Our opinion on the current state of APHAlphamin (APH) is a tin mining and exploration company operating out of Mauritius. Its primary asset is just over 80% of Alphamin Bisie Mining which has a tin mine in the DRC. The company claims that it is the best tin ore body in the world. In a report for the year to 31st December 2022 the company

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1 ZAR

880.75 M ZAR

5.38 B ZAR

528.42 M

About ALPHAMIN RES CORP

Sector

Industry

CEO

Maritz B. Smith

Website

Headquarters

Grand Baie

Founded

1981

ISIN

MU0456S00006

FIGI

BBG00JDT3DB6

Alphamin Resources Corp. engages in the acquisition, exploration, and development of mineral resource properties. It holds interest in the Bisie Tin project in Democratic Republic of Congo. The company was founded on August 12, 1981 and is headquartered in Grand Baie, Mauritius.

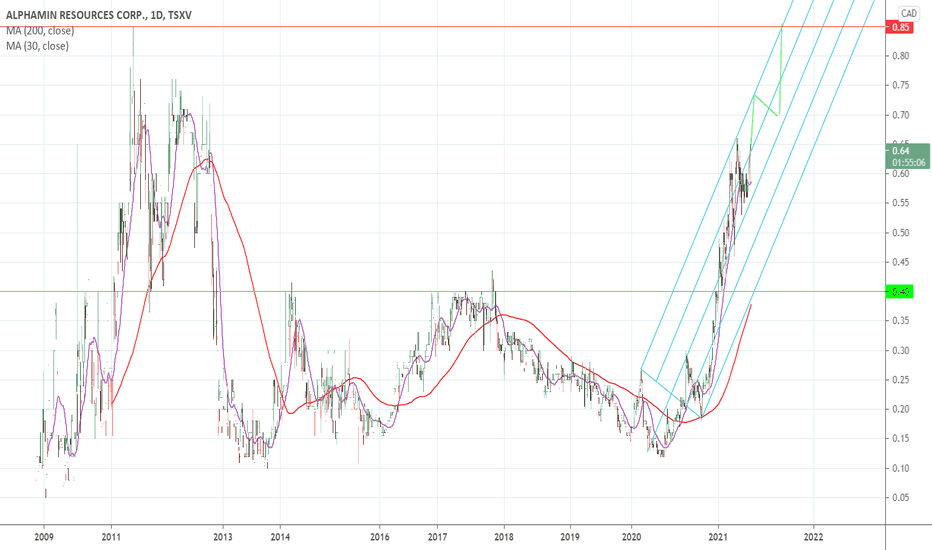

Alphamin Resources C&H and waiting for a brim break to R18.78 Cup and Handle is forming with Alphamin Resources.

We need the price to break above the Brim level before we action this.

21> 7 Price >200 - Mixed

RSI>50 - Bull divergence

Target R18.78

CONCERNS:

Price action shows an unhealthy chart - Volatile candles.

Sideways consolidation for extended period

Alphamin: China risk on tradeLower volume than when it made its run (peeking out sometime when tin reached 50k

Cup & Handle maybe forming

50ma crossed the 200 day

tin price gone from 17k-(in the november to 32k as of today) with talk of china re-opening! One of the most profitable mines on earth

youtu.be

When will someone take

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Related stocks

Frequently Asked Questions

The current price of APH is 1,090 ZAC — it has decreased by −4.72% in the past 24 hours. Watch ALPHAMIN RESOURCES CORP stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on JSE exchange ALPHAMIN RESOURCES CORP stocks are traded under the ticker APH.

APH stock has fallen by −5.22% compared to the previous week, the month change is a 36.25% rise, over the last year ALPHAMIN RESOURCES CORP has showed a −29.63% decrease.

We've gathered analysts' opinions on ALPHAMIN RESOURCES CORP future price: according to them, APH price has a max estimate of 2,704.37 ZAC and a min estimate of 2,704.37 ZAC. Watch APH chart and read a more detailed ALPHAMIN RESOURCES CORP stock forecast: see what analysts think of ALPHAMIN RESOURCES CORP and suggest that you do with its stocks.

APH stock is 11.73% volatile and has beta coefficient of 0.64. Track ALPHAMIN RESOURCES CORP stock price on the chart and check out the list of the most volatile stocks — is ALPHAMIN RESOURCES CORP there?

Today ALPHAMIN RESOURCES CORP has the market capitalization of 14.48 B, it has increased by 9.28% over the last week.

Yes, you can track ALPHAMIN RESOURCES CORP financials in yearly and quarterly reports right on TradingView.

ALPHAMIN RESOURCES CORP is going to release the next earnings report on Apr 30, 2025. Keep track of upcoming events with our Earnings Calendar.

APH net income for the last quarter is 575.49 M ZAR, while the quarter before that showed 331.12 M ZAR of net income which accounts for 73.80% change. Track more ALPHAMIN RESOURCES CORP financial stats to get the full picture.

Yes, APH dividends are paid semi-annually. The last dividend per share was 0.77 ZAR. As of today, Dividend Yield (TTM)% is 10.84%. Tracking ALPHAMIN RESOURCES CORP dividends might help you take more informed decisions.

ALPHAMIN RESOURCES CORP dividend yield was 6.67% in 2023, and payout ratio reached 120.00%. The year before the numbers were 6.90% and 58.08% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. ALPHAMIN RESOURCES CORP EBITDA is 3.81 B ZAR, and current EBITDA margin is 47.63%. See more stats in ALPHAMIN RESOURCES CORP financial statements.

Like other stocks, APH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade ALPHAMIN RESOURCES CORP stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So ALPHAMIN RESOURCES CORP technincal analysis shows the buy rating today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating ALPHAMIN RESOURCES CORP stock shows the sell signal. See more of ALPHAMIN RESOURCES CORP technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.