MCG trade ideas

#JSEMCG - Multichoice Long IdeaLast week ended with a inside bar and we have opened the week on a bullish note.

Looking for support at these levels for a LONG trade towards R98

A solid break of R85 will trigger a short...

-- MANAGE YOUR RISK - -

Disclaimer: All ideas are my opinion and should not be taken as financial advice.

JSE:MCG

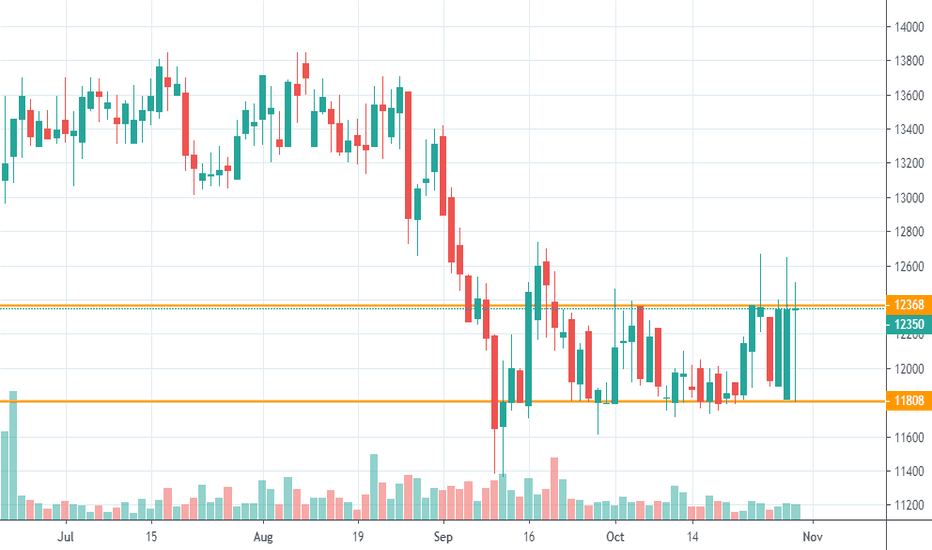

$JSEMCG DAILY Multichoice DAILY has been trading in a tight range for the last nearly two months between R118 and R123.50. The last two days it has traded over the whole range but has been unable to close above it. There is strong selling pressure around R123.50, seen by all the long wicks around this area. Will it break out or trade back to the bottom of the range?

Long opportunity MultichoiceJSE:MCG

Multichoice is particularly interesting, because the share hasn’t been trading in the market for a long enough. After being spun out of Naspers. The share found an area of value in the R90-R80 previously after trending down. Before bouncing off to the R110 levels. Since its retesting this level for the first time. I’m looking for a breakout of the rectangle. Targeting the R109-R110 levels.

Multchoice- Waiting for a kiss goodbyeIt has been one way down for this stock and quite frankly, the fundamentals don't support owning this share. Anyway, from a technical point of view, it looks to me like support is broken and any "relief rally" can be sold. I'd be looking to short at 97.00 or better for a target around 85.00. It looks really weak.

Multichoice retracement is in orderThe company announced a partnership with Netflix and Amazon Video. Seems like another HBO content deal. They also announced the introduction of a 'new' platform.

The support service is terrible and the various streaming platforms seem broken at best.

Recently the company has experienced continued declines in the number of DStv Premium and Compact Plus subscribers in South Africa.

I guess this is there response, lets see how streamers repond to 'new' products in the coming months.

A retracement is in order, at the very least.

JSE 30-Day challenge: Day #1 MCGToday morning I have the idea to start some high-risk/high return game. The main object to post one idea per each day for 30 days in a row.

Goals:

1. Buy stocks every day.

2. Keep balance at least of ZAR150.000 on 20 June

2. At least 30% of picked up stocks need to hit 25% profit gain.

Rules:

Only JSE stock exchange.

The initial budget is ZAR300.000

Limit per one trade from ZAR5.000 to ZAR10.000

Spend no more than 1 hour per day to buy any stock and publish the idea.

Last day to buy stocks - 20 May

Last day to sell stocks - 20 June

Log:

1st day is MCG ~9100

H&S Target reached and failed to confirm a break of support.JSE:MCG formed a Head & Shoulders pattern between March and December 2019, which played out nicely and reached it's target which perfectly coincided with the lowest low of 9031 from 6 March 2019. With yesterday's movement, it broke slightly lower, but retraced and failed to confirm with the close of the candle. Failing to confirm below this low could mean a possible upward move. I will wait for confirmation before entering a long position.

Another bullish retracement?We could be headed for another Bullish retracement. We had a bloodbath from 12 November to the yellow zone which is a support zone. There are buyers willing to defend price there. The steep fall naturally means we should have a retracement of some sort and the blue zone is a good candidate zone since its the approximate 50% retracement zone or rather the Kijun area. From there we monitor price but expect a another bearish impulse,this time to slice right through our yellow zone.

Entry: 1 position@ 11 726

SL: 11 450 (below our zone)

TP: 12 394 (slightly below the kijun)

Risk management as usual critical!

MULTI no CHOICE- MCGI haven't liked the stock on a fundamental basis but the technicals are starting to support a short trade. After that big spike on earnings (which was only strong due to exchange rates) last week, We are seeing the price drag lower accompanied by a momentum shift on the RSI. I expect this price to continue lower and lower. (but now I NEED a bounce to get in). I'm looking to get short at 127.00 for a target of 116.00. I'll place my stop at 132.80