Related futures

DXY - Dollar Index - Potenzial New Long phase

As we see in the chart .. in 2022 december we had a big volume accumulation before the october 2022 top to 112

After that we had a rebound and a laterality from sep. 22 to july 25.

In this moment we touche this volume and from my point of view we completed an ABC pattern.

Probably we have complete

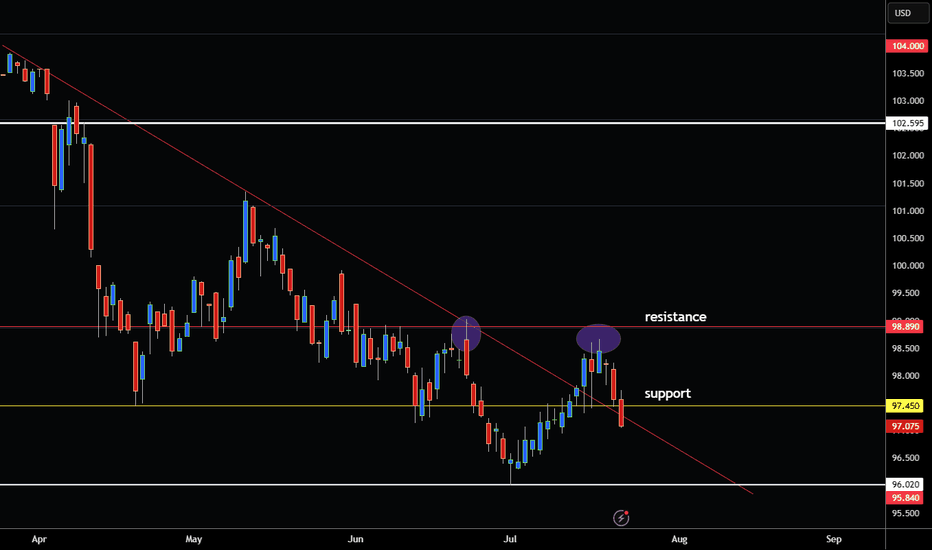

US DOLLAR BREAKS ABOVE RESISTANCE 98.99 BOTTOM CONFIRMED! Hey Traders so today looking at the US Dollar and as of today there is now a 123 bottom on the charts that has been confirmed by breaking above the 2 point.

Sees like fundamentally the US Dollar has now become bullish so with this breakout now confirmed does this mean we are in the beginning of Bu

Dollar Index - Expecting Bullish Continuation In The Short TermH4 - Strong bullish momentum followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussio

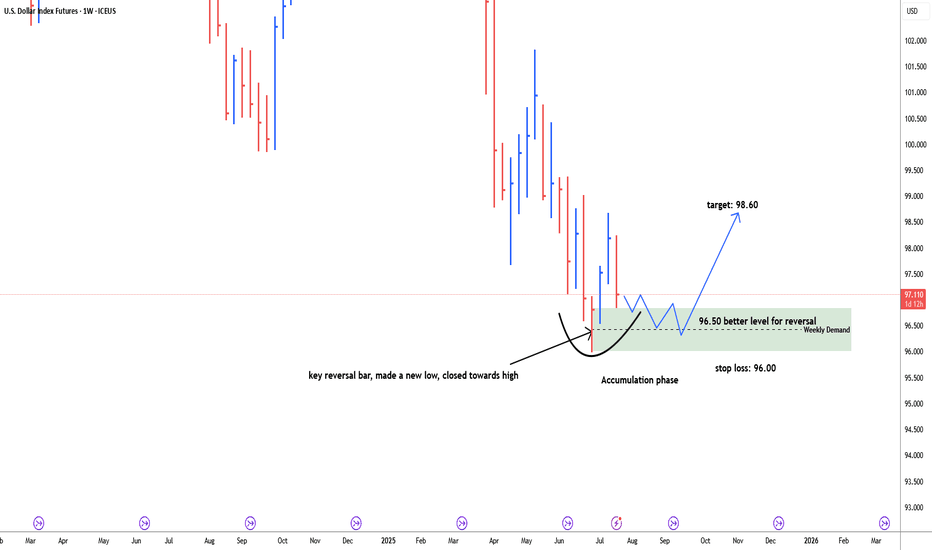

USD Dollar index possbile bullish reversal#usddollarindex, last weekly bar of the month of June is key reversal bar, made a new low and closed towards high. price retracing back down to test weekly demand zone. discount zone of demand is 96.50. possible bullish reversal target: 98.60. Stop loss below 96.00. price need time to build energy f

US DOLLAR INDEX BREAKING BELOW SUPPORT LEVEL RE-ENTER DOWNTREND! Hey Traders so today looking at the US Dollar Index or DX Market we can see that it has been in a solid downtrend since March. This is why alot of commodities and currencies have been getting stronger against it.

This is why I feel you don't need indicators to trade because price action shows you

Dollar Outlook – Bearish Trend with Key Support Levels AheadThe market is clearly bearish, and I do not recommend buying the dollar at the moment.

If the price breaks through the important zone between 98.525 and 96.725, we could see a move down toward the next zone between 95.935 and 94.790.

This lower zone is a key support level if it gets broken, the do

DOLLAR HIT LARGE DEMANDWe may hit the end of the bend. On the larger time frame, we see price retest the double bottom neckline. Last month price developed a doji a huge sign that price might be heading in the opposite direction soon. Fundamentally we see Smart money adding to their contracts and the candles are shortenin

DX - USD Index Longterm Outlook Indicates Further DeclineThis long-term chart shows how the USD Index is trading within the boundaries of the Median Line set.

We see the lower extreme, solid support around the Center Line, and the upper extreme acting as resistance.

What’s next?

Well—if it’s not heading higher, it’s likely heading lower—and the rejectio

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

A representation of what an asset is worth today and what the market thinks it will be worth in the future.

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of Mini US Dollar Index® Futures is 97.840 USD — it has fallen −0.04% in the past 24 hours. Watch Mini US Dollar Index® Futures price in more detail on the chart.

The volume of Mini US Dollar Index® Futures is 309.00. Track more important stats on the Mini US Dollar Index® Futures chart.

Open interest is the number of contracts held by traders in active positions — they're not closed or expired. For Mini US Dollar Index® Futures this number is 849.00. You can use it to track a prevailing market trend and adjust your own strategy: declining open interest for Mini US Dollar Index® Futures shows that traders are closing their positions, which means a weakening trend.

Buying or selling futures contracts depends on many factors: season, underlying commodity, your own trading strategy. So mostly it's up to you, but if you look for some certain calculations to take into account, you can study technical analysis for Mini US Dollar Index® Futures. Today its technical rating is strong sell, but remember that market conditions change all the time, so it's always crucial to do your own research. See more of Mini US Dollar Index® Futures technicals for a more comprehensive analysis.