BREAKOUT push to the upsideThere a high chance that EURJPY will break above the Zone and continue heading up for sometime. We can see according to the price analysis that the downtrend is finished and market formed a strong Invert H&S pattern which indicates strong buyers. Price is now in the Major Key Level with a high chance of breaking through due to the strong bullish momentum and if a clear breakout occurs then that means price will continue heading up

JPYEUR trade ideas

Trade Idea on a zone.EJ idea great zone on 78.6 fib head and shoulders.

The EURJPY is breaking back above the 100 day MA on the daily chart (see blue line on the chart above). Last week, the price moved up to that MA and rotated lower.

Going back to the end of February on the chart above, the EURJPY found support at 154.37, a key swing area, after briefly dipping below the 38.2% Fibonacci retracement at 155.92. The bounce from this level has led to a recovery in March. Today, the pair now testing/breaking the 100-day MA (161.31) . The 200-day MA (163.08) is the next key target. The price of the EURJPY stalled against that MA in December and again in January. .

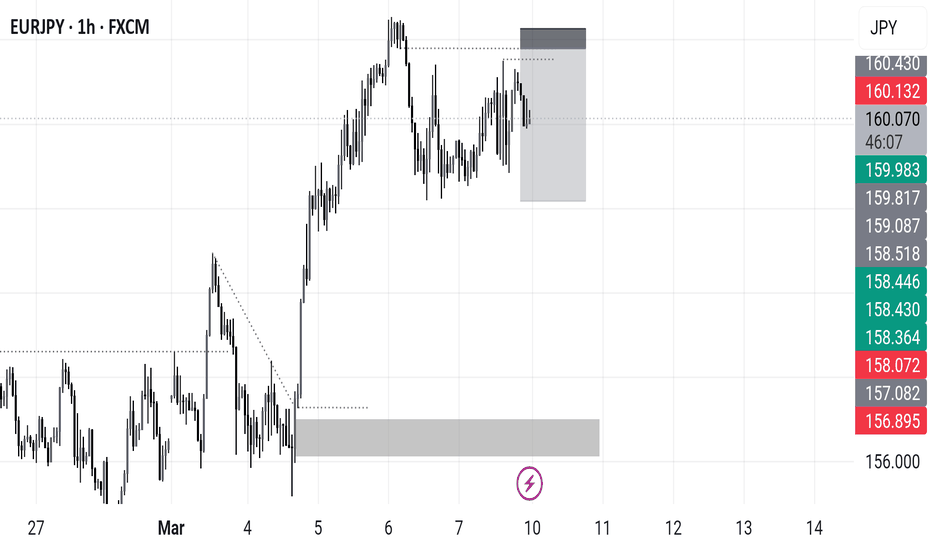

EUR/JPY Strong BullishEUR/JPY chart shows a strong bullish breakout after a period of consolidation.

### **📊 EUR/JPY Trade Outlook**

🔹 **Current Price:** 160.600

🔹 **Resistance Zone:** Near **161.000**

🔹 **Support Levels:** **160.132**, **159.797**

### **Key Observations:**

✅ Price broke above consolidation with strong bullish momentum.

✅ Moving averages indicate an uptrend continuation.

✅ Volume increase supports the bullish breakout.

EURJPY Technical Analysis! SELL!

My dear friends,

EURJPY looks like it will make a good move, and here are the details:

The market is trading on 160.92 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 159.03

Recommended Stop Loss - 161.65

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

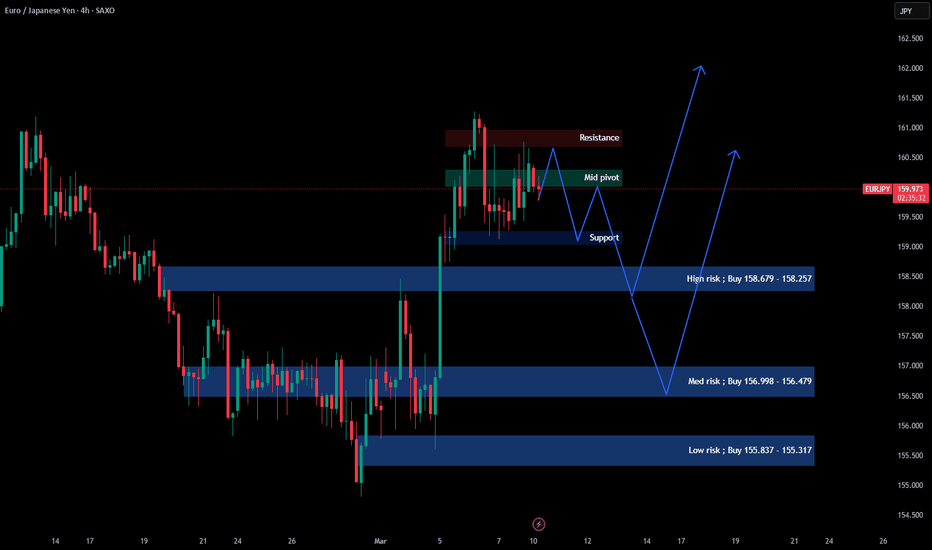

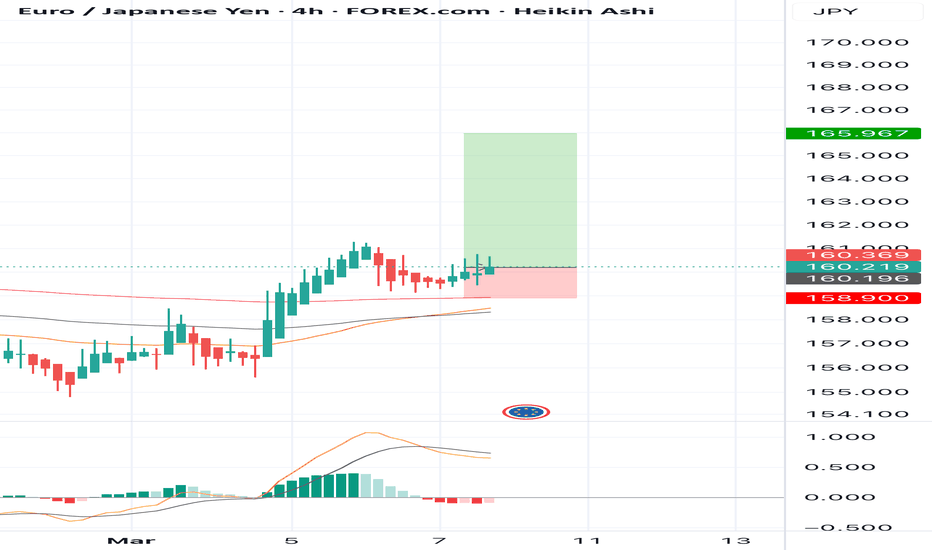

EURJPY Bullish Breakout Technical and Fundamental confluenceEURJPY Trade Analysis

Trade Type: Buy

Technical Analysis:

1. Trendline Breakout: EURJPY has broken above a key trendline, signaling a potential trend reversal or continuation.

2. Zone Breakout: The price has decisively moved past a strong resistance zone, confirming bullish momentum.

3. Double Bottom on 4H: A well-formed double-bottom pattern at a critical support level within the blue zone suggests a strong bullish reversal.

Fundamental Analysis:

Bullish Euro Outlook: Recent economic data and news favor the euro, boosting investor confidence. Positive developments such as stronger-than-expected GDP growth, hawkish ECB comments, or improved inflation outlook contribute to EUR strength.

Risk Sentiment: If global markets favor risk-on assets, JPY (a safe-haven currency) could weaken, further supporting EURJPY’s bullish move.

Trade Details:

Target Price: 163.755

Risk Management: 1% risk per trade

Risk-to-Reward Ratio (RRR): 1:3

With both technical and fundamental factors aligning, this trade setup presents a high-probability opportunity. Proper risk management will be maintained to maximize gains while minimizing exposure.

EURJPY: Growth & Bullish Forecast

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy EURJPY.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

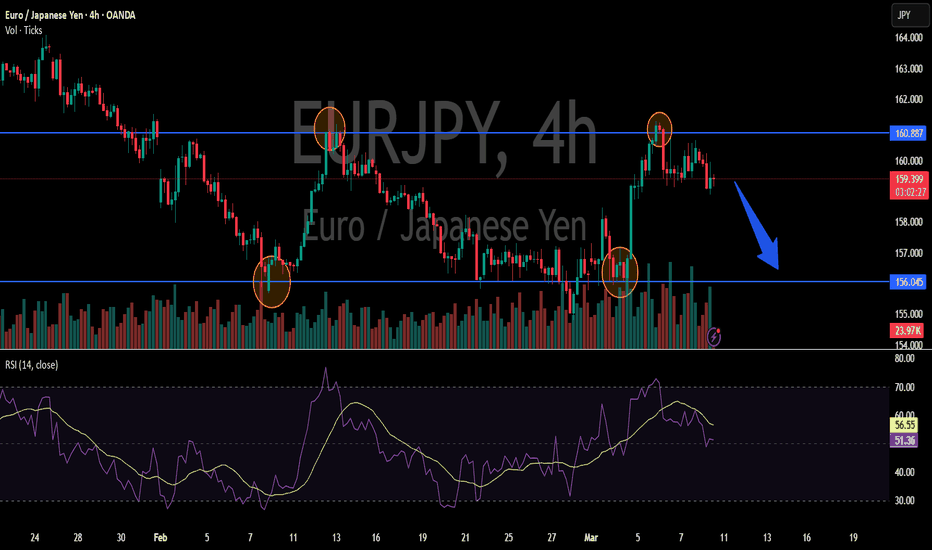

EURJPY 4h bearish ideaEUR/JPY (4H) Technical Analysis – March 6, 2025

Market Structure & Price Action:

The pair was previously in a downtrend, forming a descending channel.

A breakout above the descending trendline occurred, signaling a potential trend reversal or at least a strong retracement.

Price surged past resistance at 156.38, confirming the breakout with bullish momentum.

The next key resistance level was 159.87, which has now been tested.

Volume Analysis:

A noticeable increase in volume at the breakout point indicates strong buying pressure.

If volume starts declining at the current level, a pullback could occur before further continuation.

RSI Indicator:

RSI is at 63.92, approaching the overbought zone (70).

Momentum remains bullish, but there could be a short-term correction before the next move higher.

Key Levels to Watch:

Support: 159.87 (recent breakout level), followed by 156.38.

Resistance: 160.60 (current high) and possibly 162.00 if bullish momentum continues.

Potential Trading Scenarios:

Bullish Case: If price holds above 159.87, the uptrend could continue towards 161.00-162.00.

EURJPY can be bearish EURJPY can be bearish for this 3 reasons :

1. The price hunt the important resistance zone (161.232 - 160.184) so the trend can revers at this price.

and here is a strong bearish candle stick :

2. The bearish trend line of the daily time frame shows the bearish trend.

3.Also the RSI number (53) shows that we have space to move lower.

Trigger : You can entry with a good candle stick at the resistance or even now without trigger. or any strategy you have.

Target : the target can be the support zone or when the RSI reaches below 30 number. (I'd rather RSI)

Stop loss : my stop loss is above last candle stick on resistance zone. you can have your personal stop loss but be sure you use stop loss.

It's just my personal analysis and I have no responsibility for your trades. thanks for your attention.

EURJPY Will Go Down From Resistance! Sell!

Please, check our technical outlook for EURJPY.

Time Frame: 1D

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 159.715.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 156.155 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

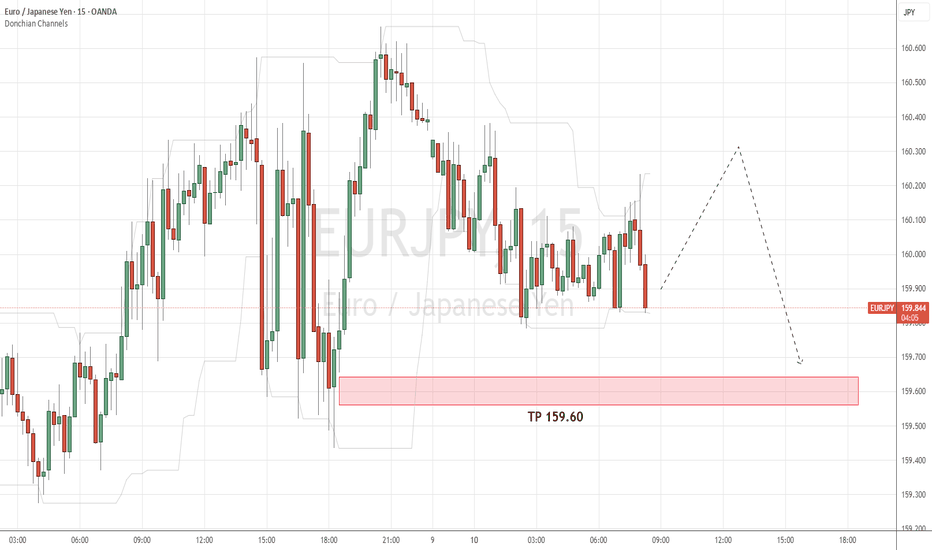

EUR JPY - Wait and seeWaiting to see a break and retest of the entry price rather than placing a buy stop order.

Here's the plan:

Watch for price to break above 160.250 with a decisive candle (preferably closing above this level)

Then wait for a pullback to retest this level as new support

Enter long when price shows rejection from the retest level (with a small bullish candle or rejection wick)

Place your stop loss at 159.900 immediately after entry

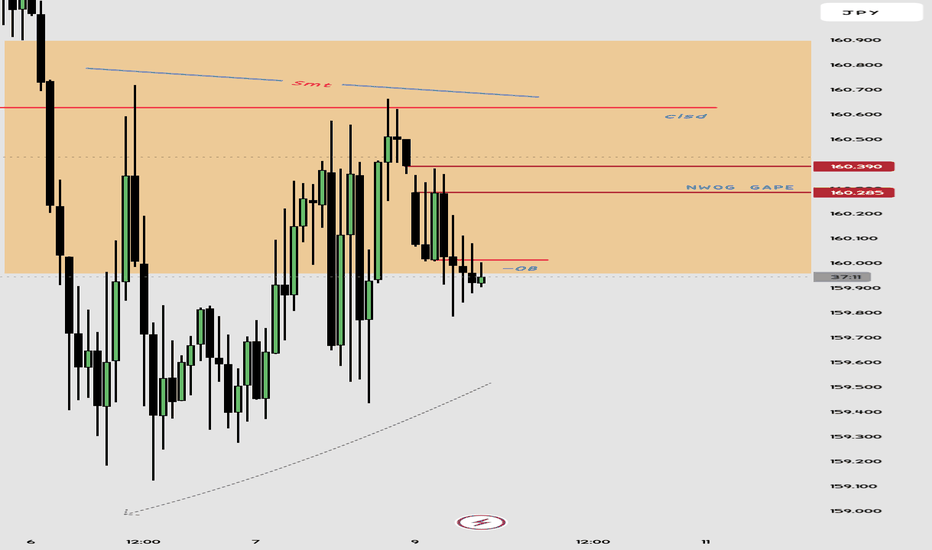

EURJPY1.4h

2.dnt

3.resist

4.double top /double top forming/

5.rsi56/sto46/volbearish

6.

7.fibext above/above

8.fibretrace above/above

9.

10.

11.

12.bearish divergence/bearish divergence/

13.bearish harami/bearish harami /

14.exp below/exp bos

1.2h

2.dnt

3.resist

4.double top/

5.

6.

7.fibext above /above

8.fibretraceabove/above

9.

10.

11.

12. bearish divergence/

13.evening star /bearish harami/tweezer top/ bearish hamami

14..exp /exp bos

We have a sell position on EURJPY

BUY EURJPY for bearish trend reversal STOP LOSS : 158.90 BUY EURJPY for bearish trend reversal

STOP LOSS : 158.90

Regular Bullish Divergence

In case of Regular Bullish Divergence:

* The Indicator shows Higher Lows

* Actual Market Price shows Lower Lows

We can see a strong divergence on the MACD already and There is a strong trend reversal on the daily time frame chart.....

The daily time frame is showing strength of trend reversal from this strong level of Support so we are looking for the trend reversal and correction push from here .....

TAKE PROFIT : take profit will be when the trend comes to an end, feel from to send me a direct DM if you have any question about take profit or anything

Remember to risk only what you are comfortable with…….trading with the trend, patient and good risk management is the key to success here