0HHB trade ideas

Stocks pairs trading: SBUX vs ARMKLet's explore why consider going long on SBUX and short on ARMK.

Fundamental Strengths of Starbucks (SBUX)

1. Operational Efficiency (Profit Margin: 10.80%)

Starbucks has a profit margin of 10.80% compared to Aramark's 3.00%. This suggests that Starbucks is more efficient at converting sales into actual profits, which is a positive sign for potential stock appreciation.

2. Dividend Attraction (Dividend Yield: 2.16%)

Starbucks offers a dividend yield of 2.16%, compared to Aramark's 1.15%. This extra incentive could attract income-focused investors and offer some downside protection.

3. Market Leadership (Analyst Recommendation: 2.50)

Starbucks has an analyst recommendation score of 2.50, compared to Aramark's 2.30. Although both are generally in the "Buy" category, Starbucks edges out with a slightly more favorable recommendation.

Risks Associated with Aramark (ARMK)

1. High Leverage (Debt/Eq: 2.15)

Aramark's debt-to-equity ratio is 2.15, suggesting the company has a higher reliance on debt to finance its operations, making it potentially more vulnerable in economic downturns.

2. Vulnerability to Sector Shifts (Operational Margin: 4.30%)

Aramark's operational margin of 4.30% could be a point of vulnerability if there are shifts away from institutional food services, its main business sector.

3. Less Favorable Analyst Recommendations (Analyst Recommendation: 2.30)

Aramark has an analyst recommendation score of 2.30, which is slightly less favorable compared to Starbucks' 2.50. This could indicate weaker investor sentiment, making it a candidate for a short position.

Starbucks China data for consideration

Strong Growth in China: Starbucks reported a 46% year-over-year increase in same-store sales in China for fiscal Q3 2023. This is significant because it shows the company's resiliency and adaptability in a crucial market.

Continued Expansion: Starbucks has consistently expanded its store count in China from 3,924 in fiscal Q3 2019 to 6,480 in fiscal Q3 2023. Despite the challenges due to COVID-19, the company never slowed down its expansion, indicating a strong long-term strategy.

Robust Operating Income: Starbucks’ operating income for its international segment, which includes China, was $375 million, up a remarkable 177% year-over-year. This shows not just a recovery, but a roaring rebound in profits.

Management’s Optimism: Starbucks aims to have 45,000 locations by the end of fiscal 2025 and 55,000 by the end of fiscal 2030, with the expectation that EPS could grow 15-20% annually. This aligns with the initial analysis of the company's growth potential and financial stability.

Questionable EPS Growth: It's worth noting that while revenues have been growing, Starbucks' EPS has remained largely flat. However, this has been attributed to underperformance in China, which is now showing signs of significant recovery.

Decision:

Long on 1*SBUX

Short on 3*ARMK

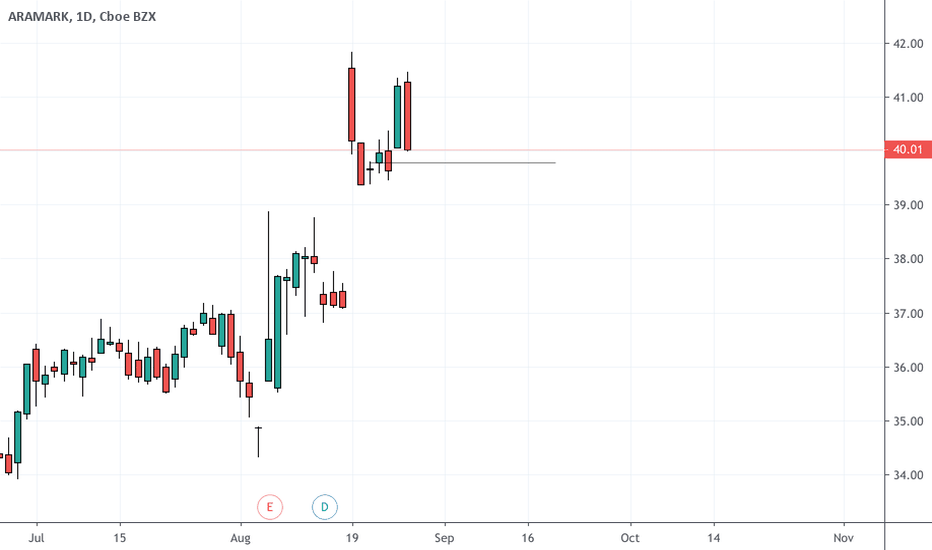

ARMK - Base FormationARMK is undergoing consolidation after finishing its breakout of a descending broadening wedge to the bullish side

This consolidation could be called a base formation

Which can be observed to have been formed in price action in history also

Structural similarities between the base formations

ARMK Daily Buy SetupNYSE:ARMK looks very bullish with a nice bottoming pattern on top of the 200 EMA. It looks almost like an inverse head and shoulders bottom

The buy setup entry is at $38.05 taking out the high of today's bar

If you want a very aggressive stop loss I would use the low of today's bar at $37.46

A more conservative stop loss is below the June 4th low at $35.52

ARMK. Rather Buy than Sell.I'm really uncertain on this one. I have too many rules and lenses to look through when picking stocks. Really need to boil down my process. Of course, once I do that a part of me will say I'm being lazy and need to research my picks more thoroughly. Who knew getting along with myself would suck so much?... Me. I did. That's why I try so hard to get along with others and avoid drugs and alcohol. Life hecking sucks, and so do I.

ARMK @38 Put Exp: 19 Apr 21Disclaimer: Futures, stocks, and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, and options may fluctuate. As a result, clients may lose more than their original investment. The impact of seasonal and geopolitical events is already factored into market prices. The highly leveraged nature of futures trading means that small market movements will significantly impact your trading account, which can work against you, leading to significant losses or can work for you, leading to large gains.

I am not your financial advisor; please do your research, and it is not recommended to risk more money than what you are willing to lose.

$ARMK with a bearish outlook after a Negative under reactionPEAD projected a bearish outlook for $ARMK after a Negative under reaction following its earning release placing the stock in Drift D

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

ARAMARK Chart DailyHey traders, ARAMARK is in an uptrend with bull shadow and low buy volume. Looking at the TIMEFRAME M1 we can see an attempt by rejected buyers with a high volume of sales. And she wants to go to her next lowest to start again on her climb. There is a good chance of going to the last precedent above (See TIMEFRAME H4). And if the buyers are still there, we can go to fill the bearish breakout gap.

Please LIKE & FOLLOW, thank you!

Testing trading my screener 10day cross 20day SMAGoing to do a trial trading with a small balance and following specific rules:

Rules:

1. No earnings plays

2. No increasing/averaging down, use a stop loss of 20-30%

3. Charting based on triangles/wedges and SMAs

4. At the money/near the money (except larger cap/further out (AMZN/TSLA/CMG), so far played these well)

5. Risk/reward 3/1 or greater

6. Buy at least 2 weeks out

7. After the first week, get out and reassess if it still hits all these criteria

Started with a BA call option yesterday $250 to $480.

ARMK $24 call, 8/21, 3 buys at $145 (should have waited to end of day). Came up on my screener, will sell before end of week if there is not move.

For my next trade I'll add a target $ and stop loss $.

For now, going to journal a list of trades for fun.

GLTA!

ARMK SHORT - Probably LOOSER, BUT HAVE TO TAKE IT !!! :/Hi traders,

today´s analysis is a little bit different because I am talking about reasons why to not enter the ARMK Short trade. So there might be the question: "Why did you open that?"

You maybe remember my video that contained claim: "Trade what you see not what you think". And that´s the situation that happens to me right now.

I see many reasons that confirm the idea, that we will probably go higher...However! I have to stick to the plan, which contains very simple rule - Follow the INSIDERS (and they increased their Short positions in this market).

In spite of being scared of taking this trade, I have to do that. Statistics show that this approach is profitable from a long term perspective.

So here are the parameters of the trade:

Market: ARMK

Direction: SHORT

Entry: 25.15

SL: 29.17

PT: 17.11

Good trading!

Jakub

FINEIGHT

aramark Pt.2So you can see we JUST held the zone and then fired off triggers..and got a little rally after it.. BUT now we gotta watch for the hurdles cuz this is trending lower on some of these time frames so this is how we manage a live trade so we dont let a winner turn into a looser. Some people do some options play that helps hedge the position If and until we break the hurdles..people who just bought the stock outright might wanna get the stop to break even. You can always get back in on the next setup. But never loose money on a winning trade. That takes some serious discipline, but great traders can do it

TriggersRemember that setup in aramark? This is why we wait for triggers.. The triggers WILL help filter out zones that just wont hold.. and lets be clear, just because you get a trigger , that DOESNT mean the trades GONNA work. This is trading. We play the probabilities. You have a much better chance of the trade working out with a trigger then without. Triggers HELP filter out bad trades..they dont filter out ALL bad trades. A big part of trading is risk managment. After we get a trigger, i like to enter 50% of the position on the trigger and then add the rest if we can get a pull back after the trigger to get me a better overall price. After you enter, stops are always put under the zone. If you dont like actual stops, then if we break the zone GET OUT!! its a bust. Move on to the next.