AUDJPY Will Go Up From Support! Long!

Please, check our technical outlook for AUDJPY.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 93.383.

Considering the today's price action, probabilities will be high to see a movement to 96.039.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

JPYAUD trade ideas

Trading idea AUDJPY, break at trendlineNOTE: I am not an expert trader by any means, I am open input and sharing my ideas. I am still learning.

-------------------------------

There is a break at the trendline.

I have two ideas.....

#1.. it was a fake out and will continue up to make an extension to 127%. (Near, green arrow head and buy position projection )

Factors:

A) Price still holding above key support

B) RSI oversold

C) News is positive for this pair

News= Increase in Aus. employment data, and trade surplus exceeded expectations = strength

#2 it will retest below trendline and continue down. (Somewhere near, red arrow head and sell position projection )

Factors:

A) Break of trendline

B) Some indicatiors are neutral, so price can do either way

We shall wait and see.

--------

(please know arrow bounces are not exact.... just showing price may bounce before making it to sell or buy targets.)

---------

Open to all advise or comments. Would love input on how I break down the market or make my analysis ...

------

FYI there is not audio my cursor is explaining this text here and the text on screen.

Happy trading.

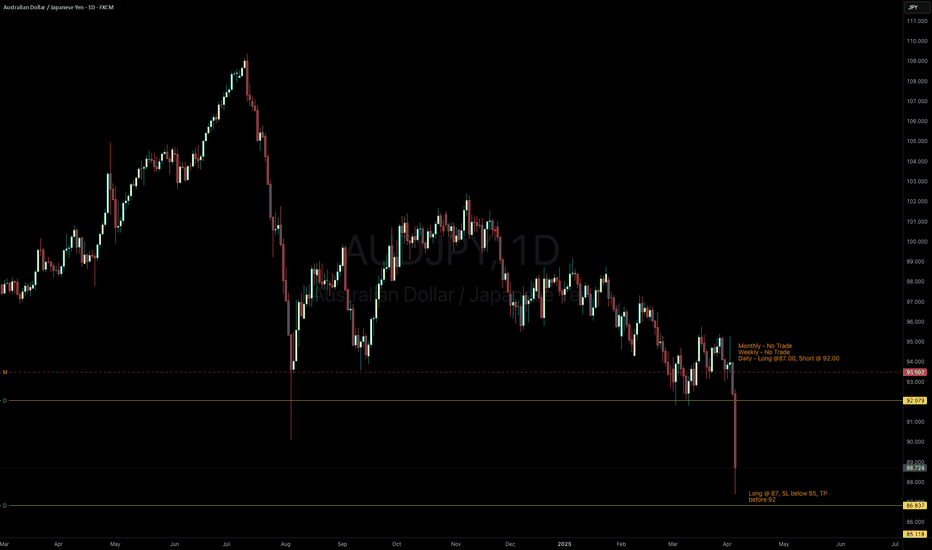

Long AUD/JPY at 87.00 with Target Near 92.00I’m looking to go long AUD/JPY around the 87.00 price area, based on levels on the Daily chart. My stop will be placed below 85.00, with a profit target just before 92.00.

Currently, there are no trade opportunities using the Weekly or Monthly levels, but I’m watching for potential longs around 83.50 and a short opportunity around 93.50.

AUDJPY SHORT FORECAST Q2 W20 D15 Y25AUDJPY SHORT FORECAST Q2 W20 D15 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUD/JPY Struggles to Test March HighAUD/JPY snaps the series of higher highs and lows carried over from last week after struggling to test the March high (95.75).

In turn, AUD/JPY may continue to give back the advance from the start of the week, with a move/close below the 92.80 (50% Fibonacci extension) to 93.30 (23.6% Fibonacci extension) zone bringing the monthly low (91.42) on the radar.

Failure to defend the 91.50 (61.8% Fibonacci retracement) to 91.70 (38.2% Fibonacci extension) region opens up 90.50 (61.8% Fibonacci extension), but a breach above the March high (95.75) may push AUD/JPY back toward the February high (97.34).

--- Written by David Song, Senior Strategist at FOREX.com

AUDJPY Wave Analysis – 14 May 2025

- AUDJPY reversed from resistance area

- Likely to fall to support level 93.20

AUDJPY currency pair recently reversed from the resistance area between the key resistance level 95.30 (former monthly high from March), upper daily Bollinger Band and the 61.8% Fibonacci correction of the downward impulse wave (C) from November.

The downward reversal from this resistance area stopped the earlier short-term impulse wave 3 from the start of May.

Given the overbought daily Stochastic and strongly bullish yen sentiment, AUDJPY currency pair can be expected to fall to the next support level 93.20.

AUD-JPY Risky Short! Sell!

Hello,Traders!

AUD-JPY grew up fast

But then hit a horizontal

Resistance level of 95.750

From where we are already

Seeing a nice pullback

And we will be expecting

A further local move down

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

AUDJPY SHORT FORECAST Q2 W20 D14 Y25AUDJPY SHORT FORECAST Q2 W20 D14 Y25

Professional Risk Managers👋

Welcome back to another FRGNT chart update📈

Diving into some Forex setups using predominantly higher time frame order blocks alongside confirmation breaks of structure.

Let’s see what price action is telling us today!

💡Here are some trade confluences📝

✅Weekly order block rejection

✅Daily order block rejection

✅15' order block targets

✅Gap to be filled

🔑 Remember, to participate in trading comes always with a degree of risk, therefore as professional risk managers it remains vital that we stick to our risk management plan as well as our trading strategies.

📈The rest, we leave to the balance of probabilities.

💡Fail to plan. Plan to fail.

🏆It has always been that simple.

❤️Good luck with your trading journey, I shall see you at the very top.

🎯Trade consistent, FRGNT X

AUDJPY is BearishPrice was in an uptrend, however now it seems that bulls are exhausted and bears are trying to assume control of the price action. A double top reversal pattern with bearish divergence is printed, and if previous higher low is broken then we can expect a bearish reversal as per Dow theory. Targets are mentioned on the chart.

AUDJPY – Short Trade ActiveAUDJPY – Short Trade Active

🔻 In a Sell | 🎯 Target: 94.32657 | ⏳ Intraday Outlook

Aiming for the level marked below, and keeping an eye on price behavior for confirmation along the way.

Should hit within 24 hours.

This is not financial advice. Just sharing what I’m doing.

💡 All trades can be replayed on TradingView for transparency.

#AUDJPY #ForexTrading #IntradaySetup #PriceAction #GlobalHorns #TradingView

AUDJPY – Bearish Drift Toward Double Target ZoneAUDJPY – Bearish Drift Toward Double Target Zone

🔻 Short Bias | 🎯 Targets: 91.85410 → 91.36166 | ⏳ Deadline: June

Price action looks heavy, and I’m aiming for both targets shown on the chart. I’ll be entering this trade as soon as the market opens.

If you’re joining me, just be prepared to hold for up to a week—this one may take time to develop.

This is not financial advice. I'm simply sharing how I’m positioning myself.

💡 All trades can be replayed on TradingView for review.

#AUDJPY #ShortSetup #ForexTrading #GlobalHorns #TradingView #BearishBias

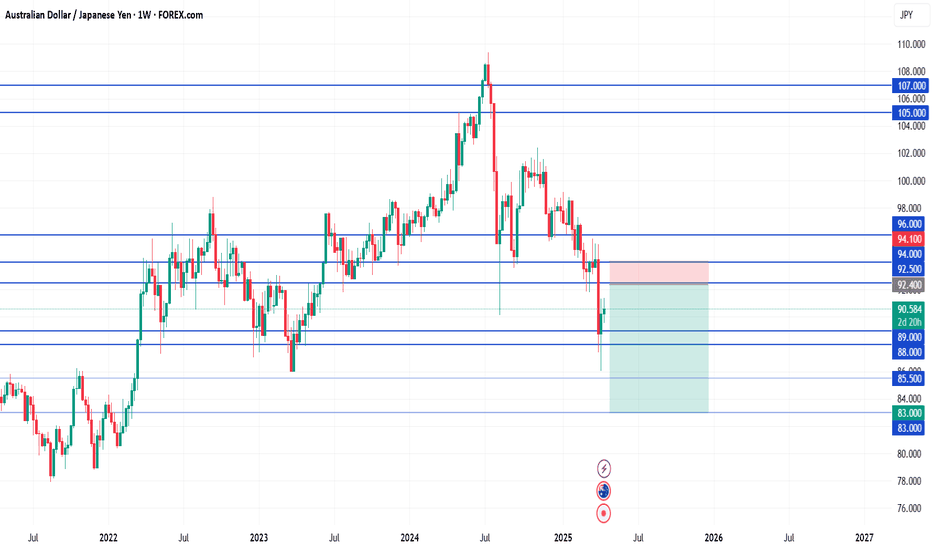

AUDJPY Trade Setup (Bullish Bias)🔥 Setup Summary:

Item Details

Bias: ✅ Bullish

Reasoning:

- Fundamentals strong (expectation no interest rate cuts + CPI bullish)

- JPY weak + overbought COT

- Exogenous: AUD strengthening

- Seasonality bearish short-term BUT medium-term bias bullish

Primary Entry: 🔑 92.30 (Buy Zone)

Dip Buy Zone: 🔄 91.80 – 92.00 (0.5–0.618 Fib retrace)

Stop Loss: 🚫 90.54 (below structure + 0.786 Fib)

Take Profit 1: 🎯 94.15 (below last swing high)

Take Profit 2: 🎯 95.00+ (extended target for trend continuation)

Risk:Reward: ~1:3+ (Entry at 92.3 / TP at 94.15–95.00)

AUDJPY –From Breakdown to Breakout Long Setup After Failed ShortFX:AUDJPY

The short idea was invalidated after price broke above the key resistance zone and hit our stop.

Now, we’re watching for a pullback to the broken zone for a potential long setup, supported by bullish momentum.

Keep it clean. Wait for confirmation.

Stay sharp, stay disciplined.

Smart Forex Analysis | Weekly Setups

Clean charts. No noise. Just levels.