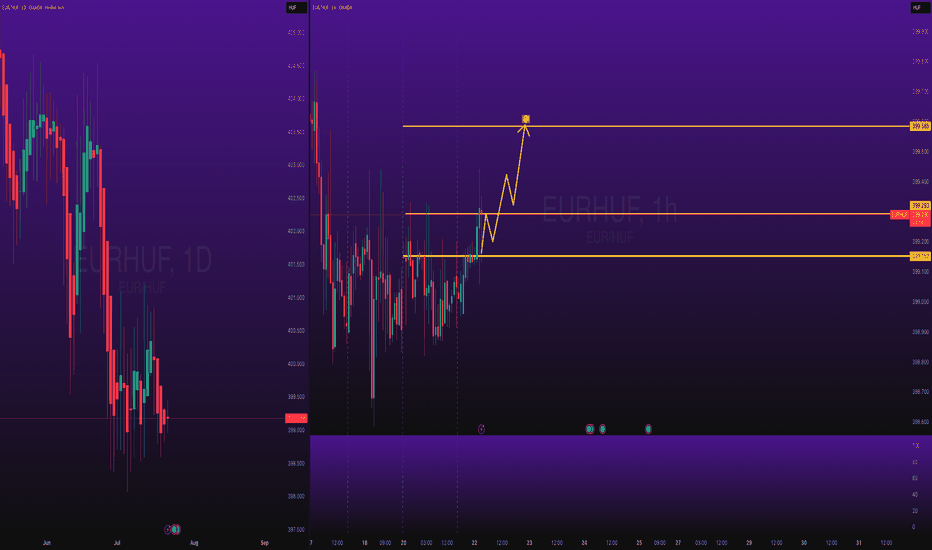

EURHUF Long OANDA:EURHUF Long Trade, with my back testing of this strategy, it hits multiple possible take profits, manage your position accordingly.

Note: Manage your risk yourself, its risky trade, see how much your can risk yourself on this trade.

Use proper risk management

Looks like good trade.

Lets monitor.

Use proper risk management.

Disclaimer: only idea, not advice

HUFEUR trade ideas

EUR/HUF: Positioning for a Probable Bullish Trend ShiftBig Picture Context

Currencies, like any market, move in cycles driven by macroeconomic forces, capital flows, and investor psychology. The EUR/HUF exchange rate has been in an uptrend since mid-2023, reflecting a broader structural shift. The key question now is whether this trend continues or if we see a meaningful reversal.

Looking at the data, we see that price has pulled back to a critical support zone (396-402 HUF). This is where buyers previously stepped in, making it a high-probability area for renewed strength. Meanwhile, resistance levels exist at 409.5 HUF, 411.75 HUF, and 420.53 HUF, with an ultimate target near 434.45 HUF.

What the Market Is Telling Us

Liquidity & Positioning: A volume spike signals increased market activity. This is often a sign that larger players are repositioning.

Momentum & Trend: Higher lows and price support at moving averages indicate that bullish sentiment remains intact.

Sentiment & Reflexivity: If buyers step in at support, it could reinforce the uptrend, drawing in more participants and accelerating price movement.

Game Plan: Managing Risk & Reward

Entry Zone: 396-402 HUF (buy into strength if support holds).

Profit Targets:

First milestone: 409.5 HUF (short-term test of resistance).

Second milestone: 420.5 HUF (trend continuation).

Final milestone: 434.5 HUF (full breakout scenario).

Stop-Loss: Below 382 HUF, where the bullish thesis breaks down.

Principles Applied

Markets are a function of supply and demand, shaped by human behavior. We’re looking at probabilities, not certainties. The key is risk-adjusted decision-making—placing asymmetric bets where upside outweighs downside. If the support holds, the next move up is likely. If it fails, we step aside and reassess.

What’s Flowing: EURHUFThe EURHUF pair displays a notable recovery after a sharp drop, indicating potential buyer interest at lower levels. The price bounced decisively from the support zone near 412.75 and is now consolidating just below the key resistance level of 414.00.

The 15-minute Heikin Ashi chart highlights a strong upward momentum post-recovery, with bullish candles showing minimal wicks. However, the current consolidation suggests indecision, and traders should watch for either a breakout above 414.00 for further upside or a retracement to retest lower support zones.

On the broader market watch, correlated currency pairs and risk sentiment should be monitored to align with the flow direction. As always, risk management is key when trading short-term movements in highly volatile conditions.

EURHUF // Preparation for the ExpansionThe market is at a break of a countertrend line.

All the timeframes show a bullish trend (brown lines), so as long as the H4 impulse base (brown H4) is not broken, and H4 waves keep going up, the expansion may come at the countertrend break on the lower timeframes.

However, we are after a huge run bumping into an H4 breakdown (turquoise), and a daily break below the daily impulse base (brown D) may start a deeper correction.

———

Stay Patient, Stay Disciplined! 🏄🏼♂️

Your comments, questions, and support are greatly appreciated! 👊🏼

EURHUF // cleared the last weekly breakdownThe EURHUF ha broken above the target fibo 61.8 and the last clear weekly breakdown, so the buyers are in control, and the long term target of the target fibo 138.2 becomes valid.

The idea is valid until the weekly structure is broken which give a quite attractive RR.

EURHUF Short-term buy signal.The EURHUF pair is attempting to form a new short-term bottom just below the 1D MA50 (blue trend-line) and based on the previous two of August and July, is should take another week to do so. Buy once Friday's Low is re-tested and target the top (Lower Highs trend-line) of the long-term Triangle at 397.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Trading Signal Alert: EURHUFDirection: Sell

Enter Price: 394.09

Take Profit: 393.263

Stop Loss: 395.018

We are issuing a sell signal for the EURHUF currency pair, supported by our advanced EASY Quantum Ai strategy. Key factors influencing this prediction include:

1. Trend Analysis: Recent technical indicators highlight a bearish trend. The EURHUF has shown resistance at higher levels and appears to be reversing its direction towards lower support levels.

2. Macroeconomic Factors: Economic data from the Eurozone and Hungary suggests increasing economic strength in Hungary relative to the Eurozone in the short term, which is expected to favour the HUF and weaken the EUR.

3. Market Sentiment: Traders are currently bearish on the EUR based on recent economic forecasts and investor sentiment.

Considering the above factors, we recommend entering the market at 394.09 with a target price of 393.263. To manage risk, place a stop loss at 395.018.

Trade wisely and always ensure to conduct your own analysis before entering any trade.

EUR/HUF BUYKey Factors Influencing EUR/HUF:

Interest Rates: Decisions by the European Central Bank (ECB) and the Hungarian National Bank (MNB) significantly impact the exchange rate. Higher interest rates in Hungary can strengthen the forint against the euro.

Inflation: Higher inflation in Hungary can weaken the forint, while low inflation can have the opposite effect.

Economic Growth: The relative economic performance of the Eurozone and Hungary affects the exchange rate. Stronger growth in the Eurozone may strengthen the euro against the forint.

Political and Global Risks: Political stability in both regions and global economic conditions can lead to volatility in the EUR/HUF exchange rate.

Overall, the EUR/HUF is influenced by a mix of economic, political, and market factors, both locally and globally.

EURHUF is set to test 400 amid capital flow divergenceThe Euro is set to rally against the Hungarian Forint to test the critical 400 level which is widely considered as the main line in the sand.

This is based on our equity market divergence model which shows that there were a change in the capital flows, as well as a general short term bullishness on the U.S. Dollar.

EUR/HUF IdeaThe EUR/HUF exchange rate has shown volatility, with the euro generally appreciating against the forint. This trend has been influenced by high inflation in Hungary and global economic uncertainties, which have favored the euro as a safer currency.

Key Factors

Monetary Policy: The divergence between the European Central Bank's (ECB) tightening and the Magyar Nemzeti Bank's (MNB) efforts to control inflation impacts the rate.

Economic Data: Indicators like GDP growth and inflation from both the Eurozone and Hungary influence the currency pair.

Geopolitical Issues: EU-Hungary relations and other geopolitical events can affect the forint's stability.

Outlook

The future of the EUR/HUF exchange rate remains uncertain. If the ECB continues to raise rates and Hungary's inflation remains high, the euro may strengthen further. Conversely, improved economic conditions in Hungary could lead to a stronger forint.

But so far we have not managed to break through the 400 level, so I expect the direction shown in the picture.

EURHUF 1D MA50 buy entry.The EURHUF pair has been trading within a Triangle pattern, which based on the highly symmtric structure of the 1D RSI, may break above its top (Higher Highs trend-line) and transition into a more aggressive Rising Wedge (diveging Higher Highs).

The last Higher Low was priced below the 1D MA50 (blue trend-line) and since the RSI's Channel Down shows we are on the level where the final Low will be priced, we expect a strong rebound next.

The previous Higher High was priced a little below the 1.236 Fibonacci extension. As a result, we set a 403.000 Target (on the diverging Higher Highs and marginally below the 1.236 Fib).

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURHUF Sell the bounce.The EURHUF pair gave us a strong sell signal last time we made a call on it (October 13 2023, see chart below) as it made the bearish break-out below the Triangle and breached through Support 2:

The price is now approaching the 1D MA200 (orange trend-line), which has been supporting since January 17. The short-term pattern is a Channel Down, a Bearish Leg similar to October - November 2023.

As a result, we are waiting for a potential bounce and sell on the next 1D MA50 (blue trend-line) contact. Our Target will be the bottom (Higher Lows trend-line) of the Triangle at 384.000.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

EURHUF to the upside---------------EURHUF LONG---------------

Regarding to this "exotic" currency pair I can tell I am already in a long position with 3 trades at average price 392.17. In the long run I expect more HUF weakness but first we can go lower to 385-383 area where I plan to add 2 more trades and I am finished with the whole position building and I will be waiting for higher price around 405-407 where I will very likely close the 80-90% of the trade. Rest I will leave to give it a chance if course wants to go even higher. But above 410 or rather 415 I will consider to start building a short position. As of now I am bullish on this pair. Of course I can be wrong and there is a possibility to go down 370ish levels.

This is not a financial advice, do your own research and analysis!