TUI - EUR Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

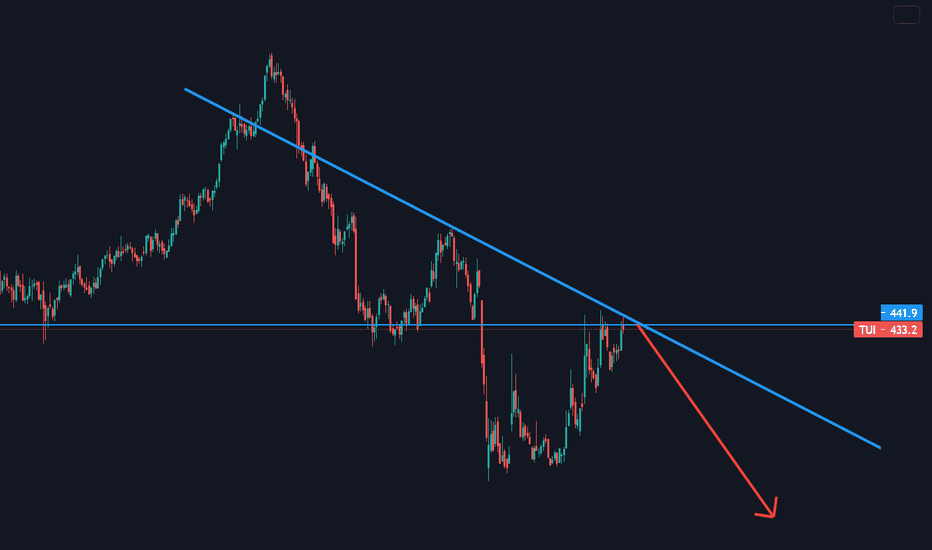

# TUI - EUR Stock Quote

- Double Formation

* 7.600 EUR | Completed Survey | Subdivision 1

* Head & Shoulders Pattern | Configuration Entry

- Triple Formation

* Retracement Not Numbered | Subdivision 2

* (Flag Structure)) | Uptrend Bias | Subdivision 3

* Daily Time Frame | Entry Settings

Active Sessions On Relevant Range & Elemented Probabilities;

European Session(Upwards) - US-Session(Downwards) - Asian Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

0ACY trade ideas

TUI stock can be considered contrarian Recent Performance: TUI's share price has been volatile, especially due to the COVID-19 pandemic. While the stock has recovered somewhat, it still hasn't reached its pre-pandemic levels. This underperformance relative to the broader market can make it a contrarian pick.

Industry Sentiment: The travel and tourism industry, which TUI is a major player in, has faced significant challenges in recent years. Negative sentiment surrounding the industry can lead to a pessimistic outlook on TUI stock, making it a contrarian choice for investors who believe in the long-term recovery of the sector.

Valuation: Some analysts argue that TUI's current valuation may be undervalued, especially considering its strong brand, diversified business model, and potential for growth. If the market sentiment towards the company improves, the stock price could rise significantly.

Potential for Recovery: As the global economy recovers from the pandemic and travel restrictions ease, TUI is well-positioned to benefit from increased demand for leisure travel. This potential for recovery can make the stock an attractive contrarian investment for those who believe in the long-term prospects of the company.

TUI - 1 year HEAD & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

The content is The Art Of Charting's personal opinion and it is posted purely for educational purpose and therefore it must not be taken as a direct or indirect investing recommendations or advices. Any action taken upon these information is at your own risk.

Unveiling Potential Opportunities in $TUI1 Stock - LONGUnveiling Potential Opportunities in XETR:TUI1 Stock: Navigating the Surge and Identifying Profit Targets

In the wake of recent developments surrounding Tui, Europe's largest package holiday operator, the decision to potentially shift its stock exchange listing from the FTSE 250 to Frankfurt has stirred considerable interest in the financial landscape. This move not only impacts Tui's positioning but also raises questions about London's standing as a global finance center.

Analyzing the Buzz:

Our analytical tools reveal a notable influx of new capital into XETR:TUI1 , suggesting a shift in investor sentiment. This surge in interest prompts a comprehensive examination of Tui's current standing and the potential for robust bullish momentum in the coming weeks. The evolving narrative surrounding Tui's future developments adds an intriguing layer to the stock's dynamics.

Key Insights:

Listing Shift Implications: The contemplation of moving the stock exchange listing from FTSE 250 to Frankfurt introduces a new dimension. Investors should closely monitor how this potential shift impacts Tui's visibility and accessibility in the global financial markets.

Bullish Momentum Anticipation: With the influx of new capital, anticipation is high for the emergence of strong bullish momentum. Investors should position themselves strategically to capitalize on potential upswings in $TUI1.

Take Profit Strategy:

As seasoned stock traders, we identify the importance of setting realistic take profit targets. Considering the current market conditions and Tui's evolving narrative, we propose the first take profit zone to be around $13.345. This level is strategically chosen based on our analysis of Tui's recent performance and the potential for continued positive developments.

Risk Considerations:

While optimism surrounds XETR:TUI1 , prudent risk management is paramount. Stay vigilant to external factors, such as geopolitical events or regulatory changes, which may impact the stock's trajectory. Maintain a keen eye on the evolving narrative and be prepared to adjust strategies accordingly.

Conclusion:

Navigating the current landscape of XETR:TUI1 requires a balance of informed analysis and strategic decision-making. As we anticipate bullish momentum, investors should carefully monitor unfolding developments, align their portfolios accordingly, and consider implementing risk management strategies.

For further insights and real-time updates, continue tracking reputable financial news sources and market indicators.

Disclaimer: The information provided is for educational purposes and does not constitute financial advice. Always conduct thorough research and consult with a financial professional before making investment decisions.

TUI1 - short time LONGSMonthly and weekly in downtrend.

D and H4 uptrend - price near D demand zone ( green area).

Waiting for 30 min to make an upside BOS for a long until the D supply area ( red zone) - counter trend trade!

SL - beneath the last H4 low (5.360 eur).

TP 1- could be at the last H4 high (5.798 eur), or to 38,2 fib level.

Russian Link to Haunt TUI!!?The Russian link is still weighing down on this stock. I have decided to short it on the backdrop of not only that fundamental news but rather the loss of momentum we saw from last week on approach of crucial resistance. Stop orders.

TUI - Good level to go long hereTUI seems to be bouncing in the downward parallel channel. Also at the spot where the gap dec 2020 is filled. Long term support slowly inchin uppwards. If TUI survives this next wave of covid it could really take off. SL under 2.2. TP1 at 2.99 (roughly channel roof). TP2 at 3.448 (gap close). TP 5.38 (a harmonics AB=CD move from nov 2020 bottom).

Tui Short but buy soonTui failed to continue its head and shoulders pattern due to a surprise share offering! thanks for that tui. this clearly shows they are still struggling which is obvious but this means continued downside for tui is expected especially over the winter. we might get a decent earings out around september next year which will boost share price.

from here now considering the offering allowed shareholders to buy at 182 there will be selling upon issue of these shares lowering share price to bottom support line in my opinion around 180/140. i consider this a buy area and can see the failing wedge pattern play out next year so lower your average down and buy anything under 150 if you get the chance.

i see travelling becoming hot in late 2022 and in 2023 and this will be the beginning of a trend. during this time no doubt the stock market will flop which will allow people to get a good temporary deal on tui and people decide to spend some profits on holidays. the rotation is coming and tui are the leader and basically only major holiday maker left in UK

Tui continued short.Tui failed to continue its head and shoulders pattern due to a surprise share offering! thanks for that tui. this clearly shows they are still struggling which is obvious but this means continued downside for tui is expected especially over the winter. we might get a decent earings out around september next year which will boost share price.

from here now considering the offering allowed shareholders to buy at 182 there will be selling upon issue of these shares lowering share price to bottom support line in my opinion around 180/140. i consider this a buy area and can see the failing wedge pattern play out next year so lower your average down and buy anything under 150 if you get the chance.

i see travelling becoming hot in late 2022 and in 2023 and this will be the beginning of a trend. during this time no doubt the stock market will flop which will allow people to get a good temporary deal on tui and people decide to spend some profits on holidays. the rotation is coming and tui are the leader and basically only major holiday maker left in UK

Tui Analysis 09.10.2021Hello Traders,

welcome to this free and educational analysis.

I am going to explain where I think this asset is going to go over the next days/weeks and where I would look for trading opportunities.

If you have any questions or suggestions which asset I should analyse tomorrow, please leave a comment below.

I would also appreciate, if you would smash that like button and help me to create more free analysis like that.

Thank you for watching and I will see you tomorrow!

Tui BuyTui looks like it could be playing out an inverse head and shoulders pattern ready to regain the 200 SMA and start trading higher again

Accumulation phaze of a lifetime As we know The airline and travel industry came under immense pressure during the pandemic, Stacking up massive losses over the past months.

For the period ended 31 March, Tui posted a net loss of €1.47bn, which widened from a loss of €861.4m a year prior, Group revenue was €716m, down 89% the company said.

Yet we need to stay optimistic but hopeful in a way,

As the pandemic is still disrupting many sectors, we can start to see the light at the end of the tunnel.

With the vaccine passes rolling out, most airliners can start seeing positive signs of a long-term recovery,

With bookings increasing by the day, Most are working towards regaining full potential

This might be a great time to accumulate some shares looking forward

TuiOne of my favourites recently. been following its trend lines for while however with the market FUDDING over inflation fears which is justified, its only a matter of time before uk markets get hit with the same downtrend. Travel is still not clear so right now i could see if coming back down to next level of support before some good news. overall im long on tui, they hold the market in the UK for package holidays and have done well to raise cash during covid.

$TUI MASSIVE SHORT POTENTIAL?! Or Reversal?Looks like we`re at the Top of the Uptrend, could be massive Short Potential.

If its breaks the big Downtrend channel it´s bullish.

The News about Covid-19 and the tourism branch will decide if were going up or down

rising wedge or pennant for tui1 ?depending on the outcome of this week, we´ll see if its a rising wedge(bear) or pennant( bull). ether way its a good buy today, Tui is a strong company with gouverment support for its fight against the corona virus. i believe it could recover to above its pre corona price.

sorry for my blurry english, i was allways sleeping at school ;D

WHY DID Tui Ag Crash? (EXPLAINED)Yet again Tui Price plummeted Roughly 7 % Since Market open, Caused by fear From institutional investors upon release of the current plans of Tui,

The public announcement of Tui Raised some fear in the market after Yet again trying to raise € 350 million in convertible bonds offering,

with the option to increase the issuance volume to € 400 million

TUI intends to use the proceeds from the Offering to further improve its liquidity position as the Covid-19 crisis continues and subsequently for the repayment of existing financing instruments.

TUI with good outlook but maybe sidewards nowTU has a good trend, but must now compete with the long-term down trend since 2019.

This struggle may end with a positiv break out, but usually this resistance will not won in a short term. So a sidewards move with several breakout attempts should be seen in the next 1-2 month, then a break out is possible, espacially if corona ends and more vacation travels beginn.