pressure on its currency, the Hong Kong Monetary Authority was prompted to intervene massively on the foreign exchange market, buying back 6 billion US dollars in one day. This intervention is aimed at defending the PEG, the peg between the Hong Kong dollar and the greenback, threatened by the latter's downward momentum, as the pair flirts with the lower limit of the corridor set between 7.75 and 7.85.

Despite the dollar's notable decline, it would be premature to see it spiraling out of control, and it could stabilize this week with the FED's monetary policy decision on Wednesday May 7. US economic fundamentals remain robust, starting with the labor market, which continues to perform well according to the latest NFP report. Jerome Powell is unlikely to yield to Donald Trump's pressure on Wednesday May 7, and the resumption of the US federal funds rate cut is not expected before the summer.

Conclusion: to sum up, although the correction in the dollar appears to be part of an underlying trend this year, 2025, it is beginning to look oversold in the short term. For the USD/HKD rate, the 7.75 threshold should be kept under very close surveillance this week.

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

USDHKD 7.75 and 7.85 PEG RANGE USDHKD is waking up and we're getting early signals of a run toward 7.85

This pair moves in slow motion, but right now the setup is clear as price is grinding higher after bouncing perfectly from our key level. HKMA’s 7.85 weak-side peg is acting like a price magnet when the Fed stays hawkish = fuel for this move

Most traders ignore this pair because it’s pegged and low volatility but that’s exactly why it works. Institutions trade this range relentlessly for easy profits. We’re riding the momentum until HKMA steps in.

Understanding a Currency PegUnderstanding a Currency Peg: Definition, Mechanisms, and Implications

Fixed exchange rates, a cornerstone of international finance, play a pivotal role in shaping global commerce and investment landscapes. This article delves into their intricacies, exploring the historical evolution, practical understanding, and the balance of benefits and challenges they present.

Historical Context of Fixed Exchange Rates

The concept of fixed exchange rate systems has evolved over centuries, but its modern form gained prominence with the Bretton Woods Agreement in 1944. This system was designed to rebuild the global economy after World War II by creating a stable international monetary framework. Under the Bretton Woods system, countries pegged their currencies to the US dollar, which in turn was backed by gold at a fixed rate of $35 per ounce. This arrangement aimed to maintain relative exchange rate stability, promote international trade, and prevent competitive currency devaluations.

To support this fixed exchange rate regime, the International Monetary Fund (IMF) was established, providing financial assistance to countries facing balance of payments problems. While Bretton Woods initially succeeded in fostering economic stability, it began to falter in the 1960s due to rising inflation and balance of payment deficits in the US. In 1971, the US suspended gold convertibility, leading to the system’s collapse and a shift toward floating exchange rates.

Despite its end, the legacy of fixed exchange rates continues, as many countries still choose to peg their currencies to major currencies like the US dollar or the euro, seeking the economic predictability such systems offer.

Understanding Fixed Exchange Rates

A fixed exchange rate is a system where a country's currency value is tied to another major currency or a basket of currencies. Specifically, when a currency peg is established, the government commits to maintaining the currency within a specified narrow range around the targeted rate, often within a band of ±1% to ±2%.

Role of Central Banks and Foreign Reserves

Central banks play a pivotal role in maintaining a pegged currency. To defend the peg, a central bank must actively intervene in the foreign exchange (forex) market. When the currency’s value drifts from the fixed rate, the central bank buys or sells its currency to adjust supply and demand, keeping the value within the target range.

These operations require substantial foreign reserves—typically in the currency to which the domestic currency is anchored. These reserves act as a buffer to absorb shocks and counteract any pressures that could destabilise the peg.

Impact on Monetary Policy and Interest Rates

Maintaining currency pegging has a significant impact on a country's monetary policy. The central bank's primary focus becomes defending the peg, often at the expense of other economic goals, such as controlling inflation or stimulating growth.

Since the central bank must prioritise the peg, it has limited ability to set interest rates independently. Instead, interest rates often need to align closely with those of the anchor currency’s country to prevent capital flight and maintain the anchor’s credibility. This lack of flexibility can lead to challenges, particularly when the economic conditions in the pegging country differ from those in the anchor currency’s economy.

Implications of a Currency Peg

For the pegging country, a currency peg may offer economic stability and predictability, which are vital for fostering a favourable environment for trade and investment. Businesses can plan with greater certainty, knowing conversion rates will remain stable.

However, all this comes with significant challenges. Countries with fixed exchange rates often lose autonomy over their monetary policy, as maintaining the anchor becomes the primary focus. This can limit the country's ability to respond to domestic economic issues. Additionally, a currency peg can impact the trade balance; if the anchored currency is overvalued, it may harm exports, while an undervalued peg could increase inflation.

On a global scale, pegged exchange rates influence international trade and investment flows by reducing exchange rate volatility, making global transactions smoother. However, these systems also carry risks. If a pegged currency becomes misaligned with its true economic value, it can attract speculative attacks, where investors bet against the currency, leading to potential financial crises. Such scenarios can destabilise not only the pegging country but also ripple through global markets and negatively impact the world economy.

List of Fixed Exchange Rate Currencies

As of 2024, several currencies operate under a fixed exchange rate system. Notable fixed exchange rate examples include:

- Hong Kong dollar (HKD) - One of the most well-known currencies anchored to the USD, the HKD is maintained at approximately 7.8 to the US dollar, providing relative stability to Hong Kong’s financial markets since 1983.

- United Arab Emirates dirham (AED) - Pegged to the US dollar since 1997, the AED is maintained at around 3.67 to 1 USD, supporting the UAE's oil-driven economy.

- West African CFA franc (XOF) and Central African CFA franc (XAF) - Both pegged to the euro at a fixed rate of 655.957 CFA francs to 1 euro, these currencies provide economic stability across 14 African countries.

- Bahamian dollar (BSD) - Anchored to the US dollar at a 1:1 ratio, the BSD facilitates trade and tourism in the Bahamas, closely linked to the US economy.

- Danish krone (DKK) - Pegged to the euro within a narrow band, typically around 7.46 DKK to 1 euro, the krone's peg supports Denmark’s economic ties with the Eurozone.

- Saudi riyal (SAR) - Pegged to the US dollar since 1986, the SAR is maintained at approximately 3.75 to 1 USD, stabilising Saudi Arabia's oil-reliant economy.

Fixed Exchange Rate Pros and Cons

While many economies choose a floating system nowadays, there are pros and cons of a fixed exchange rate.

Advantages of a Fixed Exchange Rate

- Stability in Global Trade: Pegged currencies reduce the uncertainty and risk associated with floating currencies, making it easier for businesses to plan and engage in international commerce.

- Reduced Risk in International Investments: Investors are more likely to invest in countries with currencies that have predetermined rates because it lowers the risk of losing money through price fluctuations.

- Control of Inflation Rates: Countries can maintain low inflation levels by pegging their currency to a stable, low-inflation economy.

- Prevent Competitive Devaluations: Such a regime prevents countries from engaging in competitive devaluations, which may lead to a 'race to the bottom' and global economic instability.

- Increased Policy Discipline: Anchored rates can impose discipline on a country's fiscal and monetary policies, as maintaining the peg requires consistent, responsible economic management.

- Simplified Transactions: A fixed currency simplifies the process of global transactions by providing predictability in exchange costs, reducing the need for complex hedging strategies.

Disadvantages of a Fixed Exchange Rate

- Overvaluation or Undervaluation: Maintaining a set rate might lead to misalignment, where a currency may become overvalued or undervalued relative to its economic fundamentals.

- High Costs of Maintenance: To maintain the peg, countries often need to hold large reserves of foreign currency, which may be costly and economically inefficient.

- Lack of Monetary Policy Flexibility: Countries lose the ability to set their own interest rates and conduct independent monetary policy, as they must focus on maintaining the peg.

- Vulnerability to External Shocks: Tied conversion rates can make a country more susceptible to economic problems in the nation to which its currency is pegged.

- Reduced Responsiveness to Domestic Conditions: An anchored currency regime limits a country’s ability to respond to domestic economic changes, such as inflation, unemployment, or economic downturns.

- Risk of Speculative Attacks: If investors believe a currency is overvalued or undervalued, they may engage in speculative attacks, leading to severe financial crises.

Fixed Exchange Rates in Modern Trading

In modern trading, understanding the dynamics of fixed currencies offers traders specific advantages and insights:

- Forex Pairs: Traders can anticipate less volatility in forex involving a fixed value, allowing for more solid long-term trading strategies.

- Indicator of Economic Policies: The status and changes in a fixed rate potentially signal shifts in a country's monetary and fiscal policies, providing traders with crucial information for decision-making.

- Trade and Investment Decisions: Understanding which countries have pegged rates can guide traders in making informed decisions about trade and investment opportunities.

The Bottom Line

Grasping the nuances of fixed exchange rates is crucial for anyone involved in international finance. Whether weighing their pros and cons for trading or observing their impact on financial markets, this knowledge is invaluable. For those looking to apply this understanding practically, opening an FXOpen account can be a strategic step, offering a platform to navigate and capitalise on the opportunities in the global financial markets.

FAQ

What Does Pegging Currency Mean?

The pegging currency meaning refers to fixing its value to another major currency or a basket of currencies. This is done to provide stability in international trade and reduce forex rate volatility.

What Currencies Are Pegged to the Dollar?

There are several currencies pegged to USD, including the Hong Kong dollar (HKD), United Arab Emirates dirham (AED), Saudi riyal (SAR), and Bahamian dollar (BSD), among others. These currencies maintain a fixed exchange rate with the dollar to ensure economic stability.

Why Would Another Country Want to Peg Its Currency to the US Dollar?

Countries peg their currency to the US dollar to gain economic stability, attract foreign investment, and stabilise trade with the US. The dollar’s global dominance makes it a reliable anchor for maintaining economic predictability.

What Is a Disadvantage for a Country Utilising a Currency Peg?

A significant disadvantage of a currency peg is the loss of monetary policy autonomy. The anchoring country must prioritise maintaining the peg, limiting its ability to respond to domestic economic conditions like inflation or recession.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDHKD PROJECTION FOR MY FRIENDS Dear followers and friends,

See a great analysis of USDHKD on trendline and zones,

Confirming bearish move, now we wait for the market to touch the double TOP, Confirm the start of bearish movement.

Kindly like and recommend to your friends ...

OLUMIGHTYFX ACADEMY NIGERIA

USDHKD One of the best buys in the market.The USDHKD pair just formed a 1W Death Cross this week but the current 1W candle is a green one. The reason is that it is rebounding after reaching last week the 2-year Support Zone. We believe that we will see an aggressive rise next that will approach the Lower Highs trend-line. Our target is just below it at 7.82500.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Bounced off the 2022 Support! Strong buy!The USDHKD pair hit amidst Monday's turmoil the top of the Support Zone that was established back on the week of December 05 2022 and instantly rebounded. This naturally shows the strong technical demand of that level.

Even tough another 1-2 weeks of consolidation is possible, on the long-term, we expect a test of the May 01 2023 Lower Highs trend-line. Our Target is 7.8300.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USD/HKD Trading Signal: SellDear Traders,

Our analysis using the EASY Quantum Ai strategy suggests a potential Sell opportunity for the USD/HKD currency pair. Please find the detailed signal below:

Direction: Sell

Enter Price: 7.80837

Take Profit: 7.80693667

Stop Loss: 7.80964667

Justification:

1. Technical Analysis: We've detected a downward trend formation in short-term charts, which is supported by a series of lower highs and lower lows, indicating bearish momentum.

2. Resistance Levels: The 7.80837 price level is identified as a strong resistance zone, where the price has frequently reversed.

3. Economic Indicators: Recent economic data from the US suggests potential weaknesses compared to the stability of HKD, adding to bearish pressure on USD/HKD.

4. Market Sentiment: Current trader sentiment leans bearish, as indicated by volume and open interest metrics in futures markets.

Please act accordingly and manage your risk effectively. Market conditions can change rapidly, so it's essential to stay updated.

Happy Trading!

Note: This forecast is generated using the EASY Quantum Ai strategy, which combines historical data analysis, machine learning, and advanced algorithms to provide optimized trading signals.

Trade Signal for USDHKD PairDirection: Sell

Enter Price: 7.81036

Take Profit: 7.80840333

Stop Loss: 7.81196333

We have generated a trade signal for the currency pair USDHKD, with a SELL direction at the entry price of 7.81036. The Take Profit target is set at 7.80840333, and the Stop Loss is placed at 7.81196333. This forecast is developed using the EASY Quantum Ai strategy.

Rationale Behind the Forecast:

1. Technical Analysis: Our quantitative models have identified a potential bearish trend for USDHKD based on recent price action and momentum indicators. The pairing shows signs of a downward movement after several key resistance levels have been tested and confirmed.

2. Market Sentiment: Current sentiment data indicates increased bearish positions by institutional investors in the Forex market for USD against HKD. This aligns with our sell signal and entry point at 7.81036.

3. Economic Indicators: Recent macroeconomic data from the United States and Hong Kong suggest a weakening of the USD against the HKD. Factors such as interest rate differentials and inflation rates play a significant role in this correlation.

Please execute this trade cautiously and ensure to monitor market conditions closely. Adjustments may be required based on live market behavior. Always adhere to your risk management policies.

USDHKD Be ready for a long-term buy.The USDHKD pair has been giving us excellent trades in the past 12 months and the latest (April 18, see chart below) almost hit our 7.79500 Target about 3 weeks ago:

With the price approaching yet again the 11-month Support Zone, there is no reason to diverge from this successful pattern. Right now by being so close to the Support Zone, the R/R ratio favors buying towards the Resistance Zone.

Our Target will be slightly lower at 7.83900 (April 08 High).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD - In Downtrend with Symmetrical TriangleUSDHKD in 1h time frame chart is printing Downtrend with Symmetrical Triangle pattern and there is no any divergence in RSI. Therefore market may seem more inclined to move in the direction of the existing trend.

Hence I'll take short trade with Sell Stop Order on the breakdown last Lower Low level with stoploss above at last Higher Low level.

USDHKD Approaching the 2-year Resistance Zone. Major Sell.The USDHKD pair has been rising since November 2023 after hitting the Support Zone and is approaching the 2-year Resistance Zone. The Sine Waves help us understand the cyclical nature behind it. This is a low risk sell opportunity for the long-term. Our Target is 7.79500 (top of Support Zone).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

USDHKD Wave trading continues for high percentage profits.We have been using the USDHKD pair for wave trading for a very long time (see standard example below) due to its distinct characteristic and tight correlation:

It is more than obvious on this 1D chart that the application of the Sine Wave tool gives high probability entries and exits for bottom/ top buying and selling. Currently we are on an uptrend that should start topping in February. That will be our next low risk trade and it will be a sell. Profit taking will be made towards the end of June as the Sine Wave approaches its bottom.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Fixed Exchange Rates: Benefits and LimitationsFixed exchange rates, a cornerstone of international finance, play a pivotal role in shaping global commerce and investment landscapes. This article delves into their intricacies, exploring the historical evolution, practical understanding, and the balance of benefits and challenges they present.

Historical Context of Fixed Exchange Rates

The concept of a fixed exchange rate system dates back centuries, but its modern incarnation emerged prominently with the Bretton Woods agreement in 1944. This fixed exchange rate regime established stable currency rates by pegging them to the US dollar (USD), which was convertible to gold.

This arrangement aimed to provide international monetary stability by preventing competitive devaluations and promoting economic growth. However, by the early 1970s, the Bretton Woods system collapsed, leading to a shift towards more flexible currency systems. Despite this, pegged exchange rates continue to be adopted in various forms by several countries.

Understanding Fixed Exchange Rates

A fixed exchange rate is a system where a country's currency value is tied to another major currency or a basket of currencies. In this regime, the exchange rate is maintained within a very narrow range. Countries with fixed exchange rates adopt this approach to stabilise global trade and financial relations.

A real-world fixed exchange rate example is the Hong Kong dollar (HKD), which has been pegged to the US dollar since 1983. Under this arrangement, the Hong Kong dollar is maintained at a fixed value of approximately 7.8 to the US dollar. This stability is achieved by the Hong Kong Monetary Authority, which trades the local currency against the USD as needed. You can see how this relationship has unfolded throughout the years with USD/HKD charts in FXOpen’s free TickTrader platform.

The predictability offered by a stable rate is typically advantageous for international trade and investment, but it requires significant reserves of the pegged currency to maintain its value.

Fixed Exchange Rate Pros and Cons

While many economies choose a floating system nowadays, there are pros and cons of a fixed exchange rate.

Advantages of a Fixed Exchange Rate

Stability in Global Trade: Pegged currencies reduce the uncertainty and risk associated with floating currencies, making it easier for businesses to plan and engage in international commerce.

Reduced Risk in International Investments: Investors are more likely to invest in countries with stable currencies, as it lowers the risk of losing money through price fluctuations.

Control of Inflation Rates: Countries can maintain low inflation levels by pegging their currency to a stable, low-inflation economy.

Prevent Competitive Devaluations: Such a regime prevents countries from engaging in competitive devaluations, which may lead to a 'race to the bottom' and global economic instability.

Increased Policy Discipline: Anchored rates can impose discipline on a country's fiscal and monetary policies, as maintaining the peg requires consistent, responsible economic management.

Simplified Transactions: A fixed currency simplifies the process of global transactions by providing predictability in exchange costs, reducing the need for complex hedging strategies.

Disadvantages of a Fixed Exchange Rate

Overvaluation or Undervaluation: Maintaining a fixed rate might lead to misalignment, where a currency may become overvalued or undervalued relative to its economic fundamentals.

High Costs of Maintenance: To maintain the peg, countries often need to hold large reserves of foreign currency, which may be costly and economically inefficient.

Lack of Monetary Policy Flexibility: Countries lose the ability to set their own interest rates and conduct independent monetary policy, as they must focus on maintaining the peg.

Vulnerability to External Shocks: Tied exchange rates can make a country more susceptible to economic problems in the nation to which its currency is pegged.

Risk of Speculative Attacks: If investors believe a currency is overvalued or undervalued, they may engage in speculative attacks, leading to severe financial crises.

Reduced Responsiveness to Domestic Conditions: A pegged currency regime limits a country’s ability to respond to domestic economic changes, such as inflation, unemployment, or economic downturns.

Fixed Exchange Rates in Modern Trading

In modern trading, understanding the dynamics of fixed currencies offers traders specific advantages and insights:

Predictability in Forex Pairs: Traders can anticipate less volatility in forex involving a fixed value, allowing for more stable long-term investment strategies.

Indicator of Economic Policies: The status and changes in a fixed rate potentially signal shifts in a country's monetary and fiscal policies, providing traders with crucial information for decision-making.

Trade and Investment Decisions: Understanding which countries have pegged rates can guide traders in making informed decisions about trade and investment opportunities.

List of Fixed Exchange Rate Currencies

As of 2023, several currencies operate under a fixed exchange rate system. Notable examples include:

Hong Kong dollar (HKD) - pegged to the US dollar.

United Arab Emirates dirham (AED) - pegged to the US dollar.

West African CFA franc (XOF) and Central African CFA franc (XAF) - both pegged to the euro.

Bahamian dollar (BSD) - pegged to the US dollar.

Danish krone - pegged to the euro.

The Bottom Line

In conclusion, grasping the nuances of fixed exchange rates is crucial for anyone involved in international finance. Whether weighing the pros and cons or observing their impact on modern trading, this knowledge is invaluable. For those looking to apply this understanding practically, opening an FXOpen account can be a strategic step, offering a platform to navigate and capitalise on the opportunities in the global financial markets.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USDHKD BUY AnalysisI've been following this chart for a while. After having an OVERSOLD signal in the 1D chart, I also received buy signals in the 4H chart and therefore I decided to report this position.

At this moment the position is not open yet, but if it follows the trend, as indicated in the graph (by the blue arrow), I will open the trade as soon as it reaches the indicated price (in the yellow circle).

Naturally, if it were to reverse course and therefore take the wrong path (red arrow), this trade will not open and will be cancelled.

USDHKD: Rejection on the 1D MA50 and LH trendline. Sell.USDHKD is on a neutral 1D technical outlook (RSI = 47.421, MACD = -0.002, ADX = 19.830) as it is approaching the end of a Descending Triangle pattern. Yesterday it got a double rejection on the 1D MA50 and the LH trendline.

A harmonic Descending Triangle broke down to the S1 level after after its third contact with the LH trendline. Consequently we trrat this as a sell opportunity (TP = 7.7940).

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##