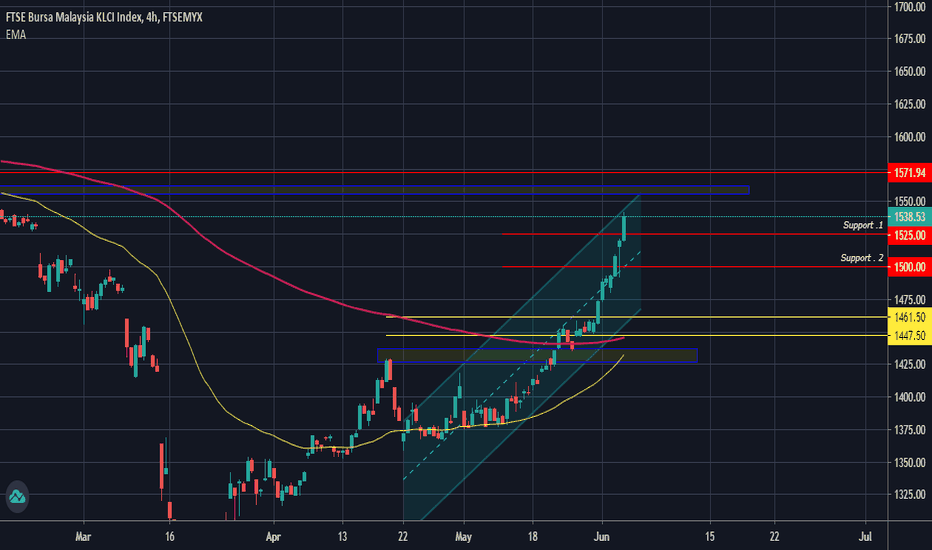

The "marubozu" Candlestick is roaring..Overall momentum remains strong, underpinned by “marubozu” candlestick pattern. Expected the index will test the psychological resistance in the near term.

Due to Malaysia Government is struggling to fight back the economy, in Q3 is seen a little bit of hope to recover back for a short period.

KLSE trade ideas

FTSE Bursa Malaysia Index - uptrend under wayThe Malaysian index has finished a corrective 3-wave intermediate pattern that retraced around 50% and reached the fourth wave level of two lower degrees, which is a typical end of corrections. It is now finishing to trace intermediate wave 1 or A. We could see a smaller correction up to 1,430 before the uptrend continues. FOLLOW SKYLINEPRO TO GET UPDATES.

Have your cake and eat it !Can we possibly have the cake and eat it at the same time ? I mean is there such thing as best of both world ?

If you understand the intermarket relationship between forex, stocks, commodities, etc , then there are pockets of opportunities available.

For example, those who stay in Singapore (SG) will know that SGDMYR is historically on a bullish trend. Based on the chart, we can exchange for 3.06 Ringgit (MYR) with 1 Sing dollar (SGD).

Like the recent stock meltdown of more than 30% globally, Malaysia stock market has presented those who use SGD an unparalleled advantage. Technically speaking , due to the exchange rate, we are using lesser SGD to buy MYR. So, as the stock price falls, we can buy more lots than before.

And if the KLSE index rose say 10%, you are getting more Ringgit back in your account.

That probably explains why many Singaporeans love to go to Malaysia to do shopping on the weekends, some even invest in the properties there as well.

Now, you can have your cake and eat it at the same time. Go enjoy !

Light at the end of the tunnelCan two person who both buy and sell at same time be right about the market ?

The answer is a resounding yes !

Why, you may asked? That is because the one who sells is doing it for short term correction while the one who is buying is doing so for long term investing.

Therefore, the 3-5% correction will not affect the buyers as his view is long term. In fact, he may average in as it is considered as a discount to him.

Read this news here

The extra precaution undertaken by the Malaysia government is a prudent one as it wants to ensure the Covid-19 cases continue to fall and the resurgence of a relapse is reduced to the lowest. This also spells positivity to the local SMEs who are slowly restarting their business operation.

KLCI index: Has The Rally starting from 17 Mac came to a pulse? 1. on weekly chart we a piercing patter W:P form right at the 50% fibs level

2. on daily, market seems to move sideways for the past 16 days.

3. we also see price making lower high for the past 16 days,

4. Maybe we could see KLCI to make a correction to 38% before continue with the bull run?

The world economy is in Depression.Hi Malaysian traders,

The world economy is really in bad shape today, the market is almost die. Nyawa2 ikan.. But the government is trying hard to re-boost the nations economy.

But, the world is really sick today. Maybe the market goes up or going down.

For Malaysian economy, it's depend on how the big-big company to help re-boost the market.. and how much is the cash flow in the market.

Be safe..

-End-

Really in bad shape.The Malaysia market is really in bad shapes....

More down turn to expected in few months ahead....

I felt this is the biggest economy depression will Malaysian had..

I feel very sad to see this chart, semoga kita semua rakyat Malaysia semakin tabah dan cekal...

Buatlah perancangan kewangan dengan teratur..

Longest Bear market in history for FBMKLCI is about to be made.Bearish market until 2024?

the trader is having no trouble making money in the bearish market but an investor who aims for long term investment is having trouble with this.

EPF, Tabung Haji and ASB earning will be lower each year in this coming few years.

I wish I could be wrong about this as our Rakyat will suffer more than ever but they don't know why.

Everyday is a struggle.

Let me know in the comment section below if you have any questions, the entry will be taken only if all rules of the strategies will be satisfied.

I suggest you keep this pair on your watchlist and see if the rules of your strategy are satisfied.

Buy at your own risk.

Ke mana arah tuju KLCI?INDEX KLCI UPDATE 1 MAY 2020

KLCI telah rebound dari point area 1212 sejak Perintah Kawalan Pergerakan di laksanakan. Persoalannya kemanakah arah tuju KLCI?

Pendapat peribadi saya, KLCI telah melepasi phsycolgy point 1400 dan telah menutupi gap yag di lakukan sebelum ini. Apa yang bakal berlaku pada bulan May? saya menjangkakan index bakal melakukan sedikit lagi kenaikan sehingga paras 1470 - 1505, sekiranya paras 1500 berjaya di kekalkan berkemungkinan index akan terus melakukan kenaikan. Walaubagaimanapun, saya melihat index akan mula Uturn melakukan kejatuhan pada range 1470 - 1505 menghala ke area point 800+.

*Perhatian!!!

Kajian yang di tunjukkan adalah pendapat peribadi sahaja, tidak ada kena mengena dengan arahan jual mahupun beli sesuatu saham. Segala perubahan boleh berlaku mengikut situasi semasa market.

#KLCI

#IbrahimZohari

#IndependentTraders