0JZ1 trade ideas

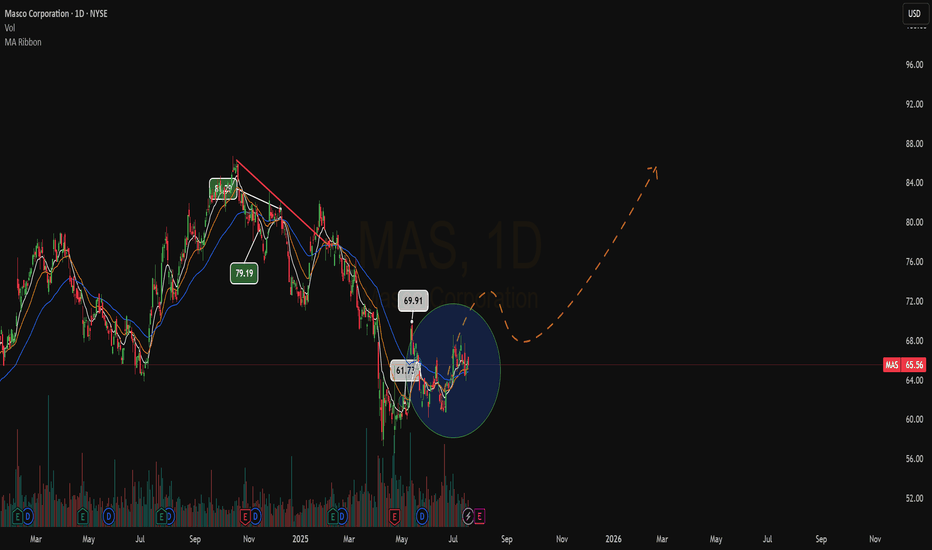

MAS potential Buy setupReasons for bullish bias:

- Falling wedge pattern

- Price is at support zone

- Overall a bullish trend on weekly

- Bullish divergence

Here are the recommended trading levels:

Entry Level(Buy Stop): 70.92

Stop Loss Level: 63.24

Take Profit Level 1: 77.79

Take Profit Level 2: Open

Note: If the price gave an ATH breakout, it would also be the bull flag pole breakout.

MAS: moving average confluenceA price action above 51.00 supports a bullish trend direction.

Increase exposure for a break above 53.00.

The target price is set at 60.00.

The stop-loss price is set at 49.00.

Testing its 38.2% Fibonacci retracement level, which is also close to the confluence of the 200-day and 200-week simple moving averages.

Furthermore, the price action to the lower range of the inclining channel pattern might support a bullish price action as well.

Just BullishLong 60.26 Looks like a rectangle.

This one has spent a ton of time consolidating. The rising wedge has most likely recovered...your opinion?

I just thing this is a bullish move, but we all have our own opinions. You can subtract the cup low from the cup high to get an idea where this may go. I have a feeling it will go higher in the long run though. I feel MAS is undervalued.

Every once in a while, can I look into the sky? (o:

Not a recommendation.

Buy Signal: 53.92Stop: 51.00

Ingenuity Trading Model is an algorithm used in- Stock, Forex, Futures, and Crypto markets. The model is a Geometric Markov Model : Focuses on reversal and continuation wave structures

In probability theory, a Markov model is a stochastic model used to predict randomly changing systems. Markov Models are used in all aspects of life from Google search to daily weather forecast. The randomly changing systems we focus on are the equity, futures, and forex markets. The geometric element of the model is the fractal sine wave structure you can find on any chart you look at across any market and across all time dimensions.

Our model focuses on the current sine wave formation (current state)- geometric price formation along with its volume and volatility over a given time period and using that information to predict the future state- future price movement. For questions or more information feel free to contact me in the comment section or via private chat

Cup and Handle Rising wedgeLong when stock gets moving

MAS has broken bottom trendline of the bearish narrowing RW, and seems to be a bit stuck s of late as far as recovering

The rest of this sector had a pull back and off they went. Most of it's cohorts were not in a rising wedge though

I am hoping MAS makes a come back before this sector rotates out

NV and OBV are high

Short interest is low

Even though this is over long entry level, I would watch it for a bit to make sure it gains momentum.

Trade safely

MAS - Elliottwave analysis - Bear case MAS - It has completed impulse in 4 hr time frame with truncated 5th wave. The current price action is in B wave within ABC correction downside. Sell on bounce near 56 - 57 level with stop level above 60.05 for target zone below 52 level.

Give thumbs up if you really like the trade idea.

A Triangle V BottomThis one does not pull back much when it does pull back as of late.

Very close to most recent high so perhaps a pull back is coming.

Not a recommendation

NV is high. I use NV to see if large players are buying as they normally buy on down days

Masco Corporation designs, manufactures, and distributes home improvement and building products in North America, Europe, and internationally. The company operates through two segments, Plumbing Products and Decorative Architectural Products. The Plumbing Products segment offers faucets, showerheads, handheld showers, valves, bath hardware and accessories, bathing units, shower bases and enclosures, toilets, acrylic tubs, shower trays, spas, exercise pools, and fitness systems; brass, copper, and composite plumbing system components; thermoplastic extrusions, extruded plastic profiles, specialized fabrications, and PEX tubing products; and other non-decorative plumbing products. This segment provides its products under the DELTA, BRIZO, PEERLESS, HANSGROHE, AXOR, GINGER, NEWPORT BRASS, BRASSTECH, WALTEC, BRISTAN, HERITAGE, MIROLIN, HUPPE, HOT SPRING, CALDERA, FREEFLOW SPAS, FANTASY SPAS, ENDLESS POOLS, BRASSCRAFT, PLUMB SHOP, COBRA, COBRA PRO, and MASTER PLUMBER brands. The Decorative Architectural Products segment offers paints, primers, specialty coatings, stains, and waterproofing products; cabinet and door hardware, functional hardware, wall plates, hook and rail products, and picture hanging accessories; decorative bath hardware, and shower accessories and doors; and decorative indoor and outdoor lighting fixtures, ceiling fans, landscape lighting, and LED lighting systems. This segment provides its products under the BEHR, KILZ, LIBERTY, BRAINERD, FRANKLIN BRASS, KICHLER, and ELAN brands. It sells its products to the plumbing, heating, and hardware wholesalers; home centers and online retailers; hardware stores; electrical and landscape distributors; lighting showrooms; building supply outlets; and other mass merchandisers. Masco Corporation was founded in 1929 and is headquartered in Livonia, Michigan.

MASCO OpportunityHey traders, MASCO is in a very important period of its history, it is at its highest historical. The shadow is a fake signal from the sellers of an unimportant drop, it goes in the direction of its last previous lower to start again on its rise. With great potential to break the consolidation zone to join the new zone if the buyers push the price down.

Please LIKE & FOLLOW, thank you!

MAS, short after channal violationBig pictrue of fundamental analysis and technical analysis. market is green but not in all time high

Write sometning about your psyhology thinking before trade? today is not my day i feel like I am a little ill

Describe the trade. What you see? there is rising wedge violited and now i expect a little pullbac and then traveling down according to book

Write why you want to enter the trade in this point? violation of wedge, also volume is according to book

Share repurchase and slimming down Bullish for MASCO CORPEntry level $47.65 = Target price $54.50 = Stop loss $45.00

Breakout trade opportunity

As part of "strategic alternatives" for cabinetry and window businesses announced in March 2019, Masco Corporation (MAS - Free Report) announced that it has entered into a definitive agreement with ACProducts, Inc. to sell Masco Cabinetry for $1 billion, which consists of $850 million in cash at closing.

In July 2019, the company revealed its plan of pursuing the sale of these businesses that include well-known brands such as Merillat, KraftMaid and Milgard. In this regard, on Nov 7, the company announced the completion of the proposed sale of Milgard Windows and Doors to MI Windows and Doors LLC for approximately $725 million. Source Zacks

Masco Corporation (MAS +0.4%) has entered into an accelerated share repurchase agreement with Royal Bank of Canada to repurchase $400M of the company's common stock.

As per the ASR agreement, Masco will receive initial delivery of 7.3M shares on November 26, 2019, representing ~85% of the number of shares of common stock initially underlying the ASR agreement.

The transaction is expected to be completed no later than February 12, 2020. Source seeking Alpha

P/E ratio 18.63 very reasonable

Masco Corp. engages in the design, manufacture, marketing and distribution of branded home improvement and building products. It operates through the following business segments: Plumbing Products, Decorative Architectural Products, Cabinetry Products, and Windows & Other Specialty Products. The Plumbing Products segment includes faucets; plumbing fittings and valves; showerheads and hand showers; bathtubs and shower enclosures; toilets; spas, and exercise pools. The Decorative Architectural Products segment offers paints and coating products; and cabinet, door, window, and other hardware. The Cabinetry Products segment comprises of assembled kitchen and bath cabinets; home office workstations; entertainment centers, and storage products. The Windows & Other Specialty Products segment consists of windows; window frame components; patio doors; staple gun tackers; staples, and fastening tools. The company was founded by Alex Manoogian in 1929 and is headquartered in Taylor, MI.