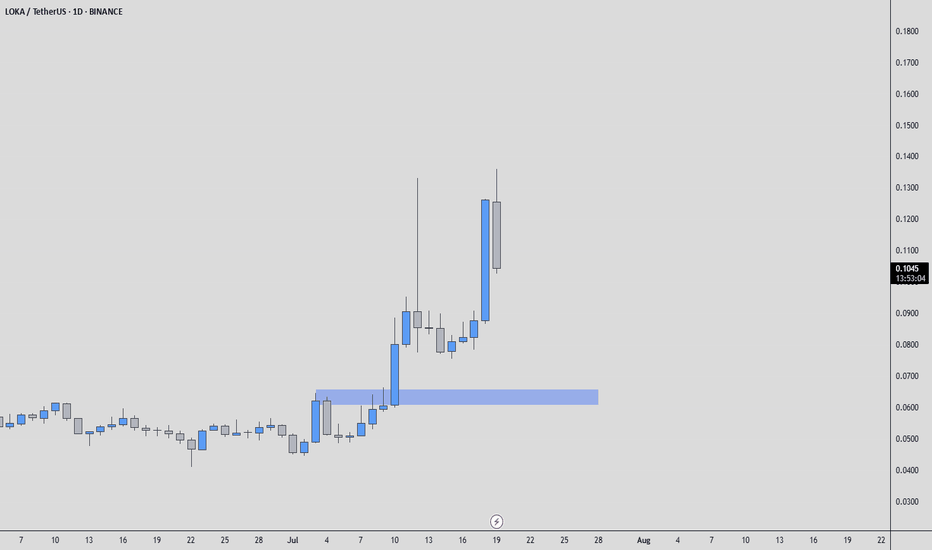

LOKAUSDT: Critical Support Zone Identified - Your Winning Entry Here's the reality: While others hesitate and overthink, successful traders act when opportunity presents itself clearly.

The Setup That Separates Winners From Losers

One major support zone (marked in blue box) tells the complete story. My footprint CDV analysis confirms what institutional money already knows - this level isn't a suggestion, it's a battle line.

Your Proven Path Forward

The Blue Box Zone: Prime accumulation target - where smart money positions for the next move up

The Choice Is Simple

Execute at this level with precision, or watch from the sidelines as others capitalize. My track record speaks for itself - this isn't hope-based analysis, it's data-driven opportunity.

What Happens Next

Follow this blueprint: You position at the blue box support, manage risk precisely, and capture the inevitable bounce that follows institutional accumulation.

Ignore it: Watch others profit while you chase price higher after the breakout.

Bottom Line

The market has drawn the map. The footprint data confirms the plan. Your success depends on one thing: execution when opportunity knocks.

The zone is marked. The analysis is complete. The choice is yours.

LOKAUSDT trade ideas

Loka/USDT Higher !!LOKA/USDT showing strength after a healthy 20% correction, indicating a potential continuation of the uptrend. The recent pullback appears to have invited fresh buyer interest. Current price action suggests accumulation by smart money, with increased volume confirming the inflow of capital.

Targeting $0.113 as the next resistance level

LOKAUSDT - Sell Market has formed head and shoulder pattern followed by Bearish Divergence.

we take entry on break of neckline and place stoploss above right shoulder. TPs as projected with R:R of 1:1 and 1:2

LOKAUSDT Forming Falling WedgeLOKAUSDT is currently showing an interesting setup that has caught the attention of crypto traders and investors. The pair is forming a classic falling wedge pattern, which is widely known as a bullish reversal pattern in technical analysis. This pattern, combined with good trading volume, indicates that LOKA may be preparing for a strong breakout to the upside. With an expected gain of 60% to 70%+, this setup could offer a compelling opportunity for those looking to ride the next wave in altcoins.

League of Kingdoms (LOKA) is a well-known play-to-earn and blockchain gaming project that has been steadily gaining traction in the GameFi space. The project allows players to build kingdoms, engage in battles, and earn rewards, which drives community engagement and token demand. As interest in blockchain gaming and NFTs continues to grow, the underlying fundamentals for LOKAUSDT could provide additional momentum to push prices higher once the wedge breakout occurs.

On the technical side, traders will be watching for a decisive breakout above the wedge resistance line, ideally supported by a surge in volume to confirm the trend reversal. If this scenario plays out, LOKAUSDT could easily reach its expected target zone with gains of 60% to 70% or more. Investors should also stay alert to news and partnerships from the League of Kingdoms team that might act as further catalysts for price action.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

LOKA/USDT – Breakout WatchLOKA has broken out of a descending channel on the 1H chart, showing early signs of bullish momentum. The price has breached the upper boundary of the falling structure, supported by strong volume and clean trend confirmation.

Support Levels:

$0.05293 (recent breakout level)

$0.04474 (range low support)

Resistance / Target Levels:

$0.06104

$0.06732

$0.07253

Stoploss: Below $0.050 to protect against false breakout

Trade Idea:

Entry on retest near $0.053–$0.054 for a safer risk-reward setup.

Targets align with previous horizontal resistances and Fibonacci levels.

LOKA looks poised for a potential trend reversal if the momentum sustains above the channel. A break and hold above $0.061 would open room for higher targets.

As always, risk management is key.

Not financial advice – DYOR.

#LOKA Trading opportunity for LOKAUSDT#LOKA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 0.0520.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.00500, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0531

First target: 0.0543

Second target: 0.0560

Third target: 0.0580

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

LOKAUSDT // head and shoulders formationAlthough there is a reverse head and shoulders formation on the chart, the targets are drawn according to Fibonacci.Let's look for closures above the blue line.

LOKAUSDT: Not Bearish Yet, But How Long Can It Hold?LOKAUSDT: Not Bearish Yet, But How Long Can It Hold? 🛑

Unlike the general market trend, LOKAUSDT is not showing bearish signs, but let's be real here: it’s unlikely to stay strong for long given the changing market conditions.

Here’s my plan:

Red Box: I’ll be looking for short opportunities from this level. But caution is key – confirmation tools are a must before taking any position.

Confirmation Tools:

LTF (Low Time Frame) market structure breaks

CDV (Cumulative Delta Volume)

Volume Profile

As always, manage your risk and trade smart. Remember, patience is key! Boost, comment, and follow for more updates! 💪

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

its Crypto Trade coin name is LOKA/USDT trade is on hourly bases as it can be considered as early entry but confident about bullish trend. RR is 15.65. buy at 0.2994 Stop Loss 0.29 and Target Will be 0.4061

Trading opportunity for LOKAUSDTBased on technical factors there is a Buy position in :

📊 LOKAUSDT

🔵 Buy Now

🪫Stop loss 0.1900

🔋Target 1 0.2500

🔋Target 2 0.2900

🔋Target 3 0.3500

💸RISK : 1%

We hope it is profitable for you ❤️

Please support our activity with your likes👍 and comments📝

Trading opportunity for LOKAUSDTBased on technical factors there is a Buy position in :

📊 LOKAUSDT

🔵 Buy Now

🪫Stop loss 0.1900

🔋Target 1 0.2500

🔋Target 2 0.3000

🔋Target 3 0.3500

💸RISK : 1%

We hope it is profitable for you ❤️

Please support our activity with your likes👍 and comments📝

Trade Alert for LOKAUSDT: Time to SellAttention traders! A new trading opportunity has been identified for the LOKAUSDT currency pair using our EASY Quantum Ai strategy. Here's the trade setup:

Trade Details

Direction: Sell

Enter Price: 0.203

Take Profit: 0.19016667

Stop Loss: 0.21666667

Analysis and Rationale

Our prediction to sell LOKAUSDT is based on a confluence of technical indicators that suggest a downward movement. Recent analysis reveals increasing bearish momentum, highlighted by downward crossing moving averages. Additionally, relative strength index (RSI) signals that the pair is approaching an overbought territory, indicating a potential reversal. Trading volumes have shown a decrease in buying interest, hinting at a weakening market.

The EASY Quantum Ai strategy, which utilizes advanced AI algorithms to recognize predictive patterns, detects these as strong sell signals. Traders are advised to enter the market at the specified price and manage their positions diligently according to the provided take profit and stop loss levels.

Remain vigilant and ensure to monitor any market updates that could affect the trade dynamics. Stay safe in the market!

#LOKA 250 % PUMP Loading..#LOKA 250 % PUMP Loading..

After #ARKM #ARK Now We Are Ready For #LOKA 250 % PUMP Festivle .

ENJOY THIS.

DM For ALL ALTS UPDATES AND NEXT PUMP.

LOKA’s Preparation for Explosion LOKA is a gaming coin. It has been in a bearish trend since issuance. Recently, bullish patterns have been forming in the current range which is an ATL. So, it’s wise to take the risk in this level and bet on it.

I expect $0.162 to be the best new entry. Breaking $0.109 cancels the whole idea. Passing $0.216 without dropping invalidates the LTF drop and indicates going higher.

Trading Signal for LOKAUSDTDirection: Buy

Enter Price: 0.2225

Take Profit: 0.2306

Stop Loss: 0.2128

Greetings Traders,

We have identified a potentially profitable trading opportunity for the LOKAUSDT pair. Based on our analysis using the EASY Quantum Ai strategy, we suggest entering a buy position at the price of 0.2225 . The target for taking profit is set at 0.2306 , while the stop loss is established at 0.2128 , ensuring minimal risk.

The rationale behind this forecast hinges on several factors that align with current market indicators. Firstly, we have observed increasing bullish momentum in LOKAUSDT, characterized by rising trading volumes and a strengthening price trend. Additionally, technical analysis has revealed the formation of a bullish pattern, signaling potential upward movement.

Furthermore, the market sentiment surrounding this pair is positive, underpinned by strong fundamental drivers that are expected to support its appreciation. With the integration of our sophisticated AI strategy, we identified these converging signals which suggest a high probability of upward price movements.

Trade wisely and ensure to manage your risks accordingly. Stay tuned for further updates and happy trading!

LOKA USDT Daily TF LOAK USDT Trade Idea.

Historical Trends:

The price has seen substantial volatility since early 2024, with a major peak above $0.350 in mid-year followed by a prolonged bearish phase.

The price has consolidated near the $0.165 to $0.176 support zone (M-W-Sup: likely Monthly or Weekly Support).

Support & Resistance Zones

Support:

Major support appears around the $0.165 to $0.176 zone, which is being retested. This level is holding well and represents a potential accumulation zone.

Resistance:

Immediate resistance lies around $0.250, with a potential move towards the $0.340 zone, as indicated by the blue projection.

Projected Path (Bullish Scenario)

The projection suggests a breakout from the consolidation around $0.201. The price could move upwards in a zigzag pattern, with the next major target being around $0.340. This implies bullish momentum for the upcoming months.

RSI Double Bottom

Upon closer inspection of the RSI:

The RSI made a low around 32.00 in early September, indicating oversold conditions.

It then bounced and made another low, slightly higher, around 47.01, forming the double bottom pattern.

This formation is often a precursor to a bullish trend reversal. As the RSI moves upward, it could signal stronger buying momentum in the near future.

The double bottom RSI pattern confirms the likelihood of upward price movement, which aligns with the chart's bullish projection.

Overall Confirmation

Price Action: The bounce from the M-W support zone around $0.165 is holding, and combined with the RSI double bottom, this strengthens the probability of a bullish breakout.

Key Levels to Watch:

If the RSI continues to climb and breaks above 60, this would further confirm a stronger bullish trend.

The projected price levels of $0.250 and $0.340 remain valid targets based on this setup.

LOKAUSDTWe can attempt to buy LOKAUSDT from specified level as it make HL , also no bearish divergence occur indicate that it moves upward.

SL , TP mention in chart.

WARNING ------- ALT SEASON IS STARTINGMartyBoots here , I have been trading for 17 years and sharing my views with the crypto community.

WARNING - Do NOT miss this opportunity

These Charts show ALT SEASON is STARTING just like it did last time

LOKAUSDT.1DLooking at the LOKA/USDT daily chart, I'm analyzing the price behavior and its interaction with established support and resistance levels. The current market sentiment and technical indicators provide a foundation for potential trading strategies.

Support and Resistance Levels:

The chart marks significant resistance at $0.2476 (R1) and a stronger resistance at $0.3413 (R2). The support level at $0.1148 (S1) is crucial, as it has historically served as a bounce point, signaling strong buying interest. Observing these levels helps in planning entry and exit points for trades.

Current Market Position:

The price of LOKA is presently oscillating around $0.2138, between the primary support and the first resistance level. This positioning indicates a consolidation phase, possibly gathering momentum for a directional move.

Technical Indicators:

The MACD line is relatively flat but slightly above the signal line, hinting at a marginal bullish momentum. However, the absence of significant divergence from the signal line suggests a cautious approach as the market could sway in either direction.

The RSI stands at 57.04, a neutral zone that leans neither to overbought nor oversold conditions. This indicates that there is room for price movement on either side without immediate pressure from market extremes.

Strategy Going Forward: Given the consolidation pattern and the positioning within key levels, my strategy would involve closely monitoring the price as it approaches R1 at $0.2476. A confirmed breakout above this level on increased volume could suggest a potential move towards R2 at $0.3413, presenting a bullish scenario. Conversely, a drop towards S1 at $0.1148 would necessitate reassessing the bullish sentiment and preparing for potential downtrend plays.

Risk Management:

Setting a stop-loss just below the recent consolidation low would be prudent to protect against unforeseen drops.

Additionally, monitoring broader market trends and news impacting the crypto market will be essential to stay ahead of abrupt price changes.

This careful and balanced approach, coupled with vigilant observation of technical cues and volume changes, will guide my trading decisions in the coming days.

LOKAUSDT(LeagueofKingdomsArena) Updated till 05-09-24LOKAUSDT(LeagueofKingdomsArena) Daily timeframe range. stuck between 0.1769-0.2481 for a while now. staying above 0.1769 will be more optimal here it will give it more chance for a push. but if 0.1769 breaks it got chance to go back to 0.1223.

LOKAUSDTWe can attempt to short LOKAUSDT from specified level as it break HL , also bearish divergence occur indicate that it moves downward .

SL , TP mention in chart.

LOKA | ATLWe have another very interesting chart here and I think we can keep it easy. The fact that LOKAUSDT is producing strong bullish growth, supported by high volume coming out of a new all-time low says it all.

The all-time low is the most important signal.

➖ The ATL candle, 5-Aug., has really low bearish volume.

Revealing that the bearish trend is over.

➖ The ensuing bullish candles are big and with high volume.

Revealing that a reversal is taking place.

Now, please consider the difference between a pair like this one and Ethereum, just as an example to mention one of the "big ones."

It is easy to be bullish on a pair like this one because it produced a new all-time low and is now growing, but, when a pair/project trade at really high prices, it is much harder to become bullish or at least to be fully certain of a trend-reversal.

While smaller capitalized altcoins can start to grow, long-term and strong, bigger capitalized altcoins might not be done with their corrective phase. This is logical and makes sense. One completed its cycle, and so is ready to grow. The other hasn't completed the cycle and it has to go through it in full before change becomes possible.

I am using the log chart because it looks better, it is more appealing to the eyes, but the linear chart shows the true perspective as to what "bottomed out" and "all-time low" really means. It means that there is huge potential for growth.

LOKA Long-term linear chart:

Based on technical analsys, the chart signals: This is a good pair for a long-term trade.

Potential for growth short-term is also good.

Thank you for reading.

Namaste.