KERNEL/USDTKey Level Zone: 0.1750 - 0.1950

LMT v2.0 detected.

The setup looks promising—price previously trended upward with rising volume and momentum, then retested this zone cleanly. This presents an excellent reward-to-risk opportunity if momentum continues to align.

Introducing LMT (Levels & Momentum Trading)

- Over the past 3 years, I’ve refined my approach to focus more sharply on the single most important element in any trade: the KEY LEVEL.

- While HMT (High Momentum Trading) served me well—combining trend, momentum, volume, and structure across multiple timeframes—I realized that consistently identifying and respecting these critical price zones is what truly separates good trades from great ones.

- That insight led to the evolution of HMT into LMT – Levels & Momentum Trading.

Why the Change? (From HMT to LMT)

Switching from High Momentum Trading (HMT) to Levels & Momentum Trading (LMT) improves precision, risk control, and confidence by:

- Clearer Entries & Stops: Defined key levels make it easier to plan entries, stop-losses, and position sizing—no more guesswork.

- Better Signal Quality: Momentum is now always checked against a support or resistance zone—if it aligns, it's a stronger setup.

- Improved Reward-to-Risk: All trades are anchored to key levels, making it easier to calculate and manage risk effectively.

- Stronger Confidence: With clear invalidation points beyond key levels, it's easier to trust the plan and stay disciplined—even in tough markets.

Whenever I share a signal, it’s because:

- A high‐probability key level has been identified on a higher timeframe.

- Lower‐timeframe momentum, market structure and volume suggest continuation or reversal is imminent.

- The reward‐to‐risk (based on that key level) meets my criteria for a disciplined entry.

***Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note: The Role of Key Levels

- Holding a key level zone: If price respects the key level zone, momentum often carries the trend in the expected direction. That’s when we look to enter, with stop-loss placed just beyond the zone with some buffer.

- Breaking a key level zone: A definitive break signals a potential stop‐out for trend traders. For reversal traders, it’s a cue to consider switching direction—price often retests broken zones as new support or resistance.

My Trading Rules (Unchanged)

Risk Management

- Maximum risk per trade: 2.5%

- Leverage: 5x

Exit Strategy / Profit Taking

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically sell 50% during a high‐volume spike.

- Move stop‐loss to breakeven once the trade achieves a 1.5:1 R:R.

- Exit at breakeven if momentum fades or divergence appears.

The market is highly dynamic and constantly changing. LMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

From HMT to LMT: A Brief Version History

HM Signal :

Date: 17/08/2023

- Early concept identifying high momentum pullbacks within strong uptrends

- Triggered after a prior wave up with rising volume and momentum

- Focused on healthy retracements into support for optimal reward-to-risk setups

HMT v1.0:

Date: 18/10/2024

- Initial release of the High Momentum Trading framework

- Combined multi-timeframe trend, volume, and momentum analysis.

- Focused on identifying strong trending moves high momentum

HMT v2.0:

Date: 17/12/2024

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

Date: 23/12/2024

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

Date: 31/12/2024

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

Date: 05/01/2025

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

Date: 06/01/2025

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

HMT v6 :

Date : 15/02/2025

- Integrated strong accumulation activity into in-depth wave analysis

HMT v7 :

Date : 20/03/2025

- Refined wave analysis along with accumulation and market sentiment

HMT v8 :

Date : 16/04/2025

- Fully restructured strategy logic

HMT v8.1 :

Date : 18/04/2025

- Refined Take Profit (TP) logic to be more conservative for improved win consistency

LMT v1.0 :

Date : 06/06/2025

- Rebranded to emphasize key levels + momentum as the core framework

LMT v2.0

Date: 11/06/2025

- Fully restructured lower timeframe (LTF) momentum logic

KERNELUSDT trade ideas

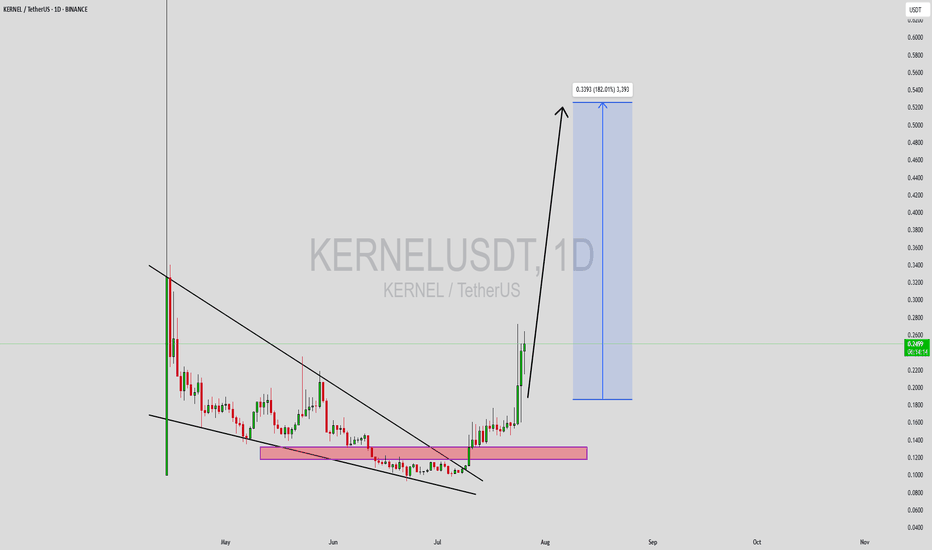

KERNELUSDT Forming Falling WedgeKERNELUSDT is shaping up as a strong breakout candidate, currently trading within a well-defined falling wedge pattern. This technical formation often marks the end of a downtrend and suggests a bullish reversal is near. As the price compresses and approaches the apex of the wedge, we typically see an increase in bullish momentum. In KERNEL's case, the volume is holding steady at promising levels, indicating growing interest and potential accumulation by savvy investors ahead of a breakout.

The falling wedge pattern is widely respected among technical analysts due to its historically high success rate when paired with rising volume and market optimism. KERNELUSDT is offering exactly that setup. With a projected gain of 140% to 150% from the current levels, this crypto pair is attracting traders who are hunting for high-upside opportunities in a consolidating market. Breakouts from such patterns are often sharp and fast, which makes proper timing crucial for maximizing gains.

Market sentiment around the KERNEL project is also improving, with increasing chatter across social platforms and trading communities. This aligns well with the technical structure on the chart and adds further weight to the bullish case. If KERNEL can break above the wedge resistance with volume confirmation, it could quickly surge into price discovery zones not seen in recent weeks.

With all indicators aligning and price tightening within the wedge, KERNELUSDT deserves close attention from technical traders. A well-timed entry here could result in substantial upside if the breakout plays out as expected.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

KERNELUSDT Forming Falling WedgeKERNELUSDT has recently completed a significant technical breakout from a well-defined falling wedge pattern, which is known in crypto trading for its strong bullish implications. The asset had been consolidating within this wedge for weeks, forming a base in the demand zone highlighted in the pink region on the chart. Now, after gaining enough strength and momentum, it has broken through resistance with solid bullish candles, signaling the start of a potential parabolic move.

Volume confirmation during the breakout phase is notable—indicating real buying interest rather than a false breakout. Based on this breakout and the current momentum, the expected gain is projected between 170% to 180%+, and the measured move target points toward the $0.33–$0.34 region. KERNELUSDT’s price action has shifted from accumulation to expansion, often the most profitable phase for trend traders. With higher highs and higher lows starting to form, bulls are in clear control.

In addition to the technical pattern, KERNEL appears to be attracting attention from investors, potentially due to its tokenomics, project fundamentals, or upcoming developments. Traders looking for high-reward opportunities with favorable entry points may find this setup ideal, particularly with the recent retest of the breakout zone acting as confirmation. If momentum continues, this rally could easily extend beyond the projected zone.

This is a textbook example of a reversal structure evolving into an explosive breakout. KERNELUSDT is now trending upward strongly, and staying updated on volume surges and any pullbacks to the breakout zone can help traders ride the wave efficiently. The crypto market rewards breakout traders when strong technicals align with market sentiment—and this is one of those moments.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market with you!

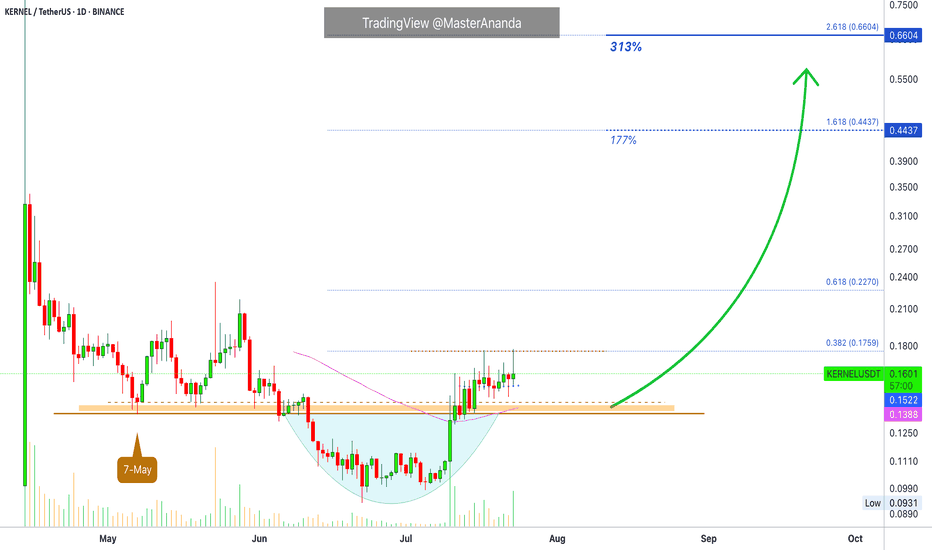

KernelDAO Short-Term Trade Setup · 300% Profits PotentialThis is another strong chart setup. I am looking at the short-term because that is the request I am getting from many of my followers. People are interested now in growing their capital so this can be used to accumulate strong reputable projects later on. Something like double-up, triple-up then grow some more. When enough cash is available; sit back, relax and hold.

The main low here is 7-May. The break below support is the liquidity-hunt event.

After the action recovers above support, bullish confirmed.

Notice KERNELUSDT trading above EMA55 and EMA89 daily.

Trading volume also favors the bullish side. Notice how red days have very low volume. On green days we have the higher numbers of volume spikes. High volume when buying, low volume when selling.

The first target is good and strong for 177%. The second target goes to 300%. This can be achieved easily within 1 month (short-term), or it can extend to two months but not much longer. The trick is to be ready to wait.

If you expect the market to move within hours or days, you might be disappointed. Yes, sometimes it moves fast but this is the exception and not the norm. Better to be prepared to wait a long time and if it moves faster, that's a bonus but we have to be realistic to produce consistent wins. If you want to be in the action, diversification is a good strategy. If you just want to win, patience is key.

Namaste.

KERNELUSDT Poised for Breakout: Double Bottom Signals ReversalDouble bottom pattern forming on BINANCE:KERNELUSDT on daily with bullish follow-through.

Price approaching downtrend resistance — a breakout could trigger a strong upside move.

Targets on breakout:

🟡 Target 1: 0.2066

🟡 Target 2: 0.2384

🟡 Target 3: 0.2734 (+54%)

Watching for daily close above trendline for confirmation.

#KERNELUSDT #CryptoBreakout #ChartPattern #DoubleBottom #AltcoinAnalysis

$KERNEL Showing Dual-Timeframe Bullish Setup🔥 $KERNEL – Setup in Motion

📉 On the Daily timeframe, $KERNEL is breaking out of a descending triangle — a classic sign that a trend reversal or fresh momentum may be brewing ⚡️

🕓 Meanwhile, on the 4H chart, price is testing a round bottom structure — often a solid base before a potential liftoff 🚀

👁 Dual confirmation across timeframes strengthens the bullish case.

👀 Keep an eye — this setup is gaining traction and could trigger a notable move soon!

WHY WILL IT GO HIGH?Reasons indicating strong potential:

- Large and active community on social media

- High scammer activity

- Trap for inexperienced users: selling on DEX at 3x lower price than on CEX due to low DEX liquidity

Let me know if you'd like it even more formal or formatted for a report.

Everything is sold...The project is new and related to restaking. Most sellers who wanted to exit have likely already done so. The project owners clearly aren’t abandoning it — there’s still activity and intent behind the scenes. The chart shows consistent spot accumulation at increasingly higher prices, suggesting it’s not just one individual buying. I recommend considering a spot position for a 1–2 week timeframe.

$KERNEL’s Bearish Trend Persists, But Oversold Signals EmergeSince its launch on April 14, $KERNEL has faced intense selling pressure, dropping 55% from its highs to $0.25, with a current market cap of $39.14M. The daily chart reveals a markdown phase with lower highs and lows, supported by rising open interest in shorts. The 50 EMA ($0.28) is acting as dynamic resistance, while the 200 EMA ($0.18) offers potential support. The Bollinger Bands are narrowing, suggesting low volatility and a possible breakout soon. On-chain data shows $1.6B in TVL, dwarfing the market cap, hinting at undervaluation. For a bullish setup, watch for a reclaim of $0.2222 with a spike in volume to confirm reversal momentum. Conversely, a break below $0.20 could see $0.15 as the next target. Use the ATR (currently 11.09%) to set stops and manage risk. This is for educational purposes only—always consult a financial advisor before trading.

$KERNEL Testing Critical Support – Is a Reversal Imminent?$KERNEL is currently trading at $0.1948, down 8.16% in the last 24 hours, and showing signs of consolidation near a key support zone around $0.1844-$0.20. On the 4H chart, the price is forming a symmetrical triangle, with lower highs and higher lows, suggesting indecision. The RSI (14) is hovering near 30, indicating oversold conditions, which could signal a potential bounce if buyers step in. However, the MACD shows bearish momentum with a recent crossover below the signal line, aligning with fading volume on rallies. Key resistance lies at $0.30-$0.35, where previous distribution phases capped upside. For bulls, a break above $0.22 with strong volume could target $0.26. Bears should watch for a breakdown below $0.1844, which may push prices toward $0.15. Always use tight stops in this volatile market and avoid overleveraging. This is not financial advice—DYOR and trade responsibly