Looking support and resistance Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

ANTM trade ideas

ANTM ready Re-Test 3000?After close the big gap on March 4, 2021, ANTM will continue the rally to retest the 2900-3000 as the strong resistence. From the commodity, the gold price ( XAUUSD ) will retest their support after break the short term downtrend. The ANTM catalyst, mostly came from nickle price that powering electric vehicle news on Indonesian. Nickle price predicted to reach 19,000 USD/T at the end of the year.

ANTMNB: DO MIND that These analyses I posted here are intended as my notes and not as investment recommendations or as financial advice! Please also note that you are always responsible for your own investments when trading on the stock exchange! The analyses are only based on my opinion and view. LETS CUANN!!!

ANTM Technical Analysis | Buy On Support Area? | 2021Medium Trading

ANTM still in Sideways Under the Blue Descending Line

Entry at Yellow Area (Support) / MA100 (Yellow)

Entry (2090 – 2210)

Taking Profit at Blue Descending Line / Green Area / Green Line

TP (2810 – 2960)

Stop Loss

Closing At / Under (1990)

Other

- Stoch RSI: Slightly Death Cross

- Stoch RSI: In Overbought Area

- Volume: Small

- Follow the IDX Syariah Rules

Please Like & Comment

DISCLAIMER ON

The content is not intended to invite, buy or sell a particular stock. The decision to invest/trade/transactions are fully in the hands of the reader. Naufal Rafiza as a writer NOT responsible for any loss or profit that occurs from reader decisions. Analysis can be wrong and not in accordance with the real market. Educational Material Only.

Bukan bertujuan untuk mengajak, membeli atau menjual suatu saham tertentu. Keputusan investasi/trading/transaksi suatu saham sepenuhnya ada di masing-masing pembaca. Saya sebagai penulis TIDAK bertanggung jawab atas segala kerugian maupun keuntungan yang terjadi dari keputusan pembaca, siapapun dan apapun. Analisa ini bisa salah dan tidak sesuai realita market. Educational Material Only.

Pullback and Trend Following Strategy with Sideways FilterThis is a strategy of short to medium term trading which combine two famous strats, they are: Pullback (mean reversion) and Trend Following. I recently code this strategy using pine script to see how profitable in long run, so later on I can set alert to the stocks in my watchlist (the pine-script source code is in the end of the post). I only apply in long position because in my country doesn't allow short trading, but feel free if you want to extend short position. As of now the result of back-tests are quite promising which I expected (overall 10-50% profit for 3 year back-test data). Okay let's begin.

Trend following can be catch up with simple golden crosses between fast and medium moving average. This strategy will make the most of your profit source, I guarantee you. In this strategy I apply SMA which set by default 20 and 50 period for fast and medium MA respectively. One of the weakness of trend following is on sideways market. In order to prevent false signal generated in sideways market, I need to filter sideways range out of the trend. I use ADX indicator which can use to identify sideways market, but some methods can also be applied as per this blog post (www.quantnews.com). Basically trend following will allows you to buy high and sell higher, the risk of this strategy is the false signals. Entry signals at golden cross (fast MA cross-over medium MA from down to up) and exit signal when dead cross (fast MA cross-under medium MA from top to down) happens. If you can catch a good strong uptrend you can combine with pyramiding strategy to average up your position. Back-test with pyramiding strategy is so tricky in TradingView, I already try it but end-up with lower profit result. So, I will do pyramiding things manually once I found a good strong uptrend. The important message is YOU CANNOT MISSED STRONG UPTREND, when the alert of trend-following golden cross happens, tighten your seat belt and don't hesitate to put your position high with strict stop loss.

The signal of strong uptrend usually after breakout its resistance with a good amount of volume. In the next update I will try to consider volume as well, as a confirmation of breakout. So the signals would be filtered only for the strong uptrend. Valid signals will give you a good profit margin.

In summary below are the points for trend following part:

Using Simple Moving Average

Medium SMA by default is 50-periods

Fast SMA by default is 20-periods

MA periods shall be chosen based on the stocks chart trend characteristics to maximize profit.

Entry when golden cross signal happens (fast MA cross-over medium MA from down to up)

Exit when dead cross signal happens (fast MA cross-under medium MA from top to down)

Reject false signals by using sideways range filter

Second part is mean-reversion or pullback trade strategy. This is the strategy which allows you to buy low sell high and the risk is when you buy low, the market will keep going lower. The key of mean-reversion is the momentum. Once your momentum guessing is correct you can achieve a very good profit in relatively short time. Here, I will use oscillator based momentum indicator RSI (Relative Strength Index) as a criteria. For entry I use 2-period RSI which not more than 5%. Why 5% ?, that's experimental value which can provide me an enough confirmation of weakness momentum. Then for exit setup I use 5-period RSI which pass 40%. A strong weak momentum in overall will be pushed as high as 40% and 40% RSI can be considered as lower bound of sideways market swing. Last but not least, this pullback trade shall be executed only in above 200-period MA, as a confirmation that overall swing is in uptrend. Thus, if the market going sideways I will use pullback trade and if the market going to form an uptrend, the strategy will sense a golden cross SMA. Inside the chart of this post, you see red and green background color. That is indicate sideways or trend market relatively to ADX index. You can adjust the parameter in order to maximize profit.

To summarize the second part (pullback trade) are:

Use 200-period SMA as a first filter for sideways market.

Got a sideways market confirmation with ADX index.

Entry on below 5% of its 2-period RSI

Exit on above 40% of its 5-period RSI or after 10 days of trade.

In the other part of my script also included the rule to size your entry position. Please find below the full pine-script source code of above explained strategy.

Hopes it will drive your profit well. Let me know your feedback then. Thanks.

// START ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

// This source code is subject to the terms of the Mozilla Public License 2.0 at mozilla.org

// © m4cth0r

//@version=4

// 1. Define strategy settings

commValue = 0.19 * 0.01

strategy(title="PB/TF+SWAY-NOTPYRM", overlay=true,

pyramiding=0, initial_capital=20000000,

commission_type=strategy.commission.percent,

commission_value=commValue, slippage=2, calc_on_every_tick=true)

//----- MA Length

slowMALen = input(200,step=1,minval=5,title="Slow MA Length")

midMALen = input(40,step=1,minval=5,title="Mid MA Length")

fastMALen = input(20,step=1,minval=5,title="Fast MA Length")

//----- DMI Length

DiLen = input(20,minval=1,title="DI Length")

ADXSmoothLen = input(15,minval=1,title="ADX Smoothing", maxval=50)

ADXThreshold = input(21,step=1,title="ADX Sideway Threshold")

//----- RSI2 for Entry, RSI5 for Exit

RSIEntryLen = input(title="PB RSI Length (Entry)", type=input.integer, defval=2)

RSIExitLen = input(title="PB RSI Length (Exit)", type=input.integer, defval=5)

RSIEntryThreshold = input(title="PB RSI Threshold % (Entry)", type=input.integer, defval=5)

RSIExitThreshold = input(title="PB RSI Threshold % (Exit)", type=input.integer, defval=40)

//----- Backtest Window

startMonth = input(title="Start Month Backtest", type=input.integer,defval=1)

startYear = input(title="Start Year Backtest", type=input.integer, defval=2018)

endMonth = input(title="End Month Backtest", type=input.integer, defval = 12)

endYear = input(title="End Year Backtest", type=input.integer, defval=2021)

//----- Position Size

usePosSize = input(title="Use Position Sizing?", type=input.bool, defval=true)

riskPerc = input(title="Risk %", type=input.float, defval=1, step=0.25)

//----- Stop Loss

atrLen = input(title="ATR Length", type=input.integer, defval=20)

stopLossMulti = input(title="Stop Loss Multiple", type=input.float, defval=2)

// 2. Calculate strategy values

//----- RSI based

RSIEntry = rsi(close,RSIEntryLen)

RSIExit = rsi(close,RSIExitLen)

//----- SMA

slowMA = sma(close,slowMALen)

midMA = sma(close,midMALen)

fastMA = sma(close,fastMALen)

//----- ATR

atrValue = atr(atrLen)

//----- Sideways Detection

= dmi(DiLen,ADXSmoothLen)

is_sideways = adx <= ADXThreshold

//----- Position Size

riskEquity = (riskPerc / 100) * strategy.equity

atrCurrency = (atrValue * syminfo.pointvalue)

posSize = usePosSize ? floor(riskEquity / atrCurrency) : 1

//----- Trade Window

tradeWindow = time >= timestamp(startYear,startMonth,1,0,0) and time <= timestamp(endYear,endMonth,1,0,0)

// 3. Determine long trading conditions

//----- Entry

enterPB = (close > slowMA) and (RSIEntry < RSIEntryThreshold) and tradeWindow and is_sideways

enterTF = crossover(fastMA,midMA) and (fastMA > midMA) and tradeWindow and not is_sideways and (strategy.position_size < 1)

//----- Bar Count

opened_order = strategy.position_size != strategy.position_size and strategy.position_size != 0

bars = barssince(opened_order) + 1

//----- Stop Loss (CANCELLED)

// stopLoss = 0.0

// stopLoss := enterTF ? close - (atrValue * stopLossMulti) : stopLoss

//----- Exit

exitPB = RSIExit >= RSIExitThreshold or bars >= 10

exitTF = crossunder(fastMA,midMA)

// 4. Output strategy data

plot(series=slowMA, color=color.purple, title="SMA 200", linewidth=2)

plot(series=midMA, color=color.navy, title="SMA 50", linewidth=2)

plot(series=fastMA, color=color.orange, title="SMA 20", linewidth=2)

bgcolor(is_sideways ? color.green : color.red) // Green is sideways trending market region and red is all others.

// 5. Submit entry orders

if(enterPB)

strategy.entry(id="ENTRY-PB", long=true, qty=posSize, limit = open*0.98)

//labelText1 = tostring(round(RSIEntry * 100)/100)

//RSIlabel1 = label.new(x=bar_index,y=na, text=labelText1, yloc=yloc.belowbar,color=color.green, textcolor=color.white, style=label.style_label_up, size=size.normal)

if(enterTF)

strategy.entry(id="ENTRY-TF",long=true, qty=posSize)

// 6. Submit exit orders

if(exitPB)

strategy.close("ENTRY-PB", when = exitPB, qty_percent = 100, comment = "EXIT-PB")

if(exitTF)

strategy.close("ENTRY-TF", when = exitTF, qty_percent = 100, comment = "EXIT-TF")

strategy.close_all(when=not tradeWindow)

// END ----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

ANTM for BakariansDisclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts

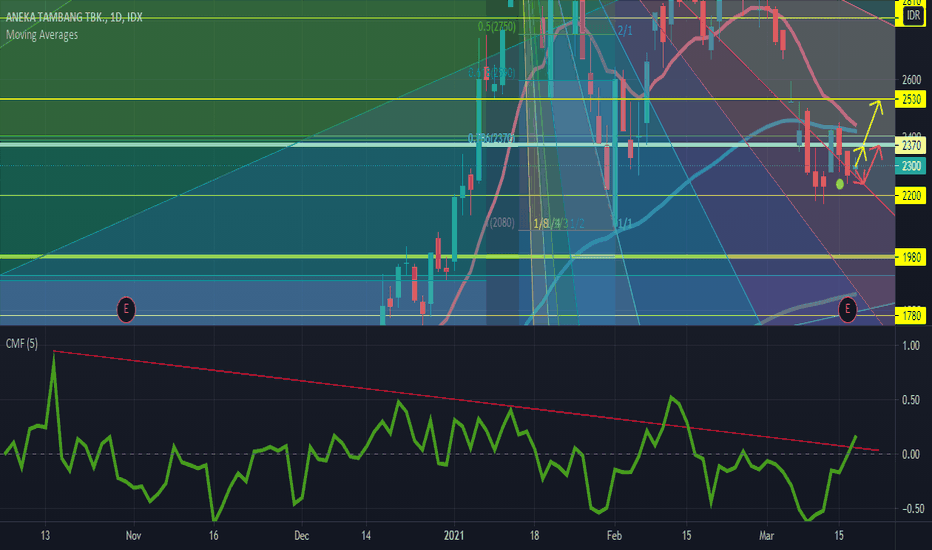

ANTMANTM support at 2200, resistance at 2370, if breakout the next resistance will be 2530.

CMF 5 confirmed breakout.

Disclaimer:

This information is for educational purposes and is not an investment recommendation nor to be representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

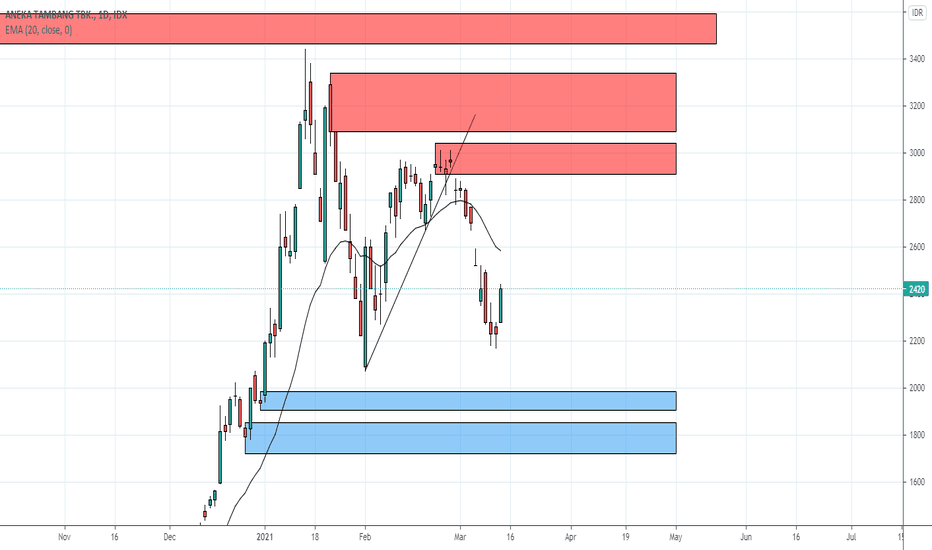

Supply & Demand Ideas, ANTM 1DThis post has 2 language version, English and Indonesian, so everyone and Indonesian people can understand it.

ID :

Setelah melakukan analisa pada timeframe 1 bulan & 1 minggu, diketahui bahwa tren pada saham ANTM adalah konsolidasi cenderung turun, hal yang serupa juga terjadi pada timeframe 1 hari, dimana telah terjadi upside momentum trendline break yang menandakan tren menaik telah selesai dan berganti ke tren turun, probabilitas tertinggi adalah harga saham ANTM lanjut turun, namun harga saham ANTM harus terlebih dahulu melakukan retest pada Supply Zone atau area jual yang berada pada rentang harga 3040-2910 per lembar saham untuk lanjut turun.

EN :

After analyzing the monthly & weekly timeframe, we know that the trend in ANTM stock is a downward consolidation, the same thing also happened on the daily timeframe, where there was an upside momentum trendline break which indicates the uptrend has ended and changed to a downtrend. The highest probability is that ANTM stock price will continue to fall, but ANTM share price must first retest the Supply Zone or selling area which is in the price range of 3040-2910 per share to continue to decline in price.

*Opinions expressed here are not intended to be a forecast of future events, a guarantee of future results or investment advice, and are subject to change based on market and other conditions.

Supply & Demand Ideas, ANTM 1WThis post has 2 language version, English and Indonesian, so everyone and Indonesian people can understand it.

ID :

Pada timeframe 1 minggu, harga saham ANTM mengalami penurunan harga sebesar 45.15% dari harga tertinggi pada tanggal 11 januari 2021 setelah melakukan retest pada Supply Zone atau area jual yang berada pada rentang harga 3590-3440 per lembar saham, namun harga saham ANTM pada timeframe 1 minggu saat ini sedang tertahan pada 20 EMA atau dynamic support, jika melakukan analisa menggunakan metode Supply & Demand, tren ANTM pada timeframe 1 minggu adalah konsolidasi atau sideways.

EN :

On the weekly timeframe, ANTM share price has fall 45.15% from the highest price on January 11, 2021 after retesting the Supply Zone or selling price in the price range of 3590-3440 per share, but currently ANTM share price on the weekly timeframe is being held by the 20 EMA or dynamic support. If we do analyzing using the Supply & Demand method, the trend on ANTM weekly timeframe is in consolidation or sideways.

*Opinions expressed here are not intended to be a forecast of future events, a guarantee of future results or investment advice, and are subject to change based on market and other conditions.

-13 march 2021 trading analysis ANTM-13 march 2021

trading analysis ANTM

Disclaimer:

This information is for educational purposes and is not an investment recommendation or representative of professional expertise. This analysis used herein is for illustration purposes only. This personal opinion should not be considered specific investment advice. I am not responsible for any trades, and individuals are solely responsible for any live trades placed in their own personal accounts.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

long possition because rebound from minor support 2200 and already break from strong support 2300, ANTM will go to next strong resist 2810

when you open position at ANTM you must be close all possition on 26xx

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

good luck, and happy profit

see you for next update

#keep learning bakkarianz metode