JPYCHF trade ideas

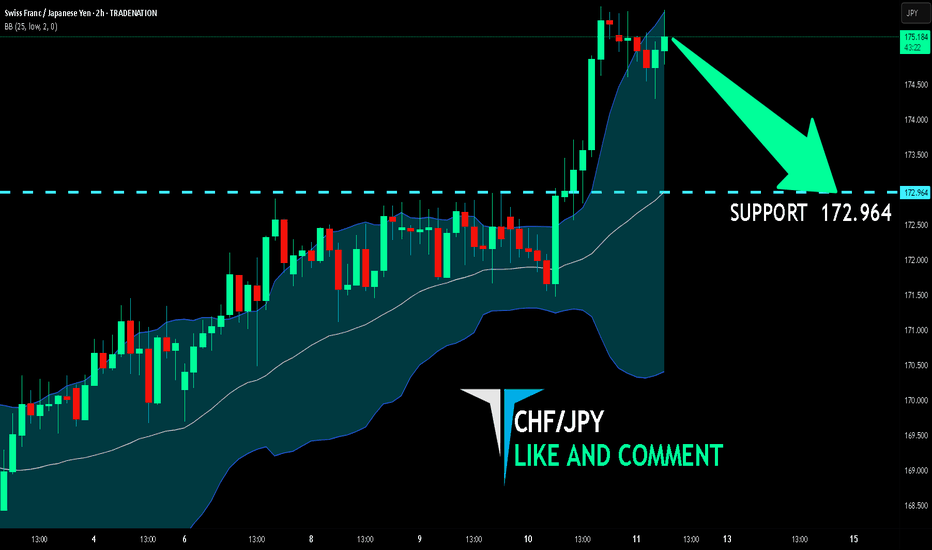

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

CHF/JPY pair is trading in a local uptrend which we know by looking at the previous 1W candle which is green. On the 2H timeframe the pair is going up too. The pair is overbought because the price is close to the upper band of the BB indicator. So we are looking to sell the pair with the upper BB line acting as resistance. The next target is 172.964 area.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

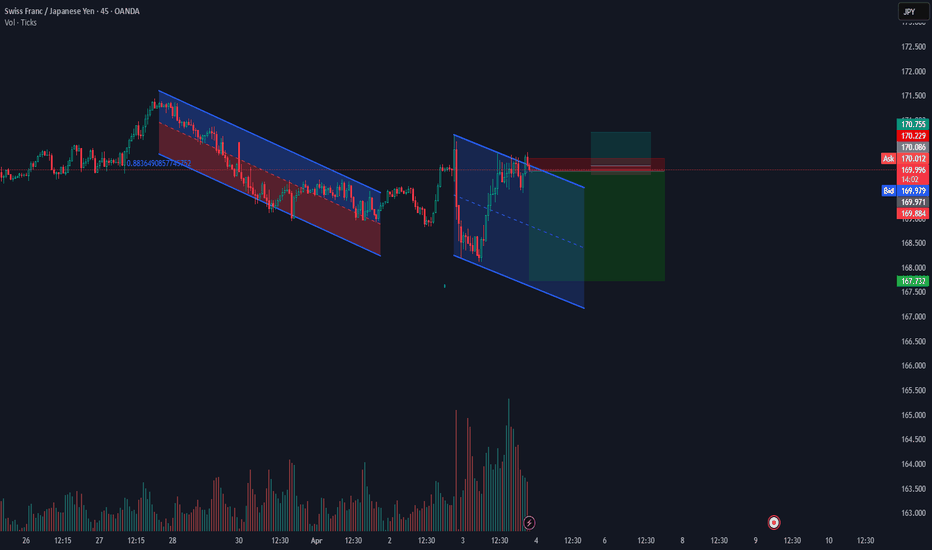

CHFJPY: Intraday Bullish Signal?! 🇨🇭🇯🇵

It looks like CHFJPY has completed a local correctional movement

after a formation of a strong bullish wave.

I see a violation of a resistance line of a falling wedge pattern as a confirmation.

Next goal - 175.72

❤️Please, support my work with like, thank you!❤️

CHFJPY LIVE TRADE EDUCTIONAL BREAKDOWN LONGThe Japanese yen is expected to strengthen by approximately 7% against the US dollar, according to Morgan Stanley.

This prediction comes as a response to potential weakening economic data and the increasing likelihood of a US recession due to recent reciprocal tariff announcements.

Morgan Stanley’s team, which includes Koichi Sugisaki and David Adams, suggests two long yen trades with revised targets.

First, they recommend shorting USD/JPY at 146.40 with a target of 135, down from the previous target of 145, and a stop at 151. The second recommendation is to short CHF/JPY at 171.30 with a target of 160 and a stop at 180.

CHFJPY Under Pressure! SELL!

My dear followers,

This is my opinion on the CHFJPY next move:

The asset is approaching an important pivot point 173.25

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 171.69

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY - Rising Wedge Breakdown Ahead?CHFJPY is currently trading within a rising wedge pattern — a classic bearish setup! 📐

Right now, it's facing strong resistance around the 172.860 level. This could be a great short opportunity if bearish momentum kicks in. 🚨

A confirmed breakdown below the wedge could trigger a sharp drop toward 171.102. 🔻

Two Trade Setups to Consider:

1️⃣ Short from Current Levels

📍 Entry: 172.651

🛑 Stop Loss: 172.946

🎯 Targets: 172.262 ➡️ 171.110

2️⃣ Short on Breakout Confirmation

📍 Entry: 171.801

🛑 Stop Loss: 172.946

🎯 Target: 171.110

⚠️ Always manage risk and wait for confirmation if you’re entering after a breakout.

📊 Let me know what you think in the comments — are you shorting CHFJPY too? 👇

#CHFJPY #ForexAnalysis #PriceAction #RisingWedge #TradingSetup #FXIdeas #TechnicalAnalysis

The battle of the safe-havensThe two currencies are seen as safe-havens, into which people jump in, when the times go rough.

Let's have a look.

FX_IDC:CHFJPY

MARKETSCOM:CHFJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

CHFJPY: Short Trade with Entry/SL/TP

CHFJPY

- Classic bearish formation

- Our team expects fall

SUGGESTED TRADE:

Swing Trade

Sell CHFJPY

Entry Level - 172.08

Sl - 172.94

Tp - 170.44

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CHFJPY The Target Is DOWN! SELL!

My dear subscribers,

CHFJPY looks like it will make a good move, and here are the details:

The market is trading on 170.81 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 169.89

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHF_JPY BULLISH BIAS|LONG|

✅CHF_JPY made a bullish

Breakout of the key horizontal

Level of 171.500 and then made

A retest and a rebound so we are

Bullish biased and we will be

Expecting a further bullish move up

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

CHFJPY Set To Grow! BUY!

My dear followers,

This is my opinion on the CHFJPY next move:

The asset is approaching an important pivot point 169.03

Bias - Bullish

Safe Stop Loss - 168.45

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 170.00

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY Will Go Down! Short!

Take a look at our analysis for CHFJPY.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 171.221.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 169.475 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

CHF/JPY BEARISH BIAS RIGHT NOW| SHORT

Hello, Friends!

CHF-JPY uptrend evident from the last 1W green candle makes short trades more risky, but the current set-up targeting 169.279 area still presents a good opportunity for us to sell the pair because the resistance line is nearby and the BB upper band is close which indicates the overbought state of the CHF/JPY pair.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

POTENTIAL SHORT TRADE SET UP FOR CHFJPYAnalysis: Utilizing chart patterns, highs & lows, and impulses & corrections, the focus is on identifying a continuation corrective structure following a breakout.

Entry: The price has reached the upper boundary of a higher time frame (HTF) bearish continuation structure, approaching this zone with an ascending wedge on the mid time frame (MTF). On the lower time frame (LTF), a bearish impulse has developed, and we will be watching for a continuation pattern to pinpoint a potential entry point for the trade.

Expectation: A downward move is anticipated, targeting the lower boundary of the HTF bearish continuation structure.

⚠️ Reminder: Always conduct your own analysis and apply proper risk management, as forex trading involves no guarantees. This is a high-risk activity, and past performance is not indicative of future results. Trade responsibly!