NZD/JPY – 4H Technical and Fundamental AnalysisNZD/JPY – 4H Technical and Fundamental Analysis

NZD/JPY remains supported fundamentally by a hawkish stance from the Reserve Bank of New Zealand, which recently held rates at 5.50%, emphasizing ongoing caution around inflation. This tone continues to favor NZD strength in the short to medium term.

Adding to that, seasonal trends also support bullish momentum July and August have historically been weak for the Japanese yen and relatively strong for the New Zealand dollar, aligning with the current upside bias.

On our Technical Side

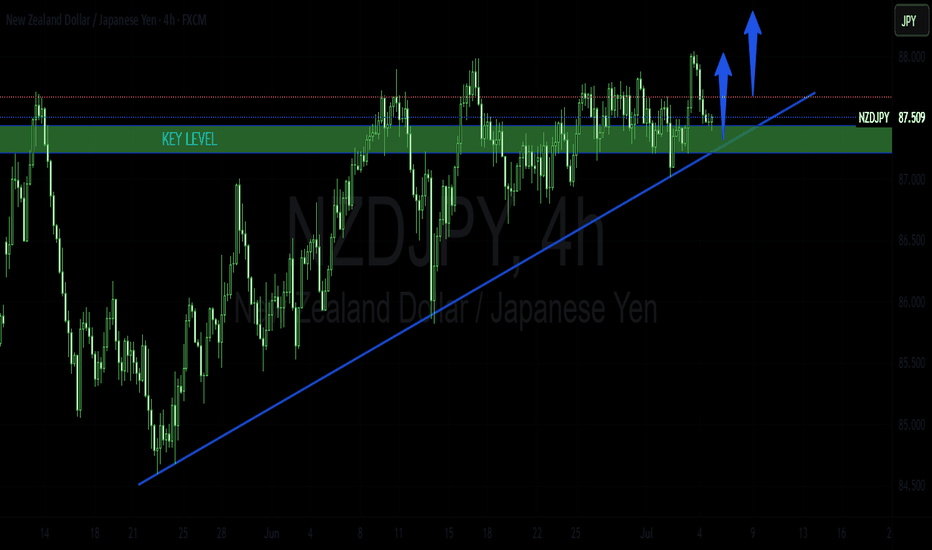

NZD/JPY recently broke above a minor key resistance at 87.900, following a multi-week period of consolidation. This breakout signaled renewed buyer interest and a potential shift into a bullish continuation phase.

After the breakout, price entered a clear accumulation zone, where early buyers positioned themselves just above support. However, smart money triggered a stop-loss hunt below 87.900, targeting liquidity trapped beneath that key level.

This liquidity grab formed a Clear liquidity within the liquidity zone, creating a cleaner setup for long opportunities. Price is now heading back toward the previous resistance now flipped into a key support level.

📍 Buy Limit Setup:

Buy Limit Entry: 88.030

Stop Loss: 87.570 (below liquidity zone)

Take Profit: 89.250 (next minor resistance zone)

📌 Disclaimer:

This is not financial advice. Always wait for proper confirmation before executing trades. Manage risk wisely and trade what you see—not what you feel.

JPYNZD trade ideas

NZDJPY Breakout: Bulls take charge above key resistanceNZDJPY has broken out of a textbook ascending triangle on the daily time frame, signaling strong bullish momentum. Price is pushing higher with a solid structure and supportive RSI levels, leaving room for continuation. A breakout retest can offer a high-probability entry.

NZDJPY Long Setup: Institutional Flow Signals Upside to 89.690🗓 Seasonal Outlook

- JPY Seasonal Weakness: Historical trends show July and August tend to be bearish months for the Japanese Yen, reinforcing weakness across JPY pairs.

- NZD Seasonal Strength: July typically supports bullish momentum for NZD, while August may present challenges. However, strength in NZD versus relative JPY softness suggests continued upside potential into early August.

💼 Institutional Positioning (COT Analysis)

- JPY: Commercial traders remain net short, suggesting expectations of further depreciation.

- NZD: Also shows commercial net shorts, yet the price structure aligns more with bullish continuation, hinting at speculative flow favoring NZD upside.

🧠 Technical Analysis

- Liquidity Dynamics:

- Price has cleared multiple buy-side liquidity levels near prior swing highs.

- Sell-side zones continue to hold, indicating strong bullish intent and failed bearish follow-through.

- Market Structure:

- Higher lows and sustained bullish reactions post-liquidity sweeps reinforce an upward trajectory.

- Current structure suggests accumulation and breakout patterns toward the proposed target.

🎯 Target Projection: 89.690

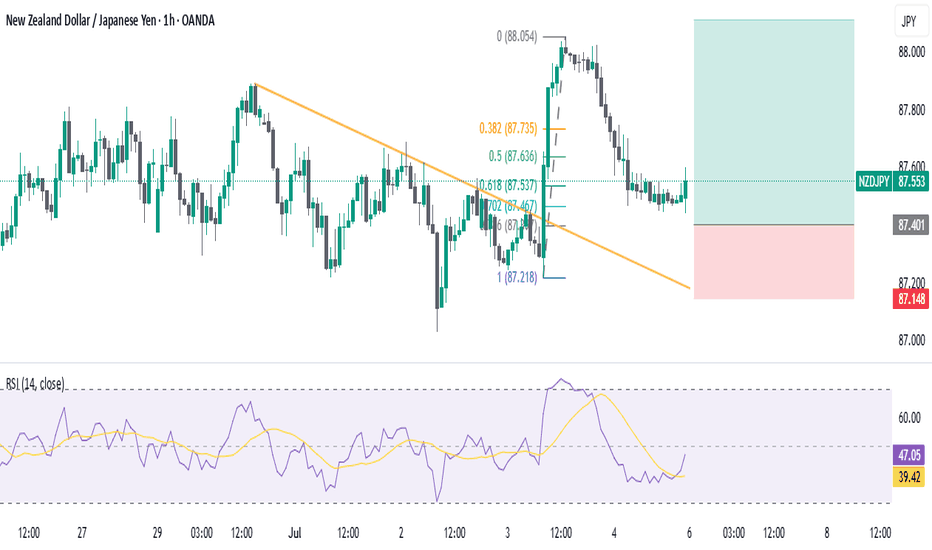

NZDJPY TRADE IDEANzdjpy also seems to be in an upward motion. lets see how it plays out, as we await a pullback to our fib level to the the trade to the upside.

its now a waiting game.

Trade can be taken and managed properly using the parameters shown in the image above.

please, this is no financial advice

nzdjpy📈 The trend is clearly bullish, with the week starting strong and Friday closing above the 22-period daily moving average.

Now it’s just a matter of waiting for a correction to enter at a more interesting price zone. Personally, I believe the price has a high probability of visiting the two marked areas — roughly a 75% and 60% chance, respectively.

If you're looking to manage a tighter stop-loss and aim for a risk-to-reward ratio around 1:5, this setup could be for you. 🔍

⚠️ Always remember: risk no more than 0.5% of your account per trade.

#NZDJPY #SwingTrade #Forex #RiskManagement #TradingView

NZD/JPY: Bearish Wedge Before RBNZ CatalystThis is a high-conviction trade idea for NZD/JPY , where a perfect storm of technical and fundamental factors is aligning for a significant short opportunity. The setup is clean, the reasoning is strong, and we have a clear catalyst on the horizon. 🚀

Fundamental Analysis 🌪️

The macro picture is the primary driver here, creating a powerful bearish case.

1️⃣ Monetary Policy Divergence (🇳🇿 vs 🇯🇵): This is the core engine of the trade. The Reserve Bank of New Zealand (RBNZ) is dovish, signaling rate cuts amid a fragile domestic economy. In stark contrast, the Bank of Japan (BoJ) is hawkish, having started a historic policy normalization to combat persistent inflation. This fundamental clash is strongly bearish for NZD/JPY.

2️⃣ Risk-Off Catalyst (🇺🇸): The market is nervous ahead of the July 9th US tariff deadline . This uncertainty is creating a classic "risk-off" environment, which typically strengthens the safe-haven JPY and weakens risk-sensitive currencies like the NZD.

3️⃣ The RBNZ Decision (🏦): The main event on July 9. The market expects a "dovish hold," meaning even if rates are unchanged, the forward guidance will likely be very cautious, highlighting economic risks and signaling future cuts. This is the catalyst that could trigger the sell-off.

Technical Analysis 📉

The 4H chart provides crystal-clear confirmation of the fundamental weakness.

1️⃣ Bearish Rising Wedge: Price is being squeezed into a classic bearish reversal pattern. This shows that buying pressure is exhausted, and the market is preparing for a move to the downside.

2️⃣ Key Resistance Zone: The wedge is pushing directly into a heavy supply zone between 87.80 and 88.00 . This area has acted as a firm brick wall 🧱, rejecting multiple attempts to move higher.

3️⃣ RSI Momentum: The RSI below the chart confirms the weakening momentum. It's failing to show strong bullish power, which supports the price action and signals that the uptrend is running out of steam. 💨

The Trade Plan 🎯

Based on this analysis, the plan is to enter with a limit order to get an optimal entry price on a potential final spike into resistance.

Direction: Short (Sell) 📉

Order Type: Limit Sell

Entry: 87.80 📍

Stop Loss: 88.40 🛡️

Take Profit: 86.00 💰

Risk/Reward Ratio: 1:3 ⭐⭐⭐

This setup presents a rare confluence of fundamental divergence, technical weakness, and a clear catalyst.

Trade safe and manage your risk.

NZDJPY- Buy SetupNZDJPY 1H – Price has broken above a descending trendline and is showing bullish momentum. RSI is recovering from near-oversold levels, supporting the bullish bias. This entry aligns with the higher time frame trend, as NZDJPY remains bullish on both the 4H and Daily charts. Trade setup targets the continuation of the overall uptrend with a favorable risk-reward.

NZDJPY is in an ascending triangle?Looking at the technical picture, FX_IDC:NZDJPY is in an ascending triangle formation. According to the TA rules, such patterns tend to break to the upside, but a confirmation break is still needed. Let's dig in.

MARKETSCOM:NZDJPY

Let us know what you think in the comments below.

Thank you.

77.3% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Past performance is not necessarily indicative of future results. The value of investments may fall as well as rise and the investor may not get back the amount initially invested. This content is not intended for nor applicable to residents of the UK. Cryptocurrency CFDs and spread bets are restricted in the UK for all retail clients.

Trade closed manually. Plus USD short 'anticipation' trade? I have closed yesterday's NZD JPY trade for a small profit of +0.6. (to avoid NFP risk).

With an early close today due to independence day tomorrow, it's debatable whether there will be a post NFP opportunity.

I do think there is a case to say a pre event USD short 'anticipation' trade is a viable option. Something like an AUD or EUR USD - buy stop order a few minutes before the release. The reasoning being that the consensus is for a below forecast number, which would compound USD weakness.

The risk being NFP is particularly volatile and any triggered trade could whipsaw as the market digests the numbers.

Personally, it's not a trade I'll be attempting, I'm just saying I think it's a reasonable idea.

Wishing you a lovely weekend, today I'll be designated photographer as Michelle graduates her PGCE.

Weekly Review to follow, please feel free to offer thoughts or questions:

NZD JPY long NZD JPY long .. As discussed this morning, I feel the environment supports a 'risk on' trade. Today's US data hasn't altered my view.

I'm leaving the USD alone due to being wary of pre NFP profit taking.

Its a 20 pip stop loss with 30 pip profit target. The risk to the trade is negative sentiment or USD liquidity if dollar weakness returns.

I will close the trade before NFP if it's ongoing.

*Arguably the GBP has been a 'catalyst short' opportunity today. But I feel like I'm late to the party on that one.

Please feel free to offer thoughts or questions:

NZDJPY to find sellers at market price?NZDJPY - 24h expiry

Trading has been mixed and volatile.

Price action looks to be forming a top.

We look for a temporary move higher.

Preferred trade is to sell into rallies.

Bespoke resistance is located at 87.80.

We look to Sell at 87.80 (stop at 88.00)

Our profit targets will be 87.00 and 86.85

Resistance: 87.80 / 88.00 / 88.25

Support: 87.20 / 87.00 / 86.75

Risk Disclaimer

The trade ideas beyond this page are for informational purposes only and do not constitute investment advice or a solicitation to trade. This information is provided by Signal Centre, a third-party unaffiliated with OANDA, and is intended for general circulation only. OANDA does not guarantee the accuracy of this information and assumes no responsibilities for the information provided by the third party. The information does not take into account the specific investment objectives, financial situation, or particular needs of any particular person. You should take into account your specific investment objectives, financial situation, and particular needs before making a commitment to trade, including seeking advice from an independent financial adviser regarding the suitability of the investment, under a separate engagement, as you deem fit.

You accept that you assume all risks in independently viewing the contents and selecting a chosen strategy.

Where the research is distributed in Singapore to a person who is not an Accredited Investor, Expert Investor or an Institutional Investor, Oanda Asia Pacific Pte Ltd (“OAP“) accepts legal responsibility for the contents of the report to such persons only to the extent required by law. Singapore customers should contact OAP at 6579 8289 for matters arising from, or in connection with, the information/research distributed.

NZD_JPY WAIT FOR BREAKOUT|LONG|

✅NZD_JPY is trading in an

Uptrend and the pair has formed

A bullish triangle pattern

And we are bullish biased

So IF we see a bullish breakout

It will be our signal that

A bullish continuation is

Likely and we will be

Able to enter a long trade

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

NZDJPY Technical + Fundamental Short Alignment = Short SetupToday, I want to review the NZDJPY ( OANDA:NZDJPY ) pair short position from a fundamental and technical perspective . It seems to be in a good zone for a short position.

Do you agree with me?

----------------------------------------

First, let's look at the fundamentals of NZDJPY.

New Zealand (RBNZ):

The Reserve Bank of New Zealand cut the OCR by 25bps in May and hinted at further easing if inflation continues to cool. Recent CPI data has shown clear disinflation trends, increasing the likelihood of more rate cuts in the second half of 2025. Consumer confidence is also declining, and retail sales have been weaker than expected.

Japan (BoJ):

The Bank of Japan is under growing pressure to tighten monetary policy. Inflation remains above 2%, and market expectations for a rate hike later this year are building. Any shift from ultra-loose policy supports JPY strength, especially against weaker yielders like NZD.

Macro Summary:

Diverging monetary policies: RBNZ easing, BoJ possibly tightening.

NZD weakened by soft data, JPY strengthened by policy expectations.

Risk sentiment is currently neutral-to-negative, favoring safe-haven JPY.

Conclusion:

Short NZDJPY is fundamentally justified. The pair aligns with macro forces: NZD is pressured by rate cuts and weak growth, while JPY is poised to strengthen with upcoming policy shifts.

----------------------------------------

Now let's take a look at the NZDJPY chart on the 4-hour time frame .

NZDJPY is currently trading near the Potential Reversal Zone(PRZ) .

In terms of classic technical analysis , it appears that NZDJPY has successfully formed a Rising Wedge Pattern .

Also, we can see the Regular Divergence(RD-) between Consecutive Peaks.

Based on the above explanation , I expect NZDJPY to drop to at least 87.159 JPY if the lower line of the Rising Wedge Pattern and the Support zone(86.50 JPY-87.00 JPY) are broken, the second target could be 86.043 JPY .

Note: Stop Loss(SL): 88.378 JPY

Please respect each other's ideas and express them politely if you agree or disagree.

New Zealand Dollar/ Japanese Yen Analyze (NZDJPY), 4-hour time frame.

Be sure to follow the updated ideas.

Do not forget to put a Stop loss for your positions (For every position you want to open).

Please follow your strategy and updates; this is just my Idea, and I will gladly see your ideas in this post.

Please do not forget the ✅' like '✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

"(NZD/JPY) Kiwi-Yen Bandit Trade: Steal 200+ Pips This Week!"🚨 NZD/JPY Bank Heist: Loot the Kiwi-Yen Rally Before the Cops Arrive!

🌟Hola! Kia ora! Konnichiwa! Hello, thieves! 🌟

Attention all market bandits & profit pirates! 🏴☠️💰

Your favorite 🔥Thief Trading Crew🔥 is back with another high-stakes forex robbery—this time targeting the NZD/JPY "Kiwi vs Yen" vault!

🔓 The Master Plan:

Long entry = Our golden key to the bank.

Target: The high-risk Yellow ATR line (where traps lurk, but so do MASSIVE profits!).

Danger zone: Overbought signals, bearish ambushes, fakeouts—but we steal smarter!

📈 Entry Point:

"Vault doors cracked open—swipe those bullish gains NOW!"

👉 Pro thief move: Set buy limits near 15-30min swing lows/highs for sneaky pullback entries.

🛑 Stop Loss (Escape Route):

Thief SL: Hide below the 4H moving average (85.800).

Adjust based on your risk appetite & loot size.

🎯 Take Profit: 88.500 (Time to vanish with the cash!)

⚡ Scalpers’ Corner:

Only scalp LONG—no bearish bets!

Big stacks? Raid the market now.

Small budget? Join swing traders & execute the heist slow & steady.

Trailing SL = Your getaway driver. 🚗💨

💡 Why NZD/JPY?

Bullish momentum fueled by:

Fundamentals (COT data, macro trends)

Market sentiment & intermarket flows (Full analysis in bi0 linkks! 🔗👉👉👉)

⚠️ Heist Alert! News = Police sirens! 📢🚨

Avoid new trades during high-impact news.

Trailing stops = Your invisibility cloak.

💖 Support the Crew!

SMASH THAT BOOST BUTTON! 💥

Help us dominate the charts & loot daily with the Thief Trading Style! 💰🔥

Next heist coming soon… Stay sharp, thieves! 😎🔪