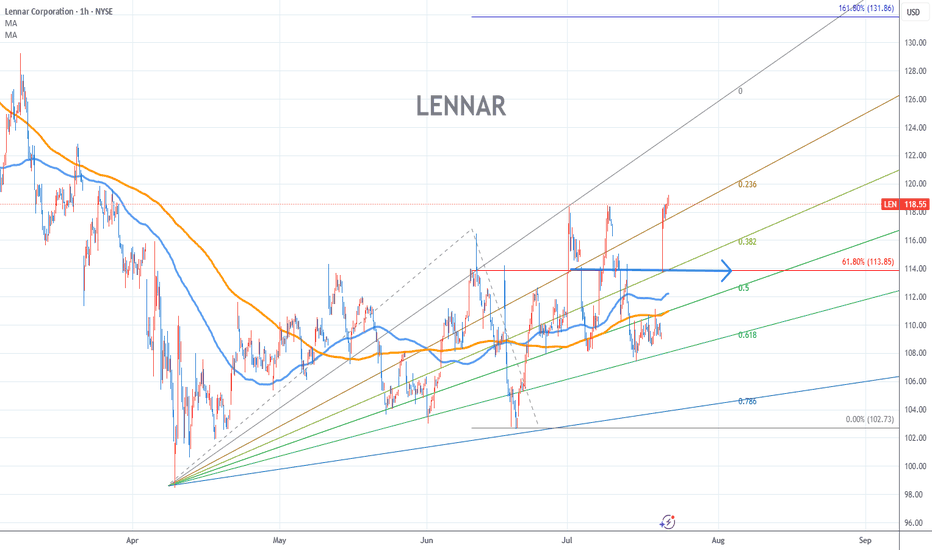

LENNAR Stock Chart Fibonacci Analysis 072225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 114/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

0JU0 trade ideas

Long Opportunity Amid Resilient Housing DemandTargets:

- T1 = $109.50

- T2 = $112.00

Stop Levels:

- S1 = $105.00

- S2 = $103.22

**Wisdom of Professional Traders:**

This analysis synthesizes insights from thousands of professional traders and market experts, leveraging collective intelligence to identify high-probability trade setups. The wisdom of crowds principle suggests that aggregated market perspectives from experienced professionals often outperform individual forecasts, reducing cognitive biases and highlighting consensus opportunities in Lennar.

**Key Insights:**

Lennar Corporation showcases resilience in an uncertain housing market, driven by demand for entry-level homes backed by FHA and VA loans, despite affordability challenges. Rising costs for land, labor, and materials persist, but Lennar's diversified portfolio across geographic regions and housing segments positions it well to navigate obstacles. Investors should focus on price stability near support levels for a potential long entry.

The company's operational efficiency and ability to cater to both entry-level and upscale homebuilders provide a diversified revenue stream that mitigates risks associated with regional market dynamics. Lennar also benefits from strong demand in the face of constrained home inventories, an industry-wide issue.

**Recent Performance:**

Lennar has maintained steady performance amid market turbulence, supported by demand for housing despite cost pressures and limited inventory. The current price aligns closely with support levels, suggesting cautious entry opportunities for investors seeking to capitalize on upward momentum in housing demand.

**Expert Analysis:**

Analysts highlight constrained inventory as a major factor in Lennar's ability to uphold robust demand. Inflationary pressures on input costs remain concerning, but Lennar's operational efficiency and adaptability provide an edge in the competitive homebuilding landscape. The company's dual focus on entry-level and upscale homes enables it to cater to various segments, ensuring consistent demand. Market volatility could provide upward momentum if bond yields soften, which could further attract capital into Lennar shares.

**News Impact:**

Rising home prices and constrained inventory are shaping housing affordability trends. FHA and VA-backed loan options provide flexibility for first-time buyers, which could drive demand for Lennar’s entry-level homes. Geopolitical tensions and elevated bond yields remain risk factors, but Lennar’s cost management and expanded geographic presence mitigate some of these challenges.

**Trading Recommendation:**

Given its strategic positioning in resilient market segments and consistent demand, a long approach on Lennar stock aligns with current market dynamics. A cautious entry near current levels ensures risk management while targeting potential gains driven by housing demand and efficient operations. Future movement above $109.50 signals upside progression to the secondary target of $112.00. Stop-losses at $105.00 and $103.22 manage downside exposure in this uncertain macroeconomic environment.

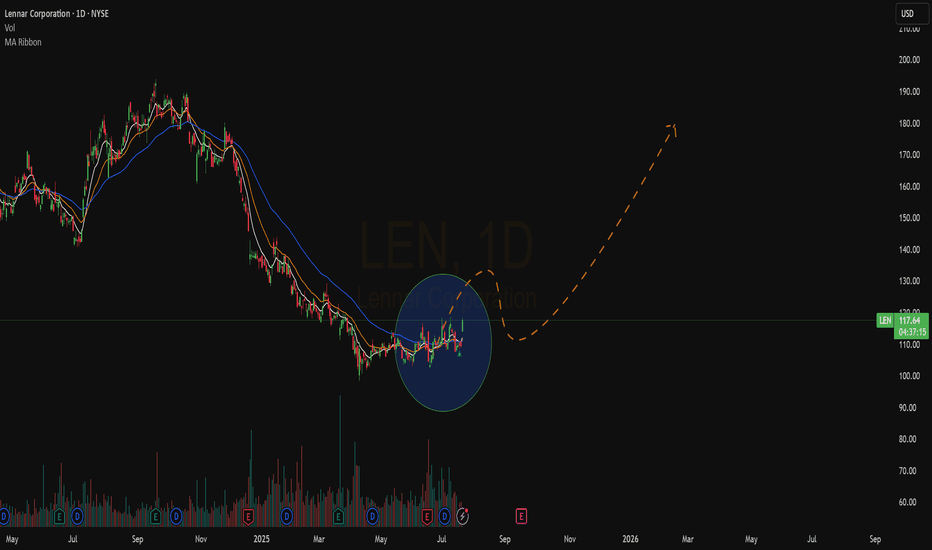

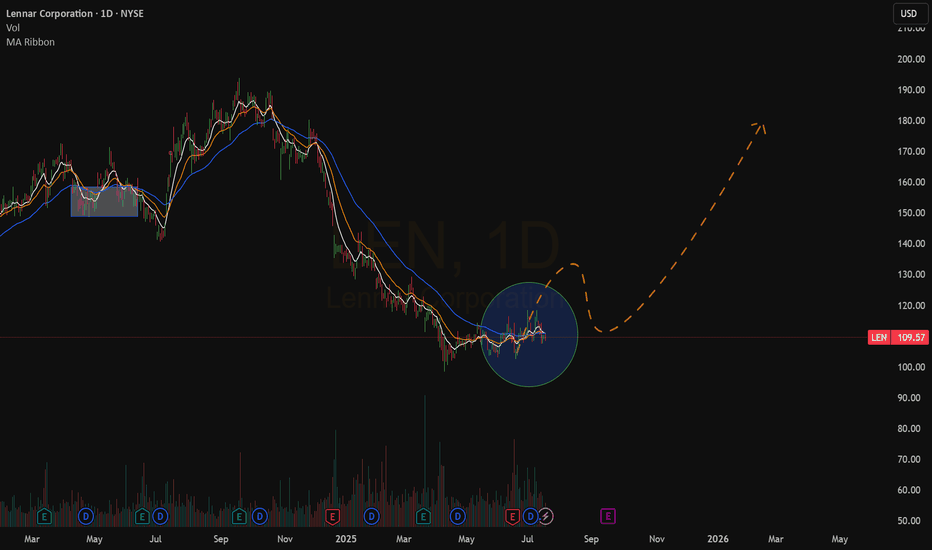

Lennar Corp | LEN | Long at $116.48Across the US, there is a pent-up demand for housing (for the vast majority of locations). While the media likes to selectively report home sales dropping for certain regions, it is more due to mortgage rates and seasonality than demand. Mortgage rates are anticipated to come down over the next 1-2 years and home builders will step in to pick-up the lack of inventory. Healthy companies like Lennar Corp NYSE:LEN , with a P/E of 8x, dividend of 1.68%, very low debt-to-equity (0.17x), etc are likely to prosper, but always stay cautious with the dreaded "recession" announcement if it creeps in...

Thus, at $116.48, NYSE:LEN is in a personal buy-zone. In the near-term, I do see the potential for the price to dip near $100 as tariff and other economic red flags continue to be in focus.

Targets:

$131.00

$145.00

$157.00

$180.00

LEN to $131My trading plan is very simple.

I buy or sell when:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes above it's Bollinger Bands

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in channel zone at bottom of 26 period channel

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under at bottom of Bollinger Band

Entry at $122.11

Target is $131 or channel top

LEN Lennar Corporation Options Ahead of EarningsIf you haven`t sold LEN before the previous earnings:

Now analyzing the options chain and the chart patterns of LEN Lennar Corporation prior to the earnings report next week,

I would consider purchasing the 170usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $3.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Lennar Corp: LONG Swing TradeThesis: Bullish Short-term

Company Profile:

Lennar Corporation develops and sells single-family and multifamily homes, along with residential land. It also provides mortgage financing, title, insurance, and closing services, and originates securitized commercial loans. Its customer base includes first-time, move-up, active adult, and luxury homebuyers, with involvement in fund investment activities as well.

Technical Analysis:

1. Monthly uptrend that might be approaching exhaustion (bearish RSI divergence).

2. Daily double-bottom pattern with large buying volume.

Fundamentals:

1. Healthy business: Net Profit Margin (11.5%) and Return on Capital (10.9%).

2. Decent growth that might be slowing down: Revenue Growth YoY (9%) - Fwd (4%).

3. Decent EPS growth that might be slowing down: EPS Growth YoY (11.8%) - Fwd (0.8%).

4. Positive revenue and earnings surprises in the last two quarters.

Conclusion:

The stock has experienced strong growth over the past two years, but it seems that investors are now beginning to show concern about future prospects. This concern manifested in a price drop after the last earnings report, despite positive surprises on both revenue (3%) and EPS (16.7%). Fundamentally, it is still a good business but the current valuation might be too high.

Coupled with bearish RSI divergence on the monthly chart, the stock is not suitable for a long-term position at the current price level, but it could still be a decent candidate for a swing trade (several weeks). The technicals show that large buyers remain interested in this stock, although selling pressure may still be strong.

It is possible to enter now with stops below the double-bottom, but a safer approach would be to wait for a third test of the support (160-163). The second option also provides a much better risk-reward ratio (3:1) and stronger support level (155)

Disclaimer

I don't give trading or investing advice, just sharing my thoughts.

LEN Lennar Corporation Options Ahead of EarningsAnalyzing the options chain and the chart patterns of LEN Lennar Corporation prior to the earnings report this week,

I would consider purchasing the 185usd strike price Puts with

an expiration date of 2024-10-4,

for a premium of approximately $5.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Lennar Sneaks Higher as Tech PlungesHomebuilders like Lennar have been climbing as the broader market struggles. Could traders look for more gains as the Federal Reserve prepares interest-rate cuts?

The first pattern on today’s chart is the rally to new highs in July, followed by a limited pullback and upside continuation in August. Such price action may reflect accumulation by longer-term investors.

Second, last week’s low occurred on Wednesday. That contrasts with the broader market, which closed near its lows on Friday. LEN’s level was also near a weekly high on August 7. Has old resistance become new support?

Third, the price zone was near a 50 percent retracement of the rally from August’s trough. That may further suggest that bulls are in charge.

Next, the stock is holding its 21-day exponential moving average (EMA). Our 2 MA Ratio custom script in the lower study also shows how the 8-day EMA is above the 21-EMA, a potential sign of bullishness in the near term.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

Can Lennar Hang On?Homebuilder Lennar has been grinding higher this year, but some traders may expect a breakdown.

The first pattern on today’s chart is the rising trendline along lows in January, February and March. Prices have sat there for the last four sessions with little sign of a bounce, which may suggest it’s losing relevance as support.

Second, the 50-day simple moving average is in the same area. That could give extra weight to the current zone and confirm a potential bearish move.

Third, MACD is falling.

Finally, the 8-day exponential moving average (EMA) crossed below the 21-day EMA last week for the first time since early November. That may suggest the short-term trend has turned negative.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options or futures); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission and a futures commission merchant licensed with the Commodity Futures Trading Commission). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association, and a number of exchanges.

TradeStation Securities, Inc. and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., both operating, and providing products and services, under the TradeStation brand and trademark. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

A Bad Trade Plan Is Better Than No Trade PlanTraders often talk about the need to be patient but to be patient, we must know what we are being patient for. That is why we have a trade plan and know ahead of time exactly where to enter, where to place a stop, where to exit, and how much size to put on.

In this post I continue with our trade planning exercise of 30 planned trades by making a trade plan for LEN. Keep in mind that the exercise is all about learning consistency and discipline and not about the method or whether the trade wins or loses.

In the video, I speak of not being worried about losing all 30 trades in a row. It's not that I have steel nerves, it's that i have planned ahead of time for 30 losses with my position size.

Shane

A Bear Call Vertical Spread on Lennar: A Contrarian TradeIntroduction:

Lennar Corporation, a prominent player in the homebuilding industry, recently released its earnings report, providing investors with valuable insights into the company's financial health and future prospects. In light of this information, we will examine the potential for a bear call option strategy on Lennar, focusing on the position opened on Friday, December 15, 2023, with options set to expire on December 22, 2023, with a call strike price 160$ (sold) cover cal 164$.

Earnings Release Impact:

Earnings releases often have a significant impact on a company's stock price, triggering heightened volatility and potential shifts in market sentiment. I

Bear Call Strategy Overview:

A bear call spread involves selling a call option and buying another call option with the same expiration date but a higher strike price, creating a net credit for the investor. This strategy profits when the stock price remains below the lower strike price at expiration.

Position Details:

Date of Position Opening: Friday, December 15, 2023

Options Expiration Date: December 22, 2023

call Strike Price Range: 160$ (sell ) 164$(buy)

Analysis:

The selection of call options a strike price range of 160/164 indicates a bearish outlook, as it implies an expectation that Lennar's stock price will either remain stagnant or decline below the lower strike price (160) by the options expiration date.

The decision to enter this bear call position immediately after the earnings release suggests a reaction to the information disclosed in the report. If the earnings report revealed concerns about Lennar's financial performance or future outlook, investors may anticipate a negative market response.

Risks and Considerations:

Market Conditions: It's crucial to consider broader market conditions and trends that may influence Lennar's stock price independently of the earnings report.

Volatility: Earnings releases can result in heightened volatility. Investors must be prepared for potential price swings that may impact the effectiveness of the bear call strategy.

Risk Management: Defined risk management strategies, such as setting stop-loss orders, are essential to mitigate potential losses in the event of unexpected market movements.

Conclusion:

Executing a bear call strategy on Lennar Corporation, with options set to expire on December 22, 2023, and a strike price range of 160/164, appears to be a strategic move post-earnings release. However, investors should remain vigilant and consider the inherent risks associated with options trading. Proper risk management and ongoing monitoring of market conditions will be key to navigating this position successfully. As always, investors are advised to conduct thorough research and, if necessary, consult with financial professionals before making any investment decisions.

$LEN: 80% upside by 2025 in the cardsLennar Corporation offers a lofty reward to risk ratio if you go long here and aim for $220 by 2025 give or take.

The long term trend kicked in this month, a continuation signal in an existing uptrend that formed in December 2022.

Best of luck!

Cheers,

Ivan Labrie.

LENNAR Stock Chart Fibonacci Analysis 110123 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 105/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

LennarWhat’s up warriors? I’m shorting Lennar from $107.50 down to the $2 gap in the volume profile. Any more price drops and incentives put them at break even on the homes which they can’t sell. They refused to see how late credit cycle we are, and they pushed forward with 10% YOY builds, despite the housing market being down nationally 10% YOY, and 20% in some regions. They’re new build neighborhoods are ghost-towns, and who would want to live in a ghost town at these prices and interest rates? Nobody. It’s game over. They go bankrupt

September Trades (LEN, BUY, 9.15-9.22, 3.03%)Lennar (LEN) reported earnings of $3.87 per share on revenue of $8.73 billion for the fiscal third quarter ended August 2023. The consensus earnings estimate was $3.519 per share on revenue of $8.49 billion. The company beat expectations by 9.97% while revenue beat expectations by 2.82%.

The company said it expects fourth quarter revenue of $9.63 billion to $10.08 billion. The consensus revenue estimate is $9.36 billion for the November 30, 2023 quarter.

Lennar Corp is a homebuilder and a provider of financial services. Its homebuilding operations include the construction and sale of single-family attached and detached homes, and to a lesser extent multi-level residential buildings.

LENNAR Stock Chart Fibonacci Analysis 082923 Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 114/61.80%

Chart time frame : B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress : A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) Hit the bottom

D) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.