KMDUSD trade ideas

Komodo Price Analysis KMD / USD: Atomic EuphoriaFundamental Analysis

Komodo spiked after the company announced the public beta phase of the AtomicDEX platform on Android. This will allow users to make atomic swaps directly from their phones. According to the project, the app is the “industry’s only mobile-native decentralized exchange built on anything-to-anything, asset-agnostic atomic swaps” and it “represents a generational change in atomic swap technology”.

Komodo / USD Short-term price analysis

Komodo has a bullish short-term bias, with the cryptocurrency trading above its key 200-period moving average on the four-hour time frame.

The four-hour time frame is showing that KMD / USD bulls are attempting to invalidate a large head and shoulders pattern, following a strong reversal from neckline support.

Technical indicators are bullish on the four-hour time frame and continue to generate a buy signal.

Pattern Watch

Traders should expect heavy technical buying if the head and shoulders pattern on the four-hour time frame is invalidated.

Relative Strength Index

The RSI indicator has turned bullish on the four-hour time frame, highlighting the growing short-term upside momentum.

MACD Indicator

The MACD indicator is bullish on the four-hour time frame and continues to generate a buy signal.

Komodo / USD Medium-term price analysis

Komodo has a bullish medium-term outlook, with the cryptocurrency trading well above its trend defining 200-day moving average.

The daily time frame is showing an extremely large inverted head and shoulders pattern, with the cryptocurrency now testing back towards the neckline its neckline.

Technical indicators across the daily time frame have turned bullish and are now issuing a buy signal.

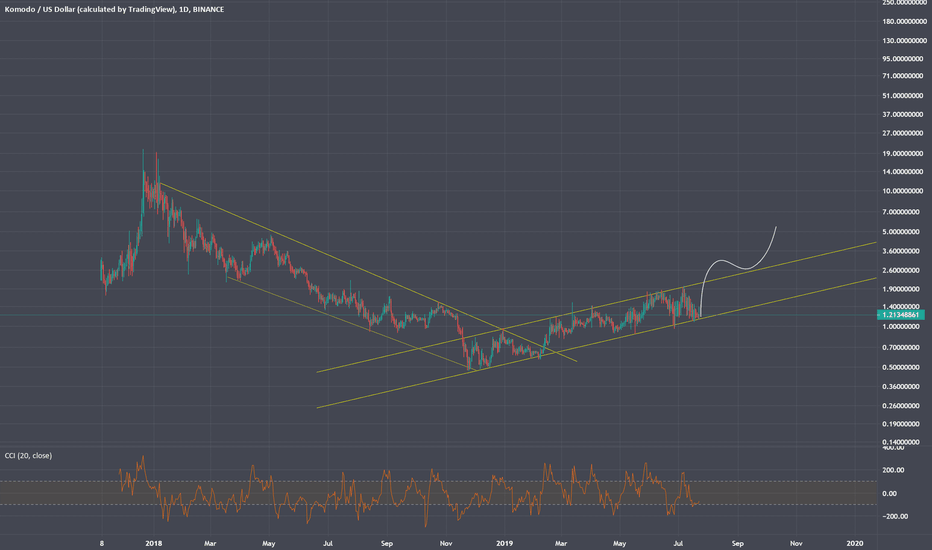

KMD / USD Daily Chart by TradingView

Pattern Watch

Traders should note that the May 22nd 2018 swing-high remains the overall upside objective of the inverted head and shoulders pattern on the daily time frame.

Relative Strength Index

The RSI indicator has turned bullish on the daily time frame and is now issuing a buy signal.

MACD Indicator

The MACD indicator on the daily time has turned bullish, with both the MACD signal line and histogram issuing buy signals.

Conclusion

Komodo has an improving technical outlook over the medium-term, with the inverted head and shoulders pattern on the daily time frame suggesting that a strong bullish breakout is nearing.

Short-term bulls now need to invalidate the bearish pattern on the four-hour time frame to further secure the KMD / USD pair’s near-term technical outlook.

KMDUSD Massive Inverse Head & ShouldersCurrently in a rising channel and at the neckline of a 9+ month inverse head & shoulders . Right shoulder was a bounce off the $0.90 support and the 200-day moving average. A close above $1.55 would be the highest close since 04 Sep '18.

Current price: $1.48

Target: $2.50

Gain: ~69%

Innovative tech + flying under the radar = undervalued

Komodo Golden Cross!Komodo has a recent golden cross with an average (15 MA) volume higher than ever before on Binance, even more so than the height (and great fall) of the market around 20k USD. Like all golden disbelief rallies, a lot of sheep will sell (out of disbelief) causing a retrace to a *higher* low, which will finally inspire smart money to start pouring in, exciting the sheep, causing the beginning of the next bull run for Komodo vs. USD.

Not to mention, another bullish signal will be the 124 candle MA (61.8% of 200) crossing the 200 candle MA on the daily chart vs. USD; I call this the golden *ratio* cross.

Komodo-KMD/USD AnalysisKomodo came out from the Zecash platform which came forth from the bitcoin network with major focus on providing standard privacy and a better security of a decentralised network.

Komodo coin has seen a recent surge in USD with 100%+ in the month of February 2019.It is one of the most promising cryptocurrencies 2019.

Bullish Case:

Komodo pair has seen a significant growth of more than 100%+ in terms of USD.It has broken the Long term down-trend line(red dotted) with significant buying volume.It signifies an early signs of more upside potential as it seems to have come-out of Bears controls for short to mid-term period.It has broken 200D-SMAs(Simple Moving Average) and ichimoku cloud.

If the support level near $0.7-$0.8 is held then three resistance level could be tested in the coming days/weeks.

Simply put, if someone's needs to buy this asset then $0.7-$0.8 are levels to watch for 50+%, with tight stop-loss around $0.5.

Bearish Case:

If the preliminary support around $0.6 is broken down then last line of defence would be $0.4 price level, breaking that would be strongly bearish(sell signal) for the asset.

There is a possibility for the beginning of an uptrend in KMDUSDTechnical analysis:

. Komodo/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 54.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.284 to 1.159). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.284)

Ending of entry zone (1.159)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 1.583

TP2= @ 1.828

TP3= @ 2.280

TP4= @ 2.719

TP5= @ 3.545

TP6= @ 4.639

TP7= @ 5.887

TP8= @ 7.428

TP9= @ 7.428

TP10= @ 11.162

TP11= @ 13.957

TP12= Free

There is a possibility for the beginning of an uptrend in KMDUSDTechnical analysis:

. Komodo/USDollar is in a range bound and the beginning of uptrend is expected.

. The price is above the 21-Day WEMA which acts as a dynamic support.

. The RSI is at 54.

. The price downtrend in the daily chart is broken, so the probability of the resumption of an uptrend is increased.

Trading suggestion:

. There is a possibility of temporary retracement to suggested support zone (1.284 to 1.159). if so, traders can set orders based on Price Action and expect to reach short-term targets.

Beginning of entry zone (1.284)

Ending of entry zone (1.159)

Entry signal:

Signal to enter the market occurs when the price comes to " Buy zone " then forms one of the reversal patterns, whether " Bullish Engulfing ", " Hammer " or " Valley " in other words,

NO entry signal when the price comes to the zone BUT after any of the reversal patterns is formed in the zone.

To learn more about " Entry signal " and the special version of our " Price Action " strategy FOLLOW our lessons:

Take Profits:

TP1= @ 1.583

TP2= @ 1.828

TP3= @ 2.280

TP4= @ 2.719

TP5= @ 3.545

TP6= @ 4.639

TP7= @ 5.887

TP8= @ 7.428

TP9= @ 7.428

TP10= @ 11.162

TP11= @ 13.957

TP12= Free

Komodo Weekly BreakoutBullish Weekly chart based on green heiken ashi candle, trendline breakout, and strong momentum.

kmd day tradejust opened long on kmd. we closed the 1 hour above a key resistance, not much in the way of it climbing to 1.50 or even 1.60 today. really small stoploss in case it gets rejected here. not advice, just what I see and what I pulled the trigger on! enjoy.

#Komodo $KMD - $USD - TREX - We have supportKomodo:

W:

I pulled up the TREX listing because of the history advantage over Binance. It doesn't quite have the Volume but all these alts look pretty similar these days anyway.

Clear downtrend from December. Sideways for a few weeks and then up for three before coming down for the last 16 weeks.

Let's establish some levels...

The most interesting for me would be .7084. That would establish a fantastic Double Bottom.

D:

Here we can see a falling wedge. Lower Lows and Lower Highs. Clearly we would like to see some bullish bias breakout the resistance but we need to make some moves first just to stay above the bottom resistance.

Trading above the 6 day EMA but below all the rest. Not the best looking Hammer a few days ago but then immediately followed by an Inverse Hammer sort of has me thinking bullish.

Spinning top for indecision and then a pretty solid bullish candle so far today. I feel that would be a pretty good indicator for the short term. Couple that with the MACD showing three upticks and about to cross over while Godmode already signaled long two days ago.

4H:

Looking pretty good for the short term in my opinion. A closer look shows us what happened in the 4H period while we broke support. BIG bullish candle to get out of that trading zone. Then sideways for a bit and now trending up. All indicators are favorable to the upside.

Komodo is also a bargain buy right now, 200-300%?Hello people,

As already explained in the BTC post on TradingView, I'm assuming that the G20 event is going to trigger another run on the fields for the altcoins and the whole crypto market. Why? We've seen a huge run up with the futures earlier (BTC 20k). The scenario is called: buy the rumour, sell the news. Currently we see a huge dump going in to a significant big event for the market (and a small dump after): sell the rumor, buy the news.

Right now one of my favourites: Komodo.

Against BTC it's approaching a very important support zone (posted on Twitter). On USD the same applies here. Depression phase with strong falling wedge and in the last drops some more falling wedges created + support area in USD from the rally before the rally initially started.

Also. This is against USD. If you assume that Komodo is going towards $4 from here, without moving in BTC value, then BTC has to go to $22.300 from here, unlikely, right?

Indicators:

WAN/USD:

1 Day: Strong bullish divergences on RSI, Stoch, MACD and histogram.

2 Days: Very strong on the 2 days as well.

3 Days: Bullish divergences everywhere too.

4 Days: Bullish divergences Histo, Stoch, MACD and RSI.

5 Days: Histo bullish divergence, MACD postivie cross. Stoch bottomed out.

1 Week: Same as on 5 Days.

Same conclusion on KMD/BTC. 3 Days RSI no bullish divergences, but turning here in the next few days creates one on the Stoch. RSI on 3D is <20.

Concluding from here we can combine the two charts and state that not only BTC is moving upwards, but the altcoins will follow in the next few weeks.

Main target zone for the disbelief phase for me is first around $3,50-4,00.

Komodo is also a bargain buy right now, 200-300%? Hello people,

As already explained in the BTC post on TradingView, I'm assuming that the G20 event is going to trigger another run on the fields for the altcoins and the whole crypto market. Why? We've seen a huge run up with the futures earlier (BTC 20k). The scenario is called: buy the rumour, sell the news. Currently we see a huge dump going in to a significant big event for the market (and a small dump after): sell the rumor, buy the news.

Right now one of my favourites: Komodo.

Against BTC it's approaching a very important support zone (posted on Twitter). On USD the same applies here. Depression phase with strong falling wedge and in the last drops some more falling wedges created + support area in USD from the rally before the rally initially started.

Also. This is against USD. If you assume that Komodo is going towards $4 from here, without moving in BTC value, then BTC has to go to $22.300 from here, unlikely, right?

Indicators:

WAN/USD:

1 Day: Strong bullish divergences on RSI, Stoch, MACD and histogram.

2 Days: Very strong on the 2 days as well.

3 Days: Bullish divergences everywhere too.

4 Days: Bullish divergences Histo, Stoch, MACD and RSI.

5 Days: Histo bullish divergence, MACD postivie cross. Stoch bottomed out.

1 Week: Same as on 5 Days.

Same conclusion on KMD/BTC. 3 Days RSI no bullish divergences, but turning here in the next few days creates one on the Stoch. RSI on 3D is <20.

Concluding from here we can combine the two charts and state that not only BTC is moving upwards, but the altcoins will follow in the next few weeks.

Main target zone for the disbelief phase for me is first around $3,50-4,00.

KMD got me ALL bothered. if you aren't bagging up Komodo right now, you are playin yourself! not only does KMD reward you for holding, its also gonna go up in value. double whammy. 10. 20. 40% gains possible short term like week or so.

15,644% gains for hodl masters

HYPERDEX GONNA BE AWESOME. CHECK IT OUT.

i probably wont sell what i buy until the end of the year fiasco. and then only to BUY MORE AT THE DIP. HODLLLLL

Komodo found the bottom?!?Chart should speak by itself. But in case it doesn't, you can see the yellow circles mark what was once the resistance, which is now a strong support. The more an area of resistance/support is tested the stronger it is. It happen to be the Fibo 0.786, what a coincidence!!! For a long term investment, we can be pretty sure this a really good accumulation zone!!! That's for the TA, now here you that is for those that like FA : glx.co

Not financial advise bla bla ...

TRADE SAFE!!!