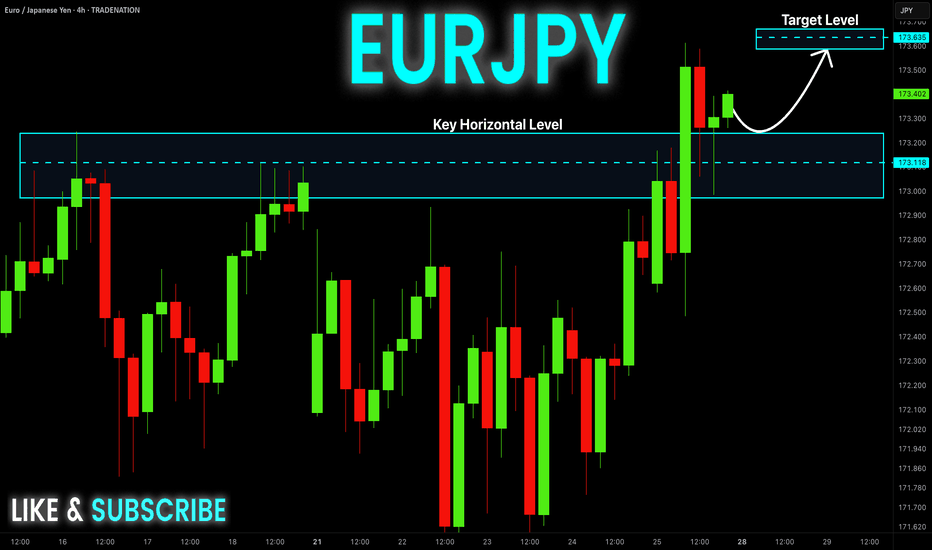

EURJPY Poised to test the top after the BOJ Rate DecisionEURJPY Poised to test the top after the BOJ Rate Decision

EURJPY broke out of a descending type of channel pattern or something similar.

The last two candles confirmed the bullish movement in a clear way and the odds are that EURJPY may rise further during the coming hours.

However this movement is also supported by BOJ Interst Rate decision.

BOJ kept rates unchanged at 0.5% as expected and they didn't change anything at all in their comments.

News - reported by forexlive

The Japanese Yen weakened across the board throughout BoJ Governor Ueda press conference. He sounded like someone who's not in a rush to hike rates at all. The two key lines were "monetary tightening effectively works on demand-driven inflation, but current inflation is largely supply-driven" and "current FX rate not diverging far from our assumptions".

He's basically saying that the current inflation is likely to be a one-off event and we all know how much weight they place on sustained inflation to durably hit their 2% target. And the comment about FX suggests that the depreciation in the JPY does not concern them at all, which gives the market the green light for further depreciation (all else being equal).

You may find more details in the chart!

Thank you and Good Luck!

PS: Please support with a like or comment if you find this analysis useful for your trading day

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

JPYEUR trade ideas

EURJPY: Overextended move to meet daily resistanceThe current market context on EURJPY shows an overextended move that has been pushing higher as price is about to reach a well-established daily resistance. The rally into this resistance lacks healthy retracements, and momentum is likely unsustainable without a deeper correction. The probability of a pause or reversal here under this circumstances increases substantially.

This extension exaggerates this imbalance making it a high probability setup. Volume and price action near this level becomes critical in this case. Signs such as long upper wicks, bearish engulfing patterns will hint that the move may be running out of steam.

I would be targeting a decent pullback towards 170.700.

Just sharing my thoughts for the charts, this isn’t financial advice. Always confirm your setups and manage your risk properly.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

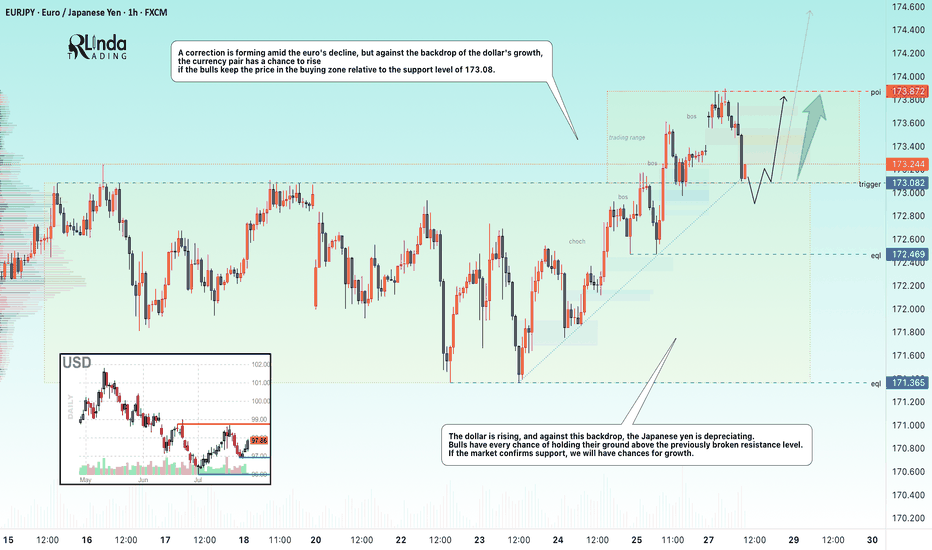

EURJPY → Retest support before growthFX:EURJPY has been correcting since the opening of the European session. The movement was triggered by yesterday's news related to the trade deal between the US and Europe...

EURJPY is reacting to news related to the deal between the US and Europe. A correction is forming amid the fall of the euro, but against the backdrop of the dollar's growth, the currency pair has a chance to rise if the bulls keep the price in the buying zone relative to the support level of 173.08.

The dollar is rising, and against this backdrop, the Japanese yen is falling. Bulls have every chance of holding their ground above the previously broken resistance. If the market confirms support, we will have chances for growth.

Resistance levels: 173.87

Support levels: 173.082, 172.47

The currency pair may form a liquidity trap relative to the previously broken consolidation resistance. A false breakdown of support and price consolidation in the buying zone (above 173.1) could trigger further growth.

Best regards, R. Linda!

EURJPY: Bullish Rebound from Key Demand ZoneEURJPY has bounced off a critical demand zone and is showing signs of a bullish recovery. Despite the recent pullback, the pair’s structure remains fundamentally and technically bullish, driven by JPY weakness and EUR resilience.

Technical Analysis (4H Chart)

Pattern: Price tested a strong demand zone near 170.35–170.50 and rejected it aggressively.

Current Level: 170.77, starting a potential bullish leg toward higher resistance levels.

Key Support Levels:

170.35 – key demand zone and invalidation level for bulls.

169.90 – deeper support if demand zone breaks.

Resistance Levels:

172.17 – first bullish target and interim resistance.

173.64 – major target if bullish continuation sustains.

Projection: A successful rebound from 170.35 could drive price toward 172.17 initially, then 173.64 if momentum holds.

Fundamental Analysis

Bias: Bullish.

Key Fundamentals:

EUR: ECB’s slower path toward easing supports EUR stability relative to JPY.

JPY: Weakness persists as BoJ maintains dovish bias, though FX intervention risk limits JPY downside speed.

Global Sentiment: Mild risk-on mood supports EUR strength against JPY.

Risks:

BoJ verbal intervention or actual FX intervention could trigger temporary JPY strength.

Sharp reversal in global risk sentiment could weaken EUR/JPY.

Key Events:

ECB speeches and data (CPI, growth updates).

BoJ FX comments and broader market risk appetite.

Leader/Lagger Dynamics

EUR/JPY is a leader among JPY pairs, often moving in sync with GBP/JPY and CHF/JPY. Its movement also tends to precede confirmation in risk-sensitive JPY crosses.

Summary: Bias and Watchpoints

EUR/JPY is bullish from the 170.35 demand zone, with a potential move toward 172.17 and 173.64. Key watchpoints include ECB communication, BoJ stance, and market risk sentiment. As long as 170.35 holds, bulls remain in control.

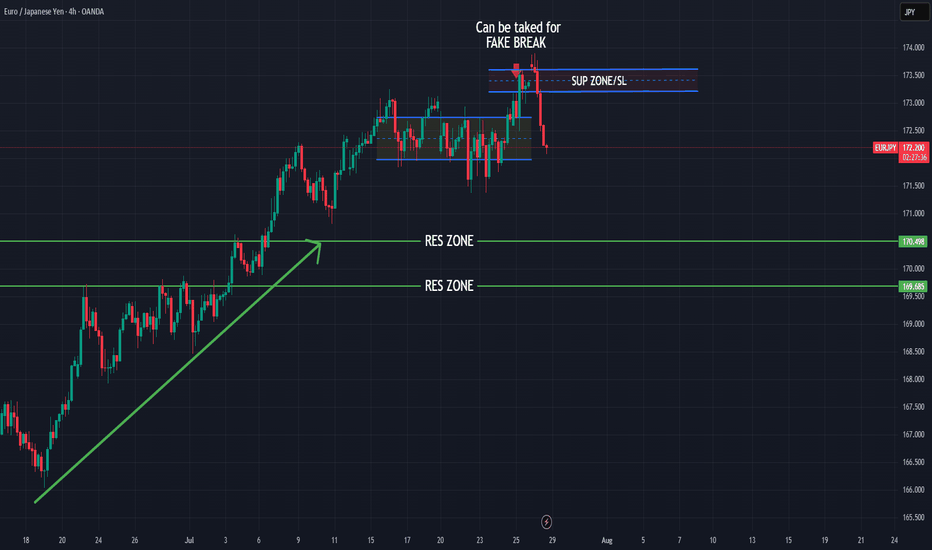

EUR/JPY Bearish Engulf as EUR/USD Sells Off Ahead of the FedA good illustration of FX market structure is on display today. EUR/USD is down sizably after teh announcement of the EU trade deal and this may be a 'buy the rumor, sell the news' kind of event. But, there's also the possibility that this is squaring up ahead of a really big week of drivers with FOMC, Core PCE and NFP all scheduled for later this week. But, there's also the sentiment argument, where a strong bullish move has taken hold of the Euro in the first half of the year as EUR/USD has jumped to fresh three-year highs.

And while USD/JPY is rallying up to the 148.00 level, displaying Yen-weakness, EUR/JPY is down on the daily with a show of JPY-strength. This highlights that the move in EUR/USD is likely driving that sell-off in EUR/JPY as EUR/JPY is currently working on a bearish engulfing candlestick on the daily. And this happens after last week showed overbought RSI on both the daily and weekly charts, with daily RSI diverging from price as EUR/JPY set a fresh yearly high shortly after the open this morning.

This shows that EUR/JPY is very much in-play this week with those US drivers, and there's also the Bank of Japan rate decision to consider. In EUR/JPY, there's possible support tests coming up, around the 170.47 and 170.93 Fibonacci levels, followed by the 170.00 big figure. - js

SELL EURJPY for bullish trend reversal SELL EURJPY for bullish trend reversal

STOP LOSS : 172.80

Trade trade is based on false breakout and divergence.....

First what is false breakout, A false breakout in Forex occurs when the price breaks through a key level (like support or resistance) but quickly reverses and returns to its original range, often trapping traders who were expecting a continuation of the breakout. It's essentially a false signal, indicating a potential trend reversal or continuation, but the price doesn't follow through....

Secondly what is divergence ,In forex trading, divergence occurs when the price of a currency pair moves in one direction, while a technical indicator (like an oscillator) moves in the opposite direction. This mismatch can signal a potential trend reversal or weakening trend. There are two main types: bullish and bearish divergence.

On this trade we are taking it because we saw regular bearish divergence

Regular Bearish Divergence

In case of Regular Bearish Divergence:

* The Indicator shows Lower Highs

* Actual Market Price shows Higher Highs

We can see a strong divergence on the RSI already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this level resistance so we are looking for the trend reversal and correction push from here .....

EURJPY shortsHello everyone

I got a EURJPY short trade coming up soon.

Reason being is that price came back to the monthly supply zone (blue)

Price than made a EQH zone which got taken out and created a CHOCH.

Price is now consolidating and has formed EQL and EQH but i believe price will break EQH first to come back to 4hr supply zone (yellow).

Some news is also coming out as well which could influence price as well

EUR/JPY – 4H Technical and Fundamental AnalysisEUR/JPY – 4H Technical and Fundamental Analysis

EUR/JPY recently pulled back after briefly touching a year-to-date high near 173.25. The pair has since traded within a tight corrective range between 170.00 and 172.30, indicating exhaustion near key resistance zones. Price has now broken below a minor support level—suggesting a potential Change of Character (ChoCh) and the beginning of an accumulation phase. This movement likely triggered liquidity hunts, sweeping stop-losses before dropping lower to re-establish downside momentum.

We are now monitoring for additional liquidity hunts within our identified zones before committing to a bearish continuation setup. The break of structure and recent liquidity grabs are strengthening the case for more downside pressure.

Fundamentals backed the move too:

🚨 Negative sentiment rose after headlines tied to weakening Eurozone economic data—particularly Germany’s recent PMI miss and cautious ECB commentary hinting at slower recovery prospects.

Meanwhile, the Japanese yen remains stable, supported by safe-haven flows amid geopolitical tensions and a broadly weaker Euro outlook.

📍 Sell Setup

Entry: Sell Stop at 170.730

Stop Loss: 171.940

Take Profit: 168.060

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

EURJPYPrice just broke key internal structure with a clear BoS (Break of Structure) after liquidity sweep above the previous highs. We're now watching for a clean retracement to the supply zone to execute a sniper short.

📍 Setup Details:

BoS Confirmed: 172.00 level cleanly broken

Area of Interest: Supply zone 172.90–173.60

Stop: Above liquidity zone ~174.55

Target: Downside continuation toward 168.00–167.00

📉 RSI shows momentum weakness on the pullback

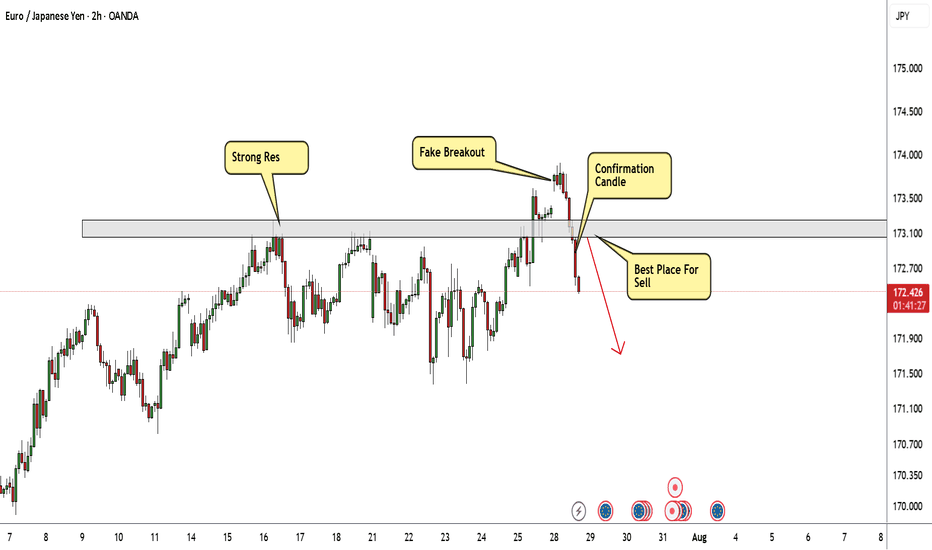

EUR/JPY Again Below My Res , Short Setup Valid To Get 150 Pips !Here is my opinion on EUR/JPY On 2H T.F , We have a fake breakout and Gap and the price back again below my res area and closed with 4H Candle below it , so i have a confirmation and i`m waiting the price to go back to retest this strong res and give me any bearish price action and then we can enter a sell trade and targeting 100 : 150 pips . if we have a daily closure above my res then this analysis will not be valid anymore .

demand zone spottedEUR/JPY – Bullish Rejection from Demand Zone | 4H Smart Money Setup

Pair: EUR/JPY

Timeframe: 4H (4-Hour)

Bias: Bullish

Status: Trade Active

Strategy: Demand Zone Rejection / Smart Money Concepts (SMC)

Market Context

EUR/JPY has been in a broader uptrend with higher highs and higher lows throughout July. Recently, the market retraced and tapped into a clearly defined demand zone, showing bullish rejection—a potential opportunity for long entries.

Key Technical Highlights

• Demand Zone marked around 170.65 – 171.30

o Formed by previous accumulation before the last strong impulsive bullish leg.

o This zone acts as institutional support, where large buy orders may reside.

o Price wicked into the zone and printed a bullish candle, suggesting buyer interest.

• Risk-Reward Structure

o Entry: ~171.33 (current price action after bounce)

o Stop Loss: Below demand zone (~170.66)

o Take Profit: 173.38 (previous high / clean traffic zone)

• The position is marked on chart with a clear long setup:

o Green zone = Target

o Red zone = Risk

o Trade offers a favorable Risk:Reward > 2:1

Scenarios

Bullish Continuation

• Price continues upward respecting demand zone.

• Confirmation from bullish price action or break of lower highs (structure shift).

• Clean targets above at 173.00 – 173.40.

•

Bearish Invalidity

• Price closes below 170.65 on a 4H candle.

• Break of demand invalidates the setup.

• Next potential support lies lower near 169.80.

Trade Plan Summary

Component Value

Entry 171.33

Stop Loss 170.66

Take Profit 173.38

R:R Ratio ~2.5:1

Status Active, Waiting for Follow-through

Conclusion

EUR/JPY is showing a clean rejection from a strong 4H demand zone after a healthy pullback. Structure still supports a bullish continuation, and the trade is positioned with tight risk and strong upside potential. Monitoring for confirmation via momentum and market structure.

EUR-JPY Local Long! Buy!

Hello,Traders!

EUR-JPY is trading in an

Uptrend and the pair made

A breakout, a retest and

A bullish rebound from the

Horizontal support of 173.200

So we are bullish biased and

We will be expecting a

Further bullish move up

On Monday!

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURJPY Wave Analysis – 30 July 2025

- EURJPY reversed from the resistance zone

- Likely fall to support level 169.60

EURJPY currency pair recently reversed down from the resistance zone between the resistance level 174.00, the upper daily Bollinger Band and the resistance trendline of the daily up channel from February.

The downward reversal from this resistance zone created the daily Japanese candlesticks reversal pattern, Bearish Engulfing.

EURJPY currency pair can be expected to fall further to the next round support level 169.60 (former resistance from the end of June).

EURJPY 4hour TF - August 3rd,2025🟦 EURJPY 4H Analysis Bearish Idea

📅 August 3, 2025

🔹 Top-Down Trend Bias:

• Monthly – Bullish

• Weekly – Bullish

• Daily – Bullish

• 4H – Bearish

EURJPY has pulled back through the previous support zone around 171.000 and is currently consolidating after a sharp bearish move. Short term trend remains bearish, but higher timeframes suggest this may be a corrective phase.

🔍 Key Zone: 171.00 – 171.70

This zone represents the 38.2% fib retracement and prior structure. A rejection from this area could trigger further downside, while a break above may confirm a higher low.

✅ Scenario A: Bearish Continuation (Blue Path)

1.If price taps into 171.00–171.70 and rejects

2.Look for bearish confirmation (rejection wick, bearish engulfing, BOS)

Target: 169.60 (key support)

This setup follows short term momentum and offers clean R:R into prior liquidity.

⚠️ Scenario B: Bullish Break & Hold (Orange Path)

1.If price breaks and closes above 172.250

2.Watch for continuation toward 173.750, our extended fib target

3.Structure shift + bullish PA would align with HTF bullish trend

This would confirm strength returning to the pair, ideal for HTF trend continuation traders.

🧠 Final Notes

• 171.00–171.70 is the reaction zone to watch

• HTFs remain bullish, but 4H momentum must flip to validate upside

• Let price confirm direction

EURJPYBank of Japan (BOJ) — July 28, 2025: Latest Overview

Policy Rate and Recent Moves

Short-term policy rate: Remains at 0.5%, the highest since 2008.

Decision timing: This rate was set in January 2025 (up from 0.25%) and has been maintained

Policy Outlook and Economic Backdrop

Inflation: Tokyo's core CPI is running above the BOJ’s 2% target (2.9% YoY in July), primarily due to external price pressures like energy and currency movements, not strong domestic demand.

Growth trends: The BOJ has trimmed its growth outlook, noting headwinds from higher U.S. tariffs and yen weakness, but still expects a moderate recovery if global trade remains stable.

Bond Purchases: The BOJ is scaling back its massive holdings of Japanese government bonds—targeting a 400 billion yen quarterly reduction through March 2026, then lowering to 200 billion yen in subsequent quarters.

Potential rate path: Market consensus and BOJ commentary indicate a possible hike to at least 0.75% by year-end 2025 if above-target inflation persists and downside global risks do not intensify.

Key Drivers and Central Bank Signals

U.S.-Japan trade: The new trade pact has reduced some uncertainties, supporting the possibility of policy tightening if inflation and yen trends remain stable.

Inflation’s nature: The BOJ stresses that any additional rate hikes will depend on seeing sustained, demand-driven price increases and wages, rather than just external cost pressures.

Governor Ueda’s message: The BOJ is maintaining a cautious, data-dependent approach, prioritizing stability and careful evaluation of global and domestic risk factors.

Quick Fact Table

Indicator Latest (July 2025) BOJ’s Signal

Policy Rate 0.5% Steady for now; another hike possible in 2025

Tokyo Core CPI (YoY) 2.9% Sustainable above-target inflation

Next Meeting July 30–31 Hawkish bias; likely no immediate change

Bonds (JGB reduction) -400B yen/Q Gradual unwinding through March 2026

Rate Outlook Stable, with upside Hike to 0.75% possible by year-end if justified

Summary:

The BOJ remains in a cautious, data-driven policy stance at 0.5% as of late July 2025, with inflation still above target and moderate growth. The central bank is slowly reducing bond purchases and may raise rates again by year-end if the current economic trends persist, but no change is expected at the imminent July meeting.

European Central Bank (ECB) — July 2025: Latest Policy and Economic Update

Key Interest Rates and Current Stance

Deposit Facility Rate: 2.00%

Main Refinancing Operations (MRO) Rate: 2.15%

Marginal Lending Facility Rate: 2.40%

These rates were set after a 25 basis point cut in early June 2025 and have now been held steady as of the ECB’s July 24, 2025 meeting.

Monetary Policy Context

Policy Pause: The ECB ended a year-long easing cycle which saw rates cut from 4% to 2%. The current pause reflects the ECB’s “wait-and-see” approach as inflation has now stabilized at its 2% target and global trade tensions—especially over U.S. tariffs—add significant uncertainty.

No Commitments: The Governing Council is explicitly not pre-committing to any future rate path, emphasizing a data-dependent, meeting-by-meeting stance.

Asset Purchases: The ECB’s asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP) portfolios are being reduced gradually, with no reinvestment of maturing securities.

Inflation and Economic Outlook

Inflation: Now at 2% (its target). The ECB expects it to remain near target for the period ahead. Wage growth continues but is slowing, and underlying price pressures are easing.

Ecoomic Growth: The eurozone economy grew more strongly than expected in early 2025, but trade uncertainty and a stronger euro are holding back business investment and exports. Higher government spending, especially on defense and infrastructure, is expected to support growth over the medium term.

Loans and Credit: Borrowing costs are at their lowest since late 2022. Households are benefiting from strong labor markets and growing wages, but banks are cautious in their lending due to uncertainty and global trade tensions.

Risks and Forward Guidance

The ECB is focused on safeguarding price stability amid exceptional uncertainty due to global trade disputes and policy risks.

There is no forward guidance for the next rate change. Markets are pricing only one possible additional cut for 2025, and a potential return to tightening in late 2026 if inflation stays below target.

Summary Table: ECB at a Glance (July 2025)

Policy Rate 2.15%

Deposit Rate 2.00%

Marginal Lending 2.40%

Inflation (Jun 25) 2% (target achieved)

GDP Growth (2025) 0.9% (projected)

Policy bias Cautious, data-dependent pause

The ECB’s current stance is one of caution, monitoring the effects of prior easing and global trade risks while inflation stabilizes at target. No further near-term cuts are planned unless significant data surprises emerge. The approach is flexible, with decisions made meeting-by-meeting in response to evolving economic and financial conditions.