0A4J trade ideas

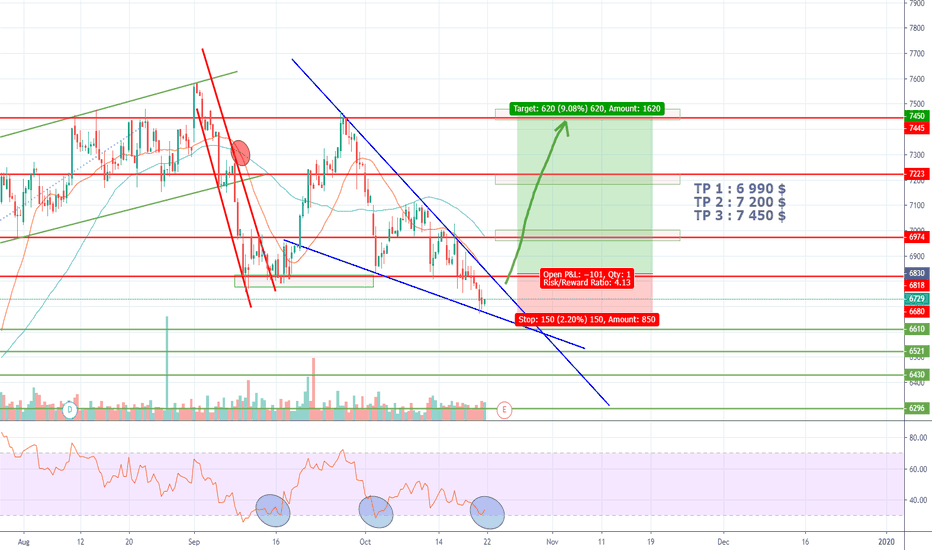

A little jump before big dump ?!Still bullish on AZN.L but ascending broadening wedge :

- Need to break 7 580$ resistance

- RSI divergence

- MM20 > MM50

Statiscally in 80% of cases, the exit of this pattern is bearish.

So, I will open a short position around 7 400 $. (TPs on chart)

Always 2 gap to fill :

- Around 6 930 $

- Around 6 550 $

Happy trading

AstraZeneca - Breaking from a wedgeBuy AstraZeneca (AZN.L)

AstraZeneca PLC (AstraZeneca) is a biopharmaceutical company. The Company focuses on discovery and development of products, which are then manufactured, marketed and sold. The Company focuses on three main therapy areas: Oncology, Cardiovascular & Metabolic Disease (CVMD) and Respiratory, while selectively pursuing therapies in Autoimmunity, Infection and Neuroscience.

Market Cap: £90.48Billion

AstraZeneca is breaking higher from a corrective wedge pattern on the daily chart. The long-term uptrend remains bullish and a move towards new highs is expected.

Stop: 6565p

Target 1: 7465p

Target 2: 7580p

Target 3: 8000p

Interested in UK Stocks?

Join our free Telegram channel for up to date analysis on the best main market opportunities in the UK right now - t.me

Astrazeneca shortHere wave 3 extended and was nearly 1.618*the length of wave 1, therefore wave 5 should be a maximum of 100% of the length of wave 1. Wave 5 is currently slightly over 61.8% of the length of wave 1. Here wave 5 is clearly an ending 5th wave diagonal and thus a sharp reversal should follow very soon.

Different scenariosI think this graphs shows the situation which we are in. I originally thought that the fifth wave was over warlier when we hit just over the 1.618 making it the perfect fib ratio. However, the last wave up surprised me. So I considered that maybe we witnessed a b wave correction inside the ABC whih goes over the previoues wave up. However the scenario wasn't convincing. So I assumed we are in the fifth wave up.

Another scenario I analysed was foe another wave up remaing in the fifth wave, however looking at the RSI level divergence that seemed less likely too.

Therefore, my current theory is that we have now wtnessed a complete wave up, and the wave A in the correction. Therefore the play i suggest is to wait for the completion of wave B, and then short the stock for the Wave C