WHL trade ideas

WHL - Potential Long SetupWe may derive the following from the Daily WHL chart:

1. Price has reversed slightly from the key resistance.

2. I am expecting price to come down to the rising trend line before moving up.

3. Monitor price action and wait for a good long opportunity.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

WHL - R60 Break Will Be RapidWe may derive the following from the Weekly WHL chart:

1. Price hasn't been able to break the upper weekly resistance (yet).

2. Price has come down a bit and may continue to do so before making a move higher.

3. Monitor carefully and wait for a good long opportunity.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

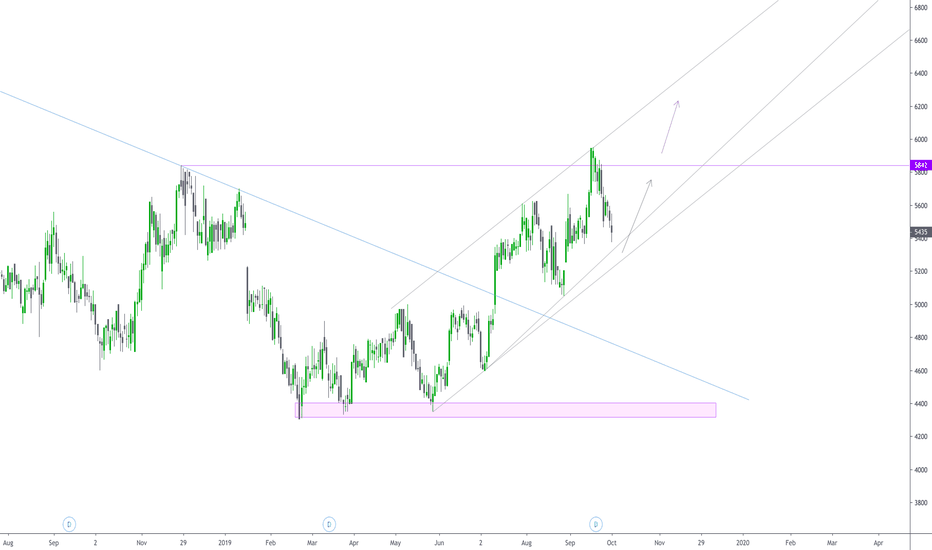

JSE:WHL | Bulls in the background suggest a buy at 5560Price ranged from early February this year all the way through to mid-July before breaking higher.

This extended period of accumulation which was followed up several bullish pushes higher suggests 6400 as a target.

We see price currently constrained in channel-type structure that looks likely to lead down to 5560 before the bulls really step in again.

I'm very interested in a buy at that level.

WHL - Almost at 1st TargetWe may derive the following from the Weekly WHL chart:

1. Price has almost reached our first target.

2. Price should in all probability test the first target / horizontal resistance.

3. Monitor price action and look out for further long opportunities.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.

WHL: look at that bearish divergence!Using the RSI to calculate bullish/bearish divergence conditions over multiple time frames (daily, weekly, monthly).

Divergence period used is 8 periods (Fibonacci number).

Bearish divergence is when the price is making higher highs, while the indicator (RSI) is making lower lows.

Indicates underlying weakness. Bulls are exhausted. Warning of a possible trend direction change from an uptrend to downtrend.

WHL - Good ProgressWe may derive the following from the Weekly WHL chart:

1. Price has been extremely bullish over the past two weeks.

2. A slight pullback may occur before another push higher.

3. I do foresee price reaching 58-60 ZAR p/s.

4. As always - maintain your risk.

Note: The views provided herein do not constitute financial advice.