Pegasystems (PEGA) AnalysisCompany Overview: Pegasystems NASDAQ:PEGA is strategically positioned to leverage the increasing demand for AI-powered customer service solutions. By incorporating advanced technologies such as natural language processing and chatbots, PEGA is enhancing user experiences and streamlining customer interactions.

Key Catalysts:

AI-Powered Solutions: The rising interest in AI technologies provides a significant opportunity for Pegasystems to grow its client base and expand its offerings in customer service automation.

Leadership Insights: CEO Alan Trefler emphasizes the company's commitment to innovation, which is expected to attract new clients and deepen existing relationships, driving revenue growth.

Financial Goals: Pegasystems aims to achieve the "Rule of 40" by 2024, balancing revenue growth with free cash flow margin. This metric is crucial for appealing to investors looking for sustainable growth and profitability.

Investment Outlook: Bullish Outlook: We are bullish on Pegasystems above $61.00-$62.00, reflecting confidence in its strategic initiatives and market potential. Upside Potential: Our target for PEGA is set at $84.00-$86.00, driven by expected growth in AI solutions and the successful implementation of financial goals.

🚀 PEGA—Pioneering AI in Customer Service. #AI #CustomerExperience #Pegasystems

0KGS trade ideas

$PEGA, AI Stock Set to Rip Apart The BearsIn the rapidly evolving landscape of artificial intelligence (AI), few companies have made as significant a mark as Pegasystems Inc. (NASDAQ: PEGA). Known for its cutting-edge software solutions, PEGA stands out for its robust AI capabilities, making it a compelling choice for investors looking to capitalize on the future of technology.

PEGA has a particular focus on its strong AI presence and innovative concept of AI factories.

A Leader in AI and Automation Pegasystems, commonly referred to as Pega, has established itself as a leader in business process management (BPM) and customer relationship management (CRM). However, its true strength lies in its AI-driven automation solutions. Pega's AI technology is designed to streamline complex business processes, enhance customer engagement, and drive operational efficiency.

The company's commitment to AI innovation is evident in its comprehensive suite of tools that leverage machine learning, natural language processing, and predictive analytics.

The Concept of AI FactoriesOne of Pega's most groundbreaking initiatives is the concept of AI factories. These AI factories are essentially integrated environments where AI models are created, trained, deployed, and continuously improved. The idea is to industrialize the production of AI models, much like traditional factories produce goods. This approach allows businesses to scale their

AI capabilities efficiently and effectively, ensuring that AI applications are not just one-off solutions but part of an ongoing, iterative process.How AI Factories WorkPega's AI factories operate on a continuous feedback loop, where data is constantly fed into the system, and AI models are iteratively refined and redeployed. This cycle ensures that the AI models remain relevant and accurate, adapting to new data and changing business conditions.

The key components of Pega's AI factories include:Data Ingestion and Preparation: Raw data from various sources is collected, cleansed, and prepared for analysis. This step is crucial for ensuring that the AI models are trained on high-quality data.Model Development and Training: Using machine learning algorithms, models are developed and trained on the prepared data. Pega's platform supports a range of algorithms, allowing for tailored solutions to specific business problems.Deployment and Integration: Once trained, the AI models are deployed into production environments.

Pega's solutions are designed to integrate seamlessly with existing IT infrastructure, ensuring minimal disruption to business operations.

Monitoring and Refinement: Post-deployment, the AI models are continuously monitored and refined. This involves tracking performance metrics, identifying areas for improvement, and updating the models as necessary.The Impact on Business Performance

The implementation of AI factories can have a transformative impact on business performance. By automating routine tasks, optimizing processes, and providing actionable insights, Pega's AI solutions help businesses reduce costs, increase efficiency, and enhance customer satisfaction. The scalability of AI factories means that these benefits are not limited to large enterprises but can be realized by businesses of all sizes.PEGA Stock: A Compelling InvestmentGiven Pega's strong AI presence and innovative approach to AI development, PEGA stock represents a compelling investment opportunity. The company's consistent focus on innovation and its ability to deliver tangible business results through AI make it a standout in the tech sector. Moreover, Pega's commitment to continuous improvement and scalability ensures that it remains at the forefront of AI advancements, positioning it for long-term growth.ConclusionPegasystems Inc. is a beacon of innovation in the AI landscape. Its concept of AI factories exemplifies its forward-thinking approach, offering businesses a scalable and efficient way to harness the power of AI. For investors, PEGA stock provides a unique opportunity to invest in a company that is not only leading in AI technology but also driving meaningful business transformation. As the demand for AI-driven solutions continues to grow, Pega's strong AI presence and pioneering initiatives make it a stock worth considering for any investment portfolio.

PEGA - JULY 24 MATrend Unsustainable Momentum- D1 is top of the range

- H1 setup showed a previous downtrend followed by a spike up today

- Slight price rejection in H1 with the opening candle

- Huge price rejection in H1 with the 22:30 candle

MATrend Unsustainable Momentum (Systematic) ⏪

The strategy identifies stocks (Tech sector ) that follows the larger market regime's momentum of the day and because they are unable to maintain it price breaks down quickly

Tight stops aligned to the price behaviour we are trying to capture. Which is a rapid break of the momentum.

PEGA - JULY 24 MATrend Unsustainable Momentum- D1 is top of the range

- H1 setup showed a previous downtrend followed by a spike up today

- Slight price rejection in H1 with the opening candle

- Huge price rejection in H1 with the 22:30 candle

MATrend Unsustainable Momentum (Systematic) ⏪

The strategy identifies stocks (Tech sector ) that follows the larger market regime's momentum of the day and because they are unable to maintain it price breaks down quickly

Tight stops aligned to the price behaviour we are trying to capture. Which is a rapid break of the momentum.

A Cup and Handle on Pegasystems! Potential of +50%NASDAQ:PEGA

Pegasystems Inc. is a leading provider of Customer Relationship Management software that enables transaction-intensive organizations to manage a broad array of customer interactions. Their software enables organizations to deliver high-quality, consistent customer service across today's preferred interaction channels, from the traditional call center environment to Internet self-service. The company's customers represent a wide range of industries, including banking and financial services, insurance, healthcare management, and telecommunications.

A cup and handle has been formed on Pegasystems. I dont need to tell much, the chart is telling everything.

I am waiting for the breakout of the bullish flag (handle), then a small entrancement to enter.

We expect to see resistance at 49 - 51, then at 54 - 56, then a move to 70.

Let's get it!!!

Many thanks for the amazing mentorship from @Market-Snipers

Pegasystems (NASDAQ: $PEGA) Starting To Look Interesting! 🦄Pegasystems Inc. develops, markets, licenses, hosts, and supports enterprise software applications in the United States, rest of the Americas, the United Kingdom, rest of Europe, the Middle East, Africa, and the Asia-Pacific. It provides Pega Platform, an application development product for clients; and Pega Infinity, a software platform that unifies customer engagement and digital process automation. The company also offers customer engagement applications, including Pega Customer Decision Hub that enable enterprises to enhance customer acquisition and experiences across inbound, outbound, and paid media channels; Pega Sales Automation to automate and manage the sales process; and Pega Customer Service to anticipate customer needs, connect customers to people and systems, and automate customer interactions to evolve the customer service experience, as well as to allow enterprises to deliver interactions across channels and enhance employee productivity. In addition, it provides intelligent automation software; Pega Cloud that allows clients to develop, test, and deploy applications and the Pega Platform using an Internet-based infrastructure; Pega Academy, which offers instructor-led and online training to its employees, clients, and partners; and guidance, implementation, and technical support services. The company primarily markets its software and services to financial services, life sciences, healthcare, communications and media, government, insurance, manufacturing and high tech, and consumer services markets through a direct sales force, as well as partnerships with technology providers and application developers. Pegasystems Inc. was incorporated in 1983 and is headquartered in Cambridge, Massachusetts.

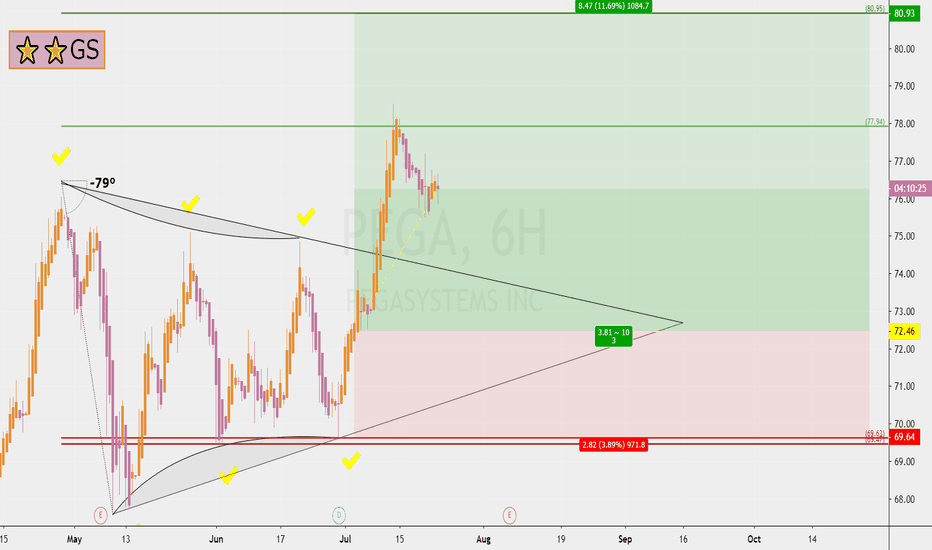

PEGA 3 RRR longTrading Methodology:

1. An asymmetric bullish/bearish pennant is drawn using ascending and descending curved trend lines with a minimum of three price action touche points per line. The direction is determined by the previous trend.

2. The angle tool is applied from the earliest two trend touch points, beginning at the earliest touch point.

3. A trend-based Fibonacci retracement triangle is drawn starting from the earliest trend touch point and ending at the earliest touch point of the opposite trend line .

4. Based on the degree, of the earlier defined angle, the appropriate (and secret) levels are selected for the fibonacci retracement ; two levels for stop-loss and two levels for take-profit. The closest stop-loss level to the current price level is the top priority stop-loss. Though the secondary stop-loss level is often chosen for some markets such as FX and some equities in order to account for seldom unexpected resistance breaks. The greater target level is the top priority, and where majority of the shares are sold, though some may choose to close part of the position at the first target level or set it to be the stop-loss once price exceeds it. Entries should be laddered in around the levels closest of the yellow line.

This trading strategy can be applied to any market and time frame, and positions most often garner the greatest risk-to-reward ratio with the highest success rate. What more can you ask for? I will only be posting my unique trading strategy until EOY. I work solely with price action to identify pennants and apply unique trend-based fibonacci retracement levels for SL and TP levels. Reach out to me if you have any questions.

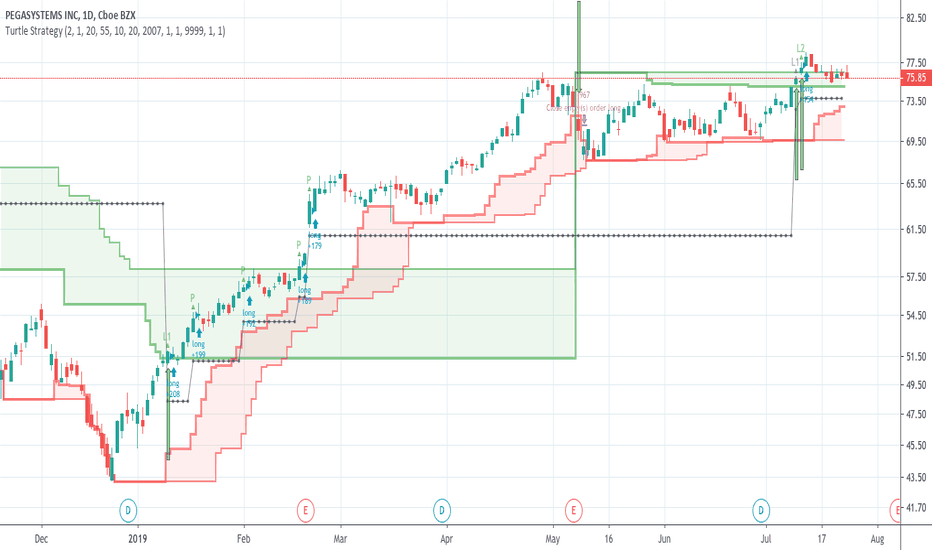

Could PEGA Make a New High? July 3, 2019It made multiple tops since two months ago and currently it is at its bullish channel's support area. We could wait and see and if the stock price could exceeds its tops at $76 area with high volume, probably the stock would reach $86 area within one trading month.

PEGA seems to be great in Robotic Automation! It looks like everything is going well for PEGA. Assuming that it is the new name in the RPA industry, what do you guys think about it as a Fundamentally Solid and a Technically Good (LT) idea. Shorter Term it seems like it is overbought (sure), but on a dip, is this worth, and are you following it, or see that it is worth following? Thanks for any opinions.