0JZH trade ideas

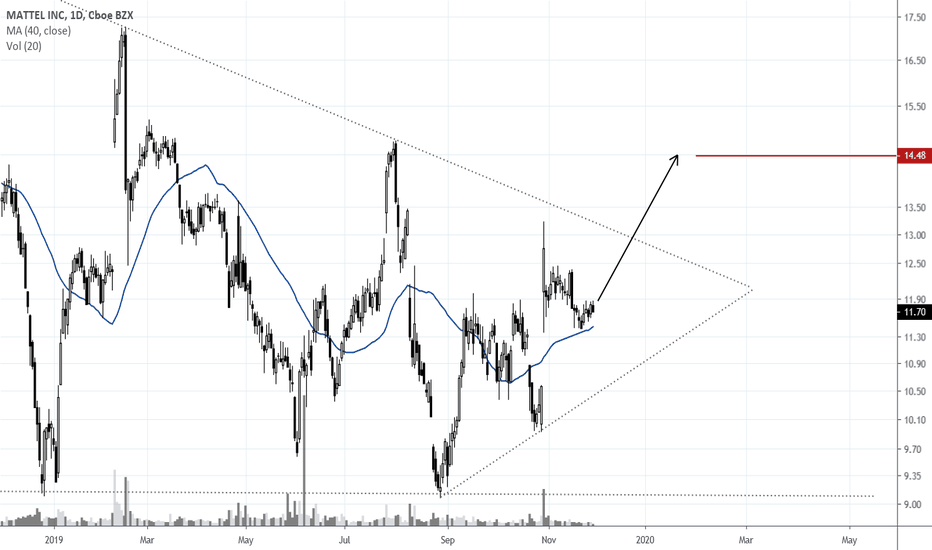

MAT big winner?MAT looks like it has been consolidating for awhile now and with the recent put sweep and selloff in the markets, it looks ready for lower. The $9 puts for 17Apr have 43k oi and look very good if we reach our final put target, as long as this stays in the box we should be good to go lower.

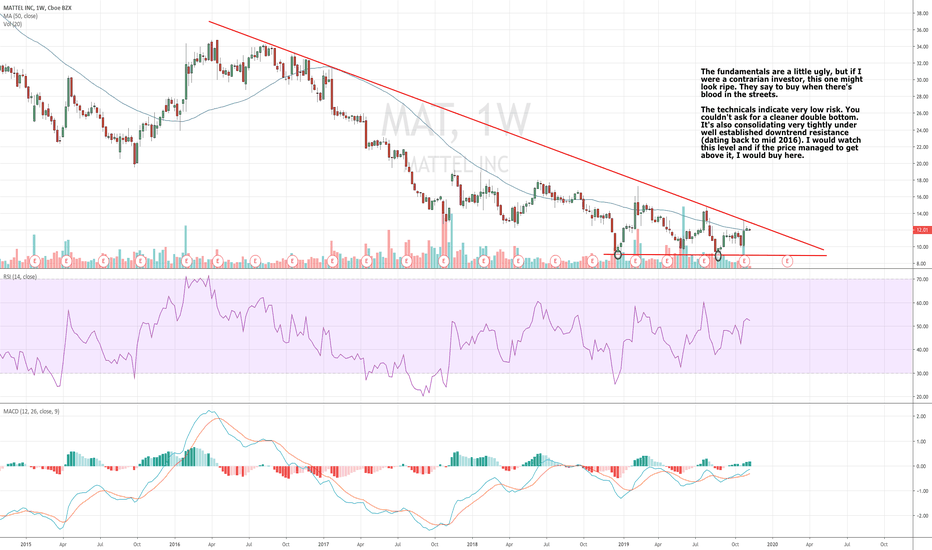

This is the best time to buy MAT! Downtrend breakout!The fundamentals are a little ugly, but if I were a contrarian investor, this one looks ripe. They say to buy when there's blood in the streets.

The technicals indicate very low risk. You couldn't ask for a cleaner double bottom. It's also breaking out of well established downtrend resistance (dating back to mid 2016). This is a buy.

Playing Mattel's momentum?Technical

MAT broke and sustained its 200sma resistance a couple of days ago.

Todays candle above the trend (pink trend line) are confirmation MAT longer downtrend might be over.

Fundamental / News

December 15th tariffs were removed, easing pressures for them. However, 25% tariffs will remain on $250 billion

Chinese imports and 7.5% will be put on much of the remainder.

Mattel (MAT) said Monday, December 9th, that it plans to offer $600 million aggregate principal amount of senior notes due 2027 to institutional buyers, subject to market conditions and other factors.

This might be the BEST time to buy Mattel!The fundamentals are a little ugly, but if I were a contrarian investor, this one might look ripe. They say to buy when there's blood in the streets.

The technicals indicate very low risk. You couldn't ask for a cleaner double bottom. It's also consolidating very tightly under well established downtrend resistance (dating back to mid 2016). I would watch this level and if the price managed to get above it, I would buy here.

The Worst Looks To Be Over For $MAT$MAT is trading higher after delivering strong Q3 earnings and putting its accounting issue behind it. Here are the highlights from Q3:

Dolls sales were up 5% during the quarter off a double-digit jump in the Barbie business, while the vehicles category saw a 13% gain off a stellar quarter for Hot Wheels.

The company's adjusted gross margin rate improved 390 bps to 46.9% of sales to smash the consensus estimate of 42.6%.

Mattel (NASDAQ:MAT): Q3 Non-GAAP EPS of $0.26 beats by $0.07; GAAP EPS of $0.20 beats by $0.02.

Revenue of $1.48B (+2.8% Y/Y) beats by $40M.

On the accounting issue:

The positive news from Mattel is that the accounting investigation didn't find any fraud and the company is now free to go back to the debt market. During the earnings call, Mattel stated that it intends to refinance $250M worth of senior notes in a move that should lower costs.

As always, trade with caution and use protective stops.

Good luck to all!