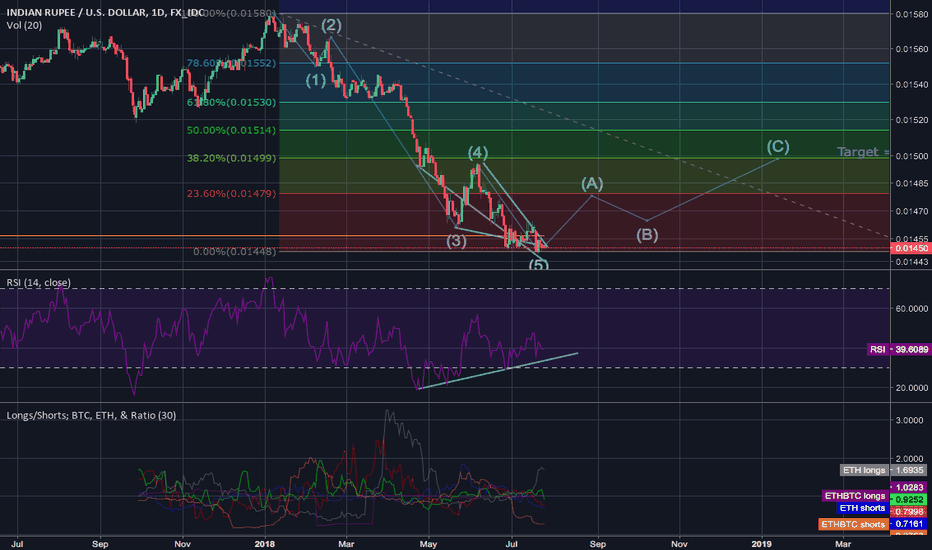

INRUSD trade ideas

USD INR Sell set upLooks like we are very near to complete a 44 year long bullrun in USDINR. Prices have moved up from 7.39 in 1974 to above 74 yesterday. Now is time for correction of this 44 year bullrun.

Retracement levels:

23.6 at 58 - 59

38.2 at 48 - 49

50 at 41 - 42.

USD INR bulls be careful. This is not a recommendation to long or short but a view on the pair.

Further EM pressure and INR will capitulate=> With oil creeping higher again we are maintaining a bearish view on India

=> There is no reason for INR to no longer remain offered as US yields push higher and attract foreign capital and global uncertainties rise.

=> The Indian government deficit has rising for half a year now and we are seeing a widening of corporate spreads with equities selling off.

=> This will be a very interesting one to track as we may see capitulation in other EM markets.

=> GL all

Key reversal for USDINR in play here=> Studies are starting to show we are extremely overbought here in USDINR and a mean reversion play looks imminent...

=> The daily close below 71.38 will confirm this and unlock both the 70.395 and 69.530 before there is anything else to the buy side.

=> Similarly to the USD/RUB and USD/TRY we are starting to see temporary short-term highs across most of the EM spectrum.

=> Good luck

USDINR - Daily - Some breathing space for the bears?Trade Alert

USDINR is now moving away lower from its all-time highs near the 72.90, which was reached today. As we can see from the chart, the pair continues to trade above a few upside lines. For now, the main focus will be on the steepest short-term upside line, taken from the low of the 9th of August. If USDINR reaches that line and bounces off of it, this could get picked by the bulls, who could then drive the pair back up towards the all-time high level, or even higher.

Even if the a break of the aforementioned upside line happened, still the bulls could have a good opportunity to jump in near the medium-term upside trendline, taken from the low of the 10th of April.

Please see the chart for more details.

Don't forget your SL.

USD/INR - Charts show a scary picture going forwardUSD/INR

Monthly Chart

CMP 70.32

A nice VCP pattern breakout observed.

Previous VCP pattern breakout propelled USD by 40%;

If history repeats, USD/INR likely to touch levels close to 98-100 in a similar time frame (around 2 years).

THIS IS NOT A TRADING CALL AS POSITIONS CANNOT BE TAKEN FOR SUCH A LONG PERIOD OF TIME.

VIEW NEGATED AT 60.