chiến lược đơn giảnThe example strategy is a simple moving average crossover system designed to identify potential buy and sell signals. It calculates a 50-period simple moving average (SMA) and monitors the price movements relative to this indicator. When the closing price crosses above the SMA, the strategy enters a long position. Conversely, when the closing price crosses below the SMA, it closes the long position. This approach aims to capture trends by following the price momentum. The strategy is implemented using Pine Script in TradingView and can be optimized by adjusting the SMA period or adding risk management parameters.

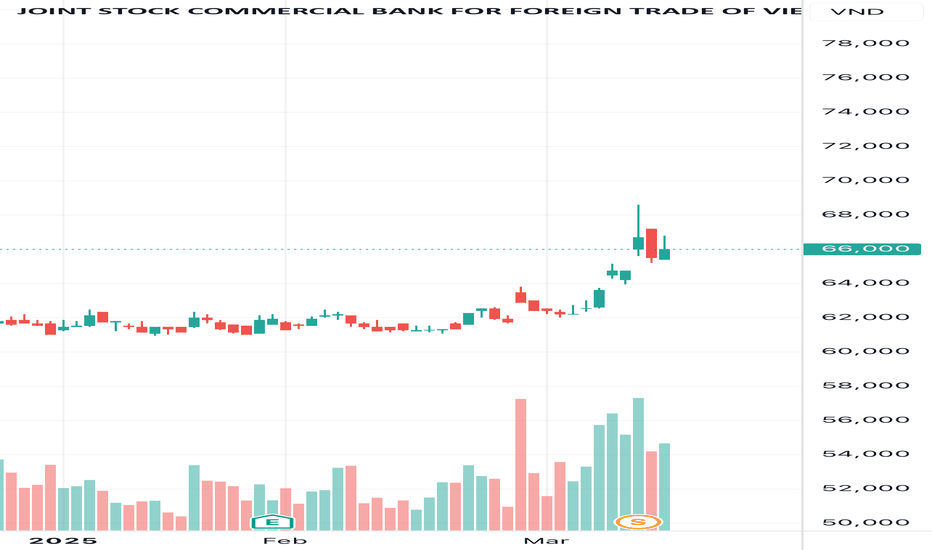

VCB trade ideas

VCB 0.5 or 0.618 Fibonacci Retracement ?With VCB 0.5 or 0.618 Fibonacci retracement is forming, I expect price has a good recover to lower band (green line) above from current price (0.5 level) or a little bit lower (0.618 level). We can wait for a lower band breakout then buy and sell at upper band as long as sideways strategy bias still active.

Beware both of market-risk sentiment lines are in purple (bearish) signs.

Vietcombank Trading diary 30/3/2023

60 years old bank

Government 74.8%

Mizuho Bank Limited 15%

Profit margin growing

P/E 14.6

P/B 3.2

Debt growing

Customer Deposit growing

Will price grow at 6-7% average? it seems possible over period of 10 years. However at current price 92 000 vnd is not attractive enough for most "value investor", this bold stock can be alternative for long term deposit. I would love to see it heading to 180 000 vnd/ share in the next 10 years.

Buy and hold...huhmm seems okay to me. Thanks Vietcombank

Look back at Vietnam's banking stocksHey traders,

After Covid has appeared since Mar 2020 in Vietnam, the market stock was slipped the same others over the world. However, everything has been okay and currently come back better than it was.

Looking back at the growth over the past year, the banking stock interest from 60 to 550%.

The prominent stock is the VIB has grown more than 550%.

-----

Part 2

-----

Part 3