chiến lược đơn giảnThe example strategy is a simple moving average crossover system designed to identify potential buy and sell signals. It calculates a 50-period simple moving average (SMA) and monitors the price movements relative to this indicator. When the closing price crosses above the SMA, the strategy enters a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4,100 VND

31.14 T VND

112.58 T VND

2.11 B

About JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM

Sector

Industry

CEO

Dung Quang Pham

Website

Headquarters

Ha Noi

Founded

1955

ISIN

VN000000VCB4

FIGI

BBG000BM8HL9

Joint Stock Commercial Bank for Foreign Trade of Vietnam engages in the provision of commercial banking services. It operates through following segments: Banking Services, Non-banking Financial services, Securities, and Other. It offers traditional banking services such as international settlement and trade finance, fund mobilization, lending, and project finance. It also provides modern banking services, which include treasury and derivatives, card service, e-banking, and securities trading and investment. The company was founded on January 20, 1955 and is headquartered in Ha Noi, Vietnam.

Related stocks

VCB 0.5 or 0.618 Fibonacci Retracement ?With VCB 0.5 or 0.618 Fibonacci retracement is forming, I expect price has a good recover to lower band (green line) above from current price (0.5 level) or a little bit lower (0.618 level). We can wait for a lower band breakout then buy and sell at upper band as long as sideways strategy bias still

Vietcombank Trading diary 30/3/2023

60 years old bank

Government 74.8%

Mizuho Bank Limited 15%

Profit margin growing

P/E 14.6

P/B 3.2

Debt growing

Customer Deposit growing

Will price grow at 6-7% average? it seems possible over period of 10 years. However at current price 92 000 vnd is not attractive eno

Look back at Vietnam's banking stocksHey traders,

After Covid has appeared since Mar 2020 in Vietnam, the market stock was slipped the same others over the world. However, everything has been okay and currently come back better than it was.

Looking back at the growth over the past year, the banking stock interest from 60 to 550%.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

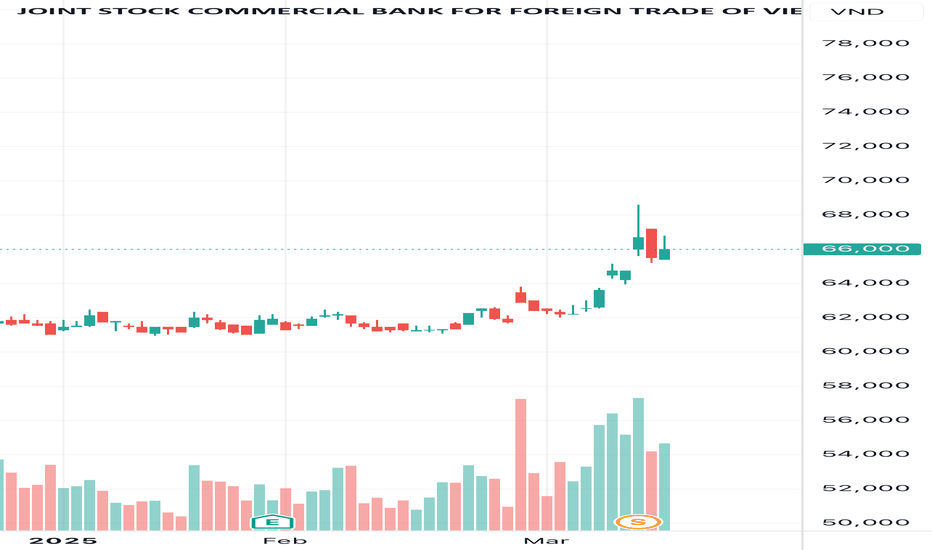

The current price of VCB is 61,500 VND — it has increased by 4.07% in the past 24 hours. Watch JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on HOSE exchange JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stocks are traded under the ticker VCB.

VCB stock has risen by 5.32% compared to the previous week, the month change is a 9.25% rise, over the last year JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM has showed a 5.08% increase.

We've gathered analysts' opinions on JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM future price: according to them, VCB price has a max estimate of 77,926.38 VND and a min estimate of 61,900.00 VND. Watch VCB chart and read a more detailed JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stock forecast: see what analysts think of JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM and suggest that you do with its stocks.

VCB stock is 4.71% volatile and has beta coefficient of 0.89. Track JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stock price on the chart and check out the list of the most volatile stocks — is JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM there?

Today JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM has the market capitalization of 492.99 T, it has increased by 1.72% over the last week.

Yes, you can track JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM financials in yearly and quarterly reports right on TradingView.

JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM is going to release the next earnings report on Aug 6, 2025. Keep track of upcoming events with our Earnings Calendar.

VCB earnings for the last quarter are 1.04 K VND per share, whereas the estimation was 1.03 K VND resulting in a 0.92% surprise. The estimated earnings for the next quarter are 1.03 K VND per share. See more details about JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM earnings.

JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM revenue for the last quarter amounts to 17.24 T VND, despite the estimated figure of 17.28 T VND. In the next quarter, revenue is expected to reach 16.81 T VND.

VCB net income for the last quarter is 8.70 T VND, while the quarter before that showed 8.57 T VND of net income which accounts for 1.53% change. Track more JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM financial stats to get the full picture.

JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 9, 2025, the company has 24.31 K employees. See our rating of the largest employees — is JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM on this list?

Like other stocks, VCB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM technincal analysis shows the strong buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM stock shows the strong buy signal. See more of JOINT STOCK COMMERCIAL BANK FOR FOREIGN TRADE OF VIET NAM technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.