CAD/JPY SHORT FROM RESISTANCE

Hello, Friends!

CAD/JPY pair is in the downtrend because previous week’s candle is red, while the price is clearly rising on the 2H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 102.749 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

JPYCAD trade ideas

CADJPY is in the Selling TrendHello Traders

In This Chart CADJPY HOURLY Forex Forecast By FOREX PLANET

today CADJPY analysis 👆

🟢This Chart includes_ (CADJPY market update)

🟢What is The Next Opportunity on CADJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

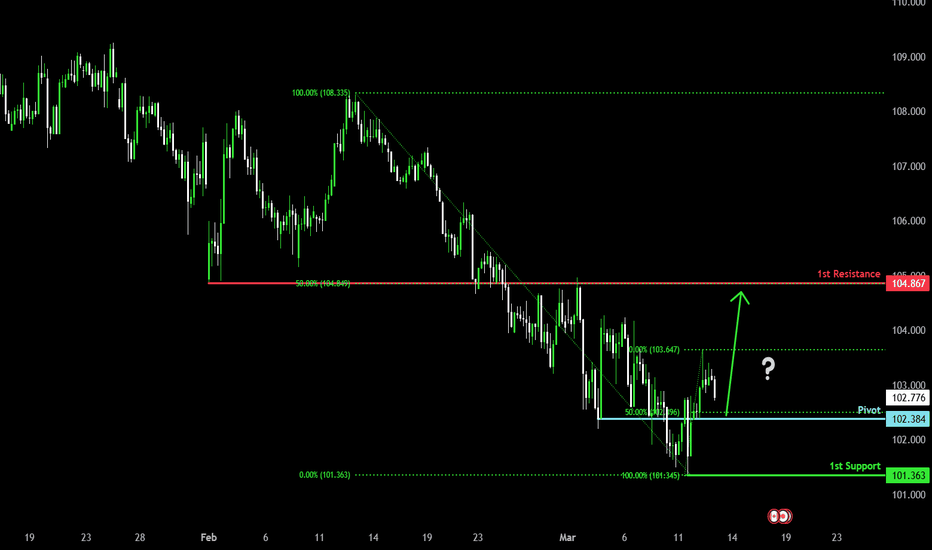

Could the price bounce from here?CAD/JPY is falling towards the pivot and could bounce to the overlap resistance.

Pivot: 102.38

1st Support: 101.36

1st Resistance: 104.86

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Potential bullish rise?CAD/JPY is reacting off the pivot and could rise to the 1st resistance which line sup with the 50% Fibonacci retracement.

Pivot: 102.38

1st Support: 101.36

1st Resistance: 104.74

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

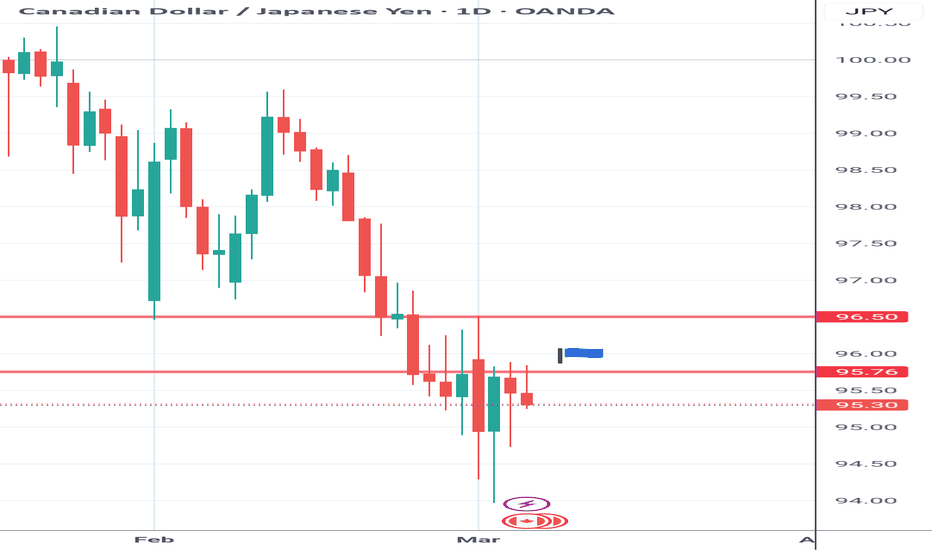

CADJPY Wave Analysis – 11 March 2025

- CADJPY reversed from the support area

- Likely to rise to the resistance level 104.00

CADJPY currency pair recently reversed up from the support area between the major long-term support level 101.60 (former multi-month support from August) and the lower daily Bollinger Band.

The upward reversal from this support area will likely form the daily Japanese candlesticks reversal pattern Bullish Engulfing.

Given the strength of the support level 101.60, CADJPY currency pair can be expected to rise to the next resistance level 104.00 (former top of wave ii).

CADJPY: Bearish Continuation is Expected! Here is Why:

The price of CADJPY will most likely collapse soon enough, due to the supply beginning to exceed demand which we can see by looking at the chart of the pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADJPY-BUY strategy Daily chartThe pair has been moving down aggressively, and even though its very oversold, it managed to move even lower than expectation. My view is unchanged, and the objective is somewhere 105.78 area or higher, hence the reward ratio is very attractive.

Strategy BUY current or add @ 101.50-101.75 and take profit near 105.57 for now.

CADJPY-BUY strategy 12 hourly chart I had placed a KAGI chart some days back, and that showed quite an oversold status. The regression analysis, as well shows we are in an oversold state, but not very extreme, but reasonable enough, and we are trading at the lower end of the channel.

Strategy unchanged view, and BUY current or add to LONG positions @ 102.00-102.35 and take profit @ 105.17 for now.

CADJPY - Take Advantage of This Clean Correction!CADJPY Daily Timeframe

CADJPY has shown a clear impulse in July 2024. We are now in a massive correction, consisting of 3 major waves, ABC. It appears we have almost completed Wave B and now we are anticipating wave C.

We expect wave C to push up to the corrective highs where we have the 61.8 fib.

Here are some key things to watch:

- Wave Structure: Ensure that Wave B has completed its corrective pattern

- Wave C Confirmation: Look for a strong bullish impulse off the lows of Wave B.

- Volume & Momentum: A rise in volume and bullish divergence in RSI/MACD could confirm Wave C is underway.

Confirmation for Wave C:

Break of Structure (BOS) / Trendline Break

When identifying confirmation for Wave C, a Break of Structure (BOS) or a Trendline Break is one of the strongest signals that the corrective phase is ending.

Break of Structure (BOS) – Key Levels to Watch

Wave B typically forms lower highs and lower lows. A break above the last lower high signals a bullish shift.

Look for a decisive close above the previous swing high on the 4H or daily timeframe. A weak break (with wicks) may indicate hesitation.

A higher low after the break adds extra confirmation.

Trendline Break – Reversal Signal

If Wave B formed a descending trendline, watch for a clean breakout with strong bullish candles (not just wicks).

Retest of the trendline as support after the breakout strengthens the case for Wave C starting.

Trade Idea:

- Watch for Wave C to start using the techniques listed above

- Once entered, keep stops below wave B

- Targets: 107 (500pips), 112 (1000pips)

Goodluck and as always trade safe!

See below for our previous swing setups:

Swing Setup 1

Swing Setup 2

Swing Setup 3

CAD/JPY Analysis – Key Levels & Market Drivers📉 Bearish Context & Key Resistance Levels:

Major Resistance at 108.32

Price previously rejected from this strong supply zone.

Moving averages (yellow & red lines) are acting as dynamic resistance.

Short-term Resistance at 106.00-107.00

Failed bullish attempt, leading to a strong reversal.

A break above this area is needed to shift momentum bullishly.

📈 Bullish Context & Key Support Levels:

Support at 102.00-101.50 (Demand Zone)

Significant buyer interest in this area.

If the price reaches this zone, a potential bounce could occur.

Deeper Support at 99.00-100.00

If 102.00 fails, the next demand level is in the high 90s, marking a critical long-term support.

📉 Current Market Outlook:

CAD/JPY is in a strong downtrend, consistently making lower highs and lower lows.

The price is testing key support areas, and further movement depends on upcoming economic events.

A potential bounce could occur at 102.00, but failure to hold could trigger further declines toward 99.00.

📰 Fundamental Analysis & Market Drivers

🔹 Bank of Canada (BoC) Interest Rate Decision – March 12, 2025

Expected rate cut from 3.00% to 2.75% → Bearish for CAD.

A dovish stance signals weakness in the Canadian economy, potentially pushing CAD/JPY lower.

If the BoC provides an aggressive rate cut or hints at further easing, the downtrend could continue.

🔹 Japan Current Account (January) – March 7, 2025

Expected at 370B JPY (significantly lower than previous 1077.3B JPY).

A lower-than-expected surplus may weaken JPY, slightly offsetting CAD weakness.

If JPY remains strong despite this data, CAD/JPY could fall further toward 101.50-100.00.

📈 Potential Trading Setups:

🔻 Short Setup (Bearish Bias):

Entry: Below 103.00, confirming further weakness.

Target 1: 102.00

Target 2: 100.00

Stop Loss: Above 104.50 to avoid volatility spikes.

🔼 Long Setup (Bullish Scenario - Retracement Play):

Entry: Strong bullish rejection from 102.00

Target 1: 105.00

Target 2: 108.00

Stop Loss: Below 101.50 to limit downside risk.

📌 Final Thoughts:

The BoC rate decision will likely be bearish for CAD, increasing downward pressure on CAD/JPY.

The Japan Current Account data could provide temporary support for JPY but is unlikely to fully reverse the trend.

102.00-101.50 is a key buying zone, while failure to hold could drive the pair toward 99.00-100.00.

🚨 Key Watch Zones: 102.00 Support & 108.00 Resistance – Strong moves expected!