CML trade ideas

Coronations continues to break higher Coronation seems to be making up for spending quite some time in the box 3700c - 4400c.. The stock broke to the 4400c - 5100c box and quickly closed into the 5100c-5800c. I’m waiting for a confirmation, a close above the 5263c, then I will add into my position with a stop half way through the 4400c-5100c box.

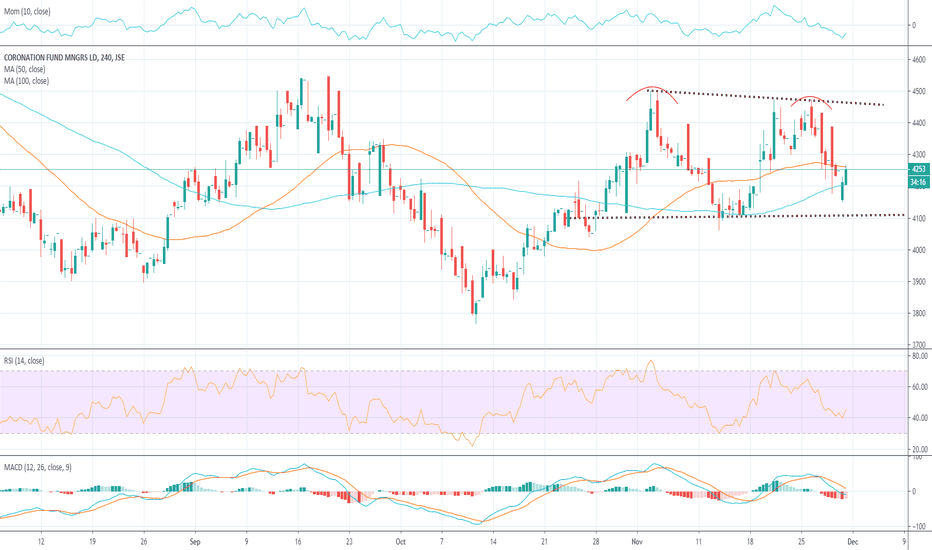

#JSECML - Retesting breakout level - Coronation broke out of a channel consolidation and has come back to test the level...

- Price action is promising and i'm looking for a continued move up from here, possibly to R56.48 - R57.66

- A close below the 200 day moving average will be bearish

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

$JSECML Coronation entering a technical shorting areaCoronation Fund Managers (JSE:CML) held a massive level of horizontal support between R38 and R39 since the early weeks of 2019. After testing this level on numerous occasions, the bears finally got the final break in March this year, which pushed the stock as low as R25.00. Since bottoming out at around R25, the stock has spent the last couple of weeks consolidating these losses only to come back and retest the breakdown level. I fear that the amount of overhead supply waiting to get out above R39 will be just to much for bulls to get an easy win here. I would expect the stock to find resistance at the old support level and start to move lower. First target R33, if things get messy, it could even retest the previous lows at R25. Not a bad risk reward here, as you could try get in as close to R38 as possible, using a stop loss as a close above R39 or R40, and target R33 to take profit.

CML CML Coronation Fund Managers | With decline (risk) asset prices, the bigger picture technical setup of CML still appears shaky, with the price knocking on the door of R40 – a level which has held for 16 months (remember, persistence often breaks resistance). Additional risks include, pressure on management and performance fees, stagnant business confidence, country risk and possibly (related to the two aforementioned) ‘Eskom Bailout via Pensions’. The risk with betting on significant further downside on CML is that the current environment is seeing industry consolidation for example Jupiter/Merian, Franklin/Legg Mason and locally RECM/Counterpoint hence CML could also become a takeover target at the right price and you may not want to be caught short in the event that buyers come knocking.

Stop and smell the flowersCoronation has been on a slippery downward slope since December 2014. The reasons for this have been twofold. Firstly, valuations were extremely stretched (end of 2014), trading at a market capitalization (mkt cap) to Assets Under Management ( AUM ) percentage of close to 7%, while the average international ratio (for global Asset Managers) was trading at around 2%. Secondly, Coronation's growth prospects are questioned in a South African market, which has seen the entry of more competitors and the growth of a passive ( ETF ) market. At the current (mkt cap/AUM) ratio of 2.3%, Coronation is trading at it's cheapest levels in 5 years.

Add into this mix a Forward PE (Source: Thomson Reuters ) of 10.8 times and a Forward DY of 9.2%; then you get an opportunity in my view.

We can clearly see the Descending Triangle in the share price movement that developed since April, which was broken recently. Should we see a break and close above the R39 levels could see the share price seeking resistance only at the 50-day moving average at R41.50. My next target would be the top of the triangle (R44), with a break and close above these levels, being very bullish technivcally.

The share price currently finds itself in extreme oversold according to its 14-day RSI. It has also massively underperformed the $JALSH over rolling 12 month period.

Consensus target price (according to Thomson Reuters ) for Coronation is R41.50 but only covered by one analyst (Avior Capital Markets).

CML - Bid HeldWe may derive the following from the Weekly CML chart:

1. Price has respected our support zone (purple box) (see linked idea).

2. Price should in all probability continue to move higher, but a retest of the support is possible.

3. Monitor price action and wait for a good long opportunity.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.