Trade Plan: GBP/JPY — 4H AnalysisTrade Plan: GBP/JPY — 4H Analysis

Market Context

Pair: GBP/JPY

Timeframe: 4H

Date: 6th August 2025

Key Observation:

Price attacked weekly sell-side liquidity (PML).

CISD (Closed Inside Swing Demand) formed, showing bullish reaction.

Higher timeframe weekly buyside liquidity (PMH) is intact and a potential long-term target.

Bias: Bullish

Key Levels

PML (Weekly Sell-Side Liquidity): Price tapped into it and reversed.

PMH (Weekly Buyside Liquidity): Near 200.000, long-term target.

Fair Value Gaps (FVGs): Two bearish FVGs (red boxes) are marked as potential reaction zones.

Entry Criteria

Entry Zone: After confirmation of bullish dealing range above CISD.

Trigger: Price breaking above minor resistance (current consolidation zone near 196.143).

Confirmation: Lower timeframe bullish FVG inside context area.

Target

Short-Term Target: 1st FVG (near 197.300–197.700).

Mid-Term Target: 2nd FVG (near 198.200–198.700).

Long-Term Target: PMH near 200.000.

Stop Loss

Below recent swing low formed during liquidity sweep (below 195.000).

Notes

Patience Required: As title suggests, wait for bullish confirmation candle to close before entry.

Risk Management: Target minimum 2R reward before scaling out.

Invalidation: Price closing below CISD and not showing bullish FVG in lower timeframe.

JPYGBP trade ideas

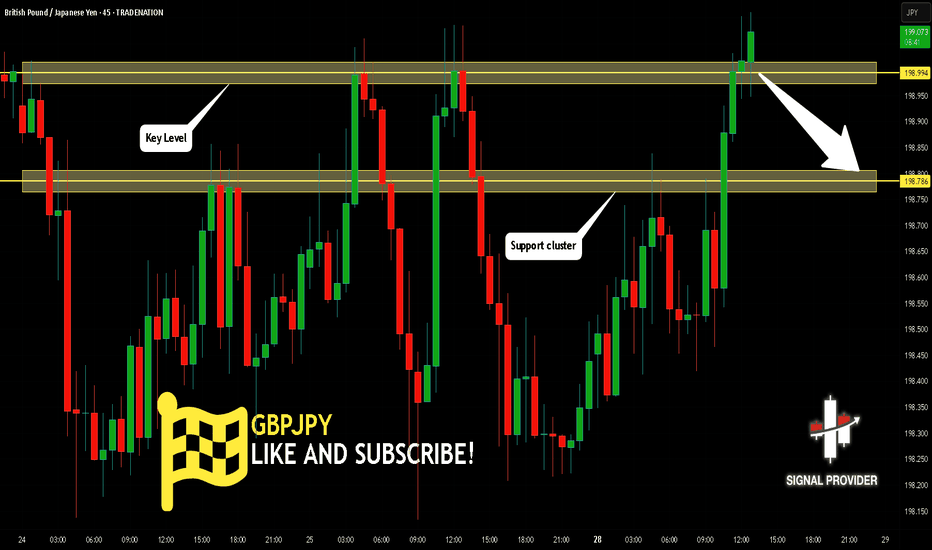

GBPJPY Is Very Bearish! Sell!

Please, check our technical outlook for GBPJPY.

Time Frame: 45m

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 198.994.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 198.786 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Trade Idea – GBPJPYBased on the daily market structure and Elliott Wave count, there’s potential for another bullish push to complete Wave 5.

However, on the H4 timeframe, price may still create one more lower low (LL) before confirming the upward move.

🔔 Wait for confirmation — either a break of structure or a bullish engulfing candle on the H1 timeframe before entering any buy positions.

#GBPJPY #ForexAnalysis #ElliottWave #Wave5Setup #UKTraders #USTraders #SwingTrading #PriceAction #ForexStrategy #H1Confirmation

GBPJPY ready to drop?GBPJPY has printed a weekly bearish engulfer with a cross over of a weekly doji and price rejected from a weekly and monthly resistance line. As price is rejecting from a very important monthly and weekly resistance level, it is highly likely price may continue to drop to weekly support level.

As 4H timeframe showing a strong head and shoulder with rejection below, we may see continuation with strong trend.

Upon price action confirmation, a sell trade is high probable.

GBPJPY – Bearish Continuation Setup AheadPair: GBPJPY

Timeframe: 4H

Bias: Bearish

🔍 Technical Overview:

GBPJPY has broken down with high momentum and is now hovering at a 4H support zone (195.30). A clean break and close below this level opens the door for a deeper move toward the next support areas:

Entry Trigger: Break below 195.30

🎯 Target 1: 194.05

🎯 Target 2: 192.50

🛑 Stop Loss: Above 195.95 (previous resistance-turned-supply zone)

📉 RSI: 27.63 (Oversold but momentum-driven selloff suggests more downside)

🧠 Macro + Fundamental Confluence:

🏦 Central Bank Policy:

BOE (Bank of England) cut rates by 25bps (to 4.25%) in a hawkish tone, with internal disagreement (7–2 vote), signaling uncertainty and potential for further divergence.

Despite the “hawkish cut,” the market interpreted it cautiously, especially with falling UK economic momentum and weak retail data.

💴 Bank of Japan:

BoJ is slowly tightening policy — signaling an eventual exit from ultra-loose conditions.

Real interest rates remain negative, but the direction is now incrementally hawkish, strengthening the JPY across the board.

💡 Market Sentiment:

VIX at 20.42 = Risk-Off Environment → capital flows into safe-haven JPY, out of GBP.

With Nasdaq bullish, but volatility ticking up, JPY benefits from its safe-haven role.

📊 CFTC Positioning:

GBP: Longs decreasing, shorts rising, NNCs decreasing → Bearish bias

JPY: Longs flat, but massive drop in NNCs → institutional positioning is turning defensive

🧾 Economic Weakness:

UK Services PMI showing signs of stagnation

CPI and Retail Sales remain weak, suggesting limited scope for further GBP upside

Japan's latest Household Spending and Economy Watchers Survey show stabilizing conditions, supporting yen strength

📌 Final Take:

Fundamentals support the breakdown as monetary divergence and global sentiment drive capital into the JPY. Watch for confirmation via H4 close below 195.30 before entering the trade.

🧭 Trade idea aligns with macro, technicals, seasonality, and institutional flows.

GBPJPY is Holding above the SupportHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY Fundamentally Bearish🧠 Macro-Fundamental Breakdown

🇬🇧 GBP (British Pound)

🔻 GDP Shrinking: UK growth has stalled with below-trend GDP prints 3 quarters in a row.

📉 PMI Weakness: Manufacturing and Services PMIs both under 50 = economic contraction

🧊 Retail Sales Down: UK consumer confidence and demand are cooling

💼 Labor Trouble: Unemployment ticking higher + BoE hinting at peaking rates

🪙 BoE Dovish Pivot?: Market now pricing possible cuts into early 2025.

🇯🇵 JPY (Japanese Yen)

🟢 Inflation is ticking higher

🔄 BoJ is cautiously shifting from ultra-loose policy

🛡️ Yen often strengthens in risk-off environments (which aligns with current market volatility)

🇯🇵 Tokyo CPI surprises have reinforced JPY support

GBPJPY is in the Down Trend From Resistance LevelHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

Today’s Opportunity: Stay Sharp on GBPJPY!Hey friends,

Here's my latest analysis on GBPJPY.

📌 Buy Entry Zone: 197.590 - 197.336

🎯 Target Level: 198.642

📅 Today, major economic data will be released from the U.S.

Make sure to factor this into your fundamental analysis.

📊 It’s not just about the charts—fundamentals matter too.

Technical + Fundamental = Powerful outcomes ✅

💬 Every like and bit of support keeps me going.

Thanks so much to everyone backing this journey! 🙌