ERAA: Cup and Handle Pattern with Momentum to BullishSince 2021 and back to that year, ERAA's stock price has fallen from 720 to 320 (Feb-25), however on May-25, ERAA managed to break the channel trend and continues trading above the channel trend (440).

ERAA is now trading at 0.382 (478) and 0.5 (525) fibo, capturing cup and handle form. As traders, we should wait and observe if the price is still trading in the area between (478-525). Any advance over the 525 level indicates that bullish momentum remains in place. Otherwise, we should wait and see if the price retests fibo 0.382 (478) or not.

Disclaimer: The information is not an investment advice and does not constitute any offer or solicitation to subscribe or redeem. Users are advised to peruse the articles and other data in the website only as information and to rely on their own judgment when making investment decisions.

ERAA trade ideas

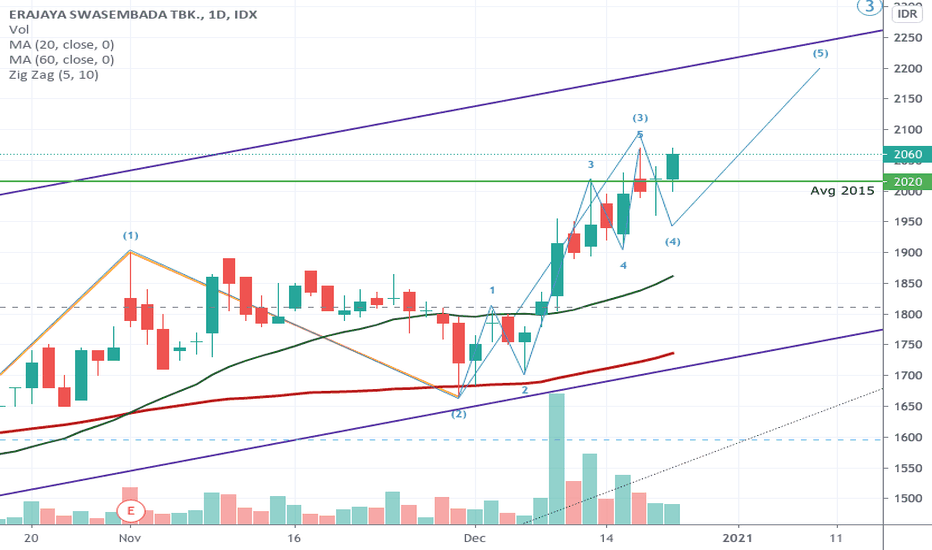

IDX:ERAA Three Drive Pattern and Double BottomENGLISH:

By paying attention to the consistency of the IDX:ERAA market movement, it can be predicted by using a descending parallel channel and three repeating patterns, the ERAA market will bounce to 525-540. If there is a daily market opening above 540 then there is a high probability that IDX:ERAA will break free from the bearish trap and return to bullish.

However, by looking at the current conditions there is still no certainty, the main bearish target is the formation of a double bottom between 410-382

BAHASA:

Dengan memperhatikan konsistensi pergerakan pasar IDX:ERAA dapat diprediksi dengan menggunakan paralel channel menurun dan tiga pola mengulang, Pasar ERAA akan mantul ke 525-540. Jika ada pembukaan pasar harian diatas 540 maka besar kemungkinan IDX:ERAA akan terlepas dari jerat bearish dan kembali bulish.

Namun dengan melihat kondisi saat ini masih belum ada kepastian, maka target bearish utama adalah terbentuknya double bottom antara 410-382

IDX : ERAA BREAKING THE HEAD N SHOULDER PATTERN !!ERAA weekly chart show us that there is Head and Shoulder pattern (Reversal Pattern From Bullish To Bearish) and already break the H n S neckline.

Thats mean ERAA will going to the target area HnS at price 380-390 in the long game (Weekly).

Stochastic indicator in weekly already Oversold, so there is a chance price will have a short Rebound to the Neckline Area.

Disclaimer ON.