Kaspa (KAS): Market Structure Break + Re-Test = Buy EntryKaspa looks good for the long haul here, with a 1:5 risk and reward ratio. There is nothing much to say, other than as long as we keep that current buy-side momentum, we are good for a long time here.

Ideal and final confirmation would be if we would form the break of structure near the $0.92 area.

Swallow Academy

KASUSDT trade ideas

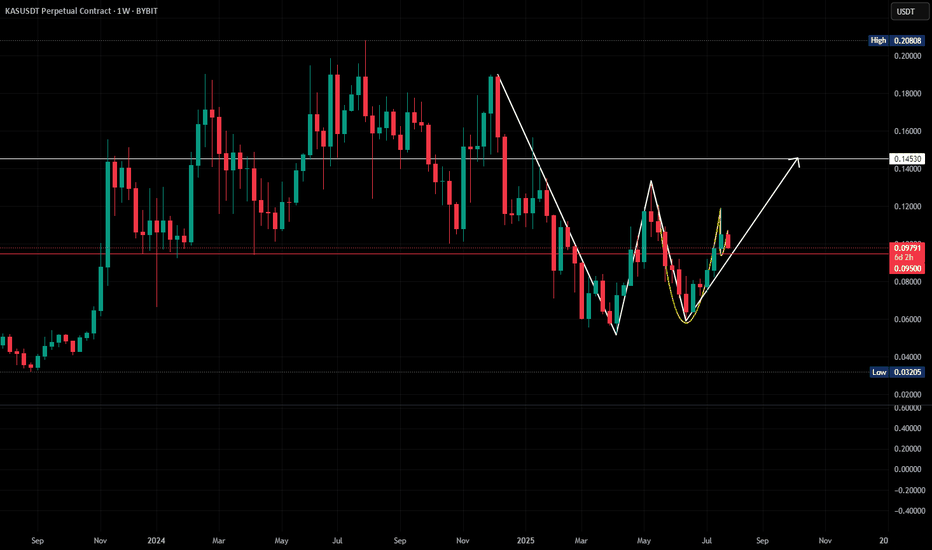

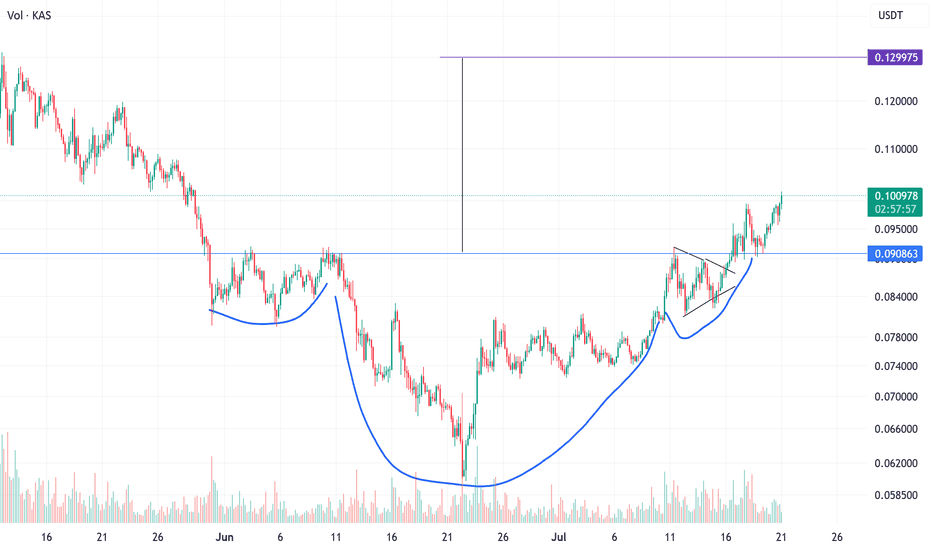

POTENTIAL LONG FOR KASPA (KAS)Timeframe: 1-Day and Weekly Charts

Current Price: $0.097946 (as at July 29, 2025)

Pattern Analysis:

Weekly Chart: Potential double bottom pattern with lows at $0.0527 and $0.0545, and neckline resistance at $0.098995. Current price of 0.0979 is testing this neckline. A breakout above $0.0990 with strong volume confirms the pattern, targeting $0.1453.

1-Day Chart: Cup and handle formation in progress. Handle resistance at ~$0.107196, support at ~$0.098851. A breakout above $0.107 could signal bullish continuation.

Trade Idea:

Entry: Enter long position on a confirmed breakout above $0.0990 (weekly neckline) with strong volume.

Target: $0.1453 (calculated from double bottom height added to neckline).

Stop Loss: Place below $0.0950 to limit downside risk.

Risk-Reward Ratio: ~1.95:1.

Action: Monitor for a close above $0.0990 with high volume to confirm entry.

If price falls below $0.0950, reassess for potential invalidation of the bullish setup.

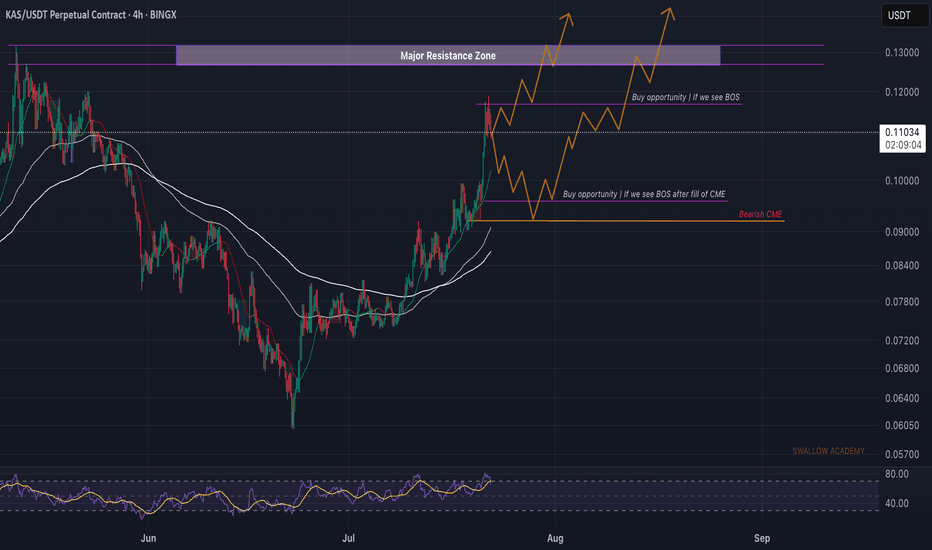

Kaspa (KAS): Looking For Break of Structure, Here or Near CMEKaspa looks pretty bearish right now, possibly going for that MSB currently, but despite that, as we are overall in a bullish trend, we are going to look for buyside movement and trading opportunities here.

So we detected 2 zones for us, one slightly above the current market price and another near the bearish CME, where on both sides we are going to look for a break of structures, which then would give us a good buying opportunity with a really good R:R ratio.

Swallow Academy

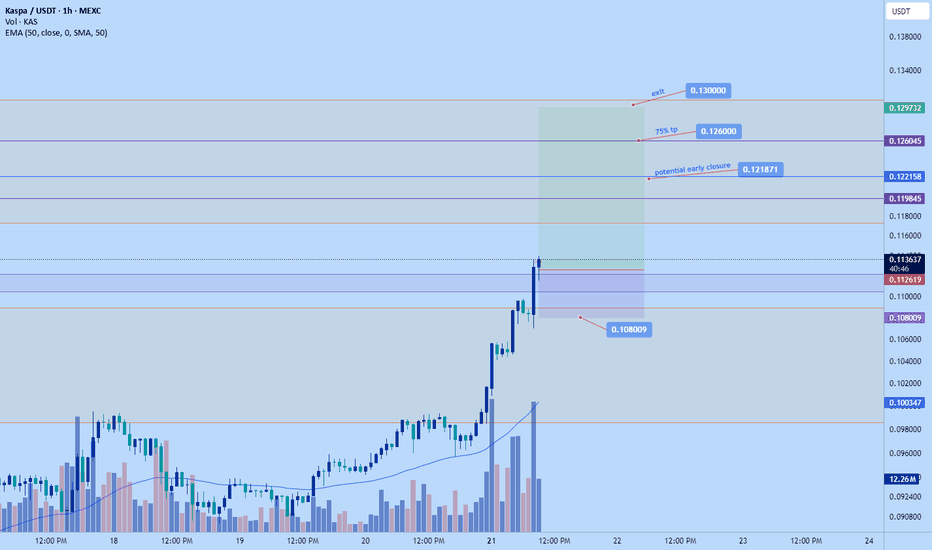

Kasusdt long to $0.13Just hopped into Kas long. Its been ripping today. Caught it late but still have good stop and the move hasn't reach target yet.

time sensitive

Sl: $0.108... can chance a tigher stoploss at your own risk. Its been pushing quite impulsively so might not correct big if happens.

Tps on chart

KASPA | Back in Trading RangeKASPA is back in the trading range, presenting a potential bullish setup after flipping the long-term resistance around $0.094 into support. This flip represents a significant technical milestone that often precedes major upward moves.

Key Observations:

Successfully converted major resistance at $0.094 into support

Price is consolidating within the established trading range

RSI showing neutral momentum, leaving room for upside movement

Ascending trendline provides additional support confluence

Trading Setup:

Entry: Now, or wait for trendline break with volume confirmation

Target: Upper resistance zone around $0.18935 (marked in blue)

Stop Loss: Below the prior resistance now turned support at $0.094

Risk Factors:

Overall crypto market sentiment remains a key factor

The projected pink arrow suggests significant upside potential if the breakout materializes, making this an interesting risk-reward setup for patient traders. The successful support flip increases the probability of reaching the upper target zone.

Last chance to reaccumulate Kaspa while it is below 10 cents?Second chance to accumulate CSE:KAS at below 10 cents after its correction down to 5 cents from its 20 cents ATH is coming to an end?

Previously, technicals looked great for CSE:KAS (and other ALTs too) with a breakout from a cup-&-handle pattern in July/Aug2024, but market says otherwise with gloomy economic report. >> For the small portion of capital assigned to trading crypto: I got stopped out from my (manually adjusted) trailing stoploss, with an approx. 6.8%avg loss from my BTC and ETH DCA spot injections into CSE:KAS from 10 cents all the way to 20 cents ATH.

For my long-term investment hold, I had bought from 2 cents all the way to almost ATH (at ~15 cents) and still holding and adding to it now as long as KAS is below. 10 cents. Had started accumulating aggressively again within the green zone, and probably gonna stop soon once KAS leaves the orange zone.

Last cycle, my main Altcoin investment focus was in ADA (POS and UTXO based chain based on academic research and peer-reviewed design), eventually selling most of other ALTs into ADA. This cycle, my personal investment focus is in Kaspa — and probably holding 15%(?) through the bear market correction after blow-off-top into the next cycle together with BTC and some ETH as well. Fingers crossed with regards to price; although the technology, decentralization ethos, and general fundamentals behind it is IMO extremely sound, and has a high probability (though not certain) to eventually establish itself to become one of the (if not THE) top L1s into the future.

———————————————

My reply re. the past YTD price performance of CSE:KAS , which I feel might be worth sharing here.

"For Kaspa, on the YTD timeframe, it has corrected ~50% down, after a ~10x rise from about 2 cents (when I first got in, in 2023) all the way to 20 cents. It is still an early tech about 3 years old and still not widely know; hence as an investment, it is definitely risky and high volatility is to be expected (not listed in high liquidity Tier1 exchanges yet), just like BTC in 2017 where I first bought at ~3kUSD, and a lot more significantly at 5k, and all the way to its ATH at 20kUSD, and stupidly held when it dropped all the way to 3kUSD, and kept on buying with a long-term view.

I view Kaspa in the same light as BTC (different from other cryptos), the only two that I will probably still hold a small but significant portion of, after the blow off top of this cycle due to its fundamentals that I am personally drawn towards -- e.g. POW but 6000x faster than BTC in bps, and ultimately will be 60000x faster once the DAGKnight protocol is implemented in 2026 (trilemma solved); protocol are based on peer-reviewed published research; fair-launched with no-VCs pre-allocation nor pre-mine; no central controlling figure; no DAG/Chain bloating due to implementation of pruning and where 0% TX-archival nodes are needed to maintain the security of mining, and are only necessary for explorers and institutions that intends to track TXs; (soon to come in Q4) Two Layer 2 implementations that will eventually be "Based-Zkrollups" (something that Ethereum planned to implement but was not feasible due to speed and cost issues, even after its POS-fork) -- where L2 TXs are instantly settled onto L1 without security compromising batching of TXs and delayed settlement that Eth-L2s currently does, and more.

But KAS is just a crypto project that I am personally interest in; and I am certainly not recommending anyone to buy as an investment, well unless they see something interesting in it too as I do. ;)"

Kaspa Bullish · The Wait is Over · Ready to GrowWe have a very interesting situation here with the Kaspa chart, KASUSDT. There is no going back. Once the bottom is in, you know the next logical step is a change of trend. It can take some time before the low settles; the low is process not a one-day event. But here it settled already and this is all we need to know that the bullish bias is fully confirmed. You can now enter KASUSDT with lev while resting easy.

Good evening my fellow Cryptocurrency trader, I hope you are having a wonderful day.

The first low happened 10-March and then a lower and final low 7-April, also a technical double-bottom. Here Kaspa produces a small reaction and grows 150%. Notice that growing 150% in 30 days is small in the Crypto-world. If you were trading conventional markets, you would have to wait 10 years to get 70% growth.

Anyway, the initial bullish reaction to confirm the end of the correction goes into retrace and 16-June (the week), 22-June specifically, the market produces a higher low. This is the final retrace before maximum growth. I mean, there will be retraces and corrections in the future but the wave that is about to start now will not be 150%, it can be much bigger and last a lot longer, this is the 2025 bull market bullish phase. It will be a major wave.

This is just a friendly reminder to let you know, you can go all-in.

Thanks a lot for your continued support.

You will be happy with the results.

Namaste.

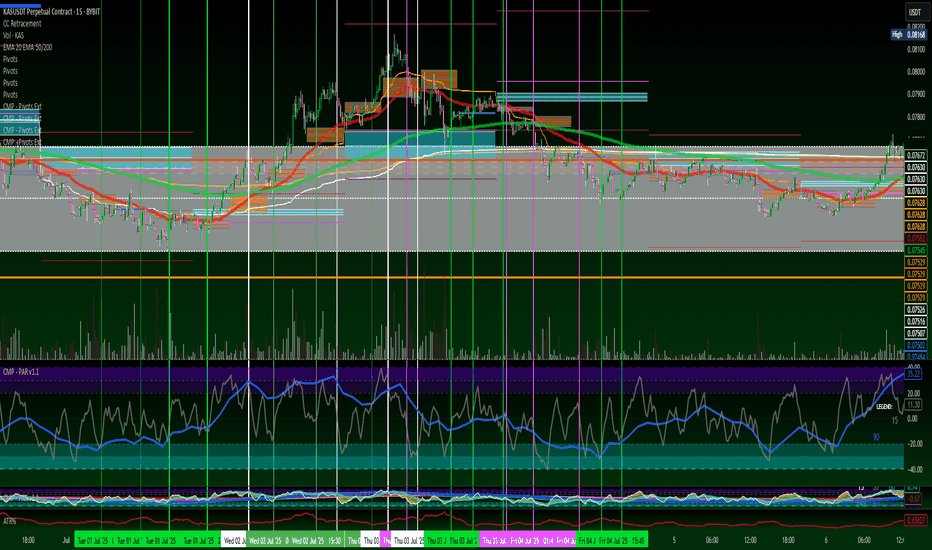

KASUSDT Analysis (30-Minute Timeframe) Key Levels on the Chart:

Broken Resistance Turned Support:

Around the 0.07520 – 0.07600 zone, there was a significant resistance area that has now been broken and is acting as new support (shown as a red box on the chart). Price broke above it with a strong candle and is currently consolidating above this zone.

Current Price Level:

The current price shown on the chart is 0.07647, sitting above the new support zone. This indicates buyers are still in control in the short term.

Target Area:

The green box on the chart marks a potential target zone, approximately around 0.07900 – 0.08000.

Stop Loss:

The stop-loss zone is set below the support area (within the red box), likely around 0.07520.

Technical Summary

The short-term trend on the 30-minute chart is bullish.

A confirmed breakout above resistance suggests potential continuation upward.

As long as price stays above ~0.07600, targets near 0.07900 – 0.08000 are reasonable.

A drop back below ~0.07520 would invalidate the bullish setup and could trigger a deeper correction.

Trading Perspective

✅ If you’re already in a long trade around 0.07620 – 0.07640:

Keep your stop-loss below 0.07520.

Reasonable target is 0.07900 – 0.08000.

If candles start closing weakly back below the support zone, consider exiting early.

⚠️ Important Note:

Volume was strong on the breakout candle but has decreased slightly afterward. If volume remains low, there’s a risk of a deeper pullback.

Since this is a lower timeframe, price can be volatile, so always manage your risk properly.

$KASUSDT Breaks Trendline #KAS

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower limit of the channel at 0.071500, acting as strong support from which the price can rebound.

Entry price: 0.075917

First target: 0.077955

Second target: 0.080166

Third target: 0.082746

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change the stop order to an entry order.

For inquiries, please comment.

Thank you.

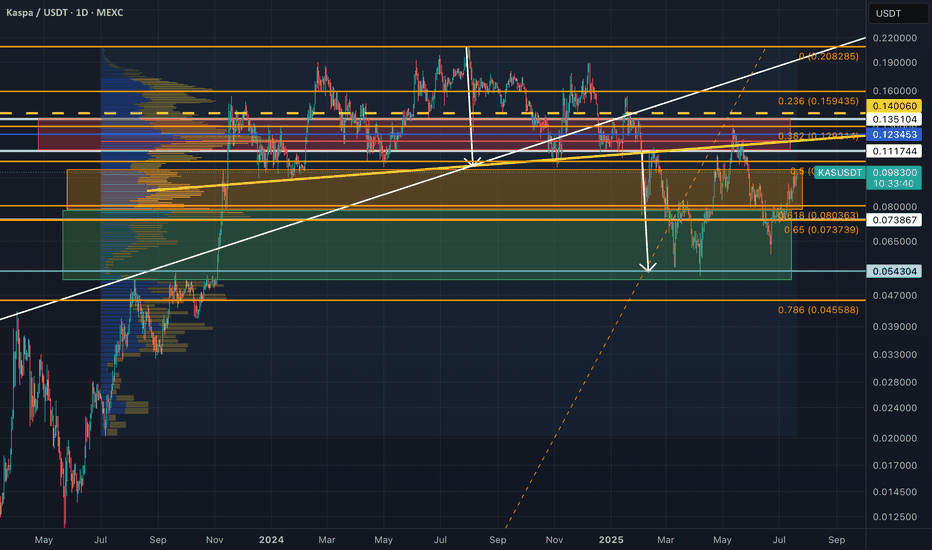

$KAS – Three Possible Scenarios in the Near FutureCSE:KAS – Three Possible Scenarios in the Near Future:

🔹 Optimistic: Growth up to $0.21

🔹 Conservative: Growth up to $0.13

🔹 Pessimistic: Decline to $0.035

🚨 Key Levels to Watch:

▪️ $0.075 — a breakout above this level in July could open the path to $0.10 – $0.11

▪️ $0.11 — a breakout above this level could open the path to $0.13

▪️ $0.13 — a breakout above this level could open the path to $0.15

▪️ $0.16 — a breakout above this level could open the path to $0.19

▪️ $0.19 — a breakout above this level could open the path to $0.20 – $0.21

▪️ $0.05 — falling to this level may indicate further downside to $0.035

Technical Analysis (KASPA/USDT - Daily Chart)Technical Analysis (KASPA/USDT - Daily Chart)

Trend & Structure Overview

KASPA has been in a prolonged downtrend after peaking near $0.22.

The Elliott Wave structure indicates a completed (A)-(B)-(C) correction pattern after a prior bullish wave (4).

Price is currently testing a triple bottom structure near $0.060–$0.065, highlighted by orange circles. This zone has previously acted as strong support.

Key Support and Resistance Levels

Type Price Zone (USDT)

Strong Support $0.060 – $0.065

Intermediate Resistance $0.080 – $0.085

Major Resistance $0.100 – $0.105

Upper Resistance Zones $0.120, $0.140, $0.160, $0.180, $0.200

The price is currently bouncing from the lower bound of this key support zone.

Indicators Summary

RSI (14):

Current: ~32.2 → Approaching oversold territory, signaling potential reversal or bounce.

Stochastic RSI:

Current: ~19.3 and crossing up, suggesting a bullish reversal signal forming.

Money Flow Index (MFI):

Value: 23 → Indicates weak inflows, but any spike could confirm a bottom formation.

VMC Cipher B:

Multiple green dots and momentum waves bottoming → Suggests bullish divergence and possible accumulation.

Volume:

No clear breakout volume yet, but prior bounce zones had relatively stronger support volume.

Trading Plan for KASPA/USDT

Entry Strategy

Primary Long Entry Zone: $0.060 – $0.065 (Current support region)

Entry Confirmation:

RSI holding above 30

Stochastic RSI bullish cross

Price maintaining above $0.065 on a daily close

Targets (Take Profit Levels)

TP Level Price Target (USDT) Rationale

TP1 $0.080 Nearest horizontal resistance

TP2 $0.100 Psychological level & prior S/R

TP3 $0.120 Top of major cluster

TP4 $0.140 – $0.160 Mid-term swing high zone

Stop-Loss Strategy

Conservative SL: Below $0.058 (breakdown of key support)

Aggressive SL: Below $0.0615 (to avoid wicks)

Risk/Reward Assessment

Risk from entry ($0.065) to SL ($0.058): ~10.8%

Potential reward to TP1 ($0.080): ~23%

R/R Ratio to TP1: ~2.1

R/R to TP3 ($0.120): ~8.5+

Alternative Scenarios

If KASPA breaks below $0.058 with volume:

Re-evaluate long positions

Possible next demand zone: $0.040 – $0.050

If volume increases on the bounce and breaks $0.085:

Add to position or open swing trade toward $0.100+

Summary

Current Bias: Cautiously Bullish

Setup Type: Support Bounce / Reversal Play

Key is holding above the triple bottom, while indicators point toward a possible short-term trend reversal.

Watch volume and momentum confirmation closely.