Bitcoin Price Rally: Market Insights and Potential Resistance Le(Taken from a clip from last week's Wyckoff Crypto Discussion)

Bitcoin Price Rally: Market Insights and Potential Resistance Levels

Explore the latest Bitcoin market analysis, including potential rally targets, supply and demand dynamics, and key resistance levels for short-term traders.

Current Market Outlook

The Bitcoin market is experiencing a notable short-term rally that has caught the attention of traders and analysts. Recent market observations suggest a nuanced approach to the current price movement, with several critical factors at play.

Rally Dynamics and Price Targets

Traders previously identified a potential long setup with an initial target around $88,000. The market is now approaching this crucial resistance level, with minimal supply pressure currently visible. This positioning presents an interesting scenario for cryptocurrency investors monitoring Bitcoin’s price action.

Supply and Demand Landscape

The current market condition is characterized by simultaneously diminished supply and demand. Experienced analysts note that such rallies typically conclude with a significant volume increase. While the upward movement has been somewhat measured, there remains potential for further price appreciation.

Key Resistance and Trading Strategy

The $88,000 level stands out as a primary resistance point of interest. Traders are closely watching for any significant activity at this price point. The current rally, while progressing, has been described as slightly underwhelming compared to typical market expectations.

Short-Term Positioning

Despite the measured progress, many traders maintain a short-term bullish position. The market continues to test support and resistance levels, creating a cautious but optimistic trading environment. Investors are looking for more decisive price action to confirm the rally’s strength.

Market Expectations

Traders typically anticipate a quick recovery and bounce following local price attempts. The current market is in a phase of continuous testing, with participants hoping to see more substantial efforts to push prices higher.

Conclusion

Bitcoin’s current market phase presents a complex trading landscape. While the rally shows promise, traders remain vigilant, watching for definitive price movements and volume changes that could signal the next significant market direction.

This analysis is for educational purposes only and should not be considered investment advice.

BMC1! trade ideas

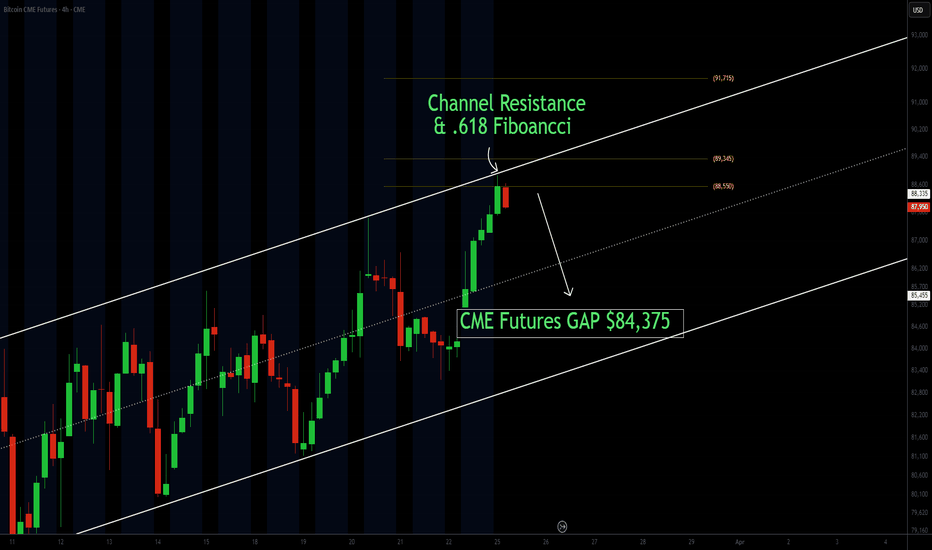

CME Futures Gap at $84,375 – Will Bitcoin Fill It Before Moving In today’s analysis, we are focusing on the CME futures chart, which has been open for trading over the past 24 hours. A key observation is the gap at $84,375, which remains unfilled despite Bitcoin’s bullish expansion on Monday. Historically, CME gaps have a high probability of being backfilled, making this an important technical level to watch.

Currently, Bitcoin is facing rejection at the range high of its trading channel, which aligns with channel resistance and the 0.618 Fibonacci retracement. If this rejection is confirmed, it increases the probability of price action rotating back toward the channel low support, which would fill the $84,375 gap before any move higher.

Key Takeaways:

• CME futures gap at $84,375 remains unfilled, which historically increases the likelihood of a pullback.

• Bitcoin is facing resistance at the channel high, in confluence with the 0.618 Fibonacci retracement.

• A confirmed rejection at resistance could lead to a move back down to fill the gap before resuming bullish momentum.

At this moment, more price action is needed to confirm whether this reversal will take place. However, traders should keep in mind that as long as the gap remains open, the probability of a move down remains high. The channel structure is key—if Bitcoin breaks down from this channel, it could signal further downside before any bullish continuation.

Patience is required as this setup develops. Keep an eye on how price interacts with key resistance and support levels before making any trading decisions.

A New ( But small ) Bitcoin CME Gap has arrivedDue to price rise in Bitcoin over the weekend, we have just opened up a new Bitcoin CME Gap.

ALL previous Gaps are Filled.

CME GAPS ALWAYS GET FILLED

So, we may see PA return to fill this gap.

the only time Gaps do not get filled is when in a Major Bull Run

We are not in one yet.

These are excellent places to put buy orders.

More Positive Signals on the Bitcoin Chart:✅ Looking at the 3D chart, the first positive sign is a slow but steady bounce after closing the CME gap.

✅ BTC is also holding strong above the 200EMA and the key trendline of this cycle.

✅ Oscillators are showing more bullish signs:

- MACD is turning around (on the weekly TF, the histogram has shifted from dark to light);

- RSI has already broken out, even though the chart itself hasn't confirmed it yet - but we’re waiting for that.

✅ Altcoins have also been keeping things interesting over the past few days, delivering breakouts and solid profits. 📈

As always, wishing everyone a productive and profitable week. Full speed ahead! 🫡🚀

What now BTC?I' ve described all in the #btc chart with call out balloons. Above 102K is the temporary invalidation. If CRYPTOCAP:BTC price movement in ascending channel declines, the target will likely be the retest zone of november rally and there also a CME #bitcoin futures gap waits to be filled by MM. Not financial advice.

The Current State of Bitcoin on the CME Futures ChartAs we analyze the current state of Bitcoin on the CME Futures chart, it's clear that a mixture of market forces and investor sentiment is playing out in an intriguing way. Looking at the Commitment of Traders (COT) index, we can observe a distinct divergence in the positioning of different market participants: commercials, retail traders, and fund managers.

Commercials: Bearish but Accumulating Over-the-Counter

Commercials, who are typically large institutions and market makers, continue to hold a bearish stance on Bitcoin in the futures market. This suggests that they are still not convinced of Bitcoin’s long-term price sustainability, likely reflecting a cautious outlook amid broader macroeconomic uncertainty. However, what stands out is their behavior in the over-the-counter (OTC) market. Despite their bearish position in the futures market, these same entities are accumulating Bitcoin in the OTC market. This suggests that while they might be hedging against short-term volatility, they still recognize Bitcoin's potential value or see it as a long-term store of value, allowing them to position themselves for future upside.

Retail Traders: Fearful and Bearish

Retail traders, on the other hand, have a far more pessimistic view of Bitcoin at the moment. With a lot of fear circulating in the market, many smaller traders are hesitant and have adopted bearish positions. This fear is compounded by the volatility that has become characteristic of the cryptocurrency market, alongside the macroeconomic challenges in traditional markets. Retail traders’ bearishness is a sign of market uncertainty and can often present opportunities for those who can see past short-term price movements. It is also indicative of the emotional influence that sentiment, such as fear, can have on the broader market.

Fund Managers: Extremely Bullish

In stark contrast to both the commercials and retail traders, fund managers are incredibly bullish on Bitcoin. They see the cryptocurrency as a valuable asset, particularly in the context of diversification and inflation hedging. The strong bullish positioning of fund managers indicates that institutional interest in Bitcoin is growing. These larger investors, likely driven by long-term growth prospects and the increasing recognition of Bitcoin as digital gold, remain optimistic about its potential. Their strong positions also suggest a belief in the fundamental value of Bitcoin and its resilience in the face of market turbulence.

Conclusion: A Complex Market Sentiment

The current state of Bitcoin futures on the CME reveals a market characterized by stark contrasts. Commercials are hedging their bets with a bearish outlook in the futures market while accumulating Bitcoin over-the-counter. Retail traders are fearful and bearish, showing caution amid uncertain market conditions. Meanwhile, fund managers stand in stark contrast, displaying strong bullishness, likely driven by the long-term potential of Bitcoin. This divergence of sentiment suggests that the market is at a crossroads, with various players taking different approaches based on their time horizon, risk appetite, and views on Bitcoin's role in the financial system.

In the short term, volatility and fear could dominate, but the long-term bullish positioning of institutional players may point toward a stronger future for Bitcoin as the market matures.

Bitcoin Rising to Fill most recent CME GAP - what then ?We have seen some pretty Good CME Gaps in recent months, a sign of volatility.

And, as I have been saying, CME GAPS ALWAYS GET FILLLED

the proof of that is right here, showing you the recent ones.

So, eight now, we are filling a gap from Below

The question is, what will we do than? Once the Gap is filled at around 86485

I would be a Very rich man if I knew for sure but as I have been saying in a few posts, I do not think PA is fully ready to berak out just yet BUT we may see a push higher to around 90K before it returns to the Low, maybe even to dip lower into the 73K zone.

But, obviously, this may not happen. However, Next time you see a CME Gap, understand it WILL get Filled.

If in a bull run Move, it will remain a gap till a later date, or, as we range as we are now, you can see howe this happens.

The Dips are great buying opportunists

Almost like the Fair Value Gaps ( FVG )

Stay safe

Bitcoin Futures CME - Short Trade Caution as FOMC meeting later tonight but price has been pushed higher this morning on lower liquidity and overall crypto sentiment is not great . High probability reversal from recent areas of strong activity and a Fibonacci area of the most recent move .

Sell 84100

Stop 85250

Target 82500

E

Large Speculators Bet on Bitcoin RallyWe published this chart a few months back noting that Bitcoin has never rallied while Large Speculators were net-long in Bitcoin futures and that streak continues this month as they remain net-long. This past week, Large Speculators actually increased their net-long positions by a lot as Bitcoin continues to struggle and near 2025 lows. This will be a good experiment to watch and see where Bitcoin goes from here and how it impacts positioning.

Some may say that Bitcoin futures is a small part of the BTC world and does not represent the entire trader population. Which may be true, but so far the COT data has done well identifying the reward/risk potential in Bitcoin. I have always said that COT data is not a great predictor of direction, but it sure does help you manage risk by knowing which side is crowded.

Bitcoin CME Gap at $77,930 Filled! Now, can $BTC push to $150K?Bitcoin CME Gap at $77,930 Filled! Now, can CRYPTOCAP:BTC push to $150K? 🚀

🔹 Support Level: $75,000 – If it holds, #BTC may target $100K+

🔻 If support breaks, my spot bids: $72K | $69K | $66K (Already filled at $77K ✅)

This drop was a liquidity flush to shake out high leverage traders. Stay prepared!

📢 Where’s your next buy order? Share below! 👇

#Bitcoin

Appetite For Risk Through the Lens of Nasdaq and BitcoinBitcoin tends to track Wall Street sentiment well, particularly compared to the Nasdaq. Growing concerns that Trump's policies will tip the US (and therefore the global economy) into a recession, which currently has the Nasdaq on the ropes and bitcoin getting dragged along for the ride. And there could be further losses to follow, though a cheeky bounce at a minimum could be due first.

Matt Simpson, Market Analyst and City Index and Forex.com

Bitcoin CME GAP Update

Don't forget panda fam that still there's a GAP at 82370 - 85920 range area keylevel currently filled by 50%.

Possible next scenario on bitcoin confluence with the CME GAP will be CME GAP filling above then continuation drop in worst case scenario since our H4 to Daily Timeframe is on clear bearish bias. 🐻

Bullish case scenario, If we manage to bounce and stay above on LAST MINOR S&R KEYLEVEL and will create a new swing for reversal sign then possibly we can test the recent Major PBr at 96k. 🐂

Is the U.S. building a crypto reserve?The United States (U.S.) is no longer just a bitcoin holder – it may be laying the groundwork for a national crypto reserve. Is this the moment bitcoin goes fully mainstream?

Strategic bitcoin accumulation?

Recent estimates suggest that the U.S. government is sitting on 200,000+ bitcoins – over $13 billion worth – mostly seized from criminal operators such as the Silk Road1. That stash makes Uncle Sam one of the largest bitcoin holders in the world. But here is the real question: what is the endgame?

Historically, seized bitcoin was auctioned off at deep discounts, flooding the market with sell pressure. This time, however, President Donald Trump’s latest executive order has put a halt to rapid liquidations, signalling a strategic shift. Instead of fire sales, the U.S. government is deliberately holding onto its bitcoin, driving speculation about a potential long-term reserve strategy.

Is this merely a temporary pause, or the first step toward establishing a full-fledged crypto reserve? While the executive order marks a clear change in approach, formally integrating bitcoin into the U.S. financial system would demand congressional approval, regulatory coordination, and a robust custody framework. The path forward is not just about policy – it is about power.

Digital gold for digital age

Crypto is not just a speculative asset anymore – it is a strategic economic lever in global power dynamics. With the U.S. dollar facing growing pressure from alternative currencies and central bank digital currencies (CBDCs), bitcoin’s appeal as a neutral, hard asset is undeniable.

Unlike traditional assets, bitcoin cannot be printed, seized by sanctions, or easily manipulated. If the U.S. sees what other nations are beginning to recognise – that bitcoin is the 21st century version of gold – it may rethink its role as a long-term reserve asset.

The conversation around crypto is no longer confined to industry circles. President Donald Trump recently issued an executive order officially recognising bitcoin as a strategic reserve asset, marking a significant policy shift. This move has sparked widespread discussion about the future role of digital assets in national reserves.

Further reinforcing this shift, the White House is set to host a Crypto Summit on March 7, where top policymakers and industry leaders will discuss digital assets. While details are scarce, this could be the first step toward formal integration of crypto into U.S. financial policy.

Meanwhile, the Federal Reserve has remained largely silent, leaving questions about its stance on bitcoin’s role in national monetary policy. Will the central bank embrace digital assets, or will it resist this historic shift?

What would it take to make it official?

Turning bitcoin into a recognised U.S. reserve asset is not just a simple executive order. It would require:

Congressional approval to classify bitcoin and other cryptocurrencies as strategic reserves.

Regulatory coordination between the Securities and Exchange Commission (SEC), Commodity Futures Trading Commission (CFTC), Federal Reserve, and Treasury.

A secure custody framework to manage holdings without risking security breaches or market instability.

A phased rollout – starting with bitcoin before expanding to other cryptocurrencies or beginning with small holdings before gradually increasing them.

This would not happen overnight. A realistic timeline? Years, not months. Expect feasibility studies, pilot programs, and intense political battles before crypto earns a seat next to gold in the U.S. balance sheet.

Market shockwaves

If the U.S. openly adopts bitcoin as a reserve asset, expect seismic shifts in global markets:

Sovereign bitcoin FOMO2 – other nations would likely follow suit, sparking a global race to accumulate bitcoin.

Institutional confidence surge – a U.S. endorsement would cement bitcoin’s status as digital gold, driving massive institutional inflows.

Reduced sell pressure – unlike past cycles of seized bitcoin dumps, retention would tighten supply and bolster price stability.

If this trend accelerates, we could be looking at a fundamental shift in the financial system – one where bitcoin plays a central role in sovereign wealth strategies. The question is not if, but when and how fast governments will adapt to this new reality.

The bottom line

With the world’s largest economy holding one of the biggest bitcoin reserves, the question is not just about policy – it is about power. Will this be the turning point where bitcoin cements itself as the next global reserve currency?

1 US Government Bitcoin Holdings, Bitcoin Treasuries by BiTBO (treasuries.bitbo.io)

2 FOMO = fear of missing out.

BTC Bullish ScenarioForgive my crude analysis of the waves displayed but this is how I see it. Assuming that the top is in for BTC, an ABC correction is expected. A wave would most likely take us to 68k - 70k region, B wave pullback to around 85k - 90k region and a C wave towards the Legendary Trading Zone around 43k. Trading below 43k means a cryptobubble is on the way, same way with the traditional stock market. Holding 43k level would validate a bullish scenario towards 200k area as Institutions/Whales want a cheaper price for BTC... That ABC correction follows a harmonic pattern as ABCD bullish scenario that would take us to the next wave of this supercycle...

$BTC1! Price reaching interesting support of a GAP from November - December 2024.

Indicators decreasing and looking for an oversold zone.

Price looking for a strong support zone on this area, before reaching the target on the chartist rate figure... .

If this theory is confirmed, we can support our monthly chart.

Bitcoin 10X Trade-Numbers (1,375% Potential)The low is in and this is the perfect timing for a long-term LONG on Bitcoin (BTCUSDT and other trading pairs).

This is for experienced traders and can end up producing huge profits, great growth, amazing results —great entry timing.

__

LONG BTCUSDT

Leverage: 10X

Entry levels:

1) $85,000

2) $83,000

3) $81,000

3) $78,000

Targets:

1) $94,810

2) $98,804

3) $101,058

4) $104,266

5) $108,353

6) $112,859

7) $115,648

8) $120,154

9) $132,643

10) $139,250

11) $158,347

12) $165,345

13) $189,212

14) $200,000

Stop-loss:

Close monthly below $78,000

Potential profits: 1375%

Capital allocation: 5%

____

Thanks a lot for your continued support.

Namaste.