INFLATION INCOMING - Real world implications (Oranges)Orange Juice is a clean way to define a couple of key things:

-- Weather forecasts

-- Inflation

-- Supply shocks

-- Global trade

Recently, I've taken note that OJ futures have skyrocketed more than 200% in the last 3 years. I was so surprised in fact, I had to look at it versus other commodities, which have seen a mild bounce (Wheat, Oats). And bigger spikes (Pork, Chicken) during the supply shocks of the pandemic.

But OJ keeps bucking the trend! Is this the REAL effect of inflation?

OJ1! trade ideas

INFLATION is coming (Real consumer costs) Orange Juice is a clean way to define a couple of key things:

-- Weather forecasts

-- Inflation

-- Supply shocks

-- Global trade

Recently, I've taken note that OJ futures have skyrocketed more than 200% in the last 3 years. I was so surprised in fact, I had to look at it versus other commodities, which have seen a mild bounce (Wheat, Oats). And bigger spikes (Pork, Chicken) during the supply shocks of the pandemic.

But OJ keeps bucking the trend! Is this the REAL effect of inflation?

Doubling Orangejuice? #OJ1! #Ojuice #orangejuice @stefanjbodeOrange juice is preparing for a breakout.

If this breakout is confirmed, then a doubling of the price in the next 3-4 years should not be surprising.

#FCOJ doubling orangejuice #OJ1! #Ojuice #orange

wkr from Hanover

@StefanJBode

#StefanBode

GravityHello friends.

Orange Juice seems to defy gravity itself. It has pushed up wildly over the past 3 years, nearly reaching a new all-time high. This has created the greatest opportunity to short orange juice since 2016. Let us explain the different elements of our idea.

Point 1 - Orange juice has reached a key resistance when measured against money supply inflation

Because of innovation, the price of commodities will almost always fall over a long time period when measured against inflation. Orange juice has made no exception to this global rule, having fallen by 85% from 1970 to the present date. That is a yearly return of -1.6%, which should also represent our "innovation factor". In other words, we get 1.6% better at making orange juice every single year.

But now it has made a retracement to the normal downtrend, which provides an opportunity for us to short. Here is something to chew on: Despite innovation inevitably increasing in the years between 2004 and 2022, the price of orange juice has risen so much that it currently goes all the way back to the same levels as the lows 18 years ago in 2004. The price rarely retraces this deeply, and whenever it has retraced in this way the price has always made a substantial decline in the following years. To use our innovation factor for this, we could say that we are likely about 1.6 times 18 = 28.8% better at making orange juice, and yet orange juice is trading at the same price. This obviously won't last forever. We should expect a new all-time low in adjusted orange juice prices within a few years if trends continue.

Point 2 - Orange Juice deficit is very minimal

Yes, we are currently running an orange juice deficit -- but it's a negligible one, and the high price will definitely rectify it in the future. The USDA estimate is that we will have roughly 3% more orange juice consumption than orange juice production for 2022. This only speaks to a short-term lack of orange juice capacity, and the long-term will not look this way. Think about this. Orange prices only rose from $0.79/kilo to $0.93/kilo over the span of 2022 (+17.7%). Yet orange juice futures rose from 140 to 210 over that time period (+50%!!). This massive difference in the price movements is important because it means that orange juice producers are raking in much bigger profits at these prices and are going to expand their production capacity in order to cash in. This expansion of production capacity will mean we see more orange juice supply coming online going into 2023 and beyond.

Point 3 - Price-sensitive consumers will not buy at high levels

The average orange juice consumer is relatively price-sensitive, especially during a recession. They may view orange juice as a good breakfast option at a low price, but they will no longer be as willing to purchase orange juice at a high price. What is stopping them from swapping out orange juice for milk, assuming they like milk just as much and milk is also cheaper? Why not swap it out for another kind of juice that hasn't seen this kind of parabolic rise, for that matter? Orange juice consumers are not like gasoline consumers, who MUST have gasoline in order to get to work. Orange juice is an unnecessary luxury. Unnecessary luxuries are the first thing that consumers cut back on when they are laid off from their jobs, and layoffs are expected to increase going into 2023 as the economy worsens. This will weaken the demand for orange juice.

If we chart the price of milk futures against the price of orange juice futures, we can indeed see that milk is starting to become cheaper and more attractive. In a more practical sense, Walmarts near me are charging ~2.5 cents per fluid ounce of milk versus 7 cents per fluid ounce of orange juice (prices will vary based on the product, but I am looking at more of a median of all the prices).

Final thoughts

Orange juice is too expensive. Consumers are going to drink less. Producers are going to make more. Prices are going to fall. Markets are going to heal. They always do.

Sugar and FCOJ Take the Bullish BatonThe soft commodities sector of the commodity market can be highly volatile. Historically, sugar, coffee, cotton, cocoa, and frozen concentrated orange juice futures that trade on the Intercontinental Exchange have doubled, tripled, and halved in value over short periods. While clothing and other consumer goods depend on the cotton market, the other sector members are foods.

The soft commodity sector rose in 2021, and Q1 2022

Coffee and cotton rose to multi-year highs in 2022

FCOJ takes off on the upside in April and makes a new multi-year high

Sugar could be next for three reasons

Trading softs from the long side- Buy those dips

Brazil is the world’s leading producer and exporter of three of the soft commodities; sugar, coffee, and oranges. Sugar comes from two sources, sugar beets and sugarcane. Brazil’s tropical climate makes it the leading sugarcane producer. Arabica coffee beans are popular in the US and other areas, while Robusta beans produce espresso coffees. Brazil leads the world in Arabica production. While many people associate orange production with Florida and California, Brazil is the world’s top orange producer. Cocoa, the primary ingredient in chocolate confectionery products, comes mainly from West Africa, as the Ivory Coast and Ghana produce over 60% of the world’s annual supplies.

Soft commodities are agricultural products, so the weather in growing areas typically determines the prices each year. Since the 2020 pandemic, the price action has been anything but ordinary.

The two latest soft commodities to lead the sector on the upside have been sugar and FCOJ futures.

The soft commodity sector rose in 2021, and Q1 2022

In 2021, the composite of the five soft commodities that trade in the futures markets on the Intercontinental Exchange rose 31.57%. In Q1 2022, the softs added to gains, rising 6.58%, with all five members posting gains.

Cotton futures led the softs higher with a 20.51% gain. Cocoa futures moved 5.16% to the upside, with FCOJ posting a 3.86% gain. Sugar rallied 3.23%, and Arabica coffee futures eked out a 0.13% gain.

Meanwhile, coffee and cotton rose to new multi-year highs during the first three months of 2022.

Coffee and cotton rose to multi-year highs in 2022

In June 2020, coffee futures made a higher low under the $1 per pound level before taking off on the upside.

The weekly chart shows the bullish trend of higher lows and higher highs that took coffee futures to $2.6045 per pound in early February 2022. Coffee futures rose to the highest price since 2011.

Cotton futures also rose to the highest level since 2011, peaking at the $1.4614 per pound level in April 2022.

Coffee futures were over the $2.20 level, with cotton above $1.40 on April 14.

FCOJ takes off on the upside in April and makes a new multi-year high

Frozen concentrated orange juice futures are the least liquid of the five soft commodities, based on daily volume and open interest metrics. While the FCOJ futures arena rose to a new multi-year high in Q1 2022, the bullish price action continued in April with higher highs.

The chart shows that nearby FCOJ futures rose to $1.8660 per pound last week, the highest level since March 2017. The all-time high in the orange juice market came in 2016 at $2.35 per pound.

Brazil is the leading producer and exporter of oranges and Arabica coffee beans. The South American country also is the leader in free-market sugarcane production and exports.

Sugar could be next for three reasons

Sugar futures rose to 20.69 cents per pound in November 2021, the highest price since February 2017.

The weekly chart shows that sugar futures were above the 20 cents per pound level last week. Sugar is approaching the first technical resistance level at the November 2021 20.69 cents high. Above there, the next target is at the October 2016 23.90 high, which is a technical gateway to the 2011 36.08 cents per pound peak.

Three factors support sugar prices in April 2022:

Rising inflation is lifting all commodity prices, and the trend is always your best friend in markets across all asset classes.

Rising crude oil and natural gas prices support sugar. Crude oil is over the $100 per barrel level, and natural gas stopped just short of $7 per MMBtu last week. Multi-year highs in the energy market support sugar as it is the primary input in Brazilian ethanol production. As more sugarcane goes into ethanol production, less is available for exports.

Sugarcane production costs are increasing as they are labor-intensive. The rising Brazilian real makes sugar more expensive to produce.

The chart illustrates the technical breakout to the upside in the Brazilian currency against the US dollar. A higher real increases the cost of production, putting upside pressure on sugar’s price.

Trading softs from the long side- Buy those dips

Stocks and bonds have been shaky in 2022, and cryptocurrencies have not yet of the slump that took prices lower since the November 2021 highs. Commodities have been the place to be for investors and traders over the first four months of 2022. The latest inflation report will likely keep the bullish party in raw material markets going.

I remain bullish on soft commodities as they are highly volatile and can offer explosive returns. Sugar is my top choice as of April 15, as the sweet commodity loosed poised to eclipse the 2021 high on its way to higher ground. Meanwhile, I favor all soft commodities in the current environment. The optimal approach to the sector has been buying on price weakness, and I expect that to continue. Bull markets rarely move in straight lines, and corrections can be the best route to optimizing returns over the coming weeks and months.

--

Trading advice given in this communication, if any, is based on information taken from trades and statistical services and other sources that we believe are reliable. The author does not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects the author’s good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice the author provides will result in profitable trades. There is risk of loss in all futures and options trading. Any investment involves substantial risks, including, but not limited to, pricing volatility, inadequate liquidity, and the potential complete loss of principal. This article does not in any way constitute an offer or solicitation of an offer to buy or sell any investment, security, or commodity discussed herein, or any security in any jurisdiction in which such an offer would be unlawful under the securities laws of such jurisdiction.

Orange Juice heading towards a clear resistance OJ is moving in a channel up movement and unstoppable in the past few weeks.

It looks like it's moving to the resistance at the level 169, 170 level which is both historical horizontal resistance and channel upper boundary.

Channel boundaries have worked reliably in the past to dictate the movement, and I am hoping it will be the case at 170. In the long run, I still think OJ is moving to the 220 region which is the ultimate test and massive historic resistance.

MsgFW : 📧 #LDR 🧃On The Loose🔑🔐👼🏻Please ?🍊

Lana Del Rey

Florida Kilo's

White lines, pretty baby, tattoos

Don't know what they mean

They're special, just for you

White lines, baking powder on the stove

Cooking up a dream, turning diamonds into snow

I feel you, pretty baby, feel me

Turn it up hot, loving you is free

I like it down, like it down way low

But you already know that

You already know

(Fuck!)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison isn't nothing to me if you'll be by my side

Yayo, yayo, yayo

And all the dope fiends

Yayo, yayo, yayo

(Fuck!)

Sun in my mouth and gold hoops

You like your little baby like you like your drinks--cool

White lines, pretty daddy, go skiing

You snort it like a champ, like the winter we're not in

(Fuck!)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison isn't nothing to me if you'll be by my side

Yayo, yayo, yayo

And all the dope fiends

Yayo, yayo, yayo

We could get high in Miami

Ooh, ooh

Dance the night away

People never die in Miami

Ooh, ooh

That's what they all say (Yay)

(You believe me, don't you baby?)

Come on down to Florida

I got something for ya

We could see the kilos or the Keys, baby, oh yeah

Guns in the summertime

Chic-a-Cherry Cola lime

Prison don't mean nothing to me if you'll be by my

Yayo, yayo, yayo

All the Floridians like

Yayo, yayo, yayo

All the Colombians like

Yayo, yayo, yayo

And all my girlfriends

Yayo, yayo, yayo

That's how we do it, like

Mm-mm, pretty baby

White lines, pretty baby

Gold teeth, pretty baby

Yeah, yeah, yeah

Dance the night away

🍊

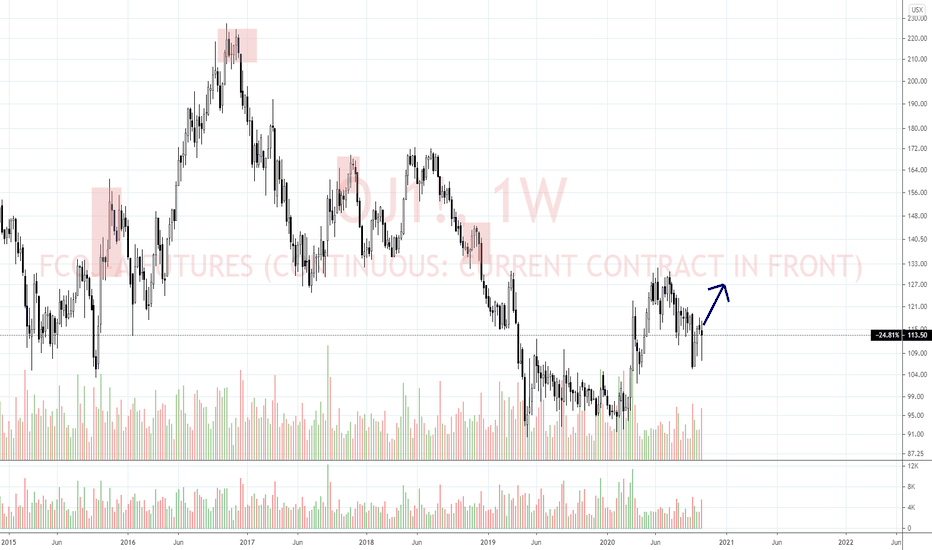

Oranges and the Next Inflation CycleOJ1 Oranges have been building a higher low since spring of 2019 and completed the higher low in the Feb. 2020 crash.

With broad commodities CRB having formed a long-term cycle low in the 1Q2020 and the global economy already heating up and many commodities already breaking out of their multi-year downtrends (Uranium, industrial metals, agriculture), it has become increasingly clear that we are in the next re-flation (growth and inflation) cycle.

a higher low for oranges over a trend duration, at a time when most commodities hit all-time cycle lows, is a more structurally healthy bullish set up than most other commodities.

Gold and silver tend to be the popular way to express a bullish view on inflation, but during times when bond yields are rising with inflation, consumer and industrial commodities tend to outperform the precious metals.

View on Orange Juice (8/12)Bearish Bias.

Waiting for price to retrace before looking for a short trade.

Sl behind swing high.

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activity

View on Orange Juice (24/10)Approaching towards the end of the fall with about few more weeks to go.

Looking bullish in the underlying product.

possible area price might head towards - 127

Disclaimer:

The information contained in this presentation is solely for educational purposes and does not constitute investment advice. We may or We may not take the trade.

The risk of trading in securities markets can be substantial. You should carefully consider if engaging in such activity is suitable to your own financial situation.

I am not responsible for any liabilities arising from the result of your market involvement or individual trade activity

How to search for an exchange and discover new assetsIn this video, we show you how to use the search box to find specific exchanges and discover new assets on those exchanges. Our goal is to make global financial data more open and accessible for all of our members. When you create a TradingView account, you instantly gain access to data from around the world.

To get started, head to the search box and type in the name of the exchange you're interested in and add a colon ":" to the end of it. For example, type "NYSE:" to see NYSE listed securities or "NSE:" to see NSE listed securities. You can do this for all of the exchanges listed on TradingView.

At the top right of the search dropdown is a button that says "All Exchanges." Click this to see all of the exchanges available to you and the region of the world they are based in. You can use this to refine your search and discover new exchanges.

If you have any questions, please write them in the comments below and our team will do their best to help. If you enjoyed this video tutorial, press the like button. Thanks for watching and we hope this tutorial helps you with your research, trading, and market knowledge.

Further reading:

- Chart Every US Listed Futures Contract From ICE

- Announcing New Data Feeds From Indonesia, Hang Seng, and More

- A Look Back at New Brokers, Exchanges, and Data on TradingView