JPYGBP trade ideas

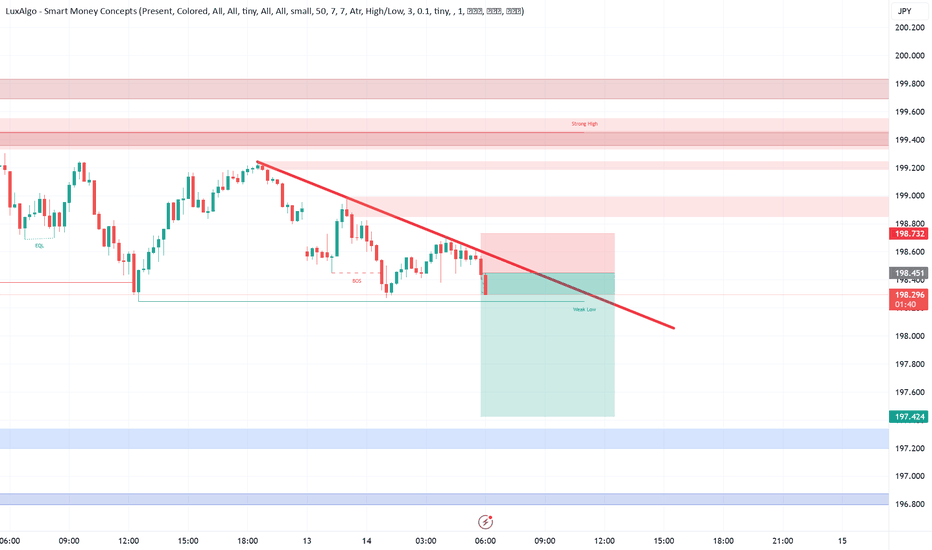

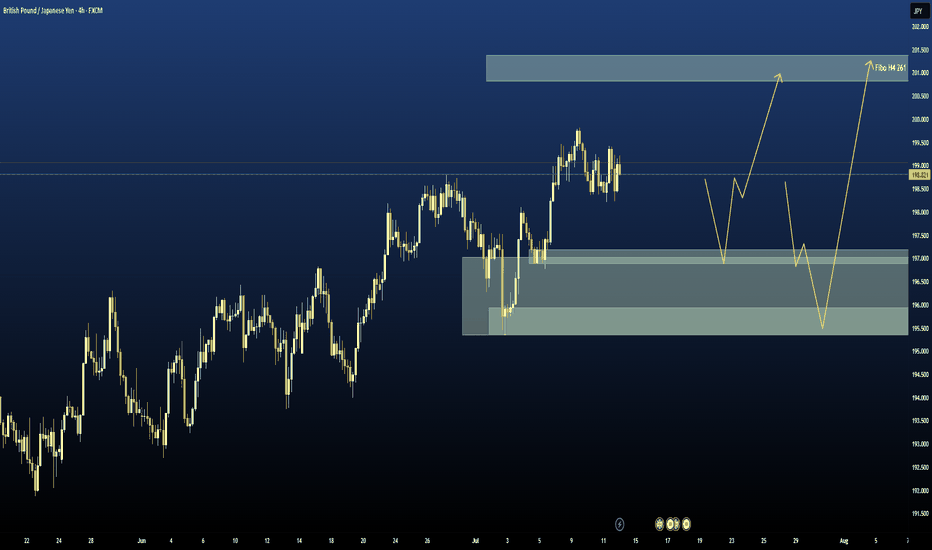

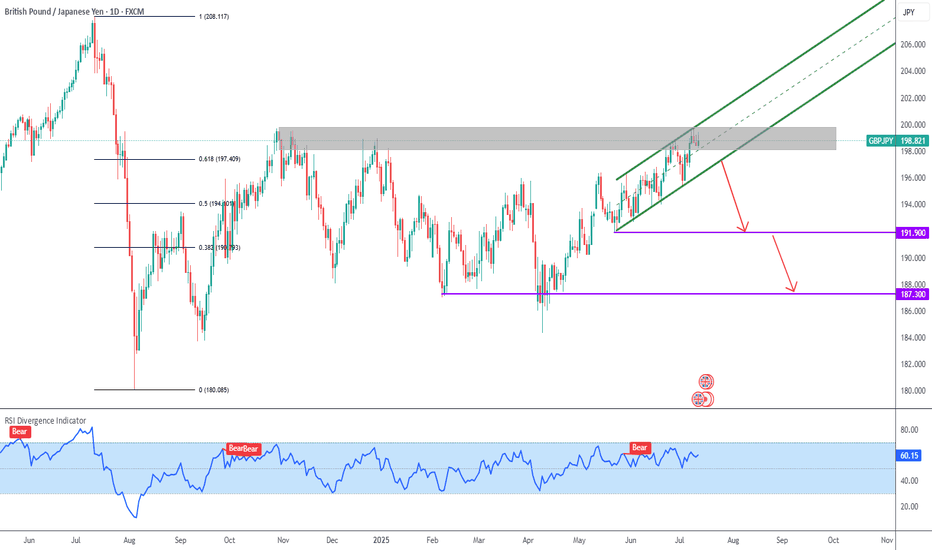

GJ Counter Pullback Likely to Daily DemandHello Traders,

On GJ, price remains in a daily counter-trend pullback phase. This has just been confirmed by a 4-hour break and close below the weak swing low (LL). To stay aligned with the overall bullish trend, I’m expecting a deeper pullback into the daily demand zone before price resumes its upward movement.

GBPJPY - Bullish BiasHTF Overview (4H): Price broke bullish structure with clean directional intent. Order flow remains aligned to the upside with no immediate signs of weakness.

MTF Refinement (30M): Zoomed into 30M for deeper structure clarity. Observing price actively reaching for sell-side liquidity (SSL) below a key low — a classic inducement setup forming.

Execution Plan: Waiting for a liquidity sweep below the SSL. Once swept, I’ll monitor the nearby 30M OB for mitigation. LTF confirmations (1M/5M CHoCH or BOS) will be needed before committing to a long entry.

Mindset: Patience over prediction — let liquidity do its job, then ride with smart money.

Bless Trading!

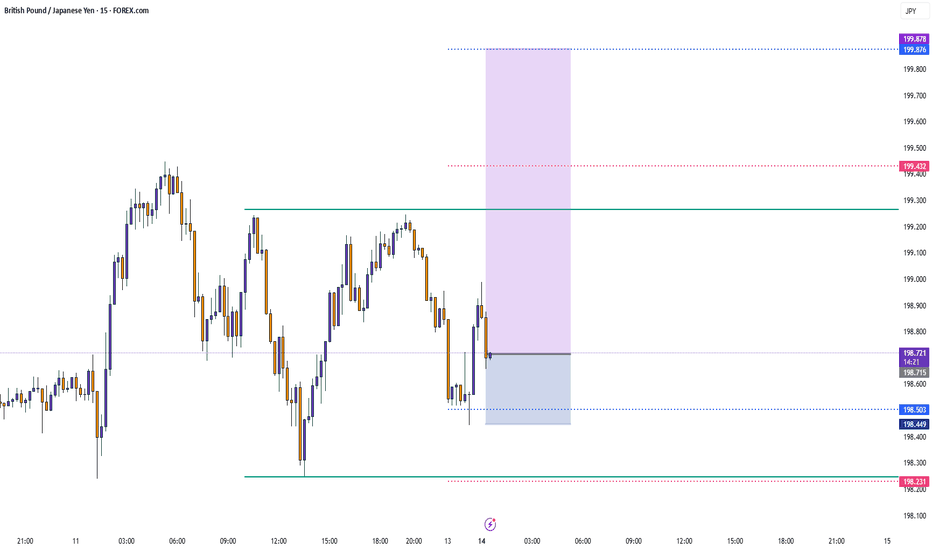

GBP/JPY -H1- Channel Breakout (14.07.2025)The GBP/JPY Pair on the H1 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Channel Breakout Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 196.70

2nd Support – 195.53

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

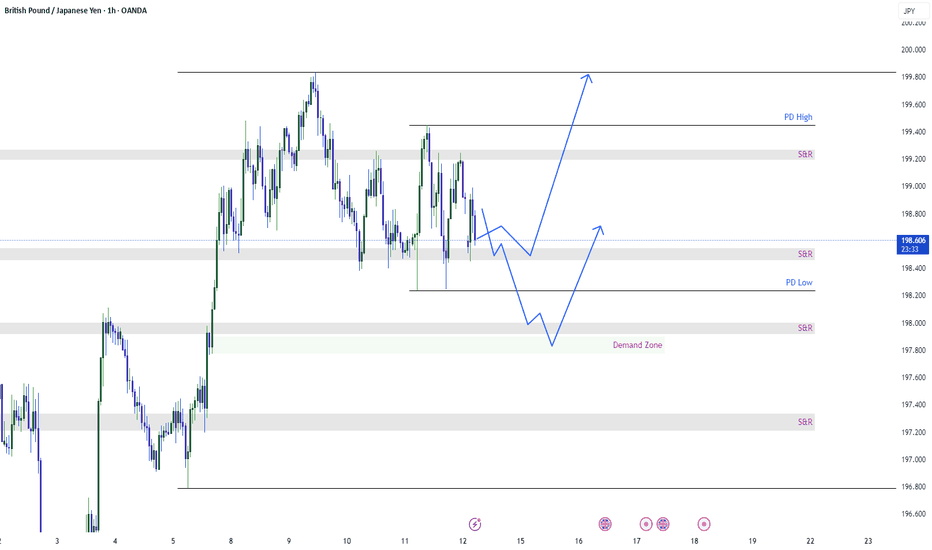

GBPJPY is still in retracementWe can see from the graph GBPJPY is oscillating between the two S&R levels. For today we expect GJ to touch the demand zone and then go higher. Therefore we can expect GBPJPY in go further down and hit the demand zone because it is still retracing. The possibilities for the GJ are shown.

Why election risk means yen volatility could rise this weekThe Japanese yen remains vulnerable ahead of Japan’s Upper House election on July 20.

Polls suggest the ruling LDP-Komeito coalition may lose its Upper House majority. Such an outcome would further weaken Prime Minister Shigeru Ishiba’s position, with his government already operating as a minority in the Lower House.

Adding to the pressure, the U.S. is set to impose 25% tariffs on Japanese goods from August 1—part of a broader protectionist push.

GBP/JPY) Bearish Analysis Read The captionSMC trading point update

Technical analysis of GBP/JPY on the 3-hour timeframe, suggesting a potential short-term pullback within a larger ascending channel.

---

Analysis Summary

Pair: GBP/JPY

Timeframe: 3H

Current Price: 198.883

Bias: Bearish move toward channel support

---

Key Technical Insights

1. Ascending Channel Formation:

Price is moving within an upward-sloping channel.

Current structure suggests price is heading toward the lower trendline support.

2. Support Level & Target Zone:

The yellow zone around 196.355 is a major support area and target point, coinciding with both structural support and the bottom of the channel.

3. EMA (200 Close):

Price is still above the 200 EMA (197.067), so overall trend remains bullish — but current move is a correction.

4. RSI (14):

RSI is neutral near 51.14, allowing room for further downward movement before becoming oversold.

---

Target Point

Target: 196.355 (support zone and bottom of channel)

---

Trade Idea

Direction Entry Stop-Loss Target

Sell 198.80–199.00 Above 199.70 196.35

SMC trading point

---

Summary

GBP/JPY is likely to retrace toward support at 196.35 before possibly bouncing within the larger bullish structure. This offers a short-term selling opportunity, with potential buy setups near the lower trendline later.

Please support boost 🚀 this analysis)

STEAL THIS TRADE! GBP/JPY Long Setup(Thief Trader’s Secret Plan)💰 Thief Trader’s GBP/JPY Heist Alert – Stealthy Long Setup Loading!

🌍 Greetings, Profit Raiders!

Hola, Konnichiwa, Ni Hao, Privyet, Hallo, Bonjour!

📢 Attention Market Bandits & Chart Pirates—the GBP/JPY Beast is ripe for plunder! Time to execute the next Thief Trader Masterplan.

🎯 Entry Zone – Loot the Dip!

Current price = Open vault. Fire longs now or snipe pullbacks (15M/30M charts recent swing low level).

Pro Thief Move: Stack buy limits near swing lows/highs. Chart alerts = your secret weapon. 🔫

🛑 Stop Loss – Guard the Treasure!

Swing Thieves: Hide SL below 2H swing low of candle wick @ (~197.000).

Day Raiders: Adjust SL to your risk size & order count. No free rides!

🎯 Profit Target – Escape with the Cash!

Take the 202.000 bag or exit early if momentum fades.

🔪 Scalpers vs. Swingers – Choose Your Weapon!

Scalpers (Quick Strikes): Longs only. No distractions.

Swing Traders (Patient Hunters): Trail stops & lock in gains.

🌪️ Market Pulse – Bullish Winds Blowing!

Price battling MA Resistance? No panic. Bulls still rule thanks to:

Fundamentals + Macro Trends

COT Data + Sentiment Shift

Quant Scores & Intermarket Alignments

(Check Linnkss for the full heist blueprint.)

⚠️ News Trap Warning!

Upcoming high-impact events? Freeze trades or tighten stops. Trailing SL = your escape route.

🚨 Join the Thief Trading Crew!

Like 👍 or Boost 🚀 this idea to fuel our next raid.

Thief Trader Tactics = Daily Market Domination. Your support keeps the heists alive! 💰❤️

🤑 Stay Locked In – The Next Big Score is Coming…

Timing is everything. Watch the charts. Strike hard. Exit smarter.

"GBP/JPY: High-Risk Pips Grab – Escape Before Cops! 🏴☠️ GBP/JPY "Dragon Heist" – Bulletproof Bullish Raid (High-Risk, High-Reward) 🚨

🔥 Attention Market Pirates & Profit Raiders! 🔥

(Day/Swing Trade Plan – Long Entry Focused)

🔑 Entry Zone (Vault Cracked!):

"The Dragon’s loot is unguarded! Bullish pullback = prime stealing opportunity."

Buy Limit Orders: Layer entries near 15M/30M swing lows (wick/body). DCA-friendly!

Thief Pro Tip: Scalpers ride long-only waves. Swing traders? Stack slowly, escape rich.

🎯 Target (Escape Routes):

200.600 (or bail early if cops (resistance) swarm!)

🚨 Red Zone = High-Risk Take-Profit (Overbought? Reversal? Police (bears) lurk here!)

⛔ Stop Loss (Emergency Exit):

4H Swing Low/High (Wick-based) – Adjust for risk/lot size!

No martyr trades! SL = your heist survival kit.

📢 Breaking News (Fundamental Edge):

Dragon’s bullish fuel? Macro data, COT reports, sentiment—CHEK THE LIiNKk 👉🔗 (Don’t skip homework!)

💣 Trading Alerts:

News = Landmines! Avoid new trades during releases.

Trailing SL = Your Getaway Car (Lock profits, dodge volatility.)

💥 Boost This Heist!

Smash 👍, hit 🔔, and fund our next raid! Every boost = more stolen pips for the crew.

Stay tuned—another heist drops soon! 🤑 #ForexBandits

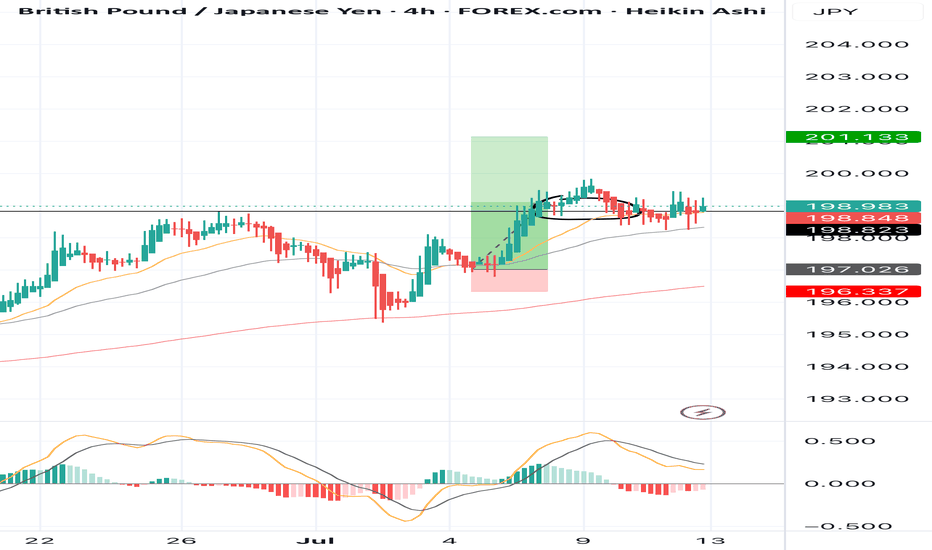

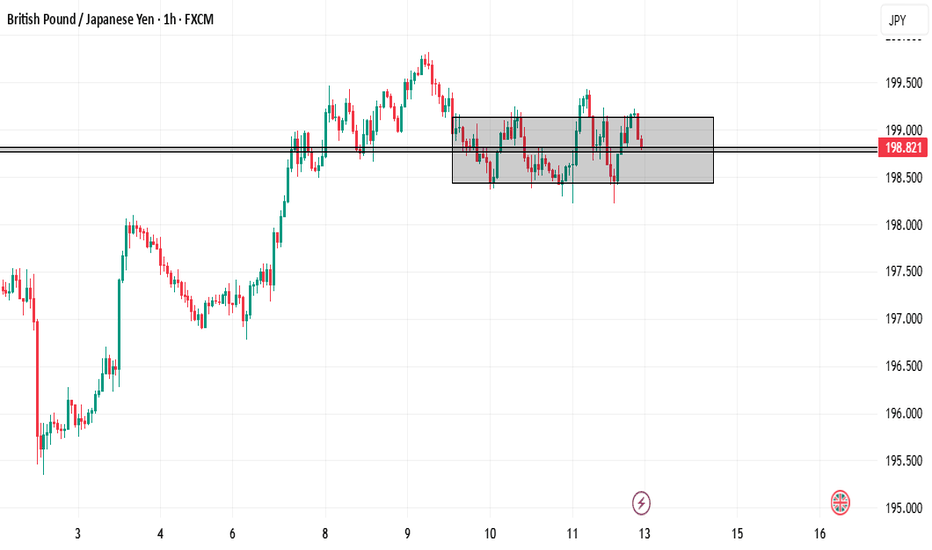

GBPJPY: floating at the top – is a drop being loaded?GBPJPY is hovering around 198.91 after an impressive rally, but now it's trapped between two key zones: 199.85 – a resistance level that keeps rejecting price, and 198.20 – a fragile support below. The price action reveals a tense sideways pattern, like a spring coiling up before release.

What’s concerning is that buyers have attempted to break above the high multiple times and failed – and each failure comes with weaker rebounds. With the Bank of England shifting toward a “pause” stance and the yen gaining mild support from rising risk-off sentiment, the market is starting to lean toward a correction.

If price breaks below 198.20, it could mark the beginning of a deeper slide back toward the lower boundary of the channel. Don’t be fooled by the silence – sometimes, calm is the precursor to a sharp fall.

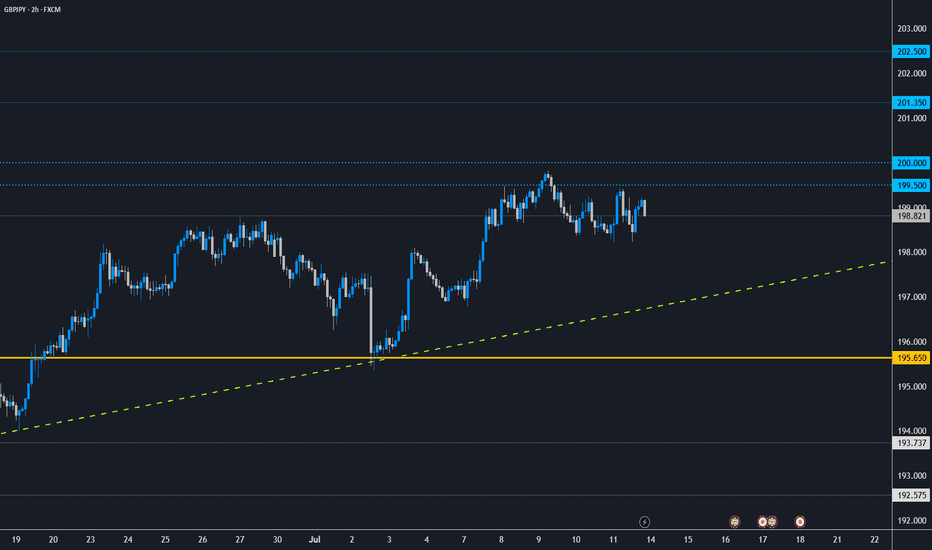

GBP/JPY - Potential TargetsDear Friends in Trading,

How I see it,

PIVOT @ 195.650

Psychological Resistance @ 200.000

1) Daily bull trend intact at this time

2) Resistance has the potential to force a correction

3) As long as price remains above PIVOT, bullish potential

remains high.

Keynote:

Monitor price action at your daily trend closely in case of a correction.

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time to study my analysis.

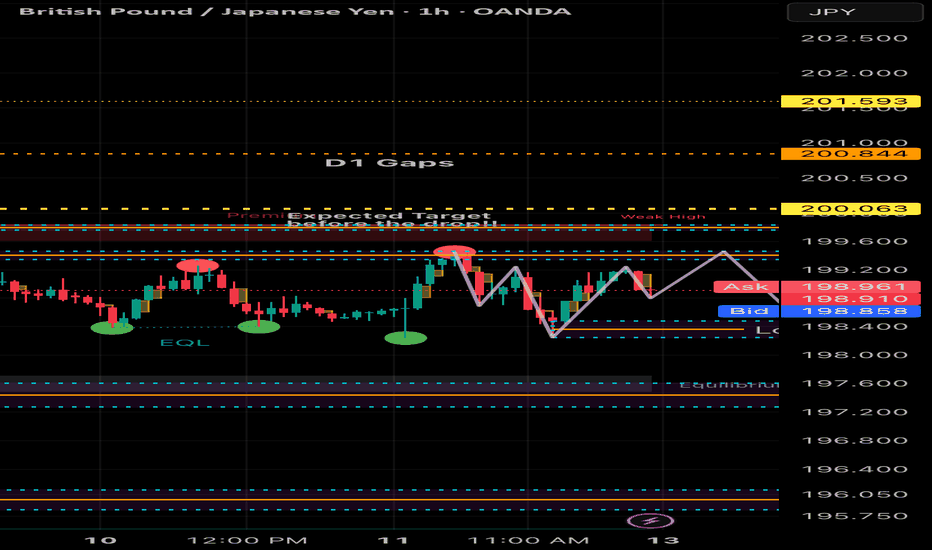

GBPJPY: Bullish Structure Still IntactGJ created a new HH then turned sideways. More consolidation or a deeper pull back could be seen before the next rally.

Last BOS: Break above 199.70 → confirmed bullish strength

H4 Demand Zone (Pullback): 198.30–198.60

Liquidity Above: Clean pools at 200.30 – 200.70

H1 Key Zone: 198.60–198.90 (H1 OB + unfilled FVG) → currently being tested.

Momentum Trigger: BOS above 199.30 to confirm buyers stepping back in.

M15 Micro-Structure: Slightly bearish (short-term), sweeping liquidity under 198.80.

What to Watch: M15 bullish BOS above 199.10–199.30 for intraday buy confirmation.

🟢Entry Zone 198.30 – 198.60

SL 197.90

TP1 199.70

TP2 200.30

TP3 201.00

❌ Bullish Invalidation

H1 close below 197.90 → bullish bias neutralized, expect deeper retrace into 197.20 – 197.50.

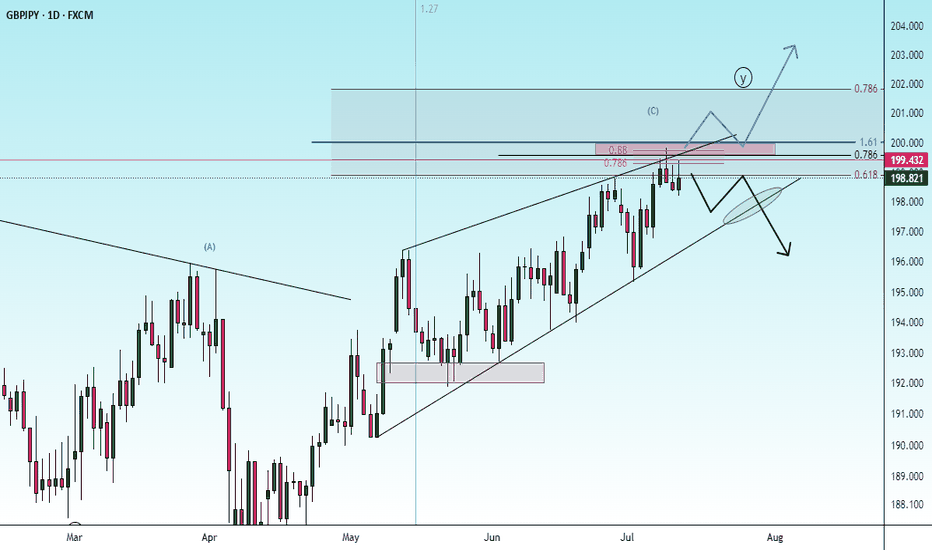

GBPJPY SELL IDEA- Weekly chart - Price reached an ATH on the weekly and closed below the major resistance with upward wick rejections - Signal for a downtrend for the new week

- Daily chart - The Last two daily closes (Thurs & Fri) were an inverse bearish pin bar and a weak bullish candle with upward wick rejections

- H4 Chart - Consolidating at the major resistance, but last highs were LHs and LLs

- H1 Chart - Consolidating at the major resistance, but last highs were LHs and LLs

Entry for sells would be break out of the consolidation on H4 and retest on lower Tfs - H1, M30 and M15