KAVAUSDT trade ideas

Kava: 5 Strong Bullish Signals, Cup & Handle, High Volume & MoreThe cup & handle pattern doesn't work at resistance. You cannot use this pattern in any meaningful way at the top of a rising trend. For the C&H to be valid, it needs to happen at the end of a downtrend, near the market bottom because this is a bullish reversal pattern.

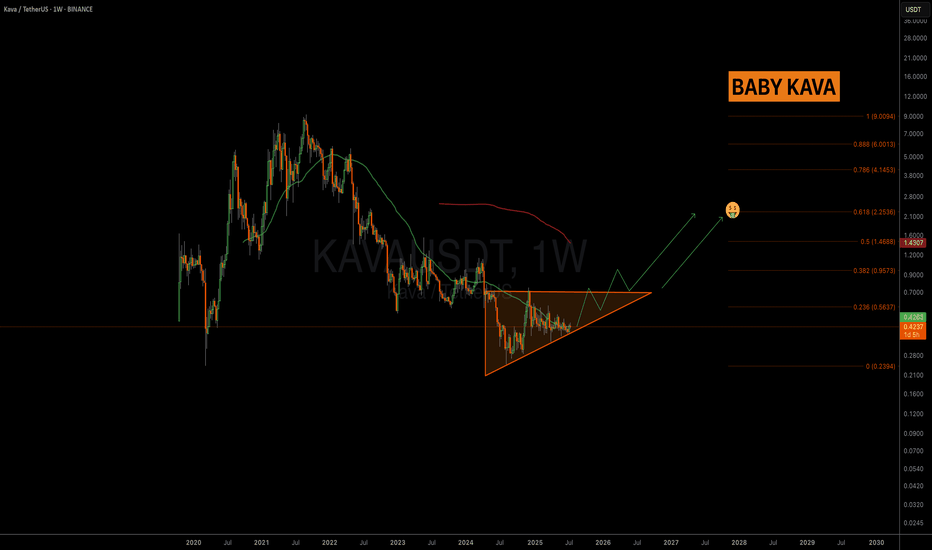

Here we have KAVAUSDT weekly up-close. August 2024 marks the lowest prices since March 2020, in more than 3.5 years. Including this strong multiple years low, we have the cup pattern forming followed by the handle. See the chart:

This is the classic cup and handle (C&H) pattern and here it is valid and can work as a reversal signal.

One signal in isolation is never enough, it needs to be coupled with 3-4 additional signals to have a strong setup. The next signal comes from the trading volume. As KAVAUSDT reached the lowest in almost 4 years, trading volume goes through the roof; the highest buy-volume ever. This is another strong signal.

We have the reversal pattern, long-term double-bottom, increasing volume, local higher low (the handle low vs the cup low) and marketwide action (the rest of the altcoins market going bullish).

There you have five signals total all supporting a change of trend. This means that soon Kava will start to grow and you know this for certain because you have the supporting data coming from the chart.

Namaste.

$KAVA breaking out of its defending phase to 4$ I would like to notice as the market picks up for Monday I think this is a great risk to take here.

KAVA LONG on a .039 - .038 entry leading into a breakout above its previous drawback.

4hr chart looks depressing but MACD shows sign of health. Holding a 20x leverage position here and hoping we can see 0.04 in the next day and half.

XRP breakout already beginning.

KAVA - We are expecting the rocket at 80%The KAVAUSDT chart shows a clear downward channel, indicating a bearish trend. However, the price is currently consolidating around the middle of the channel, creating uncertainty about the immediate direction.

Recommended signal: wait for confirmation of a breakout above the upper boundary for longs or a breakout below the lower boundary for shorts.

Is KAVA/USDT About to Explode? Major Breakout Incoming!Technical Analysis (Timeframe: 1W - Weekly)

1. Descending Triangle Breakout Setup

KAVA has been in a prolonged downtrend since 2021, forming a large descending triangle pattern. Currently, the price is nearing the apex of this formation, signaling a potential breakout in the near term.

2. Strong Accumulation Zone

A strong support base has formed between $0.24 – $0.40, which has held for over a year. This suggests significant accumulation by long-term investors at these levels.

3. Breakout Confirmation Imminent

If KAVA successfully breaks above the long-term descending trendline (yellow line), a major shift in market structure could occur, triggering a bullish rally.

4. Key Upside Targets

The following resistance levels may act as profit-taking zones if the breakout confirms:

$0.5308 – Initial minor resistance.

$0.7021 – Psychological resistance zone.

$1.1591 – Previous structural resistance.

$2.2266 – Medium-term upside target.

$5.1542 – $8.5085 – Long-term bull cycle potential targets.

5. Ideal Trading Scenario

Entry Strategy: Buy on breakout confirmation above the trendline or buy on successful retest.

Risk Management: Consider a stop-loss if price falls back below the accumulation zone (~$0.40).

🟢 Conclusion:

KAVA is approaching a critical turning point after a prolonged consolidation phase. A confirmed breakout from this pattern could initiate a strong upward trend, making it a compelling setup for swing traders and long-term investors.

📌 Note: Always apply proper risk management and wait for volume confirmation or supporting indicators before entering any trade.

#KAVA #KAVAUSDT #CryptoBreakout #AltcoinSeason #TechnicalAnalysis #CryptoChart #TradingSignals #BreakoutAlert #CryptoTrading #AltcoinAnalysis #BullishSetup #AccumulationZone

Buy KAVAKava is a decentralized finance (DeFi) platform built on the Cosmos blockchain, designed to offer a wide range of financial services, including lending, borrowing, and staking. Known for its interoperable network architecture, Kava enables users to access various DeFi services in a highly secure, scalable, and user-friendly environment.

In 2W TF, KAVA broke its long-term trendline and is retesting it. Consolidation would take some more weeks before a real take off.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

KAVAUSDT | Potential Long | POC Support | (June 5, 2025)KAVAUSDT | Potential Long | POC Support + Daily Money Flow Shift | (June 5, 2025)

1️⃣ Insight Summary:

KAVA is currently trading below the value area low and near the Point of Control (POC), suggesting a key decision zone. Despite short-term weakness, the daily money flow is starting to turn positive — this could mark a reversal level worth watching.

2️⃣ Trade Parameters:

Bias: Long

Entry Zone: Around $0.36 near the POC and support

Stop Loss: $0.3598

TP1: $0.4209

TP2: $0.4550

Additional Partial TP Zones: $0.4305, $0.4680, $0.4988

3️⃣ Key Notes:

✅ Structure: Price has been in a sideways move since December 2024, but the bigger downtrend since May 2024 could now be exhausted.

✅ Money Flow: 4H chart shows outflows, but the daily is flipping positive, hinting that buyers may be stepping back in.

📉 Bitcoin Correlation: Keep a close eye on BTC — it drives sentiment. Some spot buys have come in recently without affecting open interest much, suggesting potential for a short squeeze.

🔥 Liquidation Levels: We're trading between two liquidation zones — $0.41 (support) and $0.43 (resistance). A breakout above could squeeze shorts hard.

📆 Monthly View: Monthly data shows heavy short positioning above — further reason to suspect upside if momentum picks up.

🧠 Fundamentals:

KAVA operates in the DeFi space as a layer-1 blockchain, combining Cosmos’ speed with Ethereum’s developer network. It offers decentralized borrowing and lending solutions, aimed at replacing parts of the traditional financial system.

🤝 Partnerships & Innovation:

Key integrations include Akash Network, Finality, and an AI-based upgrade in development. The team includes Brian Kerr and Scott Stuart. Competing with projects like MakerDAO, Aave, and Compound, KAVA could still carve a niche if adoption grows.

4️⃣ Follow-Up:

I'll monitor how KAVA reacts to this support zone. If we see signs of money flow returning and Bitcoin staying strong, upside targets remain in play. Watch for updates as price action develops!

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

KAVAUSDT Forming a Bullish WaveKAVAUSDT is currently presenting a strong bullish wave pattern formation on the daily timeframe, hinting at a potential continuation of the upward trend. After a period of consolidation, KAVA has started to push higher with increasing bullish momentum. This movement is accompanied by solid volume, suggesting that the current wave could be the beginning of a larger impulse leg. The structure is favorable for swing traders and position traders looking to capture mid-term gains in the range of 60% to 70% or more.

From a technical perspective, the price has respected key support zones and is now forming higher highs and higher lows—a classic sign of a bullish trend in development. The overall market sentiment around KAVA is improving, and this is reflected in its rising trading volumes and increased mentions across crypto discussion platforms. If the bullish wave continues to unfold as expected, KAVA could challenge previous resistance levels and break into a new bullish phase.

KAVA also benefits from growing investor interest due to its strong fundamentals in the DeFi ecosystem. As a cross-chain DeFi platform, KAVA provides lending and stablecoin services, making it an attractive asset in a maturing crypto market. Technical indicators such as RSI and MACD are showing bullish signals, further supporting the case for a significant upside move. With volume surging and structure aligning, KAVA appears well-positioned to deliver a strong breakout rally.

Keep an eye on price levels around recent breakout zones as potential entry points. A successful retest could provide a good risk-reward setup for traders aiming to ride the bullish wave. Continued buying pressure and sustained volume would be key signs of strength in the coming days.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

KAVA ANALYSIS📊 #KAVA Analysis

✅There is a formation of Descending triangle pattern on daily chart 🧐

Pattern signals potential bullish movement incoming after a breakout.

👀Current Price: $0.4280

🚀 Target Price: $0.5380

⚡️What to do ?

👀Keep an eye on #KAVA price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#KAVA #Cryptocurrency #TechnicalAnalysis #DYOR

KAVAUSDT UPDATEPattern: Falling Wedge Breakout

Current Price: $0.4567

Target Price: $0.74

Target % Gain: 60.53%

Technical Analysis: KAVA has broken out of a long-term falling wedge on the 1D chart, with strong bullish momentum and price closing above the trendline resistance. This breakout signals potential continuation toward the projected target.

Time Frame: 1D

Kava potential Reversal and Target ProjectionKAVA is forming a potential bullish reversal after completing Wave 5 within a descending channel, reaching the External Demand Zone. A rally from current levels is anticipated, with initial support at the Immediate Resistance Level.

The setup targets a short-term move to 1.10, then mid-term at 2.25, with a final breakout aimed at 4.97. The pattern suggests strong upside potential, contingent on holding support and breaking through key resistance zones. A confirmed upward break above immediate resistance will validate the bullish projection toward the final target.

KAVA uptrend 20261. Technical Overview:

The chart follows the Elliott Wave pattern. It appears that a large ABC corrective wave has completed, and a new 5-wave impulse cycle (1-2-3-4-5) is starting.

Price has likely bottomed around the $0.5 zone and is showing strong signs of reversal, breaking out from a long accumulation phase that lasted over a year.

Current price is slightly breaking out from the previous lows with significant volume increase, signaling institutional or large player interest.

2. Indicators:

RSI (14): hovering around 55, above the neutral 50 level, suggesting growing bullish momentum.

MACD: bullish crossover and widening, confirming a medium-term uptrend.

3. Key Price Levels:

Strong support: $0.45 - $0.5 (long-term bottom zone).

Short-term resistance: $1.0 - $1.2.

Major resistances:

$2.0 (23.6% Fibonacci retracement)

$3.5 - $4.0 (50% Fibonacci)

$7.0 - $9.0 (historical highs and 1.618 Fibonacci extension)

4. Elliott Wave Scenario:

The chart suggests KAVA might follow a 5-wave bullish cycle:

Wave (1): from $0.5 up to around $2.0.

Wave (2) correction: potentially retracing to $1.0 - $1.2.

Wave (3): targeting $5.0 - $6.0.

Wave (5): could reach $9.0+ in a favorable macro/crypto bull market.

5. Long-Term Investment Strategy:

2025 - 2026 Period:

Accumulation Zone: $0.5 - $0.6 (breakout from long-term bottom).

Add on Breakout: consider adding more if price breaks above $1.0 with strong volume, targeting $1.2 - $1.5.

Profit-Taking Levels:

Take 20-30% profit around $2.0.

Take another 20-30% profit around $4.0 - $5.0.

Hold the rest for a potential wave (5) target at $7.0 - $9.0.

Stop-Loss:

Exit if the weekly close falls below $0.45 - $0.5, which would invalidate the bullish wave structure.

6. Notes:

This is a weekly timeframe strategy, suitable for long-term investors (6 months to 2 years horizon).

Track Bitcoin and altcoin market capitalization closely to sync KAVA's wave structure with the broader crypto market.

Wave (2) might require patience as corrective waves often cause shakeouts.

KAVABINANCE:KAVAUSDT

KAVA / USDT

1D time frame ( wait for the price to come to buying zone)

analysis tools

____________

SMC

FVG

Trend lines

Fibonacci

Support & resistance

MACD Cross

EMA Cross

______________________________________________________________

Golden Advices.

********************

* Please calculate your losses before any entry.

* Do not enter any trade you find it not suitable for you.

* No FOMO - No Rush , it is a long journey.

Useful Tags.

****************

My total posts

www.tradingview.com

KAVA ANALYSIS🔮 #KAVA Analysis

💲💲 #KAVA is trading in a Symmetrical Triangle Pattern. If the price of #KAVA breaks and sustain the higher price then will see a pump. Also there is an instant strong support zone. We may see a retest towards the support zone first and then a reversal📈

⁉️ What to do?

- We have marked crucial levels in the chart . We can trade according to the chart and make some profits. 🚀

#KAVA #Cryptocurrency #Support #Resistance #DYOR

KAVAUSDT UPDATEKAVAUSDT is a cryptocurrency trading at $0.4711. Its target price is $0.7500, indicating a potential 70%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about KAVAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. KAVAUSDT is poised for a potential breakout and substantial gains.