INRUSD trade ideas

USDINR testing 3 month long supportHi trading view members.

Thanks for interactions on my last post.

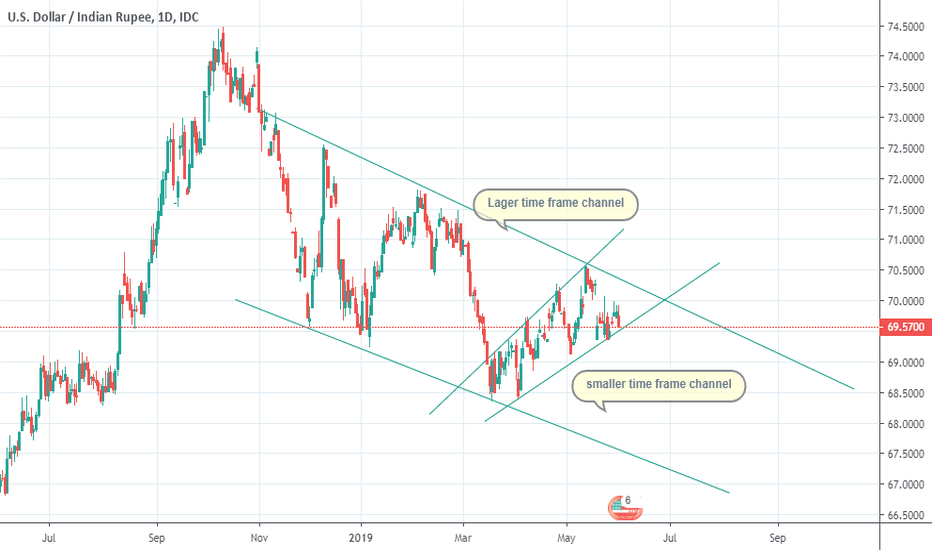

USDINR is testing 3 month long support. Looking at elections and political situation, I predict that #USDINR will oscillate in the 69 to 69.6 range.

Rebound trend expected around early End march to April.

The only level in play is 68.86=> After many requests from our followers in India we are posting an update to the USDINR map.

=> Here from a technical perspective we can see that there is a case to be made for the '5th wave' already being put in place... although we didn't quite reach the target for the minimum flow it came close enough.

=> This means the next big support level below is 68.86 which includes a confluence of major highs in 2013 and 2018. This is the 50% retrace of the final advance wave.

=> Rationally, the fact this level was so important on the way up and took many times to crack ...we know it will be equally important on the way down. A break below will increase confidence that a major top has been put in placed and afterwards there is very little in the ladder till 66.15.

=> Here actively looking to build positions to the downside and tracking 68.86 very closely.

=> Good luck to all those trading this one in live or looking to build positions ... or simply watching from the sideline