JPYNZD trade ideas

Bearish reversal?NZD/JPY is rising towards the pivot and could reverse to the 1st support.

Pivot: 87.25

1st Support: 85.57

1st Resistance: 88.39

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

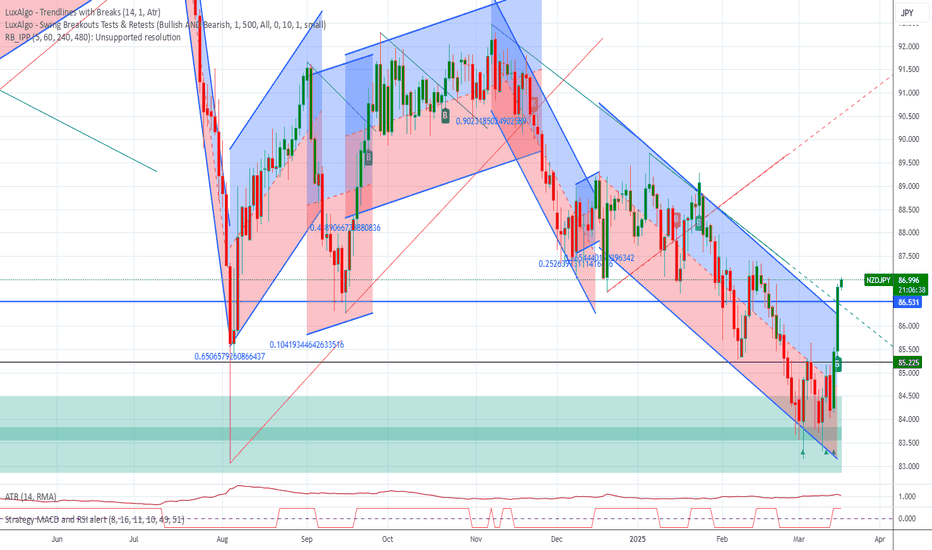

WHY NZDJPY IS BULLISH??? DETAILED ANALYSISNZDJPY is currently trading at 85.900, forming a descending channel pattern, signaling a potential breakout. This pattern often leads to bullish reversals, and once the price breaks above the resistance zone, we could see strong upside momentum toward the 90.000 target. A successful breakout with increased volume will confirm the bullish wave, leading to an anticipated gain of 300+ pips.

From a technical perspective, the pair is testing key resistance levels within the descending channel, and a breakout will align with major trend continuation signals. If buyers maintain control, we could see the price rally towards 87.500 first, followed by a push toward 90.000 psychological resistance. Traders should watch for confirmation signals such as strong bullish candles, RSI divergence, and volume spikes to validate the breakout.

On the fundamental side, market sentiment and risk appetite are favoring jpy pairs, with the New Zealand dollar benefiting from commodity price stability and global risk-on sentiment. Meanwhile, the Bank of Japan's cautious stance on monetary tightening keeps jpy under pressure, further supporting upside potential for nzdjpy. If risk sentiment remains positive, the pair could maintain its bullish outlook, making the 90.000 target highly achievable.

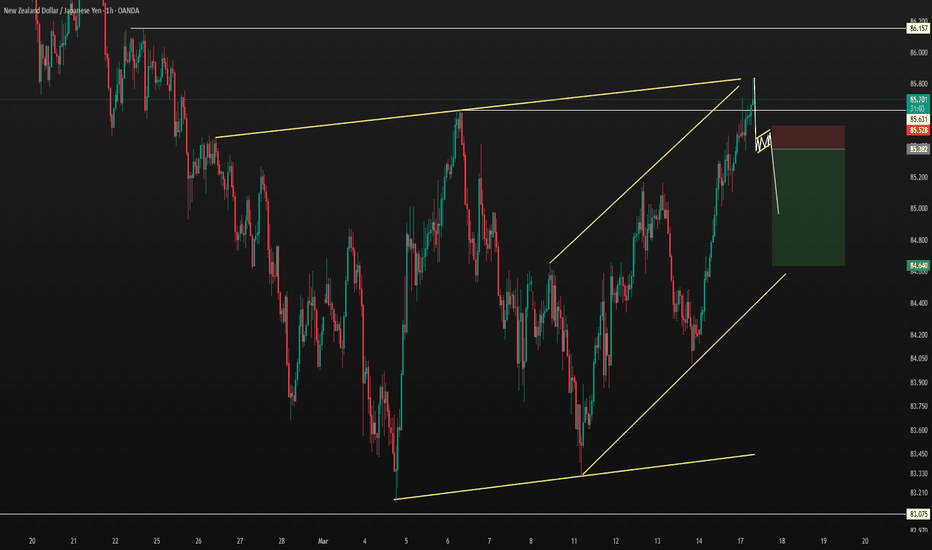

NZDJPY FORECASTTraders! Welcome back to the series of our weekly forecasting videos and today we have NZDJPY on watch. This pair looks good as we have seen the price opened with the completion of three touches structure. So when I look at the higher timeframe especially the 4H itself I see every is good. I wait for the clear price signal that it is going to drop. So let's watch this with a close eye and see what will be happening,

Wishing you a good trading day and GOD bless you!

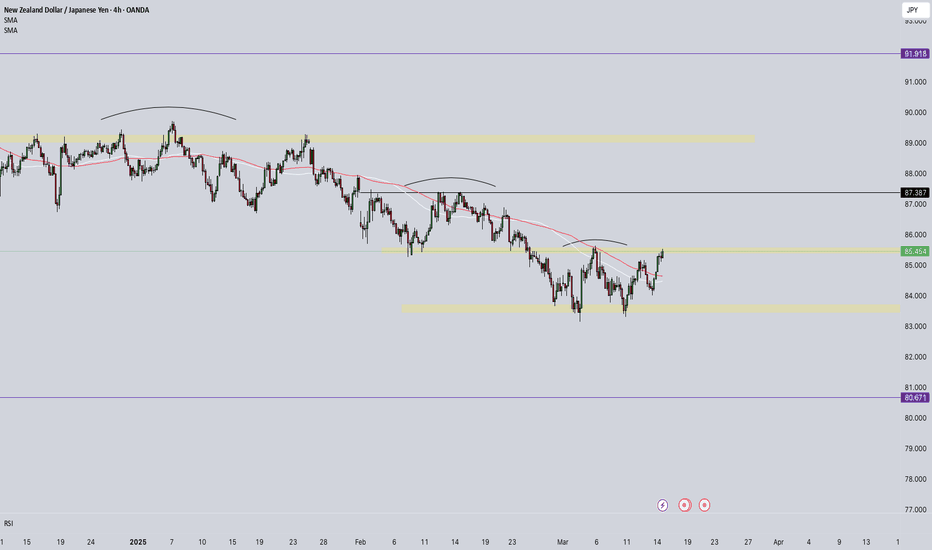

POSSIBLE SELL SET UP ON NZDJPYThe NZDJPY pair is currently experiencing a mix of trends. On the one hand, it's reached a significant support zone, which has previously acted as a key demand zone, increasing the likelihood of a bounce if buyers step in . This support zone is highlighted by previous price reactions and strong buying interest.

On the other hand, the pair is also exhibiting signs of sustained bearish momentum, with a series of lower highs and lower lows on the 4-hour timeframe . This downtrend structure suggests that the pair may continue to decline.

NZDJPY Technical Analysis! SELL!

My dear friends,

NZDJPY looks like it will make a good move, and here are the details:

The market is trading on 85.384 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 84.692

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

———————————

WISH YOU ALL LUCK

NZD-JPY Bearish Bias! Sell!

Hello,Traders!

NZD-JPY is about to

Retest a horizontal

Resistance level of 85.647

And as it is a strong level

A local bearish correction

Is to be expected

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Brace Yourselves... NZDJPY Bears Are Warming Up!NZDJPY is setting up for a potential short opportunity, and I’m watching it like a hawk! 👀 With New Zealand diving into a recession, RBNZ cutting rates like it’s Black Friday, and Japan’s economy flexing its resilience, the fundamental bias leans bearish. Technically, we’ve got a trendline break, resistance retest, and a possible liquidity grab before the drop. If the setup plays out, expect some fireworks to the downside! 🎇

🔥 Trade Idea: Looking for a break + retest confirmation before pulling the trigger. If JPY holds firm and NZD keeps struggling, this could be a clean ride south. Buckle up! 🚀

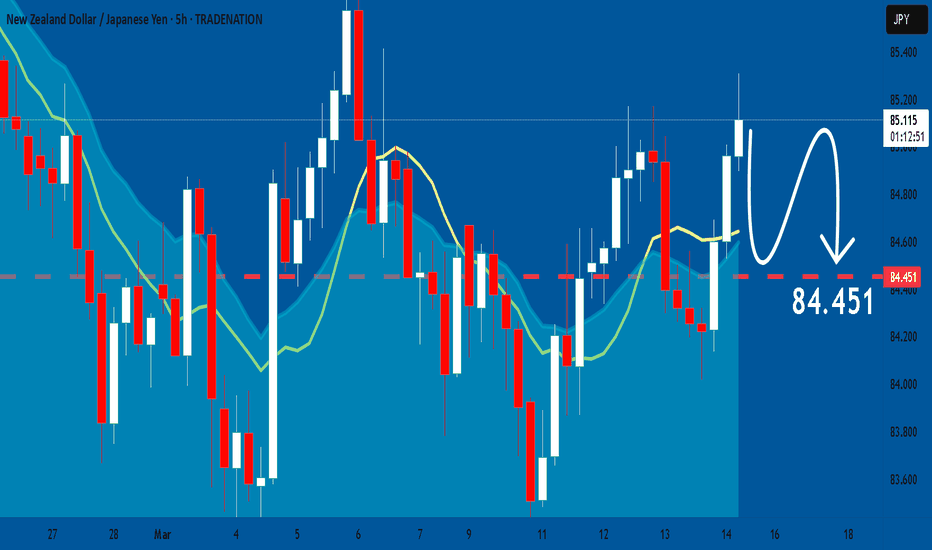

NZDJPY What Next? SELL

My dear friends,

Please, find my technical outlook for NZDJPY below:

The price is coiling around a solid key level - 84.950

Bias - Bearish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clearsell, giving a perfect indicators' convergence.

Goal - 84.452

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

———————————

WISH YOU ALL LUCK

NZD_JPY SHORT SIGNAL|

✅EUR_USD has been growing recently

And the pair seems locally overbought

So as the pair is approaching a horizontal resistance of 85.6800

We can enter a short trade

At 85.3890 with the Target of 84.9110

And the Stop Loss of 85.7260

Just above the resistance

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

NZDJPY: Expecting Bearish Movement! Here is Why:

The analysis of the NZDJPY chart clearly shows us that the pair is finally about to tank due to the rising pressure from the sellers.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

NZD/JPY BEARS ARE STRONG HERE|SHORT

NZDJPY SIGNAL

Trade Direction: short

Entry Level: 85.167

Target Level: 84.161

Stop Loss: 85.834

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 9h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Bearish drop?NZD/JPY has reacted off the pivot and could drop to the 1st support.

Pivot: 86.22

1st Support: 83.43

1st Resistance: 86.10

Risk Warning:

Trading Forex and CFDs carries a high level of risk to your capital and you should only trade with money you can afford to lose. Trading Forex and CFDs may not be suitable for all investors, so please ensure that you fully understand the risks involved and seek independent advice if necessary.

Disclaimer:

The above opinions given constitute general market commentary, and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended only to be informative, is not an advice nor a recommendation, nor research, or a record of our trading prices, or an offer of, or solicitation for a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation and needs of any specific person who may receive it. Please be aware, that past performance is not a reliable indicator of future performance and/or results. Past Performance or Forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast or any information supplied by any third-party.

Bullish bounce off overlap support?NZD/JPY has bounced off the support level which is an overlap support and could rise from this level to our take profit.

Entry: 84.57

Why we like it:

There is an overlap support level.

Stop loss: 83.93

Why we like it:

There is a pullback support level that is slightly below the 61.8% Fibonacci retracement.

Take profit: 85.61

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

NZD JPY🚀 NZD/JPY Trade Setup Alert! 📊🔥

Hey T.Y.L.A. family! 🎯 This week, we’ve got a 🔥 high-probability setup on NZD/JPY that’s looking primed for action! Let’s break it down:

📌 Entry: 84.848

🛑 Stop Loss: 84.478 (Safe risk management!)

🎯 Take Profit: 86.447 (Targeting strong momentum!)

📈 The market is showing solid structure, and we’re capitalizing on this move with precision. Stick to the plan, trust the process, and let’s stack those gains! 💰🔥

💬 Drop a comment if you’re in & let’s win together! 🚀 #TYLA #ForexSetup #CopyTrade #WeTradeSmart