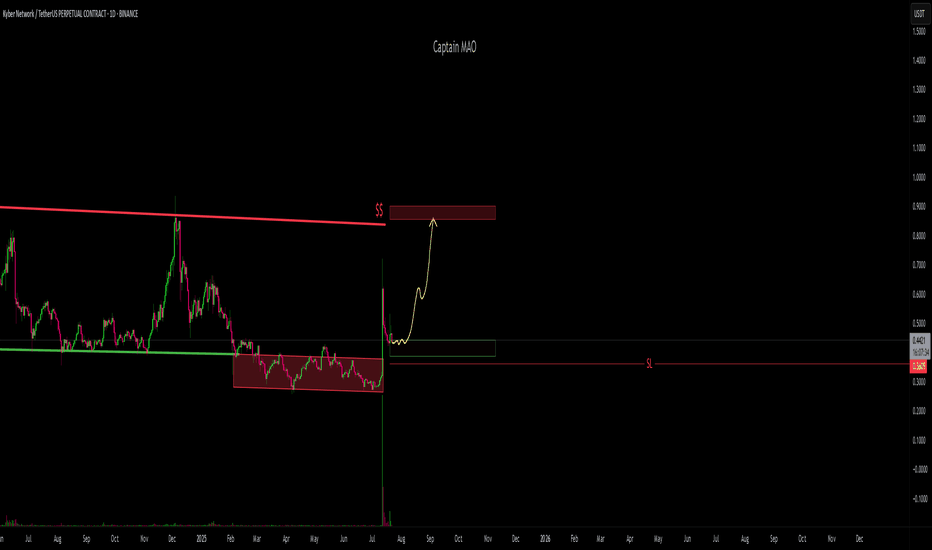

KNC/USDT +100% KNC/USDT recently performed a liquidity sweep below the $0.40 zone, followed by a strong bounce from the $0.27–$0.28 area, delivering a +150% surge. It then aggressively reclaimed the $0.40 support/resistance flip zone. After a healthy 40% correction, the price is now stabilizing and forming a new base support, preparing for its next bullish leg.

KNCUSDT trade ideas

KNC/USDT Analysis - Potential Breakout SetupKNC/USDT Analysis - Potential Breakout Setup 🚀

Hello TradingView Family! 🌟

Here’s an exciting Kyber Network (KNC/USDT) trade setup I’ve been monitoring on the 1H timeframe:

🔹 Pattern: A clear Cup and Handle formation is in play, hinting at a bullish breakout.

🔹 Entry Zone: Positioned just as the price consolidates within the handle, aligning perfectly with a key support zone.

🔹 Target: A potential upside of 17.4% with a target at $0.7058.

🔹 Stop-Loss: Risk is tightly managed below $0.5685.

📌 Key Points to Watch:

Price needs to break and hold above the upper trendline of the handle to confirm the breakout.

Keep an eye on volume surges to validate the move!

Let me know your thoughts on this setup! Are you trading KNC or watching other pairs? Share your insights below. 👇

Happy Trading! 🚀✨

KNC/USDTKey Level Zone: 0.5400 - 0.5430

HMT v5 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

HMT v5 :

Date: 23/01/2025

- Refined wave analysis for trending conditions

- Incorporated lower timeframe (LTF) momentum to strengthen trend reliability

- Re-aligned and re-balanced entry conditions for improved accuracy

KNC's Critical Support Levels and Future ProjectionsIt seems like KNC is in another bearish pattern, but smaller. It had a fake bullish breakout the previous time, with a shadow to the major support. This time, there's a small shadow to the support, even though it's not strong enough. However, we still could have a bullish breakout because of this as a sign, especially since the long-term resistance line is broken.

If a bullish breakout happens, the first target will be $0.77. Then, we might see a bounce to $0.38. In that case, an H&S pattern will be confirmed, and we will have to wait for the shoulder to be broken, which will be the current support at $0.55. Alternatively, we could go straight to $0.37, again, confirming H&S pattern.

OR

we might see an attempt to break $0.95 and reach new highs with a lower chance of happening

For now, everything is good as long as KNC holds the $0.55 support.

KNC's Critical Support Levels and Future ProjectionsIt seems like KNC is in another bearish pattern, but smaller. It had a fake bullish breakout the previous time, with a shadow to the major support. This time, there's a small shadow to the support, even though it's not strong enough. However, we still could have a bullish breakout because of this as a sign, especially since the long-term resistance line is broken.

If a bullish breakout happens, the first target will be $0.77. Then, we might see a bounce to $0.38. In that case, an H&S pattern will be confirmed, and we will have to wait for the shoulder to be broken, which will be the current support at $0.55. Alternatively, we could go straight to $0.37, again, confirming H&S pattern.

OR

we might see an attempt to break $0.95 and reach new highs with a lower chance of happening

For now, everything is good as long as KNC holds the $0.55 support.

KNC/USDTKey Level Zone : 0.6080 - 0.6150

HMT v4.1 detected. The setup looks promising, supported by a previous upward/downward trend with increasing volume and momentum, presenting an excellent reward-to-risk opportunity.

HMT (High Momentum Trending):

HMT is based on trend, momentum, volume, and market structure across multiple timeframes. It highlights setups with strong potential for upward movement and higher rewards.

Whenever I spot a signal for my own trading, I’ll share it. Please note that conducting a comprehensive analysis on a single timeframe chart can be quite challenging and sometimes confusing. I appreciate your understanding of the effort involved.

Important Note :

Role of Key Levels:

- These zones are critical for analyzing price trends. If the key level zone holds, the price may continue trending in the expected direction. However, momentum may increase or decrease based on subsequent patterns.

- Breakouts: If the key level zone breaks, it signals a stop-out. For reversal traders, this presents an opportunity to consider switching direction, as the price often retests these zones, which may act as strong support-turned-resistance (or vice versa).

My Trading Rules

Risk Management

- Maximum risk per trade: 2.5%.

- Leverage: 5x.

Exit Strategy

Profit-Taking:

- Sell at least 70% on the 3rd wave up (LTF Wave 5).

- Typically, sell 50% during a high-volume spike.

- Adjust stop-loss to breakeven once the trade achieves a 1.5:1 reward-to-risk ratio.

- If the market shows signs of losing momentum or divergence, ill will exit at breakeven.

The market is highly dynamic and constantly changing. HMT signals and target profit (TP) levels are based on the current price and movement, but market conditions can shift instantly, so it is crucial to remain adaptable and follow the market's movement.

If you find this signal/analysis meaningful, kindly like and share it.

Thank you for your support~

Sharing this with love!

HMT v2.0:

- Major update to the Momentum indicator

- Reduced false signals from inaccurate momentum detection

- New screener with improved accuracy and fewer signals

HMT v3.0:

- Added liquidity factor to enhance trend continuation

- Improved potential for momentum-based plays

- Increased winning probability by reducing entries during peaks

HMT v3.1:

- Enhanced entry confirmation for improved reward-to-risk ratios

HMT v4.0:

- Incorporated buying and selling pressure in lower timeframes to enhance the probability of trending moves while optimizing entry timing and scaling

HMT v4.1:

- Enhanced take-profit (TP) target by incorporating market structure analysis

$KNC breaking out from the Ascending triangle pattern.TSXV:KNC breaking out from the Ascending triangle on the 4H chart.

🎯 Targets:

$0.6714

$0.7243

$0.8816

⚠️ Support to watch: $0.5907. Bullish structure intact above this level.

What’s your play, #ChillFam? Are you:

💎 Holding

📤 Selling

📥 Waiting to buy

Let me know below! 👇

Blue Box Demand Zone Ready for Precision Entries!KNCUSDT: Unlocking the Potential – Blue Box Demand Zone Ready for Precision Entries! 🔵📈

KNCUSDT is shaping up with a stunning opportunity for traders, and the blue box is the key demand zone where all the action could unfold. This zone is not just another level – it’s an area carefully selected using advanced techniques to give you the best chances for a precise entry.

Why the Blue Box?

Strategically Picked Demand Zone: The blue box is a result of a detailed analysis with powerful tools such as volume footprint, volume profile, cumulative delta volume (CDV), and liquidity heatmaps . This makes it a high-probability entry zone where buyers are likely to step in.

Comprehensive Confirmation: Before executing a trade, I rely on critical indicators such as CDV, liquidity heatmaps, volume profiles, volume footprints (for strong buyer presence), and upward market structure breaks in lower time frames . This multi-step approach ensures that we are trading with confidence and clarity.

Calculated Risk/Reward Setup: The blue box presents a risk-managed approach while offering significant potential for reward. It’s where your strategy meets real-time market conditions for optimal results.

The Plan:

Waiting for the price to touch this blue box could provide you with the perfect entry point, backed by real buyer interest and technical confirmation. It’s about precision, not guesswork.

Engage & Boost!

If this analysis resonates with you, don’t forget to hit the boost and drop a comment! Your engagement fuels my commitment to sharing these high-value insights with you. Let’s create profitable strategies together!

Learn the Secrets – Completely Free!

Want to learn how to spot demand zones like this? DM me for a full breakdown of how I use CDV, liquidity heatmaps, volume profiles, and volume footprints to identify key trading areas. I’ll guide you through these powerful techniques for free!

If you think this analysis helps you, please don't forget to boost and comment on this. These motivate me to share more insights with you!

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

My Previous Analysis (the list is long but I think it's kinda good : )

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

#KNC: Harnessing Liquidity in DeFi MarketsDescription:

This trading idea highlights KNC (Kyber Network Crystal), the native token of Kyber Network, a decentralized liquidity protocol designed to power DeFi applications. KNC plays a key role in enabling seamless token swaps and liquidity aggregation across various blockchain networks. Its utility extends to governance, staking rewards, and incentivizing liquidity providers, making it a critical component of the Kyber ecosystem. As decentralized finance continues to grow, Kyber’s focus on enhancing efficiency and scalability positions KNC as a valuable asset for traders and investors seeking exposure to DeFi innovations.

It’s important to recognize that the cryptocurrency market is highly volatile, and KNC’s value can be influenced by factors such as regulatory changes, technological advancements, and market sentiment. As such, careful consideration and effective risk management are essential when trading or investing in KNC.

Disclaimer:

This trading idea is intended for educational purposes only and should not be considered financial advice. Trading cryptocurrencies like KNC carries significant risks, including the potential for complete loss of capital. Always perform thorough research, evaluate your financial circumstances, and consult with a financial advisor before making any investment decisions. Past performance is not indicative of future results.

KNC's Bullish Clues are So Strong ! KNC is showing promising bullish momentum. But before we get too excited, let’s dive into the crucial levels and scenarios to determine the next probable move.

KNC rallies from here and breaks the $0.53 resistance level, we might witness a notable shift in market structure, potentially propelling the price toward higher resistance targets.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

KNCUSDT.1DAfter examining the KNC/USDT daily chart you provided, here is my in-depth technical analysis:

The KNC/USDT pair has demonstrated a significant downward trend starting from a high point in July 2024, and it has been making lower highs and lower lows, a classic sign of a bearish trend. The price has recently formed what could be seen as a descending triangle pattern, marked by a flat support line and a downward sloping resistance line, which usually indicates a continuation of the downward trend.

Key Levels to Watch:

Support 1 (S1) at $0.4015 is critical, as it's where the price has bounced a few times, showing some buyer interest at this level. A break below this could intensify the bearish sentiment.

Resistance 1 (R1) at $0.5203 and Resistance 2 (R2) at $0.5892 are important as potential reversal points if the price were to make a bullish turnaround. R1 is particularly pivotal because it aligns with recent peaks and the downward trendline, making it a robust barrier to watch.

Technical Indicators:

The Moving Average Convergence Divergence (MACD) is below the signal line and close to crossing into positive territory, which may indicate a weakening of the current bearish momentum. However, the histogram is still very near the zero line, suggesting that any bullish momentum is not yet strong.

The Relative Strength Index (RSI) is around 46, slightly below the neutral 50 mark, indicating that the selling pressure is still present but not overwhelmingly so.

Current Price Situation: The current price of approximately $0.4450 sits just above S1, underlining its importance. The market's reaction to this support level in the coming days will be crucial.

Strategic Outlook: Given the chart's indicators and patterns, my approach would be one of cautious observation. If the price holds above S1 and we see a bullish MACD crossover along with an RSI move above 50, there might be scope for a short-term bullish entry with a target at R1. However, this would require confirmation in the form of a clear volume-supported price rise.

Conversely, if S1 is broken decisively on high volume, it would likely signal a continuation of the bearish trend, possibly reaching new lows. In this scenario, setting a stop-loss just above the last minor high or the downward trendline would be prudent to manage risk.

As always, combining these technical insights with broader market news and sentiment analysis will be crucial for a rounded trading decision. Monitoring any significant news related to Kyber Network and the broader crypto market will also help in making informed trading decisions.

Kyber Network Crystal v2On the above 2-day chart price action has corrected over 90% since the sell signal (not shown) in April. Now is an excellent moment to be long. Why?

1) A strong buy signal prints (not shown).

2) Regular bullish divergence . Lots of it. This divergence is measured over a 40-day period. Look left - blue circles. This divergence includes MFI (Money flow) - Follow the money.

3) Falling wedge breakout.

4) It is beyond ridiculous how well the Fibonacci re-tracement measured the previous cycle tops. The 4th cycle top is amazing if the pattern repeats.

Is it possible price action falls further? Sure.

Is it probable? No

Ww

Type: trade

Risk: <=6% of portfolio

Timeframe: Don’t know.

Return: 50x

KNC: Resistance BreakoutTrade setup : Trends are mixed. Following a Falling Wedge pattern, price has also broken above $0.70 resistance and 200-day moving average to signal a bullish trend reversal, with +25% upside potential to $0.90 next. Stop Loss (SL) level at $0.62 (prior swing low).

Pattern : Resistance Breakout. Once a price breaks above a resistance zone, it signals that buyers have absorbed all the supply from sellers at this level and price can resume it's advance. Following a resistance breakout, the next closest resistance zone becomes a price target. Learn to trade key level breakouts in Lesson 7.

Trend : Short-term trend is Strong Up, Medium-term trend is Neutral and Long-term trend is Down.

Momentum is Bullish (MACD Line crossed above MACD Signal Line) ABOVE days ago. Price is neither overbought nor oversold currently, based on RSI-14 levels (RSI > 30 and RSI < 70).

Support and Resistance : Nearest Support Zone is $0.55, then $0.45. Nearest Resistance Zone is $0.90.

$KNC BULLISH FROM HERE 👨🏻💻 TSXV:KNC / USDT

#KNC Network Crystal has bounced off the weekly support zone

This bounce sets up a move towards the top of the channel and a breakout📈

The target price for this potential breakout is $2.00🎯

- - - - - - - - - - - - - - - - - - - -

Follow #CryptoEase and Share it With Your Crypto Mate 😉

BITFINEX:KNCUSD

KNC/USDT It will be bullish momentum if success break the supply💎 Paradisers, KNC is indeed presenting intriguing movements that warrant close observation.

💎 The successful break of the supply zone and transition to the demand area in the lower time frames indicate a potential shift in momentum.

💎 Currently, the price is testing the demand area following a strong rejection at the supply zone, which lies between 0.7 to 0.738. There's a possibility that KNC may attempt to move upward again to break through the supply area.

💎 If successful this time, it could signal a bullish momentum, potentially leading to the achievement of our target.

💎 However, if KNC fails to break above the supply area once more and experiences a strong rejection indicated by a bearish candle, there's a likelihood of a retracement back to the downside. In such a scenario, the price could revisit the demand area, which ranges from 0.620 to 0.58.

💎 KNC must bounce from this demand area, especially considering the presence of a support trendline within it. A breakdown below the support trendline could indicate a bearish trend shift, potentially leading to further downward movement toward the support level around 0.534.

💎 When KNC reaches the support area, it must bounce back and resume its upward trajectory, potentially making another attempt at breaking the resistance. Given KNC's historical behavior of bouncing off key support levels, there's a possibility of a similar scenario playing out, resulting in a return to upward movement.

💎 However, traders should remain vigilant and closely monitor KNC's price action. A breakdown below the demand area, confirmed by a daily candle close below it, would invalidate the bullish scenario and could lead to further downward movement.

MyCryptoParadise

iFeel the success🌴

KNC's Bullish Clues are So Strong !Hi.

COINEX:KNCUSDT

If the ascending triangle breaks down, we can focus on the symmetrical triangle.

Traders, if you liked this idea or have your opinion on it, write in the comments, We will be glad.

_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!