JPYGBP trade ideas

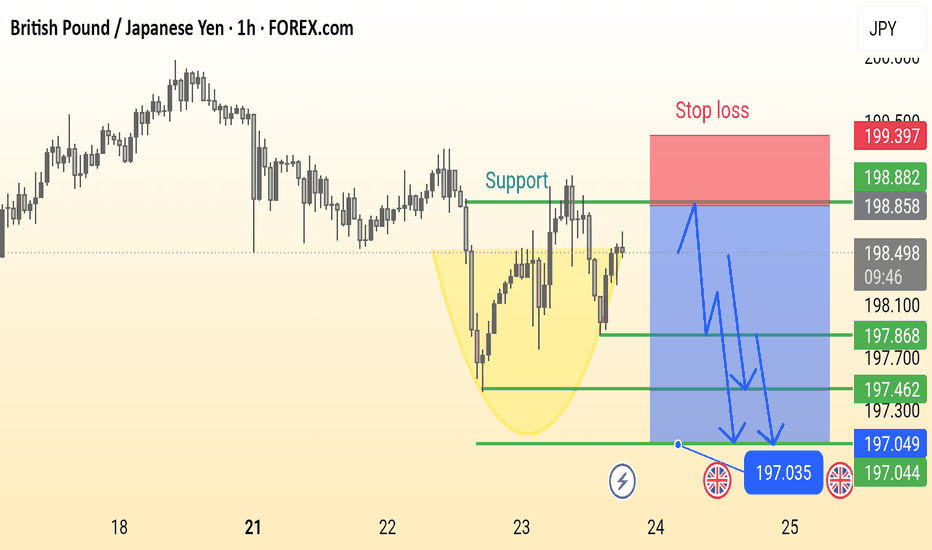

GBP/JPY Analysis is Ready This is a 1-hour chart of the GBP/JPY currency pair showing a potential bearish setup. Key elements include:

Support Zone: Around 198.000, previously tested multiple times.

Bearish Cup Pattern: Highlighted in yellow, suggesting a reversal.

Stop Loss: Marked above 199.397.

Sell Entry Zone: Near the support break at ~198.000.

Bearish Targets: 197.868 → 197.462 → 197.035 (with final support near 197.044).

Bearish Projection Arrows: Indicate expected price movement after breakdown.

This chart suggests a sell setup on breakdown, with well-defined risk and reward levels.

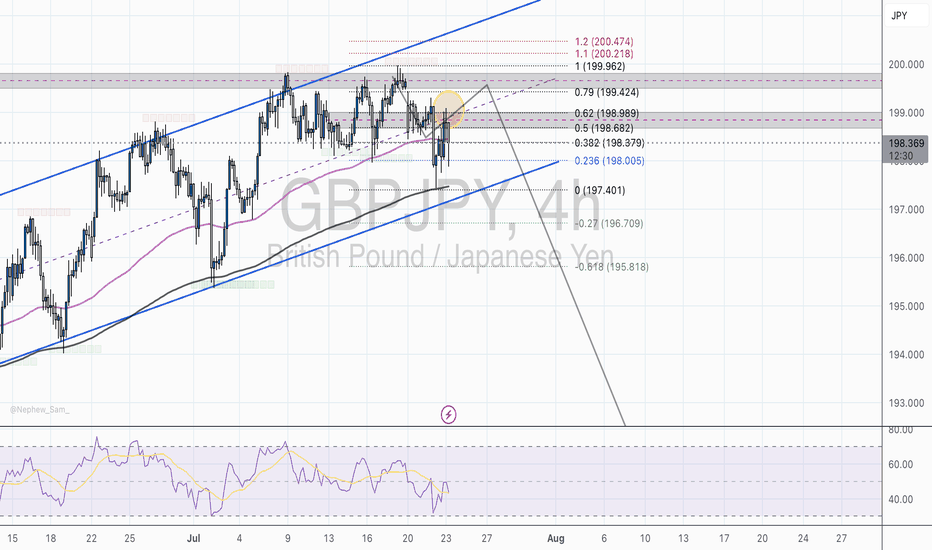

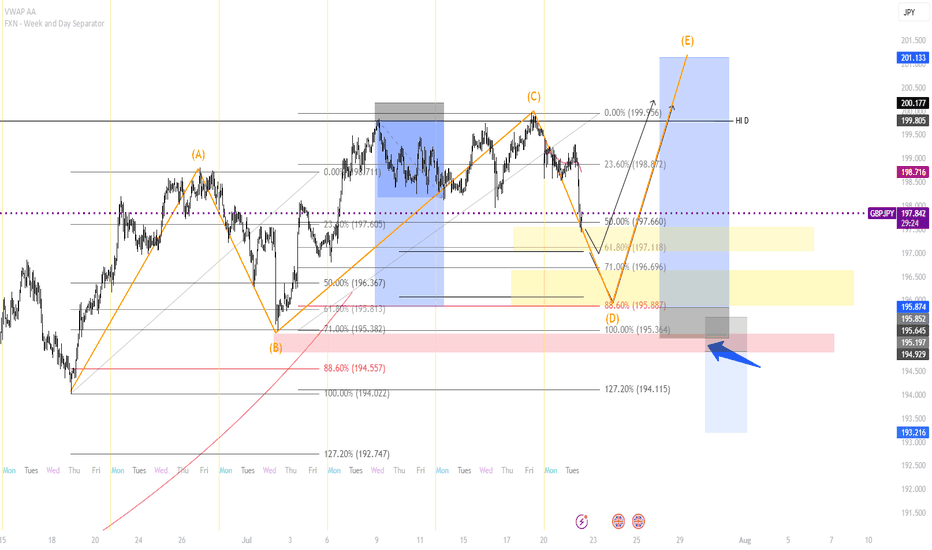

GBP/JPY 4H - Rejection from Supply Zone and Key Fib AreaOverview:

GBP/JPY is trading near 197.91, and recent price action suggests a potential short opportunity. The pair has been rejected from a key Fibonacci resistance zone, and bearish momentum appears to be building beneath a fading ascending channel. Let’s break down why this chart leans more bearish.

Market Structure Breakdown:

* Price action failed to sustain new highs above 199.90 and is now forming lower highs, a potential early sign of trend exhaustion.

* The recent bounce from 197.40 was muted and rejected near the 0.5 and 0.618 retracement levels, indicating strong supply around the 198.68–198.98 zone.

Fibonacci Confluence:

* The rejection occurred right at the 0.618 retracement of the prior downswing — a key Fibonacci level often used by institutional traders to re-enter in the direction of the trend.

* Price is now hovering below the 0.382 (198.38) and 0.5 (198.68) levels, which may now act as resistance.

* If the current rejection holds, downside targets are:

* 0.0 (197.40) – recent low

* -0.27 extension (196.70) – potential bearish continuation target

* -0.618 extension (195.81) – extended downside objective

Trendline & Channel Considerations:

* The ascending channel is losing momentum.

Moving Averages:

* Price is now below the 50 EMA, and testing the 200 EMA, which is at risk of breaking.

* A clear close below both EMAs would confirm bearish momentum.

RSI & Momentum:

* The RSI shows bearish divergence on recent highs and is struggling to break above the midline (50).

* Momentum is tilting to the downside and failing to build higher on bounces.

Key Zones:

* Resistance Zone: 198.60–198.98

* Strong Fibonacci confluence + previous supply

* Support Zone: 197.40

* Prior swing low and 0.0 Fib level

* Bearish Continuation Zone: Below 197.30

* Breakout would confirm downside acceleration toward 196.70 and 195.80

Conclusion:

GBP/JPY is showing signs of bearish pressure beneath key resistance. With the rejection from the 0.618 Fib level and weakening channel structure, the path of least resistance may be to the downside — especially if price breaks and holds below 197.40.

A confirmed breakdown opens the door toward 196.70 and possibly 195.80, as bearish continuation unfolds. Overall we can even see price hitting past historical levels at 189.50

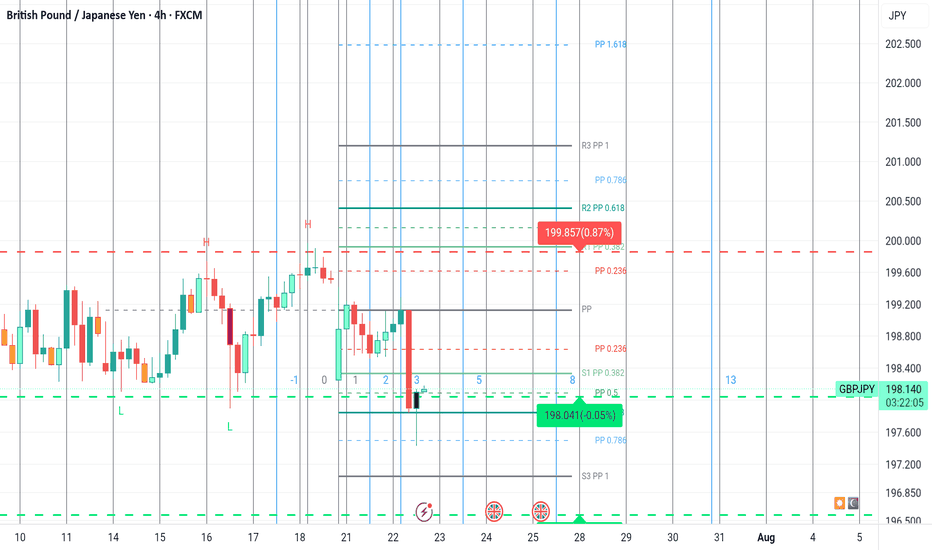

GBPJPY 4HOUR TIME FRAME ANALYISOn the 4-hour chart, GBP/JPY has been tracing out a clear up-trend over the past several weeks, marked by a sequence of higher highs and higher lows. Your proposed long entry at 198.632 neatly coincides with two layers of support:

Trendline support: A rising trendline drawn off the last two significant swing lows intercepts right around 198.6, suggesting the pair is catching a bid as it back-tests that line.

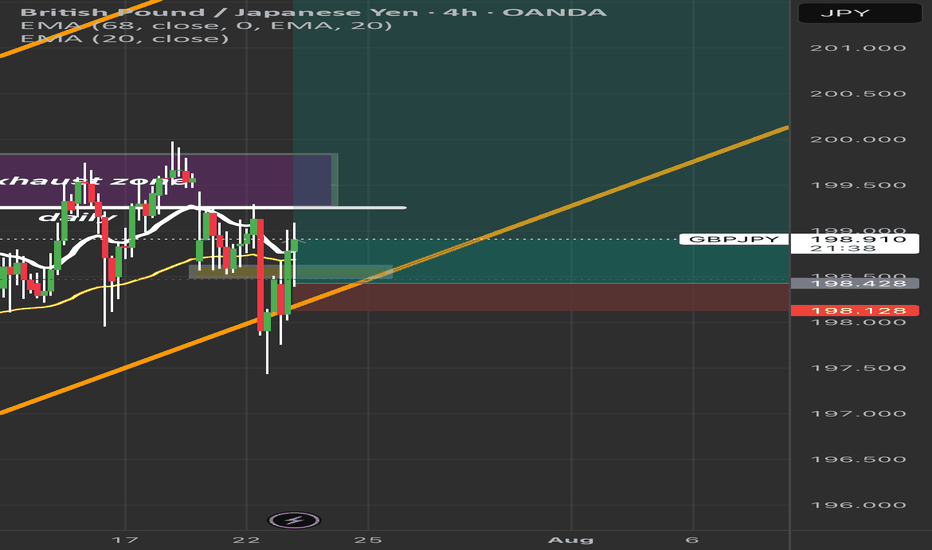

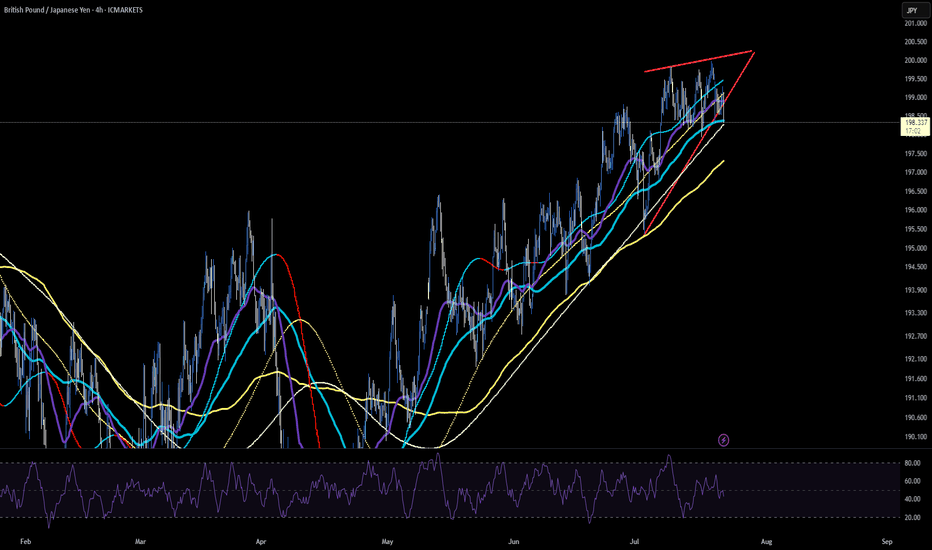

GBPJPY Breakout or Trap? Price in Key Exhaustion Zone | 4H ChannGBPJPY is sitting at a critical point inside an ascending channel. After rejecting the exhaustion zone multiple times, price is trying to reclaim bullish momentum. Key levels to watch:

✅ Bullish Bias: Hold above 198.400 and break past 199.200 for continuation toward 200.000+.

⚠️ Bearish Risk: A break below 198.400 could signal a deeper correction.

The 20 EMA and 68 EMA are converging—expect a strong move soon!

Question: Do you think we break out or fake out? Comment below! 👇

#GBPJPY #ForexTrading #PriceAction #ForexSignals #GBPJPYAnalysis #TradingView #ForexSetup #TechnicalAnalysis #ForexStrategy #SwingTrading #ForexEducation #ForexMarket #DayTrading

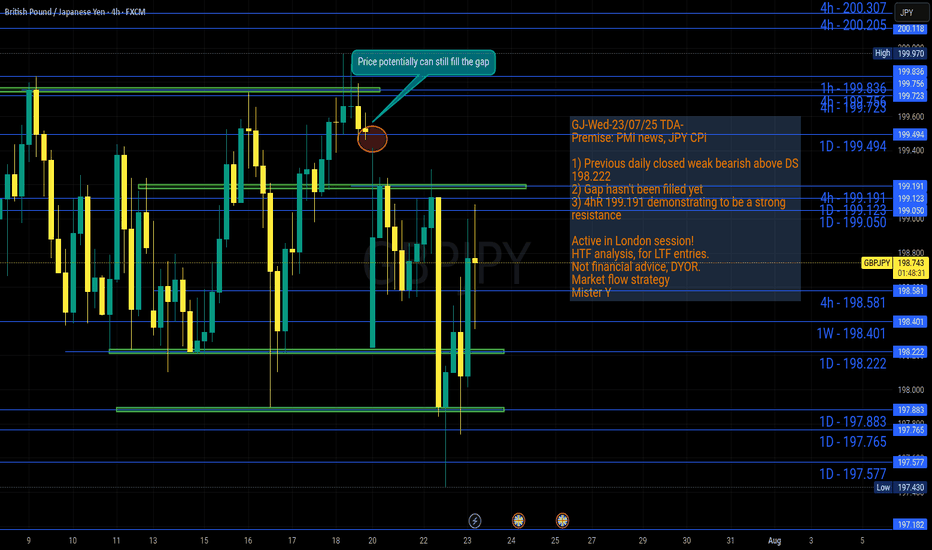

GJ-Wed-23/07/25 TDA-Gap hasn't been filled yet!Analysis done directly on the chart!

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

Bullish Continuation Setup: Reacting from Daily StructureHey Traders, hope you’re having a great day! 👋

GBPJPY is making a sharp bullish reaction after sweeping the Sell-Side Liquidity (SSL). Although price is currently at an external structure supply zone, this move originates from the daily structure, so the dominant daily bullish continuation bias remains intact.

I’m watching key Points of Interest (POIs) for potential buy trades, planning to enter only with Lower Timeframe (LTF) confirmation and after a clean liquidity sweep. This method combines smart liquidity hunting with structural alignment, increasing the probability of successful trades.

Patience and proper confirmation will be key to trading this setup effectively.

GBPJPY 4H – A+ Setup Using TCB Strategy, Bullish continuation

📈 GBPJPY 4H – A+ Setup Using TCB Strategy 🔥

Bullish continuation setup unfolding with precision.

✅ Trend Phase:

Higher highs and higher lows confirm uptrend

Price bounced from ascending trendline and demand zone

EP1 already triggered on bullish rejection from key support

✅ Countertrend Phase:

Falling wedge (countertrend channel) broken to the upside

Early confirmation for continuation from breakout

✅ Breakout Phase (Pending):

Clean structure at 199.00 acting as resistance

EP2 will be activated after bullish breakout + successful retest of 199.00

Targeting major resistance around 202.000

📍 SL below demand (~197.70)

🎯 TP: 202.000

⚖️ RRR: ~1:3

🧠 Confluences:

Bullish trendline support

Demand zone reaction

Falling wedge breakout

Upcoming key level breakout (199.00)

Price action confirmation

📌 Watch closely for the breakout-retest of 199.00 before engaging EP2.

Manage risk, move SL to breakeven at 1:1.

🔖 Hashtags:

#GBPJPY #ForexSetup #TCBStrategy #TechnicalAnalysis #BreakoutTrade #SwingTrading #SmartMoneyConcepts #FXSignals #TrendTrading #PriceAction #TCBFlow

🗣️ Drop your comment if this setup adds value or aligns with your bias! 👇

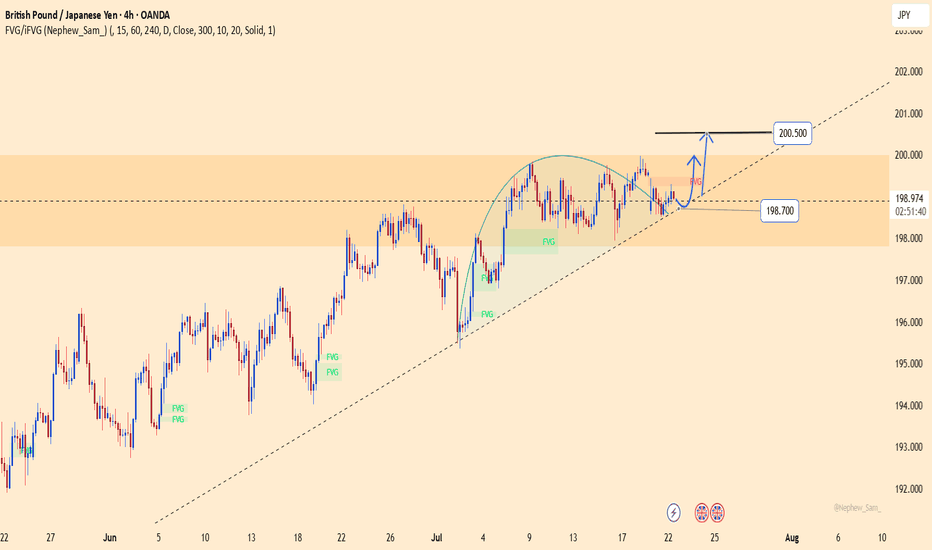

GBPJPY – breakout loading: final leap to 200.500?After days of compression, GBPJPY is flashing clear signs of an explosive breakout.

Price is holding firmly above the ascending trendline and consolidating right at the top of the FVG zone – a strong signal that buyers are preparing to punch through the 200.500 resistance in one decisive move.

Meanwhile, the JPY continues to lose ground as the BoJ shows no clear intention to hike rates, while GBP gains support on expectations that the BoE will maintain its hawkish stance longer due to persistent core inflation.

Trade setup (reference):

Buy limit: 198.900

SL: below 198.500

TP: 200.500

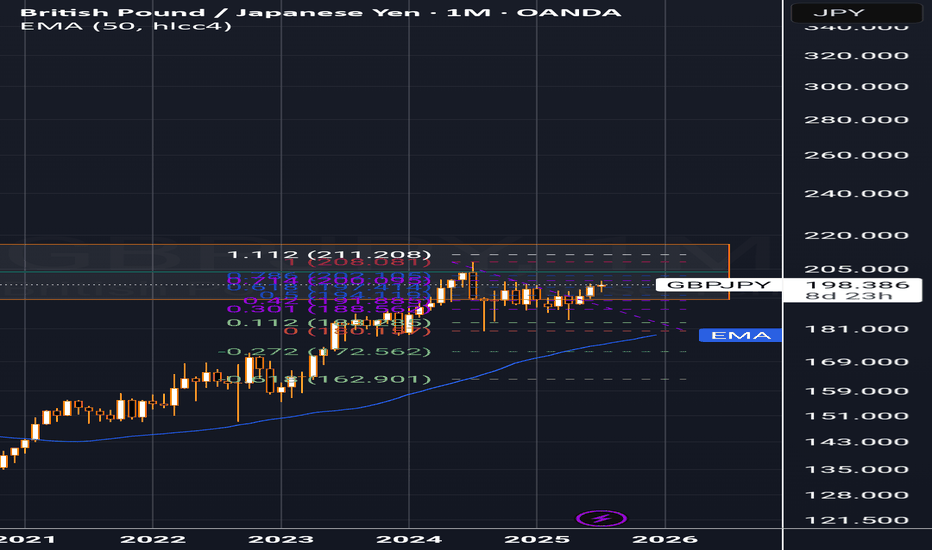

MAJOR MONTHLY SUPPLY ZONE ON GBP/JPY SELLERS INBOUNDRegarding the monthly supply zone, my technical analysis indicates that the price has historically failed to breach this area over several years. I anticipate a potential reversal and recommend waiting for confirmation, such as a double top or harmonic pattern, before initiating a sell position. Furthermore, i will consider selling opportunities upon the .618 Fibonacci level being reached.

Entry: 199.0

Take Profit: 183.3

Overall Price Target: 163.0

GBPJPY - How i see the market. WHAT DO YOU THINK?A channel within a channel .

Short-term bearish pressure to complete the 3-drives pattern, which ultimately suggests a long bullish setup. I'd only consider this setup if the trend continues to 198.000.

side note

198.000 I'll be looking for buying opportunities to the upside probably until we hit the red channel trendline. That should guarantee approx. 350pips.

You could take advantage of the current bearish move and rejoin when the bulls hit the ground running. Remember use your own trading plan and enjoy the ride . It can go either way but hopefully it respects PA and goes with this flow.

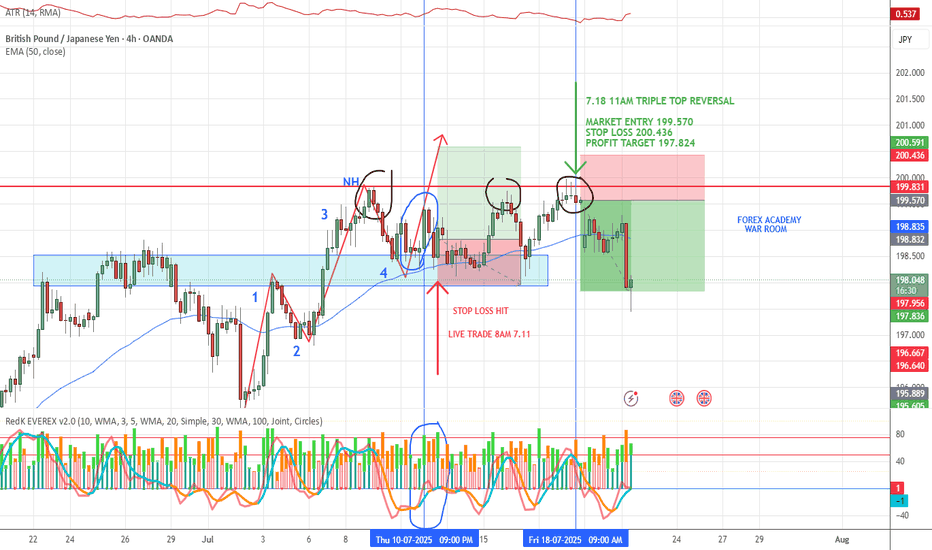

GBP/JPY WIN📈 VMS Strategy – GBP/JPY Triple Top Win

Another clean triple top reversal, this time on GBP/JPY, using the VMS strategy.

This trade checked every box:

✅ Clear triple top structure

✅ Strong engulfing candle

✅ Volume + momentum aligned perfectly

✅ Entry near the 50EMA with patience and confirmation

Price made a solid move in our favor and hit the profit target earlier this morning.

If you’re finding value in the VMS system, consider sharing it with someone who needs structure, patience, and a real edge.

📌 The trade either fits the rules—or it doesn’t. That’s what makes this work.

GBPJPY is in the Down Trend From Resistance LevelHello Traders

In This Chart GBPJPY HOURLY Forex Forecast By FOREX PLANET

today GBPJPY analysis 👆

🟢This Chart includes_ (GBPJPY market update)

🟢What is The Next Opportunity on GBPJPY Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

GBPJPY 4H – Demand Zone Rejection | Bullish Continuation🏹 GBPJPY 4H – Demand Zone Rejection | Bullish Continuation

GBPJPY tapped into a key 4H demand zone with a strong rejection wick, respecting both horizontal support and trendline structure. With bullish momentum building, price is likely to push toward the psychological 200.000 level.

✅ Demand zone + trendline confluence

✅ Bullish rejection after liquidity sweep

✅ Clean 1:3+ RRR setup

✅ Clear HTF bullish structure

Strategy: TCB – Trend Phase (Pullback Entry)

Entry Zone: 198.800

Stop Loss: 198.370

Take Profit: 200.000

Checklist Score: ✅ 100% A+ setup

#GBPJPY #ForexSetup #SmartMoney #PriceActionTrading #DemandZone #TrendTrading #ForexAnalysis #TCBStrategy #LiquiditySweep #SwingTrade #JapaneseYen #BullishMomentum #ForexChart #TradingViewIdeas #GBPJPYAnalysis

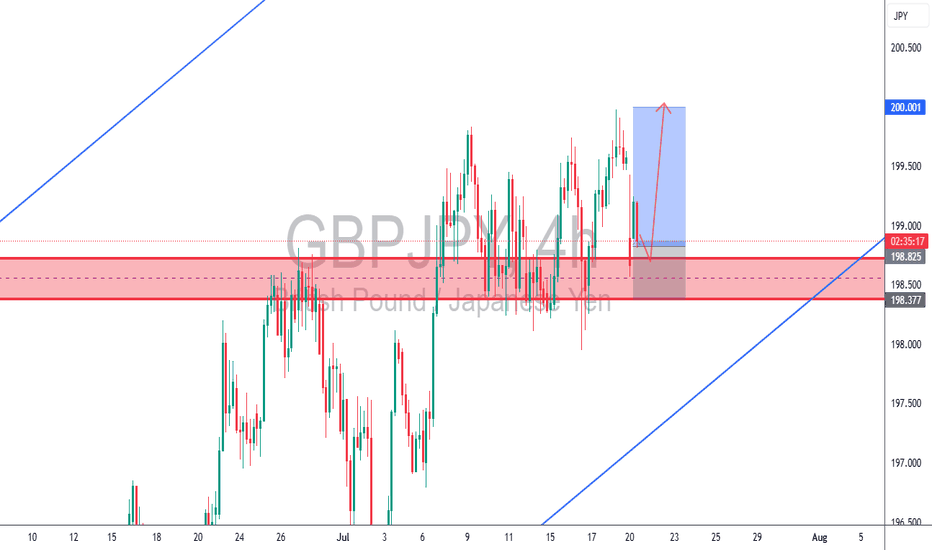

GBPJPY: Swing Trading & Technical Analysis

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPJPY chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPJPY Reversal SetupFundamentals in Politics:

Japan's ruling coalition (Liberal Democratic Party and Komeito) has lost its majority in the upper house of parliament in recent elections. This is a significant setback for Prime Minister Shigeru Ishiba, though he has stated he will remain in office to combat inflation and continue trade talks with the US.

The election results indicate a surge in support for right-wing populist parties, fueled by public frustration over economic challenges like soaring rice prices and inflation exceeding wage growth. This weakened position for Ishiba's government could lead to legislative gridlock and impact future policy decisions, including those related to trade and the Bank of Japan's monetary policy.

JPY has been experiencing notable fluctuations, largely influenced by the recent election results and their potential implications for monetary policy:

Initial Yen Strength Post-Election: Following the weekend election results where Japan's ruling coalition lost its upper house majority, the Japanese Yen showed significant strength, gaining nearly 1% against the USD. This was somewhat counter-intuitive for some analysts who expected political uncertainty to be yen-negative.

However, technicall DRAGON ( GBPJPY) seem to make a correction after testing 200.000 line.

Closing below 197.000s will trigger a deeper bearish correction.

Good Luck!

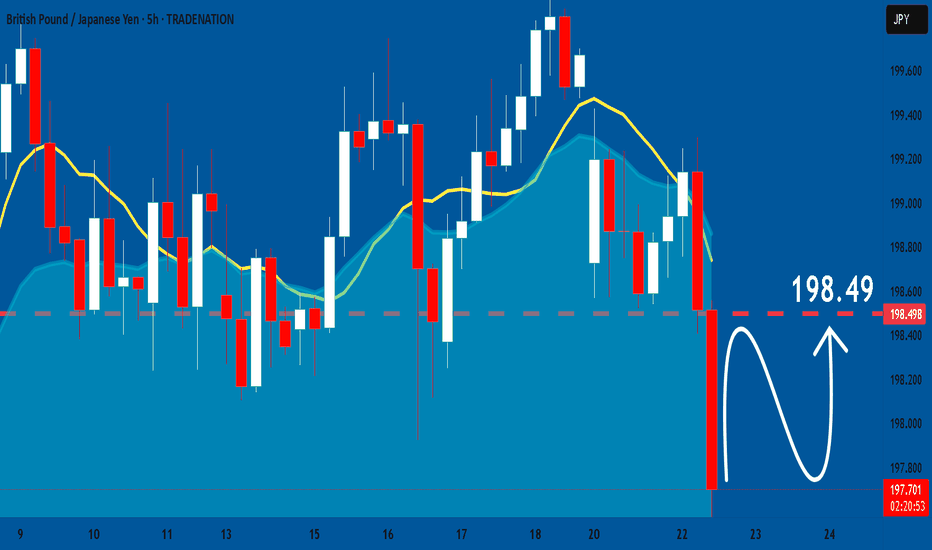

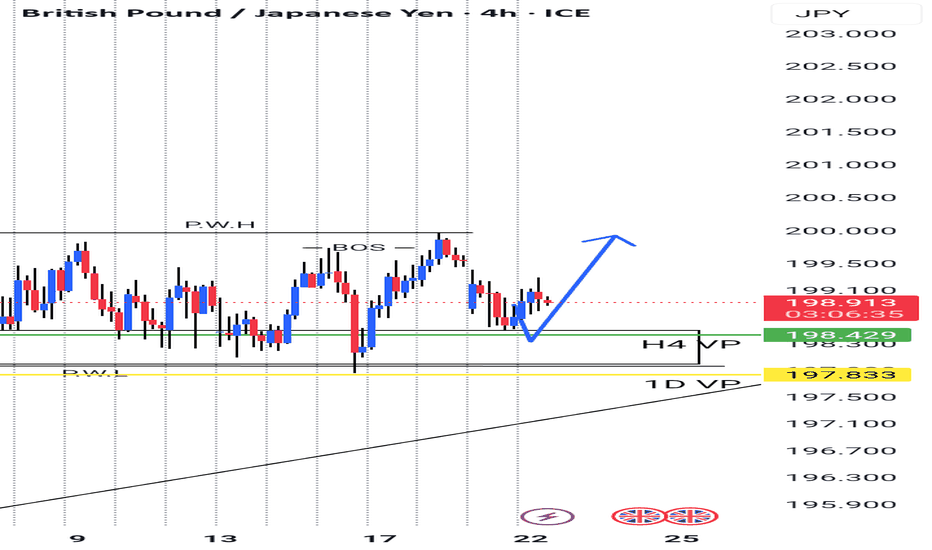

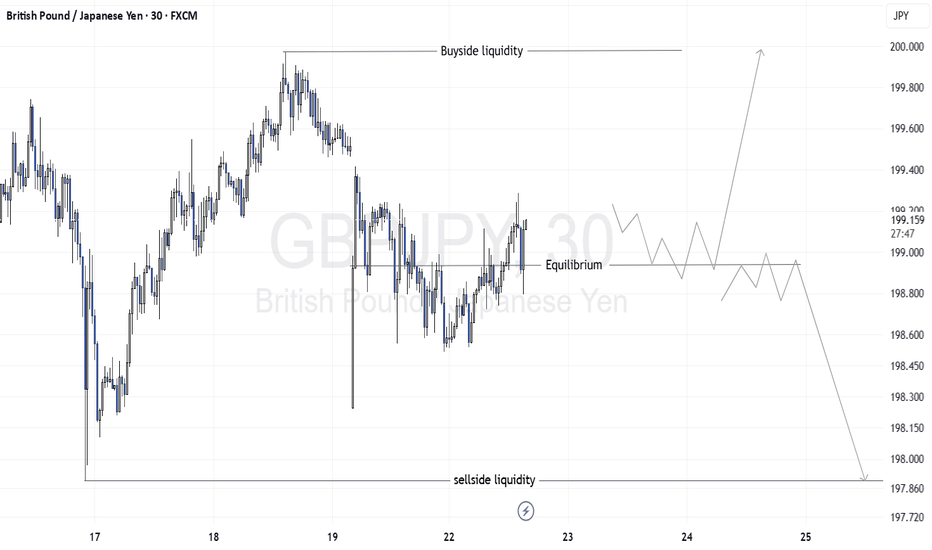

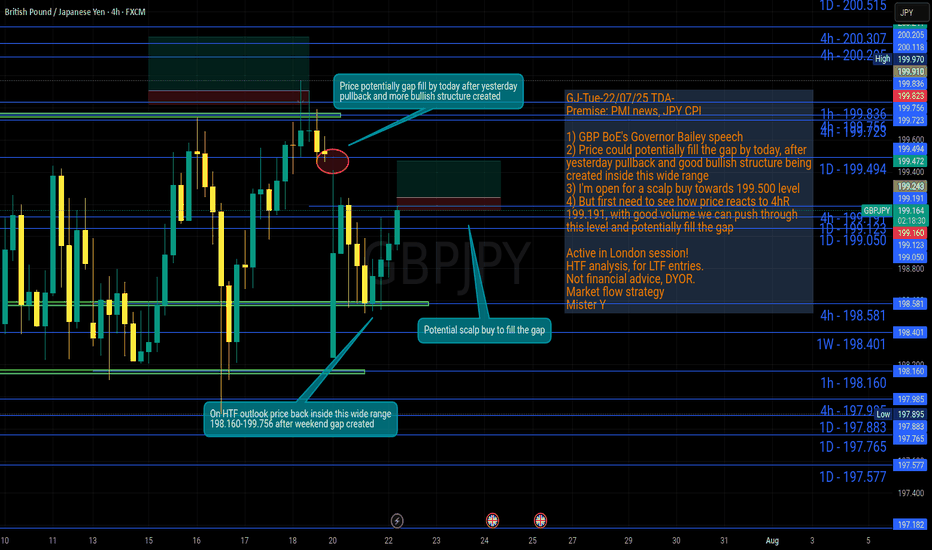

GJ-Tue-22/07/25 TDA-Potential scalp buy to fill the gap!Analysis done directly on the chart!

Weekend gaps in the majority of times (if not all the time) at some point

will be filled.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y