Bullish batPossible T2 78.6 to 89

Oil, Gas, oil, energy you say????? LOL

Healthy company that pays a good dividend

I guess these can not be worthless..or can they?

Crazier things than this have happened!!

I know must of us have turned our backs on fossil fuels...so a tough one for sure..a bit gutsy for sure to think this sector can climb out of the depths of the market

Stop below 33.6

Not a recommendation

EOG Resources, Inc., together with its subsidiaries, explores for, develops, produces, and markets crude oil, and natural gas and natural gas liquids. The company's principal producing areas are located in New Mexico, North Dakota, Texas, and Wyoming in the United States; and the Republic of Trinidad and Tobago, the People's Republic of China, and Canada. As of December 31, 2019, it had total estimated net proved reserves of 3,329 million barrels of oil equivalent, including 1,694 million barrels (MMBbl) crude oil and condensate reserves; 740 MMBbl of natural gas liquid reserves; and 5,370 billion cubic feet of natural gas reserves. The company was formerly known as Enron Oil & Gas Company. EOG Resources, Inc. was founded in 1985 and is headquartered in Houston, Texas.

0IDR trade ideas

ABC BullishHard one. Not the right sector at all at present

NV is high Short is low

Dividend is good

Could very well be the only shale producer left by the time it is all over..A Healthy company financially

Not a recommendation

EOG Resources, Inc., together with its subsidiaries, explores for, develops, produces, and markets crude oil, and natural gas and natural gas liquids. The company's principal producing areas are located in New Mexico, North Dakota, Texas, and Wyoming in the United States; and the Republic of Trinidad and Tobago, the People's Republic of China, and Canada. As of December 31, 2019, it had total estimated net proved reserves of 3,329 million barrels of oil equivalent, including 1,694 million barrels (MMBbl) crude oil and condensate reserves; 740 MMBbl of natural gas liquid reserves; and 5,370 billion cubic feet of natural gas reserves. The company was formerly known as Enron Oil & Gas Company. EOG Resources, Inc. was founded in 1985 and is headquartered in Houston, Texas.

Bullish on EOG Resources, but not a buy The stock has had such a strong move in the past few weeks it has now become overbought.

We would expect a pullback in the days to some as the type of investor that entered the stock so late in the trading year may have been chasing some quick returns and could lead to

considerable selling.

Would be nice to get a lower entry on the stock in a sector which could be in focus in 2020

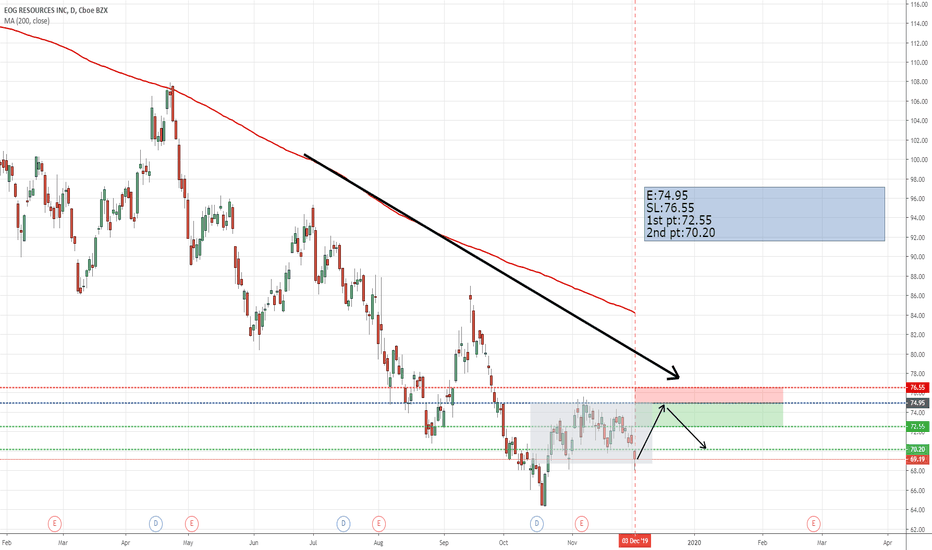

EOG - Trade setupI'm liking this setup here. If we break yesterdays low I'm taking this trade to the 200MA on the monthly chart. There is just no support anywhere till we get there and that's a nice money making move there.. Not sure how long it will take, but give yourselves some time if you do puts, (great trade for a smaller account). Wait for the break to get in

$EOG Earnings reports usually attracts sellers in EOG ResourcesEOG reports Thursday evening with a several of its peers, optimism is in short supply within the sector. Given the 15% sell off over the past week in EOG and the fact it historically sheds any post earnings gains very quickly there is no reason to get in quite yet. On the bull side, a earnings surprise could propel this beaten down stock much higher, but we see that as unlikely.

Company Description

EOG Resources, Inc. is an exploration company. The company engages in the exploration, development, production and marketing of crude oil and natural gas in United States, Canada, Trinidad & Tobago, the United Kingdom, Argentina and China. Its projects include Williston, Greater Green, Power River, Ulinta, DJ, Anadarko, Horn River, Sichuan and Columbus. EOG Resources was founded in 1985 and is headquartered in Houston, TX.

EOG Approaching Support, Potential Bounce!EOG is approaching our first support at 83.19 (horizontal swing low support, 61.8% fiboancci extension, 61.8% fiboancci retracement) where a strong bounce might occur above this level pushing price up to our major resistance at 100.05 (horizontal pullback resistance, 100% fibonacci extension, 38.2% fibonacci retracement).

Stochastic (89,5,3) is also approaching support where we might see a corresponding bounce in price.

End Of Game strategy (2)So we are facing the last boss and we need to End Our Game, The final wave , the last fall. EOG has been one of the leaders on the SP500 and since 2009 EOG gained 500% !. Its been a very impressive run. Now we might be at the end of the line and i am looking for another short term counter bounce trade

Timing = 1 ( i think the market is overdue for a bounce )

Volume = 0 ( The volume has not been moderate on this recent sell of and that might be a sign of strength? )

Group strength = -1 (Energy sector looks super weak and that worries me)

Entry = 1 ( i like this entry below current price bc of the great volume on the selloff)

Fractal = 1 (fractals support a reversal )