KMDBTC trade ideas

Komodo (Nov 22) 83% PProfit in 22 Days#KMD $KMD #BINANCE #BITTREX #HUOBI

#KMD/BTC (Binance)

Entry Zone: 920

Take Profits: 1000 - 1100 - 1200 - 1300 - 1400 - 1500

Stop Loss: 830

Weekly resistance broken on KMDTry to catch a retest of Weekly resistance if turned to support.

Volume is on fire, KMD is one of the best project in the cryptoworld for me.

2 targetsn happy trading.

Komodo Long Term HoldIf you see it, you see it.

This is a ticket out, I'm buying one, hope to see you.

$KMD, Flipping into support the ~10.2k sats level$KMD

Flipping into support the ~10.2k sats level with UCTS indicator showing buy signals across the board..

Golden cross can be spotted on the 8H (EMA50/200)

RSI at overbought

If volume keeps flowing in from here, then we can aim for higher targets at ~11700/ 13470 sats

#KMD

Komodo: An Example of the Paradigm ShiftWith Komodo (KMD) up big recently, it gives us a moment to reflect on an earlier bullish idea in this coin.

KMD was the coin that convinced us to change our view on altcoins. We were fortunate to see the breakout here. That led us to believe that a range in Bitcoin (BTC) was an opportunity for altcoins to rally.

Bottom Line: Right now, KMD is at significant resistance, and we would be taking some or all profits here. We do, however, believe that alts will continue to rally vs. BTC until further notice.

KMD/BTC significant bounce, can it Last? Important Zones plottedNear term look at the strong bounce today.

Bounce wave may have ended at blue 4,236

May hit the 4.618 before significant pullback.

If retrace starts, then keep an eye on the green zones.

Reaction at each fib line and zone will offer more clues.

Or if we surpass the blue 4.618 then I will re-evaluate.

The Purple Fib is from this big picture series:

.

See some of my other plots and trade calls below.

I also plot Forex and Stocks, take a look at my profile page .

BAT top call (still in play)

EOS top Call (near perfect plot)

LTC to $150 call (near perfect plot)

BTC $14k call (Near Perfect target, easy trade)

ETH breakout (instant Profits, no drawdown)

BTC bottom 3.1k (caught the EXACT bottom)

ADA breakout (PERFECT targets, massive profits)

ZRX bottom call (200% gain, Perfect target)

ZRX breakout (massive Profits, short wait)

XLM breakout (massive Profits, instant Win)

RVN top call (Perfect Target, take profits)

LINK re-entry (caught the spike)

MATIC top Warning (caught the EXACT top)

MATIC rocket (massive Profits, breakout entry)

NEO Rocket Launch (great entry, massive profits)

FET top warning (EXACTLY on time)

Of course, I have had total FAILS on some ideas too, not going to pretend.

But all of my plots show PRECISE entries, TIGHT stops, and EXACT targets.

Precision is the way of the Fib. Almost every turn happens at a Fib Line.

Komodo Next In Line | Decisive Break Above Resistance (65%)Komodo (KMDBTC) had a strong bounce recently and just moved above EMA50 on high volume.

This signal tells us that this pair is ready to move up and grow.

The RSI is now at 60. A few months back, we would see the RSI sitting at 10, 15, 20 and such for most altcoins even if they were moving up.

Now we are seeing strong RSI across the board even while these pairs are hitting new ATLs.

Now that KMDBTC is back above EMA50, we can expect more bullish action.

The next and main target is marked on the chart with a bold dashed magenta line.

I marked two additional targets for short-term gains.

Remember to have a plan and use a stop-loss if you decide to trade.

Thanks a lot for reading.

Namaste.

KMD Thoughts$KMD

Some volume coming in over the last days; currently at resistance with minor bearish divergences on lower TF's; I think we might be able to squeeze another +18% out of this run, however taking profit at resistance is usually smarter than holding on to a prayer.

Komodo: Doing the Unthinkable?You may have noticed that we are done telling people not to chase altcoins. That's one thing. It's another thing to say to people to buy an altcoin at resistance. That seems crazy, and it does not always work.

In the case of Komodo (KMD), it might. We are noticing that Komodo (KMD) has already taken out its previous 4th. That means it has moved past the point where the last avalanche lower began. So, even though Komodo (KMD) is up a lot, we do think you can start buying dips looking for even more upside.

Bottom Line: Whatever alt has good upside momentum may pull in more and more speculative money. We don't like it when the crypto market turns into a casino. That said, we love going with momentum in any altcoin with a decent chart and reasonable fundamentals. The Chinese have declared, "blockchain is back!" So, that means there are alt plays out there that could embark on extended up trends. Komodo (KMD) could be one of those plays.

KMD READY TO GO?Komodo has been sleeping for quite some time now will this sleeping giant finally awake ;)?

$KMD, ~6390 sats level was crossed & flipped into support...$KMD

~6390 sats level was crossed & flipped into support the over the last 24hs

Aiming for ~7230 sats w/ UCTS showing buy signals across the board

Crossing above EMA50 on the 12H

handling this position through @3commas_io Smart trade platform

#KMD

KMD in upward channelGuys I do not give any one Fish.

but I teach how to fishing....

feel free to connect with me.

LONG - KMD - Trading OpportunityKMD looks ready to break resistance, volume and price movement indicates that we have been consolidating for a couple of months now.

Entry: 0.0000730

SL: 0.0000689

TP 1: 0.0000795

TP 2: 0.0000850

TP 3: 0.0000933

CryptoCue is not providing investment advice and is not taking subscribers’ personal circumstances into consideration when discussing investments. Investment involves a high degree of risk and should be considered only by persons who can afford to sustain a loss of their entire position.

CryptoCue is not registered, licensed or authorized to provide investment advice and is simply providing an opinion, which is given without any liability or reliance 1.71% whatsoever. The information contained here is not an offer or solicitation or recommendation or advice to buy, hold, or sell any security. CryptoCue makes no representation as to the completeness, accuracy or timeliness of the material provided and all information and opinions provided by CryptoCue are subject to change without notice and provided on a non-reliance basis and without acceptance of any liability or responsibility whatsoever or howsoever arising. You hereby irrevocably and unconditionally waive, release and discharge: (a) any and all accrued rights and/or benefits you may have against CryptoCue in respect of any opinion expressed or information conveyed by CryptoCue at any time; (b) any and all Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time; (c) CryptoCue from all and any claims (whether actual or contingent and whether as an employee, office holder or in any other capacity whatsoever) including, without limitation, Claims you may have against CryptoCue arising out of any opinion expressed or information conveyed by CryptoCue at any time. ("Claims" shall include any action, proceeding, claim, demand, judgment or judgment sum of whatsoever nature or howsoever arising.) You hereby agree to indemnify and hold harmless CryptoCue in respect of any and all Losses paid, discharged, sustained or incurred by CryptoCue in the event of bringing any Claim against CryptoCue. (“Losses” shall include any and all liabilities, costs, expenses, damages, fines, impositions or losses (including but not limited to any direct, indirect or consequential losses, loss of profit, loss of earnings , loss of reputation and all interest, penalties and legal costs (calculated on a full indemnity basis) and all other reasonable professional costs and expenses and any associated value-added tax) of whatsoever nature and/or judgement sums (including interest thereon).)

Please add a comment... Positive feedback and constructive criticism are important to authors and the community.

Komodo Recovers | Strong Move Ahead | Easy 66%+ PossibleKomodo (KMDBTC) is printing a very strong bullish candle today.

After hitting a peak on the 7-Oct., KMDBTC retraced and produced good volume to break below EMA50 and EMA10... Today, a strong bullish candle regained those levels back, meaning, KMDBTC is now back above EMA10 and EMA50... This is a strong bullish signal.

This move is also supported by big volume, above-average, and the biggest volume bar since the 6-Sept. bounce after the ATL was hit, confirming that this is a strong and solid move.

The RSI is strong and the MACD on the bullish side.

Komodo can easily continue growing.

Conditions for chnage

If KMDBTC moves down and closes below EMA10 or the green trendline, the above signals are invalidated and we switch our view from bullish to bearish until a new analysis is published.

Thanks a lot for your continued support.

Namaste.

kmdbtc trading opportunitySpotted price trading in potential falling wedge pattern.

Kindly follow the suggested accumulation zone on the chart and always remember to apply stop loss according to your risk mitigation.

Level to watch for are:

POSSIBLE ENTRY ZONE

Possible Support LEVEL

SELL TARGETS

Do know that I appreciate your effort and the time spend in reading and watching my posts and Please leave a LIKE and FOLLOW us for more updates.

Thank you

Note:

It will be good to always understand risk involve in trading. Always trade with stop Loss in place.

Set up an entry/exit strategy for every trade, with good risk/reward ratio.

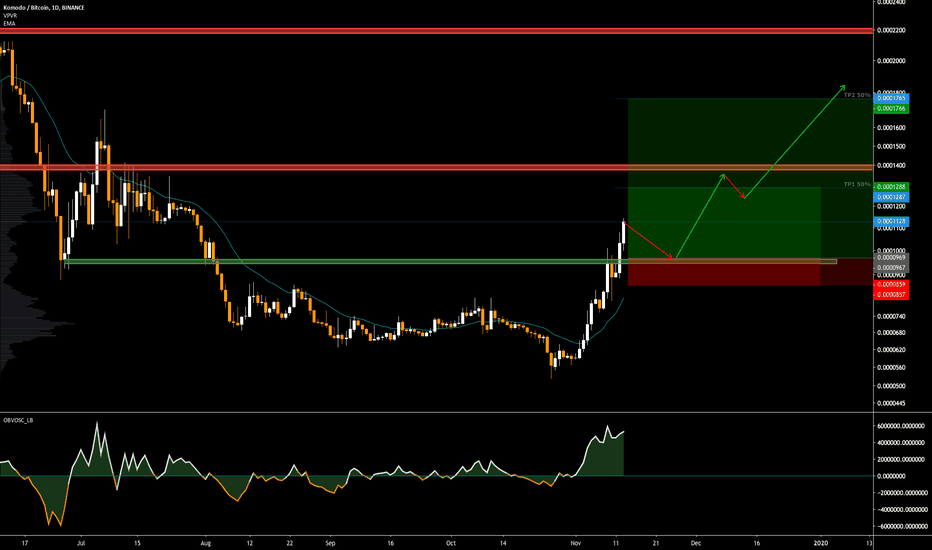

KMD/BTC LONGKMD/BTC

LONG

Open 765;

SL 724;

TP 1091;

Risk/Reward: 1/7.95

Bitcoin dominance has broken the triangle down. We expect good movements on many violas. Here is a good setup that has already shown its worth in practice.