0A77 trade ideas

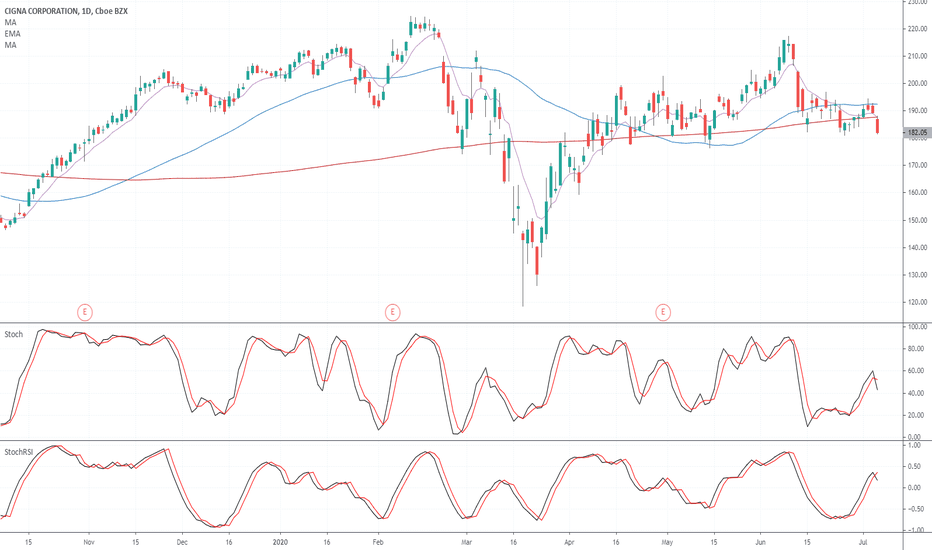

CI - My Highest Conviction InvestmentCigna our in an absolutely gorgeous inverse head and shoulders formation and is now breaking to the upside. This laggard has plenty of room to move from here towards the end of the year. Due to previous tests of the 220-225 level, I suspect there is a good possibility of breaking out even higher especially since this is considered a defensive stock.

I hope we profit together! DM me to get my ideas before the public. Cheers!

IDEA of CIGNA CORPORATIONHey people,**DISCLAIMER** content on this analysis is subject to change at any time without notice, and is provided for the sole purpose of assisting traders to make independent investment decisions. CIGNA CORPORATION is in a phase wanting to start rising, compared to its previous low little volume traded rebound on the trend support pausible takeoff.

Please LIKE & FOLLOW, thank you!

Trying to understand how drawings follow chartsI've been struggling with this for two weeks. The video shows a sequence of how I'd like it to work, and as you see it does work. Multiple times it works in the afternoon, but when I go to set up in the AM before open, it will not work. So this video is proof that it does work. I'm leaning towards the explanation that TradingView restricts allocation of data near opening bell time.

$CI Cigna Corp Golden Cross but needs a rest. Really bullish recovery from the bottom in early October, the rise has been so strong that the indicators are getting tired and overbought, we expect a slight pullback to create a better entry level.

Average analysts price target $217 | BUY.

P/E ratio 16.60.

Company profile

Cigna Corp. is a global health service company, which is dedicated to improving the health, well-being and peace of mind. Its products and services include an integrated suite of health services such as medical, dental, behavioral health, pharmacy, vision, supplemental benefits and other related products including group life, accident and disability insurance. The company was founded in 1792 and is headquartered in Bloomfield, CT.

$CI ANTHEM AND MEDICARE HAVE PRODUCED A DARK CLOUD ABOVE CIGNAFrom a fundamental perspective, this entire sector will be used as a pawn within the political parties to gain favor with the electorate until after the 2020 election, that is quite a while to wait for a safe entry point or maybe not. Cigna is also embroiled in a long suffering court case with NYSE:ANTM claiming THAT ANTM should pay compensation of $16 billion for the botched takeover in 2015. IF CI was to win the case it would be extraordinary but most likely they will be awarded the break up of fee of $1.84 billion.

From a technical point of view the chart is becoming quite interesting and suggesting a entry point may be on the way. Please consult the chart for analysis but a break and possible retest of the trend-line(blue) would be a good buy signal.

P/E RATIO 14.81

AVERAGE ANALYSTS PRICE TARGET $214

AVERAGE ANALYSTS RECOMMENDATION BUY

COMPANY PROFILE

Cigna Corp. is a global health service company, which is dedicated to improving the health, well-being and peace of mind. Its products and services include an integrated suite of health services such as medical, dental, behavioral health, pharmacy, vision, supplemental benefits and other related products including group life, accident and disability insurance. The company was founded in 1792 and is headquartered in Bloomfield, CT.