#202513 - priceactiontds - weekly update - wti crude oil futuresGood Evening and I hope you are well.

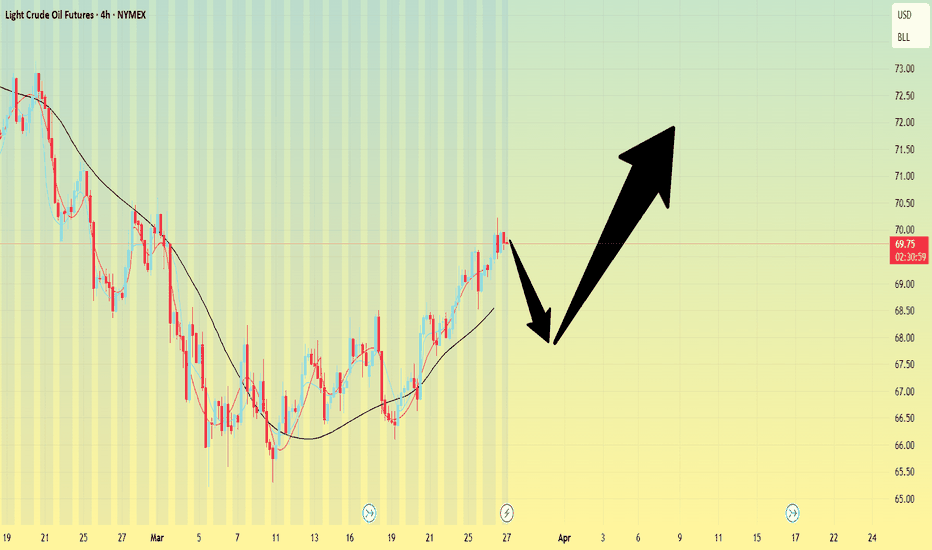

comment: Bulls continued and surprised a bit with the follow-through. 3 consecutive bullish weeks now and market has touched 70 multiple times. 70-72 is my neutral target while leaning bullish below 68. Volume is atrocious but market is free to do whatever. Could see a retest of 66 as well as going higher for 72. Absolutely no opinion on this or interest in trading, other than small scalps. Look at the weekly tf and tell me how obvious everything is, be my guest.

current market cycle: trading range

key levels: 65 - 72

bull case: Bulls produce decent tails below daily bars and keeping the market above the daily 20ema and 69. Right now they have taken somewhat control of the market after many weeks of selling, likely due to bears being exhausted. Only a daily close above 70 would change my assessment though. Sideways is more likely for me and I have no bigger interest in buying at 70 when it could be the high of a potential trading range 65 - 70.

Invalidation is below 65.

bear case: Bears sold the market relentlessly for 2 months straight and do seem exhausted. Right now they want to keep 70 resistance and since this is the first decent bounce the bulls got, the odds of this going much further up are low. It’s still a bear flag on the weekly tf and a retest of 65/66 is possible. Daily close below 68 would make me look for shorts for 100-200 ticks lower but that’s about it.

Invalidation is above 71.

short term: Neutral around 70. Bulls need a daily close above and bears something below 68 again.

medium-long term - Update from 2025-02-23: Bear trend is getting weaker but I still see this going sideways around 70 instead of a range expansion.

current swing trade: None

chart update: Removed last bear trend line, market is neutral at 70.

WBS1! trade ideas

Crude Oil at Decision Point — Breakout Coming or Just More Chop?Crude is nearing the apex of a descending triangle, but the conflicting signals across timeframes make this a tough read. The daily is breaking out to the upside, while the 4H is pushing lower — classic mixed market structure. Are we about to fake out in both directions before rolling over to fresh lows, or is this a genuine attempt to break higher? Honestly, both long and short setups feel like low-probability plays right now. Sometimes, the best trade is no trade.

buyers coming into the marketprice hit a higher timeframe resistence area at the end of the week, which we see lots

of selling off & a bearish engulfing candle.

price has now hit an institutional candle & is showing sighns of rejection from that area

buyers have already started to enter the market , as we can see on a lower timeframe.

i will be looking for buys at market open,

Crude Oil (WTI) Bullish Breakout – Eyes on $78.47!🚀 Crude Oil (WTI) Bullish Breakout – Eyes on $78.47! 🚀

📊 Trade Setup:

Entry Price: $73.12

Take Profit 1: $73.99

Take Profit 2: $76.20

Take Profit 3: $78.47

Stop Loss: $71.21 (below key support zone)

📈 Analysis:

After months of trading in a range, WTI Crude Oil has broken above the upper boundary of the channel , signaling a bullish breakout. This breakout is supported by:

1️⃣ China's Economic Optimism: Growth pledges and potential stimulus are boosting demand expectations.

2️⃣ Technical Momentum: Key resistance at $71.50 and $74 has been breached, opening the path toward higher targets.

3️⃣ Tight Weekly Chart Range: A big move was anticipated, and the bulls delivered!

🎯 Targets:

With momentum on our side, we’re targeting:

$73.99: Quick resistance retest.

$76.20: Alignment with prior highs.

$78.47: Major resistance and breakout zone.

🔹 Risk Management:

Stop loss at $71.21, well below the key support zone, ensures controlled risk in case of reversal.

⚡ Are you riding the breakout, or watching from the sidelines? Let me know your thoughts below! ⚡

Bearish Analysis: Crude Oil (CL Futures)1️⃣ Rejected at Supply Zone:

The price was strongly rejected from the $80 supply zone, where sellers clearly took control. This zone has been a key resistance level, and the recent bearish momentum confirms strong selling pressure.

2️⃣ Bearish Momentum in Play:

The sharp decline from the supply zone has broken short-term supports, signaling sustained bearish movement. The next major target is the $66–$67 demand zone, where buyers may step in.

3️⃣ Technical Indicators Supporting Bears:

RSI: At 54.88, the RSI suggests there’s room for further downside before reaching oversold conditions.

Stochastic Oscillator: A bearish crossover between the %K and %D lines confirms increasing selling pressure, with momentum favoring a continuation of the trend.

4️⃣ Fundamentals Adding Pressure:

Trump’s Energy Policy: Potential policy changes to increase domestic oil supply could create a bearish outlook for crude oil.

Stronger Dollar: The strengthening USD makes oil more expensive for global buyers, further dampening demand and supporting the bearish case.

🎯 Strategy:

TP1: $75 (Near-term target, close to the current price).

TP2: $74.30 (Minor support, a potential bounce or pause area).

TP3: $72 (A strong psychological and technical level).

TP4: $67 (Major demand zone).

🔔 Note:

Consider using a positive stop loss to secure gains and reduce risk. Always practice proper risk management to protect your capital and maintain consistent results.

CRUDE - WEEKLY SUMMARY 24.3-28.3 / FORECAST🛢 CRUDE – 17th week of the base cycle (28 weeks), second phase. The extreme forecast on March 27 halted the second phase’s upward movement at the 70 resistance level and reversed the trend. This forecast was specifically highlighted for crude at the beginning of the year. A short position has been opened. The next universal extreme forecast is April 7. The next crude-specific extreme forecast is May 5.

USOIL BUY Trade Review Bias: BULLISH due to price trading inside 1hr +NWOG (new week opening gap)

Entry model: Bull unicorn model created after price tapped into 1hr +NWOG. Confirmed with a +BB (breaker block), stop hunt, displacement thru +BB w/ FVG

Left chart shows entry model targeting equal highs created during London morning session which I use as buy side liquidity which gives price an incentive to trade higher.

MCX Crude oil Weekly LevelsAs shown in the attached chart, now MCX Crude Oil having Support at 5995 (1 hour chart) and need to sustain above the said level (hourly basis) for another major movement.

Disclaimer:- All the shared views are for educational purposes only. We provide Technical Indicators only for educational purposes. As we are not SEBI registered, there will be no claim rights reserved. Please consult your financial advisor before trading or investing.

Crude oil-----buy around 69.00, target 69.90-70.90Crude oil market analysis:

Crude oil has not been so strong for a long time. The K-line has uploaded the daily moving average, and the bulls have begun to rush up. The current suppression position is 70.00-70.60. Yesterday, the highest peak was 70.22. Today's idea is to follow the short-term buying, buy at a low price to see its moving average rebound, and the daily moving average is also starting to attack. We don’t speculate whether this wave of upward rush will change the trend of the daily line, but we can be sure that the short-term is bullish. Today’s idea is to buy directly around 69.00.

Fundamental analysis:

Although there is no big data this week, the US tariffs still cause huge market fluctuations in terms of fundamentals.

Operation suggestions:

Crude oil-----buy around 69.00, target 69.90-70.90

Crude Oil Market Insights: A Bullish Perspective on Price MovemeThe crude oil market continues to demonstrate resilience, with recent price action revealing intriguing patterns that warrant close attention from investors and traders. At the current juncture, crude oil has successfully found critical support at the $66 level, a development that aligns precisely with earlier market expectations.

Current Market Dynamics

Traders and market analysts are observing an emerging rally targeting long-term resistance levels. Interestingly, the early 2024 market upswing serves as a compelling analog for current price movements, providing a historical context for understanding potential future trajectories.

Market Movement Characteristics

The current market momentum presents a nuanced picture:

Continued upward movement is evident

Trading volume shows interesting characteristics

Price action indicates a slightly less volatile impulse compared to previous trends

What’s particularly noteworthy is how the market is maintaining its upward trajectory. Despite potential concerns about increased supply, the market has demonstrated remarkable stability. The current rally appears to be developing with a different volatility profile compared to previous market phases.

Supply and Demand Considerations

The prevailing market narrative around demand is progressively validating earlier predictions. Traders are speculating about the potential for an even stronger rally in the near term. While significant volatility might not be anticipated at current levels, the market remains dynamic and responsive.

Comparative Market Analysis

When examining the current market phase against historical patterns, several key observations emerge:

Volatility in the current market area differs substantially from previous periods

Price movements are showing measured, calculated progression

Supply increases are being absorbed without significant market disruption

Forward-Looking Perspective

Market participants should prepare for potential continued movement, albeit with a more measured approach. The expectation is not for explosive, high-volatility reactions, but rather a more controlled and strategic market progression.

Conclusion

Crude oil markets continue to provide fascinating insights for investors and traders. The current support level, emerging rally, and measured market dynamics suggest a cautiously optimistic outlook.

Key Takeaways

Crude oil finding strong support at $66

Potential for a measured rally

Reduced volatility compared to previous market phases

Continuing positive momentum in market trends

This analysis is for educational purposes only and should not be considered investment advice.

CrudeOil Breakout or Reversal?📈 CRUDEOIL – 1 HOUR TIMEFRAME ANALYSIS

CrudeOil is currently testing a key resistance zone near 5995–6000. Price action has respected the rising trendline, and the structure looks poised for a breakout or rejection move.

🔍 Two Possible Scenarios:

🔹 Bullish Breakout Above 5995 If crude sustains above 5995 with volume confirmation, we may see a sharp move toward:

🎯 Target 1: 6030

🎯 Target 2: 6065

🔹 Bearish Rejection Failure to break 5995 may trigger a rejection and lead to a correction toward:

📉 Support 1: 5931 (EMA)

📉 Support 2: 5870 (Trendline base)

📊 Key Levels:

Resistance: 5995 / 6030 / 6065

Support: 5931 / 5870

Volume will be the key factor in validating the breakout. Until then, keep a watchful eye for a trap or fake-out near resistance.

📌 Disclaimer:

This analysis is for educational purposes only. Always manage your risk and trade with proper position sizing. Market sentiment can change quickly.

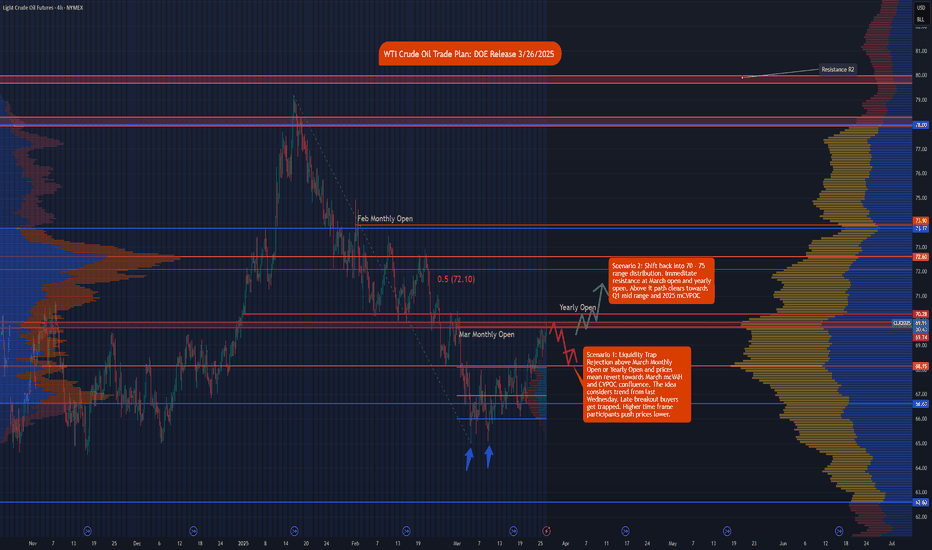

WTI Crude Oil Trade Plan: DOE Release NYMEX:CL1!

In this tradingview blog, we go over our technical setup and trade idea for Crude oil.

It is important to note we also have DOE inventory numbers coming at 10:30 ET.

Once the release has settled in, the trade idea can be framed using either of our two scenarios.

Scenario 1: Liquidity Trap

Rejection above March Monthly Open or Yearly Open and prices mean revert towards March mcVAH and CVPOC confluence. The idea considers the trend from last Wednesday. Late breakout buyers get trapped. Higher time frame participants push prices lower.

An example swing trade idea would be taking a long position once the release has settled and waiting for a pull back around 69.50.

• Entry: 69.50

• Stop: 70.30

• Target: 68.15

• Risk: 80 ticks

• Reward: 135 ticks

• Risk/Reward ratio: 1.69

This is an example swing trade idea that may play out by the end of the week.

Scenario 2: Shift back into 70 - 75 range distribution.

Immediate resistance is at March monthly open and yearly open. Above it the path clears towards Q1 mid-range and 2025 mCVPOC.

An example of a trade idea for this scenario is to wait for a breakout and close of candle on the 30 minutes time frame above yearly open. Wait for a pullback towards 70.28

• Entry: 70.35

• Stop: 69.50

• Target 71.45

• Risk: 85 ticks

• Reward: 110 ticks

• Risk/Reward ratio: 1.29

Please note that these are example trade ideas. Trades are advised to do their own preparation. Stops are not guaranteed to trigger, and losses may be greater than predetermined stops.

Crude oil ------ Buy around 68.60, target 70.00-70.60Crude oil market analysis:

Today's crude oil can be sold at short positions of 70.20-70.60, and the buying position is around 68.60. It is strong in the short term. We need to pay attention to the situation when it stands above 70.00. If the daily line stands above it, we need to pay attention to the new buying opportunities later, and the big drop will come to an end. However, the long-term trend of crude oil is still selling. In addition, with the increase in inventory data, the price of crude oil is unlikely to rise much.

Operation suggestion:

Crude oil ------ Buy around 68.60, target 70.00-70.60

Crude Oil Set for Mixed Outcomes Amidst Economic Tensions

- Key Insights: The crude oil market is experiencing mixed signals, with recent

positive momentum but an overarching bearish sentiment. Despite the slight

uptick, the market remains sensitive to economic and geopolitical factors,

suggesting cautious trading strategies. Investors should monitor key support

and resistance levels closely to inform trading decisions.

- Price Targets: Next week, traders might consider these targets:

- T1: $70.50, T2: $72.00

- S1: $66.50, S2: $65.00

This positioning aligns with the anticipation of potential upward movement while

guarding against lower breaks.

- Recent Performance: Crude oil has recently closed above key moving averages,

hinting at possible short-term gains. However, the broader market is

bearish, influenced by decreasing oil and gasoline prices, which may reduce

overall economic costs. The market's volatility is driven by broader

economic conditions and geopolitical influences.

- Expert Analysis: Opinions in the oil market are divided, with some experts

foreseeing bearish trends due to supply constraints and production capacity

issues. Others remain bullish in the long term, expecting economic

conditions like stagflation and inflation to drive demand and prices higher.

The imminent strengthening of the US dollar and its impact on linked indices

remains an area of attention.

- News Impact: Several notable events are influencing crude oil. Concerns about

sustaining production levels amidst declining rates and constrained spare

capacity highlight the critical need for investment in new projects.

Geopolitical tensions involving key global players are impacting supply

chains and pricing, potentially escalating inflationary pressures. Within

the sector, shifting production strategies and shareholder expectations may

redefine performance prospects in the near term.

Overall, while the short-term outlook might see some gains, traders should

remain cautious and informed, given the complex interplay of economic and

geopolitical factors affecting crude oil.

Crude Oil Technical Outlook Crude Oil has once again found support near the $65 area, initiating a modest rebound. This bounce may extend toward the $72 level, which I view as a potential area of interest for initiating a short position.

Should price action reach that zone, I would look to enter short with a defined target range between $50 and $42. In this scenario, the stop loss would be fixed at $80.60, preserving a clear and disciplined risk management structure.

I’ll be closely monitoring price behavior and momentum as we approach resistance, particularly looking for signs of exhaustion around $72 to validate the setup.

Crude oil-----sell near 69.00, target 67.00-66.00Crude oil market analysis:

Recently, crude oil has been hovering at the bottom. There are short-term stabilization signals, but it is basically difficult to turn around if you don't buy at 70.00. Today's idea is still bearish. Crude oil is sold regardless of weekly or short-term. Today's idea is still to sell at a high price and bearish. Crude oil pays attention to the inventory data later.

Operational suggestions:

Crude oil-----sell near 69.00, target 67.00-66.00