INJ/USD Bullish Heist: Crack the Vault & Grab the Loot!Ultimate INJ/USD Heist Plan: Snag Profits with the Thief Trading Strategy! 🚀💰

🌍 Greetings, Wealth Raiders! Ciao, Hello, Bonjour, Hola! 🌟

Fellow profit hunters, get ready to crack the INJ/USD "Injective vs U.S Dollar" Forex vault with our slick Thief Trading Strategy! 🤑💸 This plan blends razor-sharp technicals and fundamentals to loot the market. Follow the chart’s long-entry blueprint to strike at high-risk zones like the Yellow Moving Average Zone. It’s a wild ride—overbought conditions, consolidation, and potential trend reversals mean bears are lurking! 🐻 Stay sharp, grab your profits, and treat yourself—you’ve earned it! 🎉💪.

📈 Entry: Storm the Vault!

"The heist is on! Wait for the breakout (14.700) then make your move - Bullish profits await!"

The market’s ripe for a bullish grab! 💥 Place buy limit orders within the most recent 15 or 30-minute swing low/high levels. Set alerts on your chart to stay locked in. 🔔

🛑 Stop Loss: Guard Your Loot!

Set your Thief SL at the nearest swing low or candle wick. on the 8H timeframe for day/swing trades. Adjust based on your risk tolerance, lot size, and number of orders. Safety first! 🔒

🎯 Targets: Claim Your Prize!

🏴☠️ Short-Term Target: 15.700

👀 Scalpers, Listen Up!

Stick to long-side scalps. Got deep pockets? Jump in now! Otherwise, join swing traders for the heist. Use trailing stop-loss to lock in gains and protect your stash. 💰

🐂 Why INJ/USD is Hot!

The "Injective vs U.S Dollar" bullish surge is fueled by key fundamentals. Dive into Macro, COT Reports, On Chain Analysis, Sentiment outlook, Intermarket trends, and future targets via the linkss below for the full scoop. 👉🔗. Stay informed to stay ahead! 📰

⚠️ Trading Alert: News & Position Management

News releases can shake the market like a heist gone wrong! 🗞️ To protect your profits:

🚫 Avoid new trades during news events.

🛡️ Use trailing stops to secure running positions.

💥 Boost the Heist!

Hit the Boost Button to supercharge our Thief Trading Strategy! 💪 Every click strengthens our crew, making it easier to swipe profits daily. Join the squad, trade smart, and let’s make money rain! 🌧️💵

INJUSD trade ideas

Injective with a Clean 7R Setup — High Risk-Reward PotentialIt looks like Injective has found its daily higher low — time for a potential full send with a 7:1 risk-to-reward setup.

Entry: $12.15

Stop Loss: $11.11

Target: $20

BTC needs to break above 108K to confirm a strong bullish move.

This is for educational purposes only. Never risk more than 1% of your portfolio on a single trade.

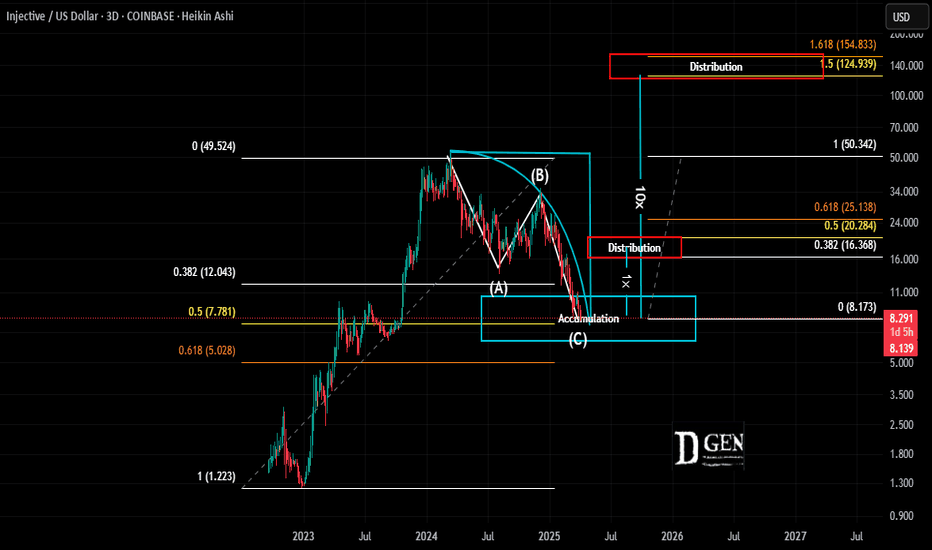

INJ Ready After 50% RetraceINJ is another crypto project that seen massive interest and price rise straight out of the bear market.

Now we see it has completed a very typical retrace pattern and percentage. Since reaching its all time high it has completed a standard ABC retrace of 50% of its low.

Current Trading Plan:

Re-accumulate and look for another major rise in price. Risk at this stage in the cycle is much higher as we are not at a bear market low. We are at a 50% retrace of that low.

Targets will be a 1/3-50% retrace back to the all time high and look for continuation for a much larger second run is the rest of the market show signs of recovery this summer.

INJ/USD "Injective Protocol vs Dollar" Crypto Market Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Thieves, 🤑 💰🐱👤🐱🏍

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the INJ/USD "Injective Protocol vs U.S Dollar" Crypto market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸Book Profits wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place Buy stop orders above the Moving average (or) Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level.

Stop Loss 🛑:

Thief SL placed at the recent / swing low level Using the 4H timeframe (13.000) swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯:

Primary Target - 20.500 (or) Escape Before the Target

Secondary Target - 25.000 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

📰🗞️Fundamental, Macro, COT, Sentimental Outlook:

INJ/USD "Injective Protocol vs Dollar" Crypto Market is currently experiencing a bullish trend,., driven by several key factors.

🟣Fundamental Analysis

1. Project Overview: Injective is a blockchain built for finance, offering high transaction throughput, interoperability, and financial primitives.

2. Tokenomics: INJ is the native asset, used for transaction fees, staking, and governance.

3. Development Activity: Injective has a strong development team, with frequent updates and improvements.

🔴Macro Economics

1. Inflation: Global inflation trends may impact investor sentiment and cryptocurrency prices.

2. Interest Rates: Changes in interest rates can influence cryptocurrency prices, as investors may seek alternative investments.

3. Global Economic Trends: Economic uncertainty and market volatility can drive investors towards cryptocurrencies like INJ.

🟤On-Chain Analysis

1. Network Congestion: INJ's network congestion is relatively low, indicating a healthy network.

2. Transaction Volume: The transaction volume on the INJ network is stable, showing consistent activity.

🔵Market Sentimental Analysis

1. Investor Sentiment: Currently leaning towards a bullish outlook, driven by increasing adoption and positive market trends.

2. Market Positioning: Investors are optimistic about INJ's potential, with some expecting a breakout above $18.

3. Next Trend Move: Potential for an upward movement, with some analysts expecting a retest of the $18 zone before the next leg up.

🟢Positioning

1. Long Positions: 58.2%

2. Short Positions: 41.8%

🟠Overall Summary Outlook

Considering the current price of 16.500, INJ/USD is expected to maintain its upward momentum, driven by increasing adoption and positive market trends. However, investors should be cautious of potential price volatility and market fluctuations.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan will enable us to effortlessly make and steal money 💰💵 Tell your friends, Colleagues and family to follow, like, and share. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

INJECTIVE Stock Chart Fibonacci Analysis 021525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 15.3/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

DEVIATON INJIt looks like we have a deviation below the demand zone and the $13.8 support, which could present a buying opportunity.

I’m waiting to see if the price finds support around $14.4.

If the price drops below $14 and stays there for an extended period, I’ll reassess the trade, as we could see another leg down toward the $8-$11 zone, where stronger support is likely.

For now, the weekly oscillators look decent—Stoch RSI is close to a bullish cross, and RSI has found support at 40.

INJUSD time to buy!!! Not so fastINJUSD Daily says we are going to the $10.66 fib support level

Im currently seeing the $13.77 area as a resistance and another resistance level at 14.77. there is a 30% downside move so i would be patient for an entry or definatly keep a stop loss on the books so you are not exposing yourself to the risks of the downside move.

Months of Accumulation, Distro Time?This, along with several other dinosaur alts were a precursor to this bull market. With Months of consolidation while bitcoin and many other newer alts make new highs.

I think we are heading into the expansion phase pretty soon from here. If we got a pullback from current resistance and formed a handle on the 2 day chart, for a nice cup and handle pattern, you bet your sweet tits a ton of money is gonna flow into this thing.

INJ/USD Pullback Entry Strategy Targeting All-Time HighsWe are preparing to enter INJ/USD on a pullback, with our primary Points of Interest (POI) being a daily imbalance and a 4-hour breaker block for added confluence. Entry will be triggered upon a market structure shift (MSS) on the 15-minute chart to confirm our setup. This approach allows us to align multiple timeframes, aiming to capture the upside momentum as we target a move toward all-time highs.

INJUSD: Highly important 1D MA200 test.Injective is neutral on its 1D technical outlook (RSI = 54.838, MACD = 0.426, ADX = 17.060) as it is trading between the 1D MA200 and 1D MA50. The 1D MA200 is more important right now as it got hit today but the priced immediately pulled back. This is the 4th failed test (so far) it had since April and failure to overcome it, should technically result in a strong rejection. Since however the price is rising after the August 5th bottom, we believe it is time to finally break. Wait until it closes over the 1D MA200 and buy, aiming for the 0.618 Fib (TP = 31.000).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

#INJUSD 1DAYINJUSD (Injective / US Dollar)

Timeframe: Daily (1D)

Pattern: Trendline Breakout

A trendline breakout has occurred on the daily chart of INJUSD, signaling a shift in market momentum. The pair had been following a descending trendline, indicating sustained selling pressure over time. However, the price has now broken above this trendline, suggesting that bearish control is weakening and a bullish reversal may be underway.

Trendline breakouts often indicate a change in trend direction, and in this case, the breakout above resistance points to potential upward movement.

Forecast: Buy

The breakout above the descending trendline signals a buying opportunity. This suggests that the price could continue to rise as bullish momentum gains strength, with the potential for further upward movement in the short to medium term.

Technical Outlook:

Support Level: The previous trendline, which now serves as support, helping to sustain the new bullish momentum.

Resistance Level: Key resistance levels above, which could serve as profit targets or areas to watch for potential price consolidation.

Key Levels to Watch: Traders should monitor price action to ensure the breakout holds, with bullish candlestick formations and volume spikes providing further confirmation.

This pattern often leads to continued upward price movement, but traders should remain aware of broader market conditions that could influence INJ’s performance, such as news related to cryptocurrency regulation or market sentiment.

Keep an eye on the broader cryptocurrency market as well, as shifts in sentiment can quickly affect the performance of altcoins like Injective.

Injective , 180$ inevitable I gave you inj at 8$ all the way up but still I haven’t sold . I need to get the extract or the upcoming bullrun , injective is very promising and well performed. I have faith in 180$ in coming months and will remind you then . I think its safe to accumulate till 15$ and wait for the explosion.

Dyor and stay safe