ICPUST trade ideas

ICP Is Bearish For MidTerm (3D)On the chart, it appears that we have a large-degree ABC structure, where Wave B formed a triangle and has now completed.

Wave C should take more time than Wave A. Since Wave B has retraced 0.382% of Wave A, it is expected that Wave C will also be deep

We have marked the price and time boxes on the chart.

A daily candle closing above the invalidation level will invalidate this analysis

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ICPUSDT 1WThe price, after completing a 5-wave Elliott impulse, has entered an ABC correction. It is now in the process of completing wave 5 of C around the lower boundary of the channel.

It seems that we should start preparing for a strong upward move in this asset. The expected price and time range are indicated in the chart.

ICP | Bull Market is comming | Fundamentals |The chart says it all—truly a historic buying opportunity. 💎

Don't miss out! The fundamentals are in place; all that's left is execution on the chart. ✅

Fundamentals:

🚀 The fastest blockchain today.

🛠️ The only blockchain capable of hosting a full application on-chain (not just the smart contract).

🤖 The only blockchain capable of running AI without additional resources.

⚡ 1-second transactions.

💰 Near-zero transaction costs.

📈 The fastest-growing and most innovative blockchain.

👨💻 The blockchain with the highest developer activity.

🔥 Soon to be deflationary.

🔒 No tokens left to unlock.

🔗 Direct integration with BTC, ETH, and more—no bridges needed.

🏛️ The largest DAO, with over $1.5 billion locked (mostly for 8 years).

🤯 Upcoming AI release capable of building 100% on-chain applications.

Source:

internetcomputer.org

dashboard.internetcomputer.org

chainspect.app

www.developerreport.com

x.com

ICP: Preparing for a Major Move!

FWB:ICP is currently trading at $6.62, approaching a key Fibonacci re-correction zone, making it a potential buy opportunity for the next bullish cycle. 📊🔥

Price is currently retesting the 0.786 Fibonacci retracement, a strong demand zone.

Holding this level could trigger a reversal towards key upside targets.

Targets 🎯

Target : $15.27

ICP and Others 1D RSILet me be clear, alt’s are not doing anything they’re suppose to be doing as per past cycles for a lot of reasons. I think these include there’s just to damn many of them, there is not going to be a parabolic phase this cycle, and many retailers got lost in the shit for brains meme market. Unless you bought alts months/years ago the hold option is not an option. You have to play the alts as a swing trader at best, getting in for weeks/months and getting out, take your profit and run.

How do you do that? One method I suggest is buy at the RSI daily low when a bullish divergence shows and sell at the RSI daily top range when a bearish divergence shows. Simple eh.

So in this post I’m looking at 1D timeframe RSI which I’m a big fan of always using RSI with my forks, cycles and Elliot ta. Remember, presently, alts are going to do nothing until BTC finishes its sideways downward pa (see my previous posts about BTC) and, market cap starts upward trend again. Having said that…

Looking at ICP, you can see RSI bottomed 06Feb25 (just a few days after that wicked wick on the 3rd. Since then pa has fallen yet RSI has risen and indicates a definite bearish divergence. PA could even drop some more, which I think it will because BTC’s not finished yet, and I believe the RSI will still be above the bottom of 06Fed continuing the bearish divergence. A good possible candidate for when things start an upward trend.

Other alt’s that I’m seeing the same RSI divergence action are PHA, ILV, SUPER, CRV, GALA, WIF, AVAX, ALG, HBAR, AVAX, BEAM FIL, IMX, ADA, RENDER, MUBI, MAVIA, MYRIA, VRA, ORAI, AIOZ and PYR.

Surprisingly, I don’t see this on BTC, ETH or SOL.

Anyway, although as I said, I don’t think we’re going to see an alt rally as in the past, these alts might be ones to watch for some decent action “when” BTC gets it’s shit together and runs.

My thoughts, not financial advice Oklah. Cheers

ICPUSDT NEXT MOVESell after bearish candle stick pattern, buy after bullish candle stick pattern....

Best bullish pattern , engulfing candle or green hammer

Best bearish pattern , engulfing candle or red shooting star

NOTE: IF YOU CAN'T SEE ANY OF TOP PATTERN IN THE ZONE DO NOT ENTER

Stop lost before pattern

R/R %1/%3

Trade in 5 Min Timeframe, use signals for scalping

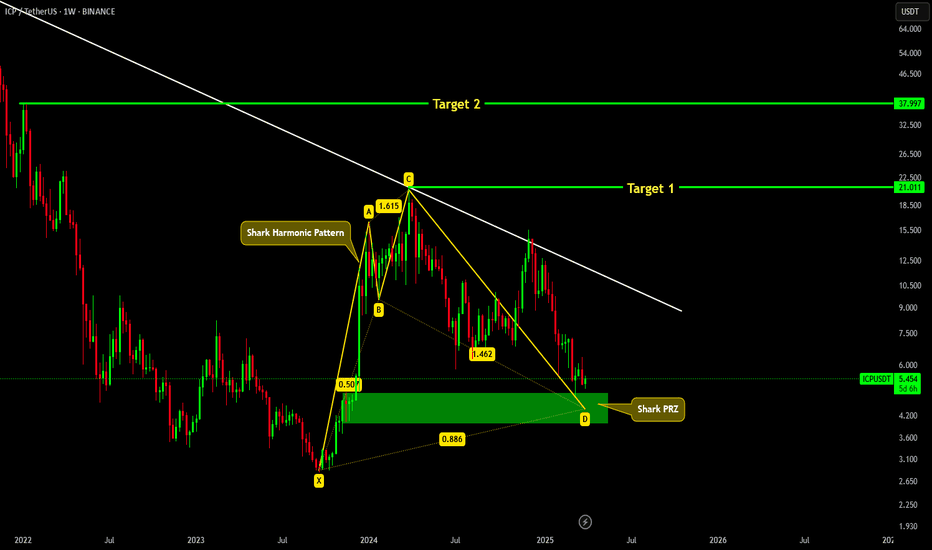

ICP/USDT 1W🩸 CRYPTOCAP:ICP ⁀➷

#InternetComputer. Macro chart Another

💯 Intermediate Target - $22

🚩 Macro Target 1 - $35

🚩 Macro Target 2 - $62

🚩 Macro Target 3 - $105

- Not financial advice, trade with caution.

#Crypto #InternetComputer #ICP #Investment

✅ Stay updated on market news and developments that may influence the price of DFINITY. Positive or negative news can significantly impact the cryptocurrency's value.

✅ Exercise patience and discipline when executing your trading plan. Avoid making impulsive decisions driven by emotions, and adhere to your strategy even during periods of market volatility.

✅ Remember that trading always involves risk, and there are no guarantees of profit. Conduct thorough research, analyze market conditions, and be prepared for various scenarios. Trade only with funds you can afford to lose and avoid excessive risk-taking.

ICP/USDT AT A KEY SUPPORT!📊 Weekly Analysis of ICP/USDT

🔥 ICP at a Key Support! Long Opportunity or Breakdown?

In the weekly timeframe, ICP has reached a critical support zone that has shown significant reactions in the past and is now being tested again.

🔍 Key Highlights:

📉 Increase in Selling Volume: As the price approaches this support, selling pressure has intensified, indicating potential weakness.

📊 RSI Below the 50 Average: Currently at 40.77, suggesting a lack of strong buying momentum.

🟢 Strong Weekly Support: The price is at a major weekly support level, which could trigger a bullish reaction if confirmed.

📈 Potential Scenarios:

✅ Bullish Scenario: If confirmation is received and the 4-hour timeframe box breaks, there is potential for an upward move toward the next key horizontal resistance at $14.55.

❌ Bearish Scenario: If the current support is lost, the next significant support zone is at $3.58, which could lead to further downside.

🔔 Conclusion:

ICP is at a critical decision point. Traders should watch for a breakout in the 4-hour timeframe before considering a long position. If support is lost, lower levels may come into play.

⚠ Given the market structure and conditions, always remember to manage your risk and capital wisely.

👀 What’s your take on ICP? Will this support hold? 👇🔥

#ICP #TechnicalAnalysis #Crypto #TradingView #RiskManagement

Long timeICP did what it went to do, maybe something's still there to be done, who knows, but someday, someday it'll climb back to those double digits.

Carl the moon gave yesterday warning about altcoins, this might b a good signal to do the opposite,

Nah but seriously this might take some time . . . i wouldn't leverage... well maybe a 2 or 3 :D

Understanding Market Activity in CryptoMarket activity measures the level of trading intensity in a market. It includes transaction volume, price fluctuations, supply and demand, and how different participants interact. In crypto, this is reflected in metrics like trading volume, liquidity, and order book depth.

Example: Bitcoin ( BTC ) trading volume spikes when major news (e.g., ETF approvals) or macroeconomic events occur. This increased activity shows how market sentiment drives price movement.

Who Are the Market Participants?

Market participants are anyone buying or selling an asset. In crypto, this includes:

- Retail traders (individuals buying BTC, ETH, etc.)

- Institutional investors (hedge funds, large companies)

- Market makers (liquidity providers ensuring smooth order flow)

- Miners & validators (securing the network and earning rewards)

The more participants in a market, the more liquid it becomes, making price movements smoother and reducing volatility.

Example: Bigger CEX have a deeper liquidity than a small DEX, meaning orders execute faster with less slippage.

Price + Time = Value (Crypto Perspective)

One fundamental rule in markets is:

➡️ Price + Time = Value

This means that an asset’s value is determined not just by its price but also by how long people are willing to hold or trade it.

Example: A long-term BTC holder who bought at $1,000 and held for 5 years sees a much different "value" than a day trader who flips BTC in minutes.

Additionally, crypto markets always have price levels that attract buyers and sellers (support and resistance levels).

Example: Bitcoin's $20,000 level in past cycles acted as both strong support and resistance, attracting buyers when the price dipped and sellers when it surged.

Market Analysis & Price Patterns (Normal Distribution in Crypto)

To analyze market activity, traders break price movements into time segments. One useful tool is the normal distribution curve, which shows where most trades happen.

Example: In on-chain analysis, if most Bitcoin transactions happen between $40,000–$45,000, this becomes the value area where market participants agree on price.

Crypto analogy: Think of a whale buying BTC in chunks over days, forming a distribution pattern. If they stop buying, price trends shift.

Supply & Demand in Crypto (Using a Bakery Analogy)

Markets function based on supply and demand. Imagine a bakery:

In the morning, fresh bread (high demand, low supply) = higher prices

By evening, leftover bread (low demand, excess supply) = discounted prices

The same happens in crypto:

New altcoin launch: Limited supply, high hype = price pumps

Token unlocks: More supply enters the market = price dumps

Example: When a project like Aptos (APT) unlocks millions of tokens, supply increases, and the price often drops due to selling pressure.

Short-Term vs. Long-Term Market Trends

Markets move in different timeframes—hourly, daily, weekly, and even yearly trends.

Short-term example: Ethereum’s price swings daily based on trader speculation.

Long-term example: Bitcoin halving cycles create multi-year trends that drive overall growth.

Example: In 2020, BTC was under $10K, but by 2021, it reached $69K due to long-term macro factors.

Crypto Market Makers (Real-World Examples)

Bitcoin Miners: Similar to a car company adjusting production, Bitcoin miners decide whether to sell mined BTC or hold it for higher prices.

2️⃣Whales & Institutions: Like property developers adjusting prices, whales accumulate crypto at low prices and distribute at highs.

3️⃣Liquidity Pools in DeFi: Like restaurants pricing meals based on demand, liquidity providers adjust fees and slippage in Uniswap pools.

Example: Alameda Research (before FTX collapsed) was a key market maker, providing liquidity across major crypto exchanges.

Long-Term Disruptions (Crypto Example: Ethereum vs. Bitcoin)

Long-term players reshape entire markets over time.

Example:

Bitcoin ( CRYPTOCAP:BTC ) was the first mover, dominating the crypto market for years.

Ethereum (ETH) introduced smart contracts, shifting activity from BTC to DeFi, NFTs, and Web3.

Now, new chains like Solana challenge ETH, forcing changes in network fees and scalability.

This mirrors how Japanese car companies disrupted the U.S. market, forcing competitors to evolve.

How to Spot Fair Prices in Crypto?

Markets always seek equilibrium—a price where buyers and sellers agree.

Example:

If a new altcoin doubles in price, but trading volume drops, it signals overvaluation.

If on-chain data shows steady BTC accumulation, it suggests a fair price floor forming.

➡️ Traders watch repeated transactions to gauge market sentiment.

Consumer Awareness in Crypto

As investors, we naturally understand how price and time impact value. However, we also need to watch long-term market participants like:

Whales (Smart Money): Who is accumulating?

On-Chain Data: Are large wallets buying or selling?

Institutional Trends: Are hedge funds moving into crypto?

📌 Example:

When Tesla bought #bitcoin in 2021, it signaled institutional confidence, but when they sold, market sentiment shifted.

Final Thoughts

Crypto markets follow the same supply and demand principles as traditional markets but with 24/7 trading, higher volatility, and unique tokenomics. Understanding market activity helps traders anticipate moves and make better investment decisions. 🚀

Hope you enjoyed the content I created, You can support with your likes and comments this idea so more people can watch!

✅Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only not for financial Investment Purposes.

---

• Look at my ideas about interesting altcoins in the related section down below ↓

• For more ideas please hit "Like" and "Follow"!

ICP Bounces from Strong Support: Bullish Reversal Ahead?FWB:ICP has bounced from a strong support zone around $6.5–$7.0, signalling a potential bullish reversal. This key demand area has historically supported price recoveries.

> $6.5–$7.0 range holding firm with strong buyer interest.

> Next hurdle is $9.4–$10.0; a breakout could target $12+.

> RSI is recovering from oversold levels, hinting at bullish momentum.

If ICP holds above support, an upward move is likely. A daily close below $6.5 may invalidate this outlook.

DYOR, NFA

#ICP #Crypto #Altcoins

$ICP #ICP potentially repeating patterns? We are #BULLISHAF2024

WIth the recent merger "news", this is definitely an important one for the AI blockchain space

I had targets for ICP that played out

the news came after the fact

and seeing it pamp past cpl days, its interesting how the news headlines show up at key moments instead of when its consolidating at the lows

Regardless, its not a sell signal, can easily continue pamping

IF we drop, were looking for similar patterns to play out with target range $4-$8 before start new leg and next phase of #BullRun2024

The next phase is where we can anticiapted BTC.dom becoming weaker as alts start taking over

You SHOULD want THIS drop

esp if you are bullish

We wait, pattern and chart tells me to favor the move

First big drop always get nice bounce (great to re-accumulate/take small quick fast profits)

2nd big drop favors the local bottom target range (great to start re-accumulation) before the bottom is completed. Then we wait for higher lows breakout & retest to go LONG

Should take few weeks.

We wait.