Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

9.90 HKD

25.12 B HKD

144.34 B HKD

2.17 B

About Baidu, Inc.

Sector

Industry

CEO

Yan Hong Li

Website

Headquarters

Beijing

Founded

2000

FIGI

BBG00ZMFX1S5

Baidu, Inc. engages in the provision of internet search and online marketing solutions. The firm’s products and services include Baidu App, Baidu Search, Baidu Feed, Haokan, Quanmin, Baidu Post Bar, Baidu Knows, Baidu Encyclopedia, Baidu Input Method Editor or Baidu IME, Baidu AI Cloud and Overseas Products. It operates through the following segments: Baidu Core and iQIYI. The Baidu Core segment provides search-based, feed-based, and other online marketing services. The iQiyi segment is an online entertainment service provider, which offers original, professionally produced and partner-generated content on its platform. The company was founded by Yanhong Li and Xu Yong on January 18, 2000 and is headquartered in Beijing, China.

Related stocks

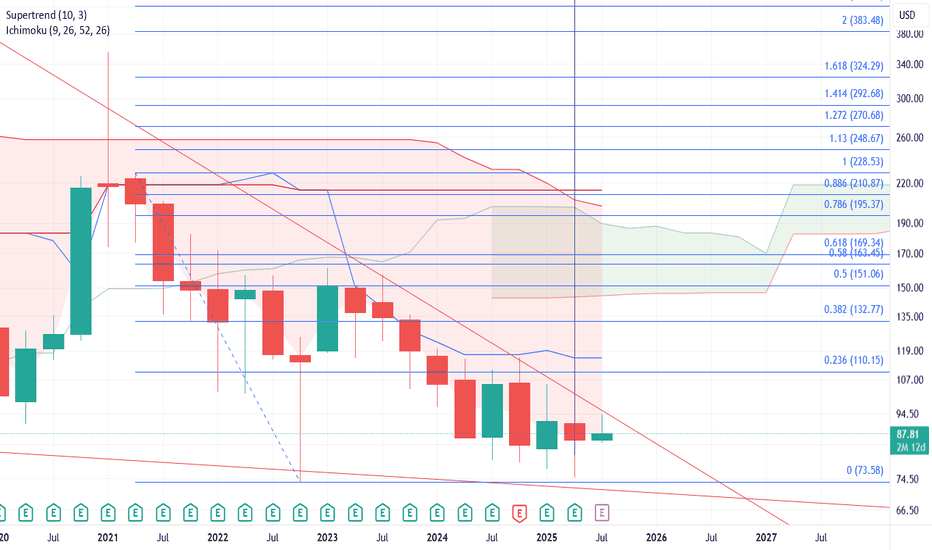

BIDU 1D: triangle breakoutBIDU 1D: triangle breakout + real-world AI deployment boosts bulls

Baidu (BIDU) breaks out of a triangle within a falling channel on the daily chart, with solid volume, reclaim of the 50MA, and approach to the 200MA. $90.09 flips into support. Targets stretch to $105.47 / $113.68 / $124.06 (Fibo l

Baidu Accelerates Robotaxi Expansion and Opens the European DoorBy Ion Jauregui – Analyst at ActivTrades

Baidu (NASDAQ: BIDU), the Chinese tech giant, is doubling down on autonomous vehicles through Apollo Go, its robotaxi platform. According to industry sources, the company is planning to expand into Europe, with Switzerland and Turkey as its first potentia

BIDU close watchAs of the latest update, here’s a snapshot of Baidu Inc. (BIDU) stock:

Current Price: $86.86 (as of May 11, 2025, 10:26 AM EDT)

After-Hours Price: $87.29

Day Range: $86.68 – $87.75

52-Week Range: $74.71 – $116.25

Market Cap: $29.86 billion

P/E Ratio: 9.66

Dividend Yield: 0% 1

Analyst Outlook:

Conse

$bidu smash or crashNASDAQ:BIDU continues to get bought up at this demand zone that has held for 12 years between $85-$73. One of the most beautiful charts Ive seen on an individual name in a long time. Not the most exciting name around but $70 cash per share on hand and a PE of 9 with as solid of a defined R/R as yo

Baidu Wave Analysis – 11 April 2025

- Baidu reversed from support zone

- Likely to rise to resistance level 90.00.

Baidu recently reversed from the support zone between the major long-term support level 78.60 (which has been reversing the price from the end of 2022) and the lower weekly Bollinger Band.

The upward reversal

Baidu | BIDU | Long at $82.50Baidu NASDAQ:BIDU - the Google of China. This one is being ignored by AI investors, and may be an opportunity. Maybe... nothing is certain (especially with the "risks" of Chinese investments).

P/E = 9x

Debt/Equity = 0.27x

Price/Sales = 1.55x

Price/Book = 0.80x

Price/Cash flow = 7.59x

Baidu: Possible move as per previous chart patternNASDAQ:BIDU

Hello,

Just a guess work.

I see similar pattern played out few years ago, I guess it can follow the same pattern, may be the magnitude is different.

Please exercise caution while trading these stocks as they can stay flat for years.

Happy trading

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 9888 is featured.

Frequently Asked Questions

The current price of 9888 is 85.50 HKD — it has increased by 1.06% in the past 24 hours. Watch BAIDU INC stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HKEX exchange BAIDU INC stocks are traded under the ticker 9888.

9888 stock has fallen by −4.36% compared to the previous week, the month change is a 1.24% rise, over the last year BAIDU INC has showed a −1.38% decrease.

We've gathered analysts' opinions on BAIDU INC future price: according to them, 9888 price has a max estimate of 156.83 HKD and a min estimate of 69.67 HKD. Watch 9888 chart and read a more detailed BAIDU INC stock forecast: see what analysts think of BAIDU INC and suggest that you do with its stocks.

9888 reached its all-time high on Mar 23, 2021 with the price of 256.60 HKD, and its all-time low was 73.25 HKD and was reached on Apr 9, 2025. View more price dynamics on 9888 chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

9888 stock is 2.69% volatile and has beta coefficient of 1.19. Track BAIDU INC stock price on the chart and check out the list of the most volatile stocks — is BAIDU INC there?

Today BAIDU INC has the market capitalization of 236.29 B, it has increased by 1.90% over the last week.

Yes, you can track BAIDU INC financials in yearly and quarterly reports right on TradingView.

BAIDU INC is going to release the next earnings report on Aug 20, 2025. Keep track of upcoming events with our Earnings Calendar.

9888 earnings for the last quarter are 2.52 HKD per share, whereas the estimation was 1.91 HKD resulting in a 31.53% surprise. The estimated earnings for the next quarter are 1.82 HKD per share. See more details about BAIDU INC earnings.

BAIDU INC revenue for the last quarter amounts to 35.27 B HKD, despite the estimated figure of 33.09 B HKD. In the next quarter, revenue is expected to reach 35.93 B HKD.

9888 net income for the last quarter is 8.25 B HKD, while the quarter before that showed 4.98 B HKD of net income which accounts for 65.71% change. Track more BAIDU INC financial stats to get the full picture.

No, 9888 doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 41.3 K employees. See our rating of the largest employees — is BAIDU INC on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. BAIDU INC EBITDA is 29.86 B HKD, and current EBITDA margin is 27.00%. See more stats in BAIDU INC financial statements.

Like other stocks, 9888 shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade BAIDU INC stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So BAIDU INC technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating BAIDU INC stock shows the sell signal. See more of BAIDU INC technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.